- TeleTrade

- Cooperación

- Noticias

- The Blueprint of Forex Trading

The Blueprint of Forex Trading

Forex is a truly profitable marketplace, with trillions of dollars being traded each and every day. Numerous traders from all corners of the world take advantage of the great opportunities the foreign exchange market gives to make substantial gains and take control of their financial life.

Forex is a truly profitable marketplace, with trillions of dollars being traded each and every day. Numerous traders from all corners of the world take advantage of the great opportunities the foreign exchange market gives to make substantial gains and take control of their financial life.

With the constantly improving technologies, trading in financial markets has never been easier. In this article, we walk you through the basics of Forex trading, so you can grasp the meaning of its most essential terms and understand how it works.

What is a currency pair?

In the foreign exchange market you trade currencies, which are always traded in pairs. There are seven major currency pairs, which are traded against the US dollar. These pairs are the:

- EUR/USD

- GBP/USD

- USD/JPY

- USD/CHF

- AUD/USD

- NZD/USD

- USD/CAD

You can also trade cross currency pairs, not involving the US dollar, such as the EUR/GBP, EUR/CHF, GBP/JPY, GBP/CAD, AUD/JPY and NZD/JPY.

What is a quotation?

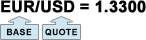

A quotation is the price of a currency denoted in relationship to another currency. The first currency of the pair is called the base currency and the second is called the counter or quote currency. When you buy a currency pair you always buy the base currency and sell the counter currency. On the contrary, when you sell the pair, you sell the base and buy the counter. Say, the exchange rate of the EUR/USD pair is 1.3300, this indicates that you need 1.33 US dollars to buy 1 euro. Conversely, if you sell 1 euro you will get 1.3300 US dollars.

Let’s suppose you buy 10,000 euros against the US dollar. At an exchange rate of 1.3300 you would pay €13,300 (1 EUR=$1.33, thus €10,000=$13,300). The following day the euro goes up and the exchange rate rises to 1.3400. This signifies that for every euro that you bought, you have earned 1 cent, which in this instance means you would have realized a profit of $100 ($13,4000 - $13,300). In case that you had chosen to trade in the opposite direction by selling the currency pair, you would have sold the euro to buy the US dollar. In our example the dollar fell in value against the euro. You sold 10,000 EUR at 1.33, which means that for every euro that you sold you have lost 1 cent. For a trade worth of 10,000 EUR, that would have been a loss of $100 ($13,400 - $13,300).

What is a pip?

When trading Forex, the movement of prices is measured in pips. The abbreviation pip stands for the phrase ‘percentage in point’ and it represents the smallest possible price change that a financial instrument can record. Almost all currency pairs are quoted to four decimal points, so the smallest unit of movement is that of the last decimal.

In our example EUR/USD trades at 1.3300, which means that number 0 is the pip. In case the exchange rate rises from 1.3300 to 1.3301, then it went up by 1 pip. Traders normally gauge their profit, as well as their losses in pips. In case that someone buys EUR/USD at 1.3300 and the price rises to 1.3320, this indicates that the price went up by 20 pips and that the trader gets a 20-pip profit.

It should be noted, that Japanese currency pairs are presented a bit differently, with the pip being the second number behind the decimal point. If the currency pair USD/JPY trades at 102.4800, then number 8 is the pip.

What is the spread?

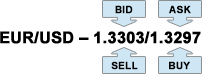

The spread represents the difference between the buy – also called ask – price and sell – also called bid – price. It is a term used to denote the difference between the highest price that a market maker is willing to buy from a trader and the lowest price at which the market maker is willing to sell to a trader.

Let us illustrate this through the following example. Say, the EUR/USD pair currently trades at 1.3300 and you want to buy this pair at the particular price. The market maker will not sell it to you at 1.3300, but submit a slightly higher quote, for example 1.3303. If you want to sell this pair, then you will be given a slightly lower quote than 1.3300, for instance 1.3297.

Clearly, there is a difference between the two quotes (1.3303 and 1.3297). The difference, which lies at the amount of 6 pips, denotes the difference between the price at which the market maker is willing to buy from you and the price at which he is willing to sell to you. This forms the spread, which is essentially the cost of your trading.

The spread value differs for each currency pair. Volatile currency pairs usually have a tighter spread, while cross currency pairs with low liquidity have a higher spread. This is why most traders opt to trade the majors, as they usually provide lower spreads.

What does it mean to open a long or short position?

Forex is such a lucrative market, because traders can profit from both increases and decreases in exchange rates. When anticipating a rate to go up, a trader will buy and make profit if his forecast realizes. When anticipating a rate to fall, he will sell at the current rate and, should the rate decreases as forecasted, make profit upon closing his position. Put it simply, buy when you expect a rise in price and sell when you expect the price to drop. These are the two types of positions when trading Forex – long and short.

- Long: buy – open a long position to profit from a price increase.

- Short: sell – open a short position to profit from a price decrease.

If you decide to trade EUR/USD and open a long position in this pair, then you are buying the euro and selling the greenback. If you are to open a short position in the particular pair, then you do the opposite – buy the greenback and sell the euro.

The long position mechanism is simple – buy low when the price is cheaper and sell high when the price rises. If you want to open a short position, you have to first sell at a specific price and then close the position, by buying the pair at a lower rate in order to make profit.

During open positions, all earnings or losses are not realized and remain as such until the position is closed. The positions cannot be terminated, as the trader is the one to decide on the timing of opening and closing a position, having the option to do it in a matter of minutes or go as long as a few days with an open position before closing it out.

Learn how to trade Forex and harness the great moneymaking power of the market to get an incremental revenue source.

©2000-2026. Todos los derechos reservados.

El sitio es administrado por Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

La información presentada en el sitio, no es una base para tomar decisiones de inversión y es proporcionada sólo con fines informativos.

La empresa no atiende ni presta servicio a clientes residentes en Estados Unidos, Canadá y los países incluidos en la lista negra del FATF.

La realización de operaciones comerciales en los mercados financieros con instrumentos financieros de margen, abre grandes oportunidades y permite a los inversores que estén dispuestos a correr riesgos a obtener altos rendimientos, pero al mismo tiempo conlleva un nivel de riesgo de pérdidas potencialmente alto. Por lo tanto, antes de comenzar a comercializar, se debe tomar de manera responsable a la cuestión de elegir la estrategia de inversión correspondiente, teniendo en cuenta los recursos disponibles.

Uso de información: al usar completamente o parcialmente los materiales del sitio, el enlace a TeleTrade como fuente de información es obligatorio. El uso de materiales en Internet debe ir acompañado de un hipervínculo al sitio teletrade.org. Importación automática de materiales e información del sitio está prohibida.

Para cualquier duda o pregunta, póngase en contacto con pr@teletrade.global.