- Аналітика

- Новини та інструменти

- Новини ринків

- Foreign exchange market. European session: the euro dropped against the U.S. dollar despite the strong industrial production in France

Foreign exchange market. European session: the euro dropped against the U.S. dollar despite the strong industrial production in France

Economic

calendar (GMT0):

01:30 Australia National Australia Bank's

Business Confidence May 6 7

01:30 Australia ANZ Job Advertisements

(MoM) May +2.2% -5.6%

01:30 Australia Home Loans

April -0.8% +0.3%

0%

01:30 China PPI y/y

May -2.0% -1.5%

-1.4%

01:30 China CPI y/y

May +1.8%

+2.4% +2.5%

05:45 Switzerland Unemployment Rate May 3.2%

3.2% 3.2%

06:00 Japan Prelim Machine Tool Orders,

y/y May 48.7%

24.1%

06:45 France Industrial Production,

m/m

April -0.4% +0.3%

+0.3%

06:45 France Industrial Production,

y/y

April -0.8% 0.0%

07:15 Switzerland Retail Sales Y/Y

April +3.4% +3.5%

+0.4%

08:30 United Kingdom Industrial Production (MoM) April -0.1%

+0.4% +0.4%

08:30 United Kingdom Industrial Production (YoY) April +2.3%

+2.7% +3.0%

08:30 United Kingdom Manufacturing Production (MoM) April +0.5%

+0.4% +0.4%

08:30 United Kingdom Manufacturing Production (YoY) April +3.3%

+4.0% +4.4%

The U.S.

dollar traded higher against the most major currencies. The U.S. dollar was

still supported by Friday’s nonfarm payrolls report. The U.S. economy added

217,000 in May, missing expectations for a 218,000 rise, after a 282,000 gain

in April. April’s figure was revised down from a 288,000 increase.

The euro dropped

against the U.S. dollar despite the strong industrial production in France. Industrial

production in France rose 0.3% in April, meeting expectations, after a 0.4%

decline in March. March’s figure was revised up from a 0.7% decrease.

On a yearly

basis, industrial production in France was flat in April, after a 0.8% fall in

March.

The

European Central Bank’s interest rate decision weighed on the euro. The

European Central Bank cut its interest rate to 0.15% from 0.25% last Thursday.

The ECB also cut its marginal lending to 0.40% from 0.75% and reduced its

deposit rate to -0.10% from 0.0%. The European Central Bank is the world’s

first major central bank to use a negative rate. The deposit rate of -0.10%

means that commercial bank will be charged for holding their reserves. This

measure should spur commercial banks to ramp up lending.

The British

pound traded lower against the U.S. dollar. Manufacturing output in the U.K.

increased 0.4% in April, meeting expectations, after 0.5% gain in March. On a

yearly basis, manufacturing production in the U.K. rose 4.4% in April,

exceeding expectations for a 4% increase, after a 3.3% increase in March.

Industrial

production in the U.K. climbed 0.4% in April, in line with forecasts, after a

0.1% decline in March. On a year-over-year basis, industrial production in the

U.K. rose 3.0% in April, after a 2.3% increase in March. That was the biggest annual

increase since 2011. Economists had expected a 2.7% gain.

The Swiss

franc declined against the U.S. dollar. Switzerland’s unemployment rate

remained unchanged at 3.2% in May, as expected.

Retail

sales in Switzerland increased 0.4% in April, missing expectations for a 3.5%

gain, after a 3.4% rise in March. March’s figure was revised up from a 3.0%

increase.

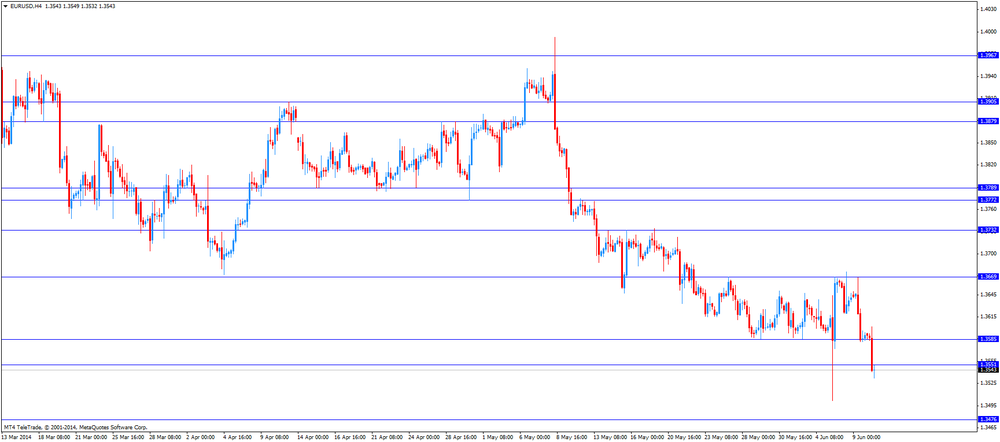

EUR/USD:

the currency pair declined to $1.3532

GBP/USD:

the currency pair decreased to $1.6764

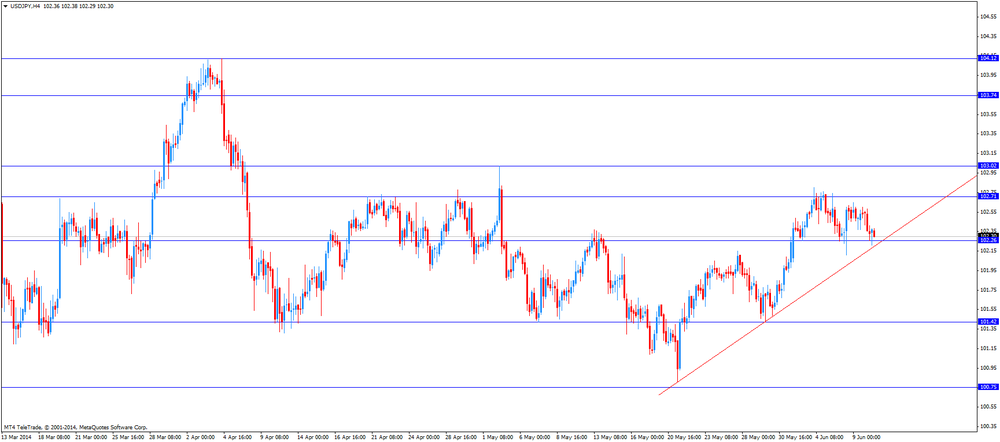

USD/JPY:

the currency pair traded mixed

The most

important news that are expected (GMT0):

14:00 United Kingdom NIESR GDP Estimate May +1.0%

14:00 U.S. JOLTs Job Openings April 4014 4040

23:50 Japan BSI Manufacturing Index

Quarter II 12.5 14.1

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.