- Аналитика

- Новости и инструменты

- Новости рынков

- Forex: Tuesday's review

Forex: Tuesday's review

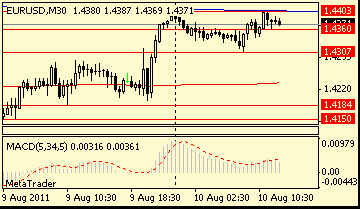

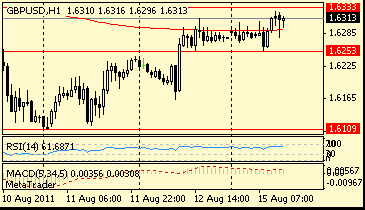

The euro rose to a three-week high against the dollar on speculation European officials will approve additional aid to Greece next month, dimming the prospects of a sovereign-debt restructuring.

Today the Luxembourg Prime Minister Jean-Claude Juncker said the region’s leaders will decide on a new aid package by the end of June and have ruled out a “total restructuring” of Greece’s debt. Germany may stop demanding an early rescheduling of bonds, according to a report.

The euro stayed higher after a report showed German retail sales rose in April as unemployment fell below 3 million for the first time in almost 19 years, fueling bets the European Central Bank will signal next week that it may raise interest rates for a second time this year.

Data showed sales increased 0.6% from March, when they fell 2.7%. Economists had a forecast a 1.8 percent gain. Sales increased 3.6 percent from a year earlier.

A separate European Union report showed euro-region inflation slowed in May to 2.7% from April’s 2.8%, the fastest pace since October 2008.

Inspectors from the EU, the International Monetary Fund and the European Central Bank are set to conclude a review of Greece’s progress in meeting the terms of last year’s 110 billion-euro ($158 billion) bailout in coming days. The EU will then formulate its plan for additional aid.

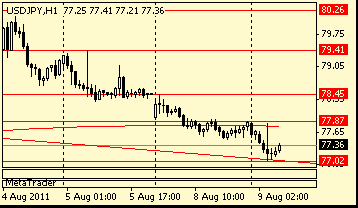

The yen pared losses versus the dollar and euro after a report showed U.S. consumer confidence unexpectedly fell in May to a six-month low, and other data showed a drop in home prices and weakening manufacturing.

The Canadian dollar gained the most this year versus its U.S. counterpart after the Bank of Canada kept its benchmark interest rate at 1%, where it has been since September.

US data starts at 1100GMT with the weekly MBA Mortgage Application Index, which is followed at 1130GMT by Challenger Layoffs and then at 1145GMT by the weekly ICSC-Goldman Store Sales data. Also today in the US, domestic-made light vehicle sales are expected to slow to a 9.7 million annual rate in May after the slight improvement in April. The seasonal adjustments factors for May tend to be one of the strictest, so raw sales will need to be strong to keep the seasonally adjusted selling rate steady or rising. US data continues with the 1215GMT relesae of the latest ADP National Employment Report .This morning also sees the Manufacturing PMI releases due, including the final May readings for France at 0648GMT, Germany at 0653GMT and the main EMU data at 0658GMT all of which are expected to confirm their preliminary readings.

UK data at 0830GMT includes Bank of England lending data as well as the UK Manufacturing PMI data, which is expected to slip to a reading of 54.1.

There is a raft of US data due at 1400GMT, including the May ISM Index, Construction Spending and the latest Help-wanted Online data. The ISM manufacturing index is expected to fall to a reading of 58.0 in May from 60.4 in April.

Construction spending is expected to rise 0.1% in April after the surprise 1.4% gain in March. Housing starts fell sharply in the month, so residential construction is expected to slow after surging in March on remodeling.

© 2000-2026. Все права защищены.

Сайт находится под управлением TeleTrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Информация, представленная на сайте, не является основанием для принятия инвестиционных решений и дана исключительно в ознакомительных целях.

Компания не обслуживает и не предоставляет сервис клиентам, которые являются резидентами US, Канады, Ирана, Йемена и стран внесенных в черный список FATF.

Проведение торговых операций на финансовых рынках с маржинальными финансовыми инструментами открывает широкие возможности и позволяет инвесторам, готовым пойти на риск, получать высокую прибыль. Но при этом несет в себе потенциально высокий уровень риска получения убытков. Поэтому перед началом торговли следует ответственно подойти к решению вопроса о выборе соответствующей инвестиционной стратегии с учетом имеющихся ресурсов.

Использование информации: при полном или частичном использовании материалов сайта ссылка на TeleTrade как источник информации обязательна. Использование материалов в интернете должно сопровождаться гиперссылкой на сайт teletrade.org. Автоматический импорт материалов и информации с сайта запрещен.

По всем вопросам обращайтесь по адресу pr@teletrade.global.