- Análisis

- Análisis de mercado

- Análisis técnico

- There is a moderate upward movement on the NZD/USD

There is a moderate upward movement on the NZD/USD

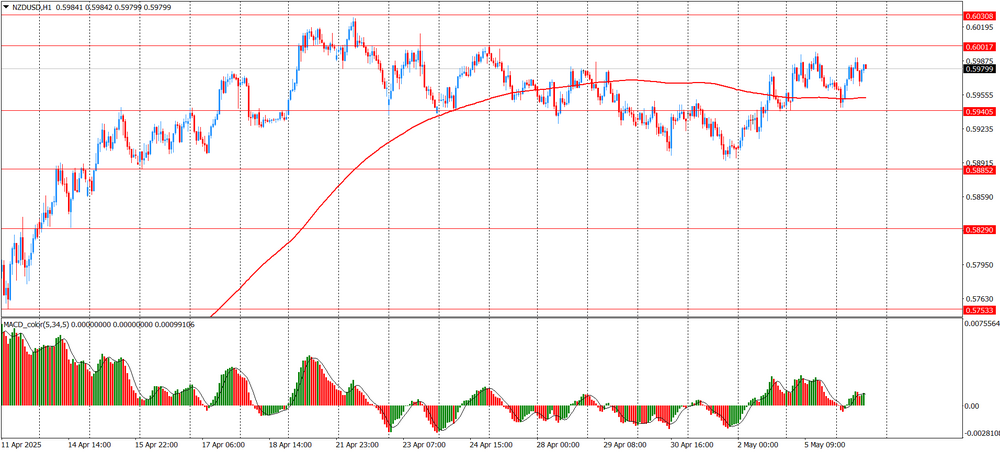

Today, a moderately upward movement is observed on the hourly chart of NZD/USD, while the price has confidently consolidated above the moving average of MA (200) H1, which turned upward, indicating a change in the short-term trend towards growth. In recent sessions, the price has formed a series of higher lows and highs, confirming the buying pressure. The nearest resistance is located at 0.6000, and the pair is currently trading close to it, which makes it possible to test and attempt a breakdown of this zone. In case of a successful breakdown, the next target level is 0.6030 resistance. From below, support is provided by the 0.5940 level, which also coincides with the consolidation zone and acts as a potential pullback point. The MACD indicator shows a positive value, the histogram is colored green, and growth is observed, indicating the presence of an upward momentum. If the momentum continues, the bulls may try to gain a foothold above 0.6000 and develop an upward movement. Otherwise, a correction to 0.5940 is possible, where demand may be retested. The overall picture is currently moderately bullish, with the potential for further growth provided the current resistance is overcome.

Resistances are at the marks:0.5955, 0.6000, 0.6030

An alternative scenario: 0.5940, 0.5885, 0.5830

The main scenario of the pair's movement implies a breakout of 1.6000 (April 24-25 high) and there may be an increase to 0.6030 (April 22 high)

An alternative scenario suggests a breakout of the session low of 0.5940 and there may be a decline to 0.5885 (April 16 low)

©2000-2026. Todos los derechos reservados.

El sitio es administrado por Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

La información presentada en el sitio, no es una base para tomar decisiones de inversión y es proporcionada sólo con fines informativos.

La empresa no atiende ni presta servicio a clientes residentes en Estados Unidos, Canadá y los países incluidos en la lista negra del FATF.

La realización de operaciones comerciales en los mercados financieros con instrumentos financieros de margen, abre grandes oportunidades y permite a los inversores que estén dispuestos a correr riesgos a obtener altos rendimientos, pero al mismo tiempo conlleva un nivel de riesgo de pérdidas potencialmente alto. Por lo tanto, antes de comenzar a comercializar, se debe tomar de manera responsable a la cuestión de elegir la estrategia de inversión correspondiente, teniendo en cuenta los recursos disponibles.

Uso de información: al usar completamente o parcialmente los materiales del sitio, el enlace a TeleTrade como fuente de información es obligatorio. El uso de materiales en Internet debe ir acompañado de un hipervínculo al sitio teletrade.org. Importación automática de materiales e información del sitio está prohibida.

Para cualquier duda o pregunta, póngase en contacto con pr@teletrade.global.