- Análisis

- Análisis de mercado

- Opiniones de mercado

- Investors reconsider Netflix churn rate boosting shares by 7.24%

Investors reconsider Netflix churn rate boosting shares by 7.24%

Netflix (NFLX) stocks gained 7.24% closing $349.6 on Thursday after investors reconsider a disappointing guidance from the streaming giant where it stated elevating churn rate for 1Q2020.

"Our Q1'20 forecast reflects the continued, slightly elevated churn levels we are seeing in the U.S. plus an expectation for more balanced paid net adds across Q1 and Q2 this year, with seasonality more similar to 2018 than 2019", Netflix warned in a press release.

The company delivered quarterly earnings beat both in EPS of $1.30 and revenue of $5.47 billion vs analysts' average forecast EPS of $0.52 on revenue of $5.45 billion. That was also significantly higher compareв with EPS of $0.30 on revenue of $4.19 billion the same 4Q a year before.

In the same report Netflix posted new 550,000 U.S. and Canada streaming subscribers, missing forecasts of 589,000, but performed much better worldwide adding 8.33 million new subscribers, well above the 7.2 million generally expected before.

The market gave a one-day break after mixed Wednesday's dynamics of both Netflix shares and main US indexes and probably came to a more realistic conclusion: year by year Netflix goes global. Even with a relatively higher churn levels in the U.S. compared to Disney and Apple streaming services the total number of Netflix "devotees" is rapidly increasing.

The company focuses on international markets as streaming space gets crowded, 95% of new 4Q2019 subscribers came from the outside the North American continent.

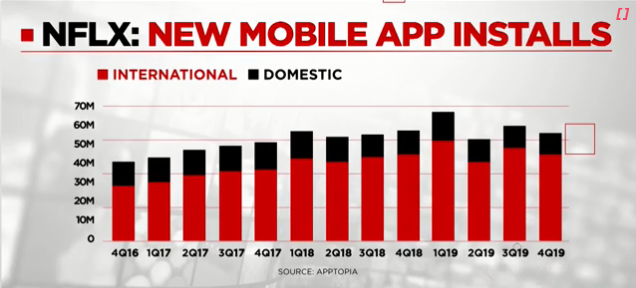

Pic.1 Netflix mobile application new installations

Source: Apptopia

Moderate gains in Nasdaq and the S&P500 on Thursday supported the rise in Netflix shares, but they outperform the market breaking through the $345 strong 7-months' resistance level. Still, Netflix shares are still 9.42% below their 52-week high of $385.99 set on May 1, 2019.

After that brilliant trading session, some of big funds raised their target price on Netflix stocks. Guggenheim Partners with a $275 billion under management revealed surprisingly high forecast of possible $420 per share after $400 target before.

More realistic and possible target technically could be seen on a half way to $385.99 peak, and any of such an upward scenarios may be able to remain in effect as long as the price fluctuates at least above $315 (former strong November resistance level).

Disclaimer:

Analysis and opinions provided herein are intended solely for informational and educational purposes and don't represent a recommendation or investment advice by TeleTrade.

Indiscriminate reliance on illustrative or informational materials may lead to losses.

©2000-2026. Todos los derechos reservados.

El sitio es administrado por Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

La información presentada en el sitio, no es una base para tomar decisiones de inversión y es proporcionada sólo con fines informativos.

La empresa no atiende ni presta servicio a clientes residentes en Estados Unidos, Canadá y los países incluidos en la lista negra del FATF.

La realización de operaciones comerciales en los mercados financieros con instrumentos financieros de margen, abre grandes oportunidades y permite a los inversores que estén dispuestos a correr riesgos a obtener altos rendimientos, pero al mismo tiempo conlleva un nivel de riesgo de pérdidas potencialmente alto. Por lo tanto, antes de comenzar a comercializar, se debe tomar de manera responsable a la cuestión de elegir la estrategia de inversión correspondiente, teniendo en cuenta los recursos disponibles.

Uso de información: al usar completamente o parcialmente los materiales del sitio, el enlace a TeleTrade como fuente de información es obligatorio. El uso de materiales en Internet debe ir acompañado de un hipervínculo al sitio teletrade.org. Importación automática de materiales e información del sitio está prohibida.

Para cualquier duda o pregunta, póngase en contacto con pr@teletrade.global.