- Análisis

- Análisis de mercado

- Opiniones de mercado

- Breakthrough of the euro?

Breakthrough of the euro?

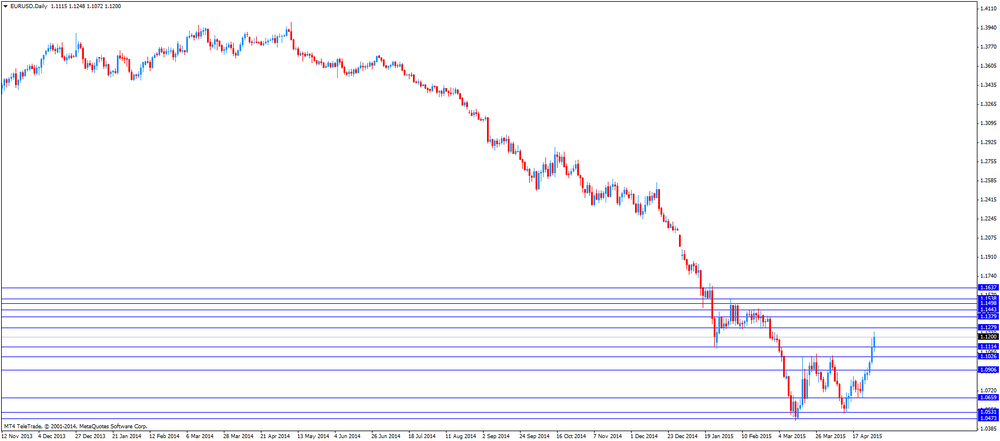

The euro started to rise against the U.S. dollar yesterday morning. The euro appreciated more than 280 pips. The significant increase was driven by different factors. Investors hope that Greece and its creditors will sign a new agreement. Tsipras reshuffled his team negotiating with European and IMF creditors on Monday. Deputy Foreign Minister, Euclid Tsakalotos, was appointed co-coordinator of the team. This news was considered positive.

An agreement will be signed between Athens and its creditors sooner or later as worries about the possible consequences of the Grexit are very high among European officials.

Yesterday's weaker-than-expected U.S. GDP growth and the results of the Fed's monetary policy meeting are other factors. The U.S. preliminary gross domestic product increased at an annual rate of 0.2% in the first quarter, missing expectations for a 1.3% gain, after a 2.2% rise in the fourth quarter.

The Fed kept its monetary policy unchanged on Wednesday, but noted that the U.S. economy slowed down during the winter months. The slowdown was driven by "transitory factors", according to the Fed's statement.

The Fed did not rule out the interest rate hike in June. But it is unlikely that the Fed will raise its interest rate in June as the U.S. labour market slowed down in March. The U.S. economy added 126,000 jobs in March, missing expectations for a rise of 251,000 jobs, after a gain of 264,000 jobs in February.

The U.S. central bank will have to wait the release of the economic data in Mai and June to decide if it starts to hike its interest rate or not.

Due to the current factors, the euro is expected to trade in the range between $1.1000 and $1.1300. If the euro breaks through the resistance level at 1.1279, the euro may increase toward $1.1400.

©2000-2026. Todos los derechos reservados.

El sitio es administrado por Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

La información presentada en el sitio, no es una base para tomar decisiones de inversión y es proporcionada sólo con fines informativos.

La empresa no atiende ni presta servicio a clientes residentes en Estados Unidos, Canadá y los países incluidos en la lista negra del FATF.

La realización de operaciones comerciales en los mercados financieros con instrumentos financieros de margen, abre grandes oportunidades y permite a los inversores que estén dispuestos a correr riesgos a obtener altos rendimientos, pero al mismo tiempo conlleva un nivel de riesgo de pérdidas potencialmente alto. Por lo tanto, antes de comenzar a comercializar, se debe tomar de manera responsable a la cuestión de elegir la estrategia de inversión correspondiente, teniendo en cuenta los recursos disponibles.

Uso de información: al usar completamente o parcialmente los materiales del sitio, el enlace a TeleTrade como fuente de información es obligatorio. El uso de materiales en Internet debe ir acompañado de un hipervínculo al sitio teletrade.org. Importación automática de materiales e información del sitio está prohibida.

Para cualquier duda o pregunta, póngase en contacto con pr@teletrade.global.