- Análisis

- Análisis de mercado

- Opiniones de mercado

- Technical analysis for USDJPY Probable Bearish Sentiment

Technical analysis for USDJPY Probable Bearish Sentiment

Technical analysis for USDJPY Probable Bearish Sentiment

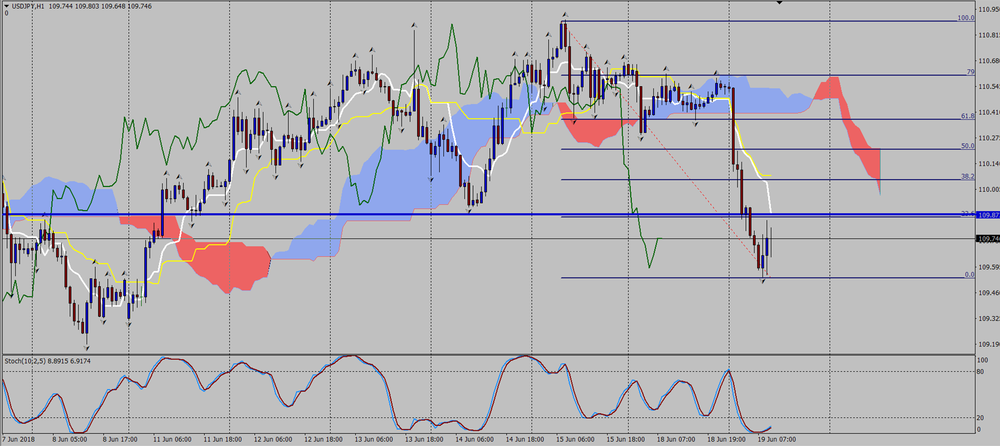

• On 18/6/18 the price reached the level 2 times 110.610 which was the Fibonacci level of 79% and reverse.

Based on the technical analysis we can see that the price is creating lower lows and lower highs, failing to recover.

On 18/6/18 the price reached the level 110.610 2 times which was the Fibonacci level of 70% and reverse.

If we examine the Ichimoku system, we can see that the price also respects the Kumo cloud by not be able to penetrate it which is at the same level 79% of Fibonacci.

It is notable here that we have a valid kumo break out signal as well on the bear side.

The price is below the cloud, the Tekan sen and kijun sen seem to be in a bear formation and the Chikou span is below the price.

Those clues giving us the confidence we need to confirm that the kumo breakout signal is valid

USDJPY 1H Chart

Disclaimer: Materials, analysis, and opinions contained, referenced or provided herein are intended solely for informational and educational purposes. Personal Opinion of the Author does not represent and should not be construed as a statement or an investment advice made by TeleTrade. All Indiscriminate reliance on illustrative or informational materials may lead to losses. Past performance is not a reliable indicator of future results.

Risk Warning: Investment services are provided by TeleTrade-DJ International Consulting Ltd, a Cyprus Investment Firm under Reg. number HE272810 operating in accordance with MiFID, under license 158/11 by the Cyprus Securities and Exchange Commission. Trading in leveraged derivative financial instruments carries a high level of risk and may not be suitable for all investors. Past performance is not a reliable indicator of future results. Indiscriminate reliance on informational or historical materials may lead to losses

©2000-2026. Todos los derechos reservados.

El sitio es administrado por Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

La información presentada en el sitio, no es una base para tomar decisiones de inversión y es proporcionada sólo con fines informativos.

La empresa no atiende ni presta servicio a clientes residentes en Estados Unidos, Canadá y los países incluidos en la lista negra del FATF.

La realización de operaciones comerciales en los mercados financieros con instrumentos financieros de margen, abre grandes oportunidades y permite a los inversores que estén dispuestos a correr riesgos a obtener altos rendimientos, pero al mismo tiempo conlleva un nivel de riesgo de pérdidas potencialmente alto. Por lo tanto, antes de comenzar a comercializar, se debe tomar de manera responsable a la cuestión de elegir la estrategia de inversión correspondiente, teniendo en cuenta los recursos disponibles.

Uso de información: al usar completamente o parcialmente los materiales del sitio, el enlace a TeleTrade como fuente de información es obligatorio. El uso de materiales en Internet debe ir acompañado de un hipervínculo al sitio teletrade.org. Importación automática de materiales e información del sitio está prohibida.

Para cualquier duda o pregunta, póngase en contacto con pr@teletrade.global.