- Аналітика

- Новини та інструменти

- Новини ринків

- Foreign exchange market. Asian session: the New Zealand dollar dropped against the U.S dollar due to the weaker-than-expected inflation data from New Zealand and yesterday’s comments by the Fed Chair Janet Yellen

Foreign exchange market. Asian session: the New Zealand dollar dropped against the U.S dollar due to the weaker-than-expected inflation data from New Zealand and yesterday’s comments by the Fed Chair Janet Yellen

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Leading Index May +0.1% +0.1%

02:00 China Retail Sales y/y June +12.5% +12.4%

02:00 China Industrial Production y/y June +8.8% +9.0% +9.2%

02:00 China Fixed Asset Investment June +17.2% +17.2% +17.3%

02:00 China GDP y/y Quarter II +7.4% +7.4% +7.5%

05:00 Japan BoJ monthly economic report July

08:30 United Kingdom Average earnings ex bonuses, 3 m/y May +0.9% +0.7%

08:30 United Kingdom Average Earnings, 3m/y May +0.7% +0.7% +0.3%

08:30 United Kingdom Claimant count June -27.4 -27.1 -36.3

08:30 United Kingdom Claimant Count Rate June 3.2% 3.2% 3.1%

08:30 United Kingdom ILO Unemployment Rate May 6.6% 6.6% 6.5%

09:00 Eurozone Trade Balance s.a. May 15.8 16.3 15.3

09:00 Switzerland Credit Suisse ZEW Survey (Expectations) July 4.8 0.1

The U.S. dollar traded higher against the most major currencies due to yesterday's comments by the Fed Chair Janet Yellen. The Fed Chair said the economy in the U.S. is continuing to improve but the recovery is not yet complete. She added that if the labour market continues to improve more quickly, the Fed will hike its interest rate sooner than expected, but weaker conditions will mean a longer period of low interest rate.

The Fed Chair Yellen will testifiy before the House Financial Services Committee today.

The New Zealand dollar dropped against the U.S dollar due to the weaker-than-expected inflation data from New Zealand and yesterday's comments by the Fed Chair Janet Yellen. New Zealand's consumer price index increased 0.3% in the second quarter, missing expectations for a 0.5% rise, after a 0.3% gain in the previous quarter.

On a yearly basis, the consumer price index in New Zealand rose 1.6% in the second quarter, after a 1.5% increase in the previous quarter.

The Australian dollar declined against the U.S. dollar due to yesterday's comments by the Fed Chair Janet Yellen. The leading index for Australia released by Westpac and the Melbourne Institute climbed 0.1% in June, after a 0.1% rise in the previous month.

Some better-than-expected economic data from China hadn't any positive impact on the Australian and New Zealand dollar. China's gross domestic product rose 7.5% in the second quarter, exceeding expectations for a 7.4% increase, after a 7.4% in the previous quarter.

Industrial production in China climbed 9.2% in June, beating forecasts for a 9.0% rise, after a 8.8% gain in May.

Fixed asset investment in China rose 17.3% in June period, exceeding expectations for a 17.2% gain, after a 17.2% increase in May.

Retail sales in China gained 12.4% in June, after 12.5% rise in May.

The Japanese yen traded lower against the U.S. dollar dollar due to yesterday's comments by the Fed Chair Janet Yellen. The Bank of Japan (BoJ) said in its monthly report on Wednesday that Japan's economy has continued to recover moderately. The BoJ also said that Japan's output gap was 0.6% in January-March, turning positive for the first time since Q2 2008.

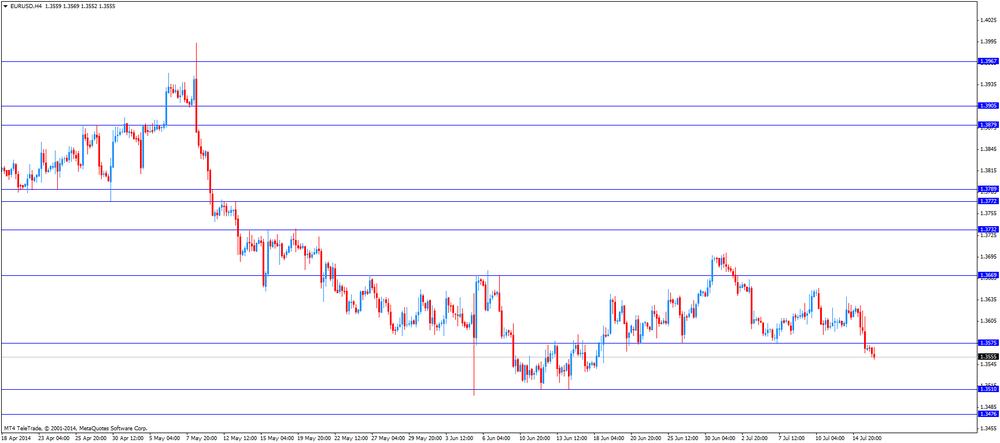

EUR/USD: the currency pair declined to $1.3560

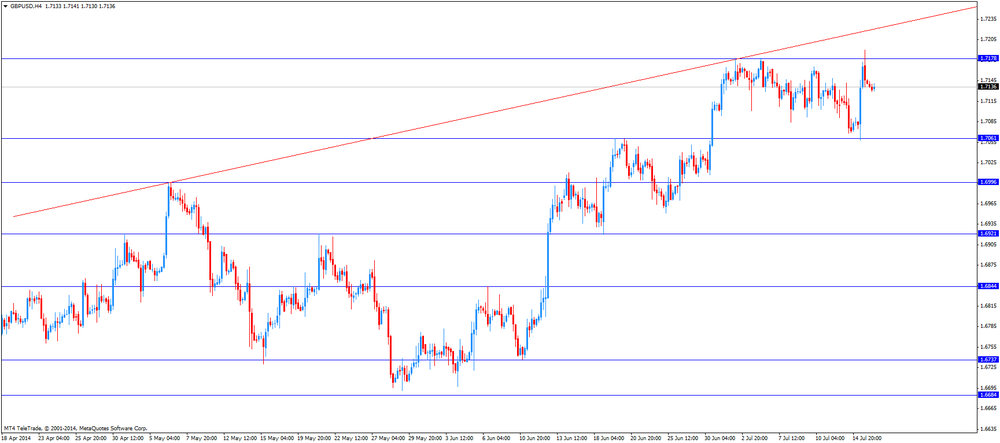

GBP/USD: the currency pair decreased to $1.7135

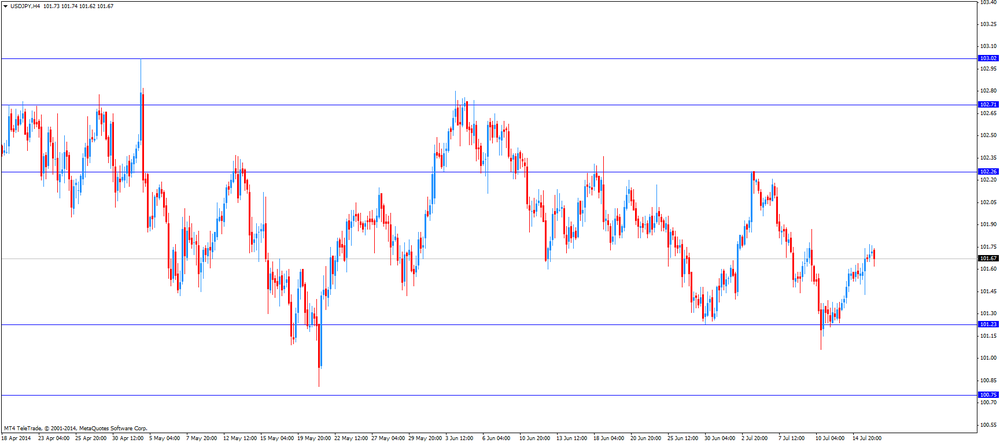

USD/JPY: the currency pair rose to Y101.80

The most important news that are expected (GMT0):

12:30 Canada Manufacturing Shipments (MoM) May -0.1% +0.4%

12:30 U.S. PPI, m/m June -0.2% +0.2%

12:30 U.S. PPI, y/y June +2.0% +1.8%

12:30 U.S. PPI excluding food and energy, m/m June -0.1% +0.3%

12:30 U.S. PPI excluding food and energy, Y/Y June +2.0% +1.7%

13:00 U.S. Net Long-term TIC Flows May -24.2 27.4

13:00 U.S. Total Net TIC Flows May 136.8

13:15 U.S. Industrial Production (MoM) June +0.6% +0.4%

13:15 U.S. Capacity Utilization June 79.1% 79.4%

14:00 Canada Bank of Canada Rate 1.00% 1.00%

14:00 Canada Bank of Canada Monetary Policy Report

14:00 Canada BOC Rate Statement

14:00 U.S. Federal Reserve Chair Janet Yellen Testifies

14:00 U.S. NAHB Housing Market Index July 49 51

15:15 Canada BOC Press Conference

16:00 U.S. FOMC Member Richard Fisher Speaks

18:00 U.S. Fed's Beige Book July

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.