- Аналітика

- Новини та інструменти

- Новини ринків

- Foreign exchange market. European session: the euro traded higher against the U.S. dollar as the Greek parliament approved the draft deal on the third bailout programme

Foreign exchange market. European session: the euro traded higher against the U.S. dollar as the Greek parliament approved the draft deal on the third bailout programme

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

02:15 Australia RBA Assist Gov Kent Speaks

05:30 France GDP, q/q (Preliminary) Quarter II 0.7% Revised From 0.6% 0.2% 0.0%

05:30 France GDP, Y/Y (Preliminary) Quarter II 0.8% 1.0%

06:00 Germany GDP (YoY) (Preliminary) Quarter II 1.1% 1.5% 1.6%

06:00 Germany GDP (QoQ) (Preliminary) Quarter II 0.3% 0.5% 0.4%

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Finally) July 0.8% 1% 1%

09:00 Eurozone Harmonized CPI July 0.0% -0.6% -0.6%

09:00 Eurozone GDP (YoY) (Preliminary) Quarter II 1.0% 1.3% 1.2%

09:00 Eurozone GDP (QoQ) (Preliminary) Quarter II 0.4% 0.4% 0.3%

The U.S. dollar traded lower against the most major currencies ahead of the release of the U.S. economic data. The U.S. PPI is expected to increase 0.1% in July, after a 0.4% rise in June.

The U.S. producer price inflation excluding food and energy is expected to rise 0.1% in July, after a 0.3 gain in June.

The U.S. industrial production is expected to climb 0.3% in July, after a 0.2% rise in June.

The preliminary Thomson Reuters/University of Michigan preliminary consumer sentiment index is expected to climb to 93.5 in August from a final reading of 93.1 in July.

The euro traded higher against the U.S. dollar as the Greek parliament approved the draft deal on the third bailout programme on Friday. Out of 300 Greek MPs 222 voted for the deal, 64 voted against the deal, 11 abstained and three were absent.

Out of 149 Syriza MPs 43 voted against the deal.

News reported that the Greek Prime Minister Alexis Tsipras will ask for a confidence vote before parliament in the next week.

Eurozone finance ministers are expected to approve the deal later on Friday.

Meanwhile, the economic data from the Eurozone was mixed. Eurozone's preliminary gross domestic product (GDP) increased by 0.3% in the second quarter, missing expectations for a 0.4% rise, after a 0.4% gain in the first quarter.

On a yearly basis, Eurozone's preliminary GDP rose by 1.2% in the second quarter, missing expectations for a 1.3% increase, after a 1.0% gain in the first quarter.

Eurostat released no details of the component breakdown of GDP.

Eurozone's final harmonized consumer price index dropped 0.6% in July, in line with the previous estimate, after a flat reading in June.

On a yearly basis, Eurozone's final consumer price inflation remained unchanged at 0.2% in July, in line with the previous estimate.

Eurozone's consumer price inflation excluding food, energy, alcohol and tobacco rose to an annual rate of 1.0% in June from 0.8% in June, in line with the previous estimate.

Germany's preliminary GDP gained by 0.4% in the second quarter, missing expectations for a 0.5% rise, after a 0.3% increase in the first quarter.

The increase was driven by higher exports as the euro remained weak. Exports increased much more than imports.

Household and government consumption expenditure continued to develop positively.

On a yearly basis, Germany's GDP rose to 1.6% in the second quarter from 1.1% in the first quarter, exceeding expectations for a gain to 1.5%.

France's preliminary GDP was flat in the second quarter, missing expectations for a 0.2% rise, after a 0.7% increase in the first quarter. The first quarter's figure was revised up from a 0.6% gain.

On a yearly basis, Germany's GDP rose to 1.0% in the second quarter from 0.8% in the first quarter.

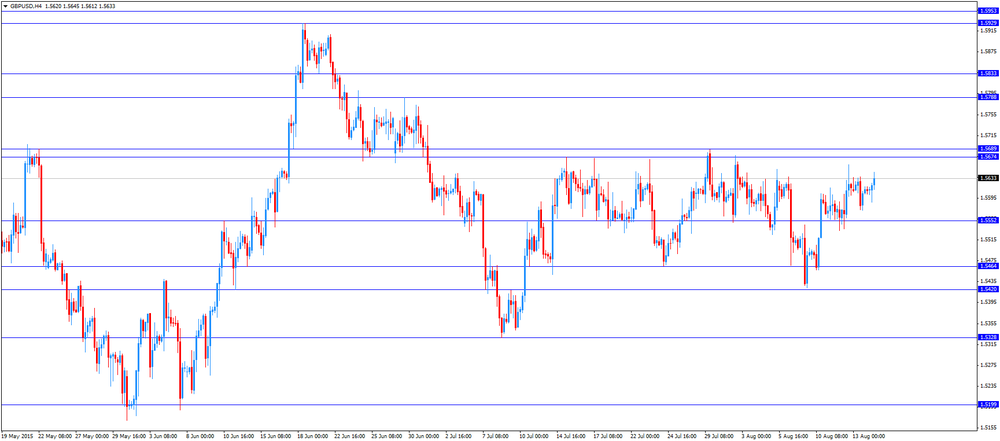

The British pound traded higher against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded higher against the U.S. dollar ahead of Canadian economic data. Canada's manufacturing shipments are expected to increase 2.1% in June, after a 0.1% gain in May.

EUR/USD: the currency pair rose to $1.1188

GBP/USD: the currency pair increased to $1.5645

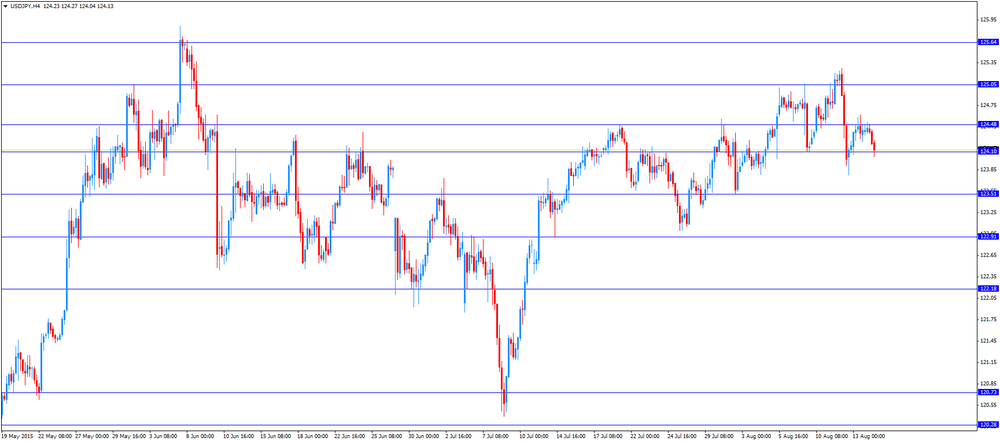

USD/JPY: the currency pair fell to Y124.04

The most important news that are expected (GMT0):

12:30 Canada Manufacturing Shipments (MoM) June 0.1% 2.1%

12:30 U.S. PPI excluding food and energy, m/m July 0.3% 0.1%

12:30 U.S. PPI excluding food and energy, Y/Y July 0.8% 0.5%

12:30 U.S. PPI, m/m July 0.4% 0.1%

12:30 U.S. PPI, y/y July -0.7% -0.9%

13:15 U.S. Capacity Utilization July 77.8% 78%

13:15 U.S. Industrial Production (MoM) July 0.2% 0.3%

13:15 U.S. Industrial Production YoY July 1.3%

14:00 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) August 93.1 93.5

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.