- Análisis

- Análisis de mercado

- Opiniones de mercado

- Between Possibility and Opportunity: GOLD

Between Possibility and Opportunity: GOLD

Analysts are trained to see charts and markets in terms of possibilities: there are thousands of ways the market could move, and they try to know and study them all.

Traders, being closer to the action, must look at things differently. For them, the markets and the charts are full of opportunities - out of those thousands of ways the market can go, they are interested in those areas and moments offering a window of opportunity.

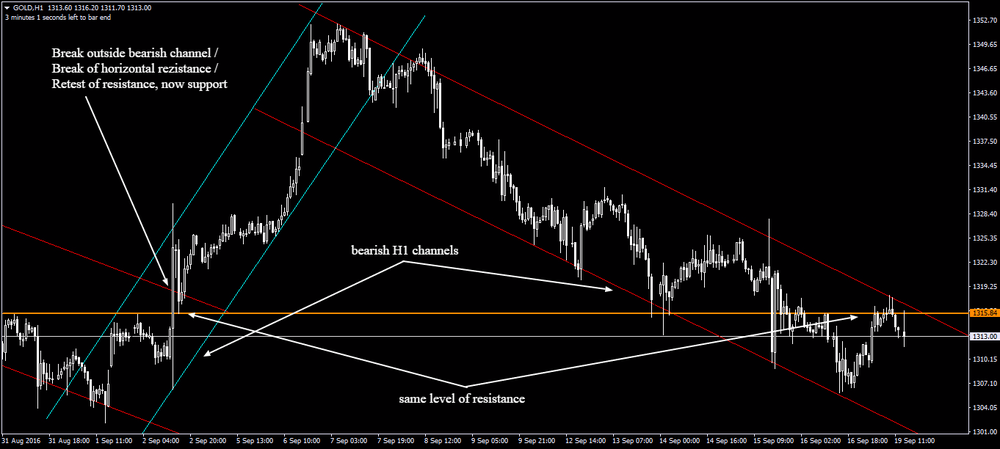

Today, Gold is giving us a rather interesting picture, which I would like to discuss with you today. Possibility or opportunity? I let you be the judge of that.

Gold is currently displaying a price action pattern very similar to that before the Sep.2 breakout. We are in a downward channel of about the same amplitude and duration, we are at the exact same horizontal key level and price has already pushed up into a first wave test at the key level. Could a similar scenario output happen, or could we expect that this time bears have learned their lesson?

Scenario/possibility 1 (Bullish): Gold could rise rapidly into a steady, powerful breakout to the upside. Opportunity: longs could be taken above the resistance line which (if history is any guide) could again turn into support after the breakout.

Scenario/possibility 2 (Bearish): Gold could remain bound within the same downward channel, or could spike up for a false breakout. Opportunity: in this case shorts would continue to be favored, and especially in the case of a false breakout bears will look for new lows withing the next 1-2 days.

What about you? Ideas? Comments? What is your outlook for Gold for the next few trading sessions?

©2000-2026. Todos los derechos reservados.

El sitio es administrado por Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

La información presentada en el sitio, no es una base para tomar decisiones de inversión y es proporcionada sólo con fines informativos.

La empresa no atiende ni presta servicio a clientes residentes en Estados Unidos, Canadá y los países incluidos en la lista negra del FATF.

La realización de operaciones comerciales en los mercados financieros con instrumentos financieros de margen, abre grandes oportunidades y permite a los inversores que estén dispuestos a correr riesgos a obtener altos rendimientos, pero al mismo tiempo conlleva un nivel de riesgo de pérdidas potencialmente alto. Por lo tanto, antes de comenzar a comercializar, se debe tomar de manera responsable a la cuestión de elegir la estrategia de inversión correspondiente, teniendo en cuenta los recursos disponibles.

Uso de información: al usar completamente o parcialmente los materiales del sitio, el enlace a TeleTrade como fuente de información es obligatorio. El uso de materiales en Internet debe ir acompañado de un hipervínculo al sitio teletrade.org. Importación automática de materiales e información del sitio está prohibida.

Para cualquier duda o pregunta, póngase en contacto con pr@teletrade.global.