- Аналітика

- Новини та інструменти

- Новини ринків

- Asian session: The euro is under pressure

Asian session: The euro is under pressure

01:30 Australia Employment Change s.a. (Jun) 23.4K

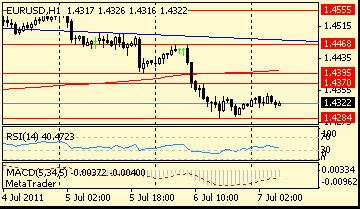

The euro traded near the lowest level in a week against the Swiss franc after analysts said Ireland’s credit rating may be cut to junk by Moody’s Investors Service following Portugal’s loss of its investment-grade rating.

The euro snapped yesterday’s loss against the dollar and yen after Moody’s said it differentiates “significantly” among European periphery countries, suggesting it may not imminently cut Ireland’s rating to junk in line with Portugal and Greece.

The European Central Bank will increase its main refinancing rate to 1.50 percent today from 1.25 percent, according to all economists in a survey. The central bank may increase borrowing costs further in the fourth quarter, according to a separate survey.

European data starts at 1000GMT by German in industrial output data. At 1145GMT, the ECB decision is due, which will be followed at 1230GMT

by the usual press conference with ECB President Jean-Claude Trichet.

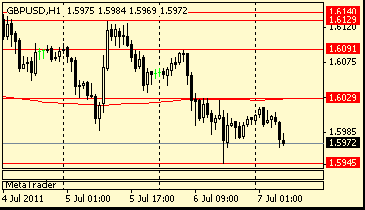

UK data includes at 0830GMT Industrial Production/Manufacturing Output data is due for release. The data is expected to show a bit of a rebound from the previous month, with industrial production rising 1.3% m/m but remaining lower by a reading of -0.4% y/y. Manufacturing output is seen

up 1.1% m/m, 2.2% y/y. The Bank of England Monetary Policy Committee makes it's announcement at 1100GMT but no change is expected in either

the current 0.50% overnight rate or the 200 billion level of asset purchases.

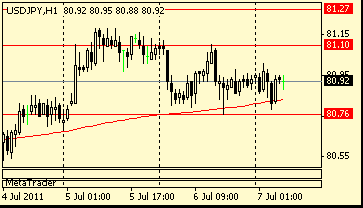

At 1215GMT, the ADP National Employment Report is due. Last month the unexpectedly soft reading caused some to revise their estimates

lower. The lackluster 54,000 increase in non-farm payrolls justified the revision. At 1230GMT, initial jobless claims are expecting toll to 420,000 in the July 2 week. Claims have been above 420,000 since the April 30 week. In the July 25 week, a labor analyst said there no special factors

contributing to the decline of 1,000 claims.

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.