- Analytics

- Market analysis

- Technical Analysis

- EUR/USD remains above MA (200) H1

EUR/USD remains above MA (200) H1

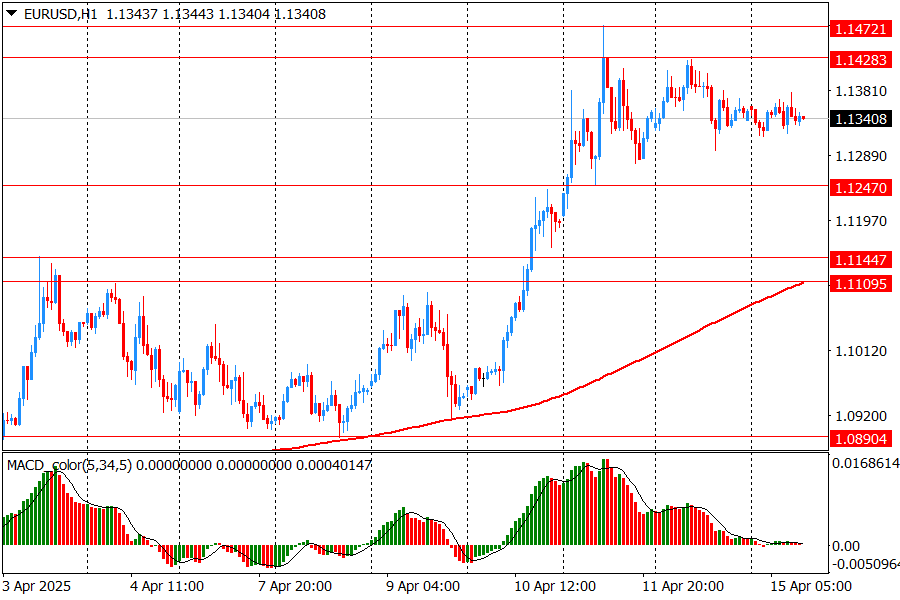

Today, on the hourly chart, the EUR/USD pair is showing stabilization after rapid growth, which began with a breakdown of the 1.1145 level and peaked at 1.1470. After a sharp upward impulse on April 10-11, the price is consolidating in a narrow range above the 1.1340 level, which may indicate accumulation before a new movement. The current quote is above the MA (200) H1 moving average (1.1110), which preserves the overall uptrend. However, the MACD indicator shows a decrease in momentum: the histogram is gradually decreasing, which indicates a weakening of bullish dynamics and a possible correction or sideways movement in the short term. Thus, the current technical picture indicates a pause in the movement with the possibility of correction, however, the uptrend persists as long as the price remains above MA (200) H1 and key support levels.

Resistance levels are: 1.1430, 1.1470, 1.1510

Support levels are: 1.1250, 1.1145, 1.0890

The main scenario for the pair's advance implies a breakout of resistance at 1.1430 (April 14 high) and an increase towards 1.1470 (April 11 high).

An alternative scenario suggests a breakout of support at 1.1250 (the low of the European session on April 11) and there may be a decline to 1.1145 (April 3 high)

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.