- Analytics

- Market analysis

- Technical Analysis

- The GBP / USD pair declined, but remains near the highs of early September

The GBP / USD pair declined, but remains near the highs of early September

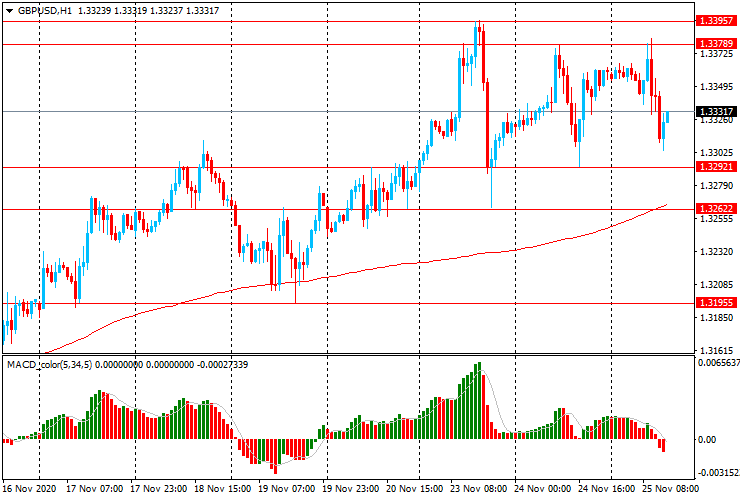

Today, the GBP / USD pair is trading mostly with a decline in the range of $1.3305-85, but remains near the high of early September ($1.3395), reached on Monday. The pair is trading above MA (200) H1 ($1.3265) on the hourly chart and above MA (200) H4 ($1.3090) on the four - hour chart. The $1.3290 support may keep the GBP / USD from falling further. If it breaks through, the pair may fall to $1.3260-65. The upper limit of $1.3395 represents the resistance level. If this level is passed, the pair can rise to $1.3480. The most likely range of movement of the pair today can be hidden within the range of $1.3260-$1.3395.

⦁ Resistance levels are at: $1.3395-1.3400, $1.3480, $1.3520

⦁ Support levels are at: $1.3290, $1.3260-65, $1.3195

The main scenario for the pair's promotion - the pair may grow to $1.3395-1.3400 (September 2 and November 23 highs)

An alternative scenario - if the support of $1.3290 is broken (November 24 low), the pair may decline to $1.3260-65 (November 23 low, MA (200) H1)

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.