- Analiza

- Analiza tržišta

- Tehnička analiza

- There is a moderate upward movement on the NZD/USD

There is a moderate upward movement on the NZD/USD

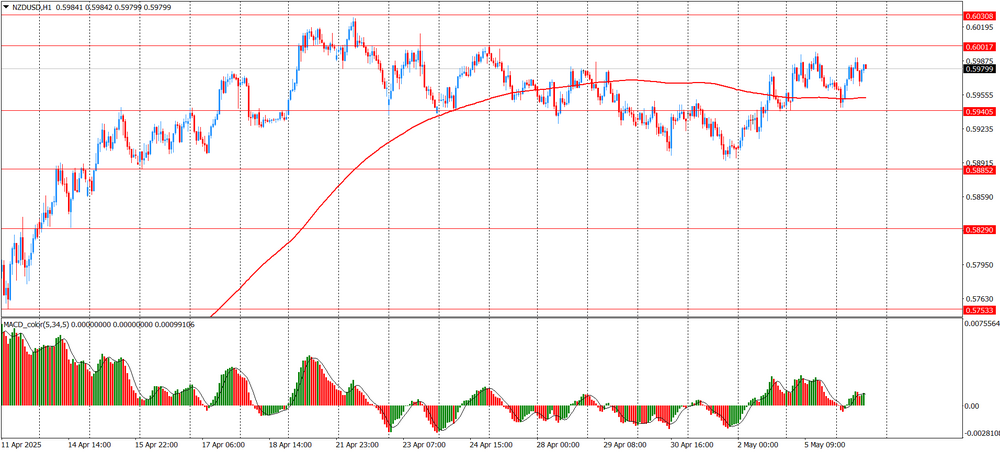

Today, a moderately upward movement is observed on the hourly chart of NZD/USD, while the price has confidently consolidated above the moving average of MA (200) H1, which turned upward, indicating a change in the short-term trend towards growth. In recent sessions, the price has formed a series of higher lows and highs, confirming the buying pressure. The nearest resistance is located at 0.6000, and the pair is currently trading close to it, which makes it possible to test and attempt a breakdown of this zone. In case of a successful breakdown, the next target level is 0.6030 resistance. From below, support is provided by the 0.5940 level, which also coincides with the consolidation zone and acts as a potential pullback point. The MACD indicator shows a positive value, the histogram is colored green, and growth is observed, indicating the presence of an upward momentum. If the momentum continues, the bulls may try to gain a foothold above 0.6000 and develop an upward movement. Otherwise, a correction to 0.5940 is possible, where demand may be retested. The overall picture is currently moderately bullish, with the potential for further growth provided the current resistance is overcome.

Resistances are at the marks:0.5955, 0.6000, 0.6030

An alternative scenario: 0.5940, 0.5885, 0.5830

The main scenario of the pair's movement implies a breakout of 1.6000 (April 24-25 high) and there may be an increase to 0.6030 (April 22 high)

An alternative scenario suggests a breakout of the session low of 0.5940 and there may be a decline to 0.5885 (April 16 low)

© 2000-2026. Sva prava zaštićena.

Sajt je vlasništvo kompanije Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Svi podaci koji se nalaze na sajtu ne predstavljaju osnovu za donošenje investicionih odluka, već su informativnog karaktera.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Izvršenje trgovinskih operacija sa finansijskim instrumentima upotrebom marginalne trgovine pruža velike mogućnosti i omogućava investitorima ostvarivanje visokih prihoda. Međutim, takav vid trgovine povezan je sa potencijalno visokim nivoom rizika od gubitka sredstava. Проведение торговых операций на финанcовых рынках c маржинальными финанcовыми инcтрументами открывает широкие возможноcти, и позволяет инвеcторам, готовым пойти на риcк, получать выcокую прибыль, но при этом неcет в cебе потенциально выcокий уровень риcка получения убытков. Iz tog razloga je pre započinjanja trgovine potrebno odlučiti o izboru odgovarajuće investicione strategije, uzimajući u obzir raspoložive resurse.

Upotreba informacija: U slučaju potpunog ili delimičnog preuzimanja i daljeg korišćenja materijala koji se nalazi na sajtu, potrebno je navesti link odgovarajuće stranice na sajtu kompanije TeleTrade-a kao izvora informacija. Upotreba materijala na internetu mora biti praćena hiper linkom do web stranice teletrade.org. Automatski uvoz materijala i informacija sa stranice je zabranjen.

Ako imate bilo kakvih pitanja, obratite nam se pr@teletrade.global.