- Análisis

- Análisis de mercado

- Opiniones de mercado

- What makes public debt sustainable?

What makes public debt sustainable?

When considering the analysis of a country's public debt, it is important to remember that it should not be done only through a simple fiscal point of view in which the difference between revenues and costs is compared, as if its sustainability would simply depend on having the present value of future primary balances higher than the equivalent of future outstanding debt. When we talk about public deficits and debt, we always refer to its relationship with that country's Gross Domestic Product (GDP) - for example, country X has a deficit of 3% of GDP or a public debt of 130% of GDP. It is therefore essential to look at public debt sustainability with a view that takes into account its relationship with the country's production.

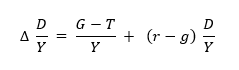

In order to help the most curious and analytical, below is described a basic formula on which the variation of the public debt depends (it is neither vital nor determines the understanding of the article):

where D refers to the nominal value of the public debt, Y to the Gross Domestic Product of the country in question, G to the state's expenses, T to the tax revenue, r to the real interest rate paid for the public debt and g to the real growth of the GDP.

Basically, simply put, this formula means that the variation of a country's public debt depends essentially on two factors:

- Primary government balances: this refers to the difference between state revenues and costs (excluding interest paid on debt) as a percentage of GDP. In other words, if the revenues obtained through taxes are higher than the costs, then there is a surplus that can contribute to the reduction of a country's public debt. The opposite can happen if we are facing a deficit. An increase in the value of GDP also leads to a decrease in the value of a deficit/surplus;

- Difference between the real interest rate paid on the debt and the growth rate of real GDP: that is, if a country's real GDP growth is higher than the real interest paid by that country to obtain debt, then this also contributes to reduce the existing public debt. If the opposite is true, this share will cause the debt as a percentage of GDP to increase.

This last point, however, has a detail that ends up revealing an important conclusion regarding the variation of a country's public debt. If economic growth is always higher than the interest paid by debt (r

Therefore, it is understood that debt sustainability does not depend so much on its absolute value, but mostly on its trajectory! Assuming that less debt is always favorable, it could be concluded, however, that one Japanese debt of 230% of GDP may be in a more sustainable than the public debt of 25% of Chile.

There is, however, a degree of uncertainty that needs to be taken into account - and that is why it is necessary to look at each country with its particularities. In the Portuguese case, it is interesting to look at the last few years based on this rationale. With the great financial crisis of 2008, Portugal began to have high fiscal deficits - that was a consequence not only of an already deficient fiscal balance, but mainly due to an economic slowdown. This meant that the interest rate paid on the debt was much higher than the growth rate of the economy (r> g), which caused the debt to quickly enter a clearly unsustainable path. Basically, the two parts of the formula (fiscal balance and difference between debt interest rates and GDP growth) were contributing to its increase. The solution found was to ask for foreign aid, which eventually led to an increase in taxes and a decrease in state spending. This was the only possible situation under European circumstances, but not necessarily the best.

In the USA, during the same financial crisis, the Fed started buying large amounts of American public debt which contributed substantially to mitigate the decrease in real GDP growth (g) and to reduce the real interest rate paid for the debt (r) leading thus to a more sustainable trajectory of public debt. If the European Central Bank (ECB) had done the same in the Eurozone, all fiscal consolidation would have been less demanding and therefore less painful for all European citizens. In the same way that the ECB "saved" the euro years later with the same measures used by the Fed, it could certainly have avoided that same extreme "bailout" situation in which the eurozone found itself.

Returning now to Portugal and its present. It is expected that the country enters a cycle of budgetary surpluses and since its economic growth prospects are, in principle, much higher than the long-term rate that will pay for its debt, there are reasons to be optimistic regarding its public debt sustainability. Moreover, Blanchard points out that a real GDP growth rate higher than the real interest rate paid for the debt "is historically a rule and not an exception" (except in very rare situations).

Although there is always uncertainty, Portugal will most likely be better prepared to face an eventual recession (with more sustainable public finances) and having the ECB already set the precedent for unconventional measures, it is then expected that it will act with greater ability and readiness.

Disclaimer:

Analysis and opinions provided herein are intended solely for informational and educational purposes and don't represent a recommendation or investment advice by TeleTrade. Indiscriminate reliance on illustrative or informational materials may lead to losses.

©2000-2026. Todos los derechos reservados.

El sitio es administrado por Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

La información presentada en el sitio, no es una base para tomar decisiones de inversión y es proporcionada sólo con fines informativos.

La empresa no atiende ni presta servicio a clientes residentes en Estados Unidos, Canadá y los países incluidos en la lista negra del FATF.

La realización de operaciones comerciales en los mercados financieros con instrumentos financieros de margen, abre grandes oportunidades y permite a los inversores que estén dispuestos a correr riesgos a obtener altos rendimientos, pero al mismo tiempo conlleva un nivel de riesgo de pérdidas potencialmente alto. Por lo tanto, antes de comenzar a comercializar, se debe tomar de manera responsable a la cuestión de elegir la estrategia de inversión correspondiente, teniendo en cuenta los recursos disponibles.

Uso de información: al usar completamente o parcialmente los materiales del sitio, el enlace a TeleTrade como fuente de información es obligatorio. El uso de materiales en Internet debe ir acompañado de un hipervínculo al sitio teletrade.org. Importación automática de materiales e información del sitio está prohibida.

Para cualquier duda o pregunta, póngase en contacto con pr@teletrade.global.