- Аналітика

- Новини та інструменти

- Новини ринків

- Foreign exchange market. European session: the euro traded higher against the U.S. dollar after the mostly weaker-than-expected economic data from Eurozone

Foreign exchange market. European session: the euro traded higher against the U.S. dollar after the mostly weaker-than-expected economic data from Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Export Price Index, q/q Quarter IV -3.9% 0.0%

00:30 Australia Import Price Index, q/q Quarter IV -0.8% +0.9%

07:00 United Kingdom Nationwide house price index January + +0.2% +0.4% +0.3%

07:00 United Kingdom Nationwide house price index, y/y January +7.2% +6.6% +6.8%

08:55 Germany Unemployment Change January -25 Revised From -27 -13 -8

08:55 Germany Unemployment Rate s.a. January 6.6% Revised From 6.5% 6.5% 6.5%

09:00 Eurozone Private Loans, Y/Y December -2.7% Revised From -0.9% +3.1%

09:00 Eurozone M3 money supply, adjusted y/y December +3.1% +3.6%

10:00 Eurozone Business climate indicator January 0.15 Revised From 0.2 0.16

10:00 Eurozone Economic sentiment index January 100.8 101.4 101.2

10:00 Eurozone Industrial confidence January -4.0 -4.7 -5.0

11:00 United Kingdom CBI retail sales volume balance January 61 39

13:00 Germany CPI, m/m (Preliminary) January 0.0% -0.7% -1.0%

13:00 Germany CPI, y/y (Preliminary) January +0.2% 0.0% -0.3%

The U.S. dollar traded mixed against the most major currencies ahead of the U.S. economic data.

Pending home sales in the U.S. are expected to climb 0.6% in December, after a 0.8% increase in October.

The euro traded higher against the U.S. dollar after the mostly weaker-than-expected economic data from Eurozone. German preliminary consumer price index dropped 1.0% in January, missing expectations for a 0.7% decline, after a flat reading in December.

On a yearly basis, German preliminary consumer price index decreased to -0.3% in January from 0.2% in December, missing forecasts for a flat reading. That was the lowest level since July 2009.

The number of unemployed people in Germany declined by 8,000 in January, missing expectations for a 13,000 decline, after a 25,000 drop in December. December's figure was revised down from a 27,000 decrease.

Germany's adjusted unemployment rate fell to 6.5% in January from 6.6% in December, in line with expectations. December's figure was revised down from 6.5%.

Eurozone's adjusted M3 money supply rose 3.6% in December, after a 3.1 gain in November.

Investors remained cautious amid concerns over Greece's future policy. Syriza party won the country's parliament elections on Sunday. The party has pledged to renegotiate the terms of the country's €240 billion euro financial bailout and to reverse many of the austerity measures.

The British pound traded mixed against the U.S. dollar after the mixed house prices from the U.K. The Nationwide Building Society released its house price inflation figures for the U.K. on Thursday. The U.K. house price index increased 0.3% in December, missing expectations for a 0.4% gain, after a 0.2% rise in November.

On a yearly basis, the U.K. house price inflation fell to 6.8% in December from 7.2% in November, beating expectations for a decline to 6.6%.

EUR/USD: the currency pair rose to $1.1326

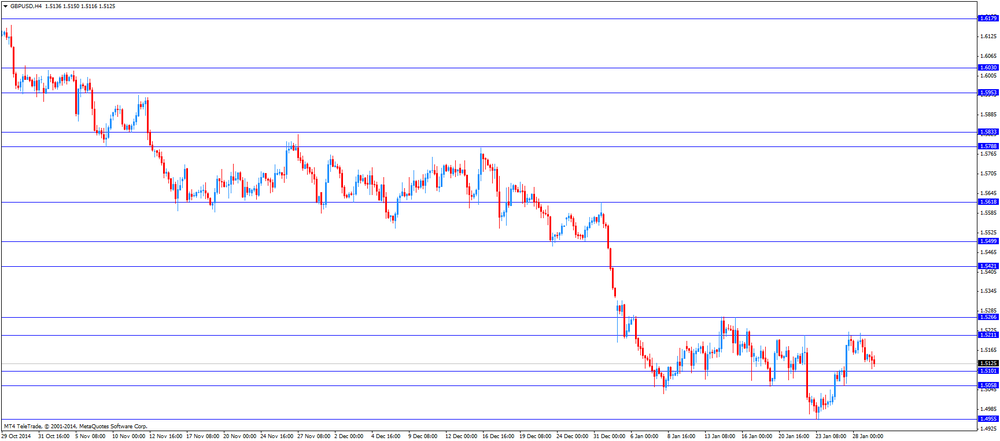

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair climbed to $118.18

The most important news that are expected (GMT0):

13:30 U.S. Initial Jobless Claims January 307

15:00 U.S. Pending Home Sales (MoM) December +0.8% +0.6%

23:30 Japan Tokyo Consumer Price Index, y/y January +2.1%

23:30 Japan Tokyo CPI ex Fresh Food, y/y January +2.3% +2.2%

23:30 Japan Household spending Y/Y December -2.5% -2.5%

23:30 Japan National Consumer Price Index, y/y December +2.4%

23:30 Japan National CPI Ex-Fresh Food, y/y December +2.7% +2.6%

23:50 Japan Industrial Production (MoM) (Preliminary) December -0.6% +1.3%

23:50 Japan Industrial Production (YoY) (Preliminary) December -3.7%

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.