- Analiza

- Analiza tržišta

- Tehnička analiza

- USD/CHF remains below MA (200) H1

USD/CHF remains below MA (200) H1

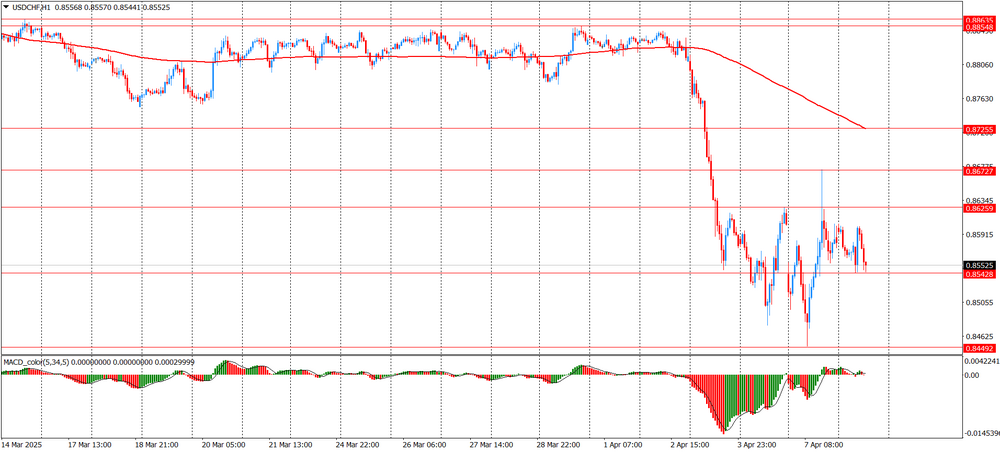

Today, there is a strong downward movement on the hourly chart of the USD/CHF currency pair, which began on April 2, after which the price fell sharply from around 0.8725 and reached a low near 0.8450. There was an upward rebound from this level, but the growth turned out to be limited by the 0.8625 resistance zone, from which the price repeatedly bounced. At the moment, the quotes are fluctuating in the range of 0.8540-0.8605, showing signs of consolidation after a strong fall. The MA (200) H1 moving average (0.8725) is well above the price and is directed downwards, indicating a continuing bearish trend. The MACD indicator shows a weak upward momentum with the histogram moving into a positive zone, but signs of a slowdown may indicate insufficient buyer strength. If the price breaks through the 0.8540 support, it will confirm the market's readiness to resume the downtrend with a target at 0.8450. In case of an upward breakdown of the 0.8625 resistance, the path to 0.8670 will open, but in the current conditions this looks less likely. The overall picture remains bearish, despite local signs of stabilization.

Resistance levels are: 0.8625, 0.8670, 0.8700

Support levels are: 0.8540, 0.8450, 0.8430

The main scenario for the pair's advance suggests a breakout of the session low of 0.8540 and a possible decline to 0.8450 (April 7 low)

An alternative scenario implies a breakout of the resistance 0.8625 (April 4 high) and there may be an increase to 0.8670 (April 7 high)

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.