- Аналітика

- Новини та інструменти

- Новини ринків

- Foreign exchange market. European session: the British pound traded lower against the U.S. dollar after the weaker-than-expected manufacturing PMI from the U.K.

Foreign exchange market. European session: the British pound traded lower against the U.S. dollar after the weaker-than-expected manufacturing PMI from the U.K.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia MI Inflation Gauge, m/m May 0.3% 0.3%

01:00 China Non-Manufacturing PMI May 53.4 53.2

01:00 China Manufacturing PMI May 50.1 50.2 50.2

01:30 Australia Company Gross Profits QoQ Quarter I -0.4% Revised From -0.2% 0.5% 0.2%

01:30 Australia Building Permits, m/m April 2.9% Revised From 2.8% -2% -4.4%

01:35 Japan Manufacturing PMI (Finally) May 49.9 50.9 50.9

01:45 China HSBC Manufacturing PMI (Finally) May 48.9 49.1 49.2

07:30 Switzerland Manufacturing PMI May 47.9 48.4 49.4

07:50 France Manufacturing PMI (Finally) May 48.0 49.3 49.4

07:55 Germany Manufacturing PMI (Finally) May 52.1 51.4 51.1

08:00 Eurozone Manufacturing PMI (Finally) May 52.0 52.3 52.2

08:30 United Kingdom Purchasing Manager Index Manufacturing May 51.8 Revised From 51.9 52.5 52.0

12:00 Germany CPI, m/m (Preliminary) May 0.0% 0.1% 0.1%

12:00 Germany CPI, y/y (Preliminary) May 0.5% 0.7% 0.7%

The U.S. dollar traded mixed against the most major currencies ahead of U.S. economic data. The personal consumer expenditures (PCE) price index excluding food and energy is expected to increase 0.2% in April, after a 0.1 rise in March.

Personal income in the U.S. is expected to rise 0.3% in April, after a flat reading in March.

Personal spending in the U.S. is expected to gain 0.2% in April, after a 0.4% increase in March.

The ISM manufacturing purchasing managers' index is expected to climb to 52.0 in May from 51.5 in March.

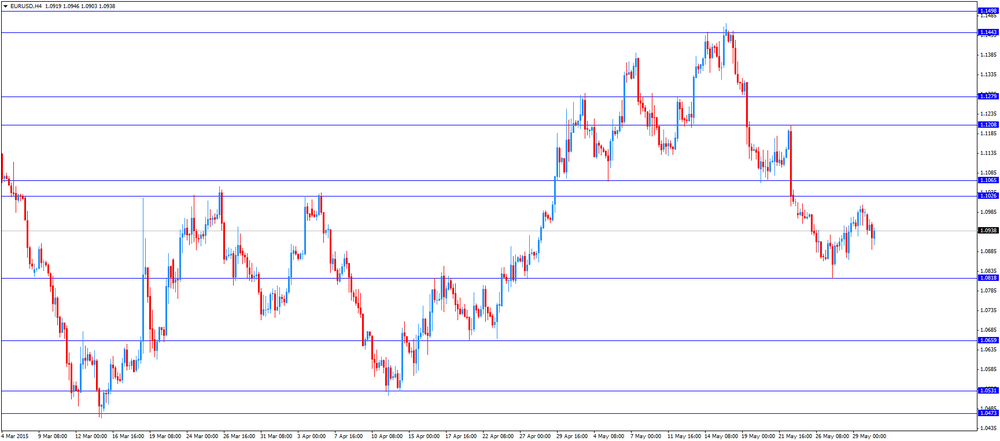

The euro traded mixed against the U.S. dollar after mixed economic data from the Eurozone. German preliminary consumer price index rose 0.1% in May, in line with expectations, after a flat reading in April.

On a yearly basis, German preliminary consumer price index increased to 0.7% in May from 0.5% in April, in line with expectations.

Eurozone's final manufacturing purchasing managers' index (PMI) rose to 52.2 in May from 52.0 in April, down from a preliminary reading of 52.3.

Spain, the Netherlands and Italy were strongest performers.

Markit's Chief Economist Chris Williamson said that Spain and Italy benefited in particular from exports.

Germany's final manufacturing PMI decreased to 51.1 in May from 52.1 in April, down from a preliminary reading of 51.4.

France's final manufacturing PMI climbed to 49.4 in May from 48.0 in April, up a preliminary reading of 49.3.

The Greek debt crisis also weighed on markets. Greece have to repay €310 million IMF loans this week but a new debt deal between Greece and its creditors is not reached yet.

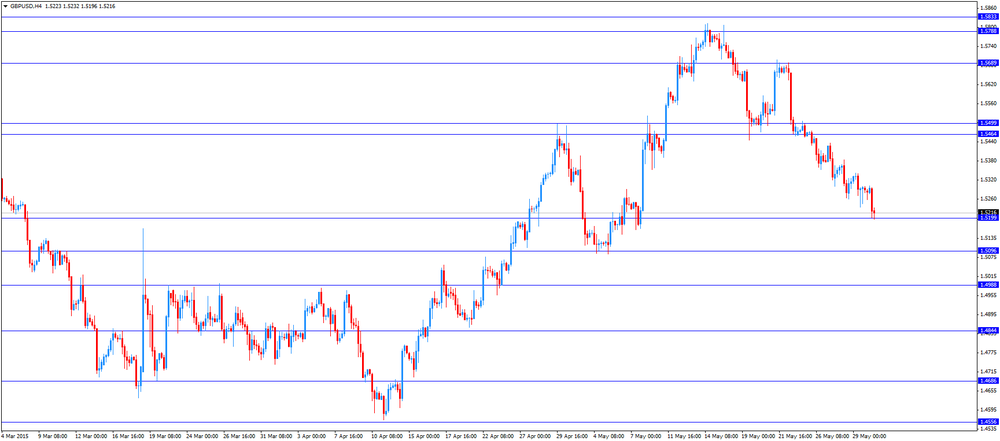

The British pound traded lower against the U.S. dollar after the weaker-than-expected manufacturing PMI from the U.K. The Markit/Chartered Institute of Procurement & Supply manufacturing PMI for the U.K. increased to 52.0 in May from 51.8 in April, missing expectations for a rise to 52.5. April's figure was revised down from 51.9.

The increase was driven by rises in output and new orders.

The Swiss franc traded mixed against the U.S. dollar after the better-than-expected manufacturing PMI from Switzerland. The manufacturing purchasing managers' index in Switzerland rose to 49.4 in May from 47.9 in April, exceeding expectations for an increase to 48.4.

The increase was driven by a rise in backlog of orders.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair fell to $1.5196

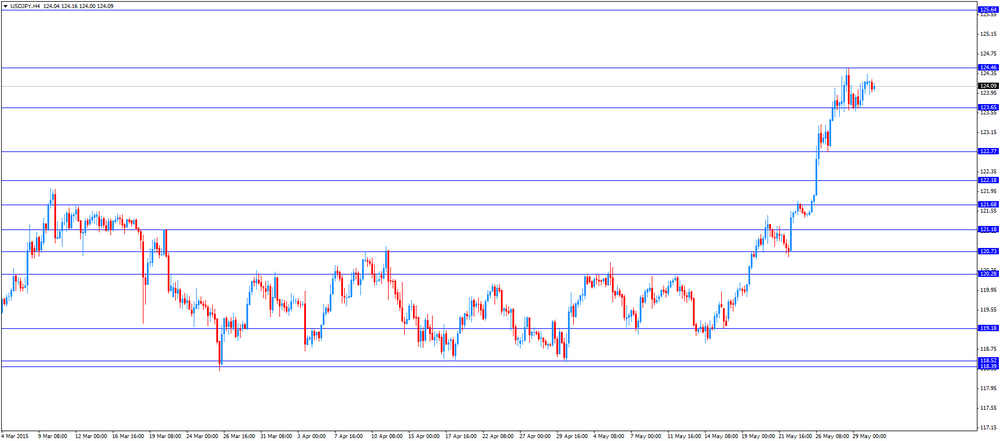

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:30 U.S. PCE price index ex food, energy, m/m April 0.1% 0.2%

12:30 U.S. Personal spending April 0.4% 0.2%

12:30 U.S. Personal Income, m/m April 0.0% 0.3%

12:30 U.S. PCE price index ex food, energy, Y/Y April 1.3%

13:45 U.S. Manufacturing PMI (Finally) May 54.1 53.8

14:00 U.S. Construction Spending, m/m April -0.6% 0.8%

14:00 U.S. ISM Manufacturing May 51.5 52.0

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.