- Аналітика

- Новини та інструменти

- Новини ринків

- Foreign exchange market. European session: the euro traded higher against the U.S. dollar as the consumer price inflation increased slightly

Foreign exchange market. European session: the euro traded higher against the U.S. dollar as the consumer price inflation increased slightly

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia Import Price Index, q/q Quarter I 0.9% -0.2%

01:30 Australia Export Price Index, q/q Quarter I 0.0% -0.8%

01:30 Australia Private Sector Credit, y/y March 6.2% 6.2%

01:30 Australia Private Sector Credit, m/m March 0.5% 0.59% 0.5%

03:00 Japan BoJ Interest Rate Decision 0% 0% 0%

03:00 Japan BoJ Monetary Policy Statement

03:00 Japan Bank of Japan Monetary Base Target 275 275

05:00 Japan Housing Starts, y/y March -3.1% 1.66% 0.7%

05:00 Japan Construction Orders, y/y March 1.0% 1.04% 8.2%

06:00 Germany Retail sales, real unadjusted, y/y March 3.3% Revised From 3.6% 3% 3.5%

06:00 Germany Retail sales, real adjusted March -0.1% Revised From -0.5% 0.7% -2.3%

06:00 Japan BOJ Outlook Report

06:30 Japan BOJ Press Conference

06:45 France Consumer spending March 0.1% Revised From 0.2% -0.5% -0.6%

06:45 France Consumer spending, y/y March 3.0% 2.1%

07:00 Switzerland KOF Leading Indicator April 90.9 Revised From 90.8 89.5

07:55 Germany Unemployment Change April -14 Revised From -15 -13 -8

07:55 Germany Unemployment Rate s.a. April 6.4% 6.4% 6.4%

09:00 Eurozone Harmonized CPI, Y/Y (Preliminary) April -0.1% 0.0% 0.0%

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Preliminary) April 0.6% 0.68% 0.6%

09:00 Eurozone Unemployment Rate March 11.3% 11.3% 11.3%

The U.S. dollar traded mixed against the most major currencies ahead of the U.S. economic data. Personal income in the U.S. is expected to rise 0.2% in March, after a 0.4% gain in February.

Personal spending in the U.S. is expected to gain 0.3% in March, after a 0.1% increase in February.

The number of initial jobless claims in the U.S. is expected to rise by 5,000 to 300,000.

The results of the Fed's monetary policy meeting weighed on the greenback. The Fed kept its monetary policy unchanged, but it did not rule out the interest rate hike in June.

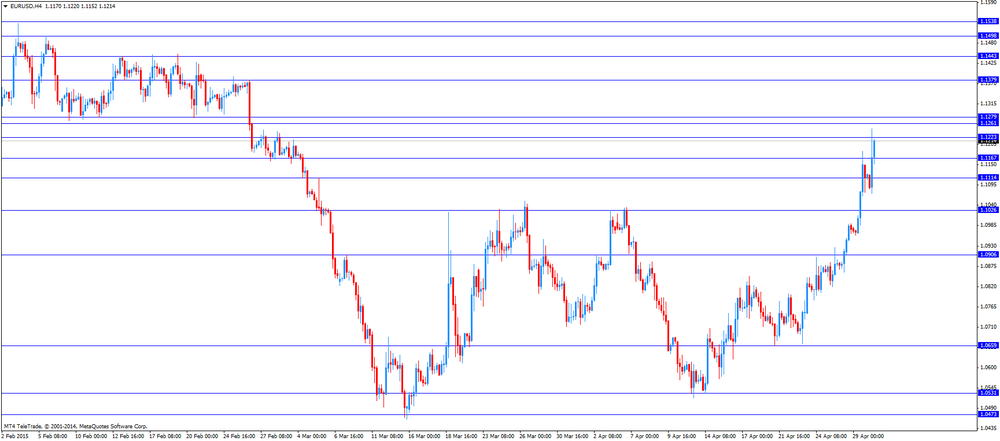

The euro traded higher against the U.S. dollar as the consumer price inflation increased slightly. The preliminary consumer price inflation in the Eurozone rose to an annual rate of 0.0% in April from -0.1% in March, in line with expectations. The increase was driven by ECB's quantitative easing programme.

Eurozone's unemployment rate remained unchanged at 11.3% in March, in line with expectations.

The number of unemployed people in Germany declined by 8,000 in April, missing expectations for a 13,000 decline, after a 14,000 drop in March. March's figure was revised down from a 15,000 fall.

Germany's adjusted unemployment rate remained unchanged at 6.4% in April, in line with expectations.

German adjusted retail sales dropped 2.3% in March, missing forecasts of a 0.7% rise, after a 0.1% gain in February. February's figure was revised up from a 0.5% decrease.

French consumer spending decreased 0.6% in March, missing expectations for a 0.5% fall, after a 0.2% rise in February. February's figure was revised up from a 0.1% increase.

The British pound traded mixed against the U.S. dollar in the absence of any major economic data from the U.K.

The Canadian dollar traded lower against the U.S. dollar ahead of Canadian GDP growth data and a speech by the Bank of Canada Governor Stephen Poloz.

The Swiss franc traded higher against the U.S. dollar despite the weaker-than-expected KOF leading indicator from Switzerland. The KOF leading indicator decreased to 89.5 in April from 90.9 in March. March's figure was revised up from 90.8.

EUR/USD: the currency pair increased to $1.1248

GBP/USD: the currency pair traded mixed

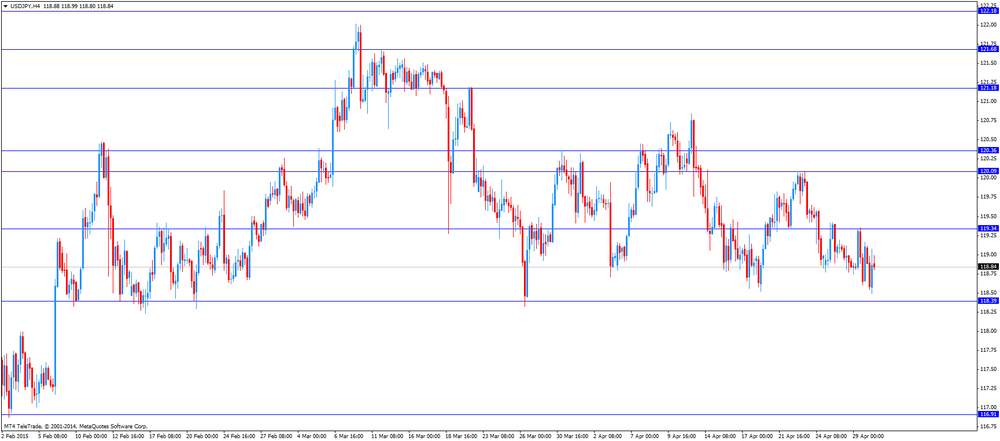

USD/JPY: the currency pair rose to Y119.07

The most important news that are expected (GMT0):

12:30 Canada GDP (m/m) February -0.1%

12:30 U.S. Initial Jobless Claims April 295 300

12:30 U.S. Personal spending March 0.1% 0.3%

12:30 U.S. Personal Income, m/m March 0.4% 0.2%

12:30 U.S. PCE price index ex food, energy, Y/Y March 1.4%

12:30 U.S. PCE price index ex food, energy, m/m March 0.1%

13:45 U.S. Chicago Purchasing Managers' Index April 46.3

14:30 Canada BOC Gov Stephen Poloz Speaks

23:30 Japan Household spending Y/Y March -2.9% -10%

23:30 Japan Tokyo Consumer Price Index, y/y April 2.3%

23:30 Japan Tokyo CPI ex Fresh Food, y/y April 2.2%

23:30 Japan National Consumer Price Index, y/y March 2.2% 2.3%

23:30 Japan National CPI Ex-Fresh Food, y/y March 2% 2.1%

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.