- Analiza

- Analiza tržišta

- Tehnička analiza

- GBPUSD: Cable Retakes 1.30, Fights for 100 DMA

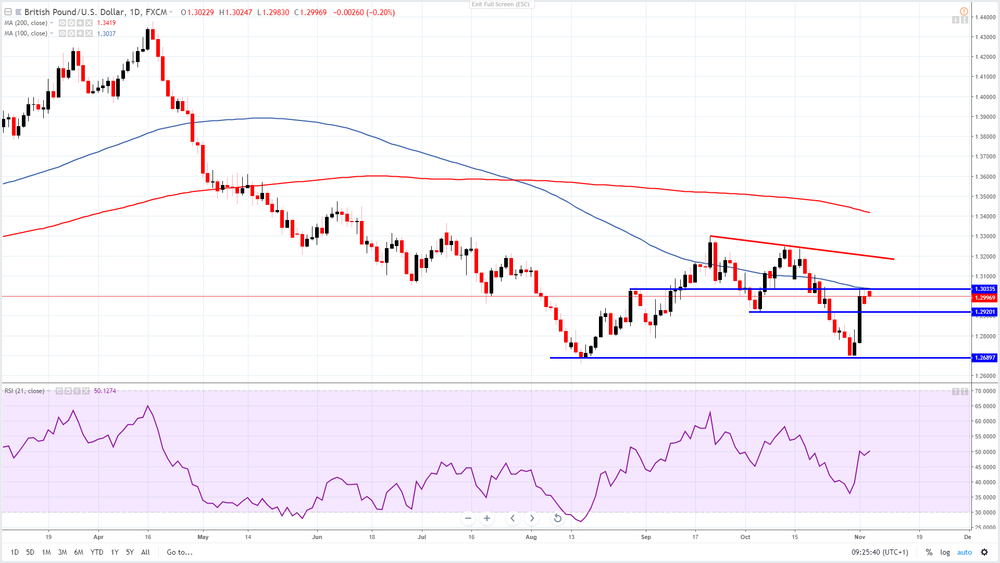

GBPUSD: Cable Retakes 1.30, Fights for 100 DMA

The Pound soared on Thursday, which brought

the GBPUSD pair back

to the psychological level of 1.30 and the Sterling is now trying to settle

above this level. It was seen at 0.25 per cent stronger during the London

session on Monday.

The next resistance for bulls is at the

100-day moving average near 1.3040 and if this level is broken, the trend might

switch back to bullish, at least from the short-term point of view. Another

area which could be worth paying attention to at the short-term bearish trend

line, could be slightly below the 1.32 mark.

On the other hand, the support for today’s

trading could be at 1.2920. For this positive outlook to be maintained, the Pound

needs to stay above this level.

The major support remains at last week’s

lows at 1.27 and it seems like this could be a double bottom formation on the

daily chart. If the Sterling receives a positive boost from an unexpected soft Brexit

deal, the resistance of this pattern could be at 1.33, with the potential of

this formation toward the 1.39 level.

The Dollar index failed to push to new

cycle highs and slid from the 97.00 level, which could boost the Sterling over the

next couple of days.

Disclaimer:

Analysis and opinions provided herein are intended solely for

informational and educational purposes and don't represent a recommendation or

an investment advice by TeleTrade. Indiscriminate reliance on illustrative or

informational materials may lead to losses.

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.