- Аналітика

- Новини та інструменти

- Новини ринків

- Foreign exchange market. European session: the British pound traded lower against the U.S. dollar despite the better-than-expected U.K. retail sales data

Foreign exchange market. European session: the British pound traded lower against the U.S. dollar despite the better-than-expected U.K. retail sales data

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

04:30 Japan All Industry Activity Index, m/m December -1.1% Revised From -1.0% -0.3% -0.9%

07:00 Germany Producer Price Index (MoM) January -0.5% -0.3% -0.7%

07:00 Germany Producer Price Index (YoY) January -2.3% -2% -2.4%

09:30 United Kingdom PSNB, bln January -7.49 Revised From 7.49 13.95 11.81

09:30 United Kingdom Retail Sales (MoM) January -1.4% Revised From -1% 0.8% 2.3%

09:30 United Kingdom Retail Sales (YoY) January 2.3% Revised From 2.6% 3.6% 5.2%

13:00 U.S. FOMC Member Mester Speaks

The U.S. dollar traded mixed to higher against the most major currencies ahead of the release of the U.S. consumer price inflation data. The U.S. consumer price inflation is expected to rise to 1.3% year-on-year in January from 0.7% in December.

The U.S. consumer price index excluding food and energy is expected to remain unchanged at 2.1% year-on-year in January.

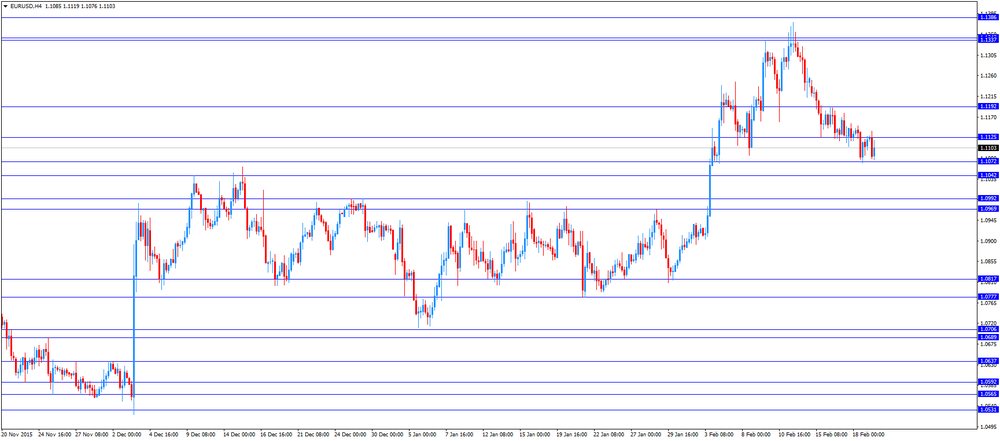

The euro traded lower against the U.S. dollar in the absence of any major economic reports from the Eurozone.

Destatis released its producer price index (PPI) for Germany on Friday. German PPI producer prices declined 0.7% in January, missing expectations for a 0.3% fall, after a 0.5% drop in December.

On a yearly basis, German PPI dropped 2.4% in January, missing expectations for a 2.0% decrease, after a 2.3% fall in December.

The decline was mainly driven by a drop in energy prices.

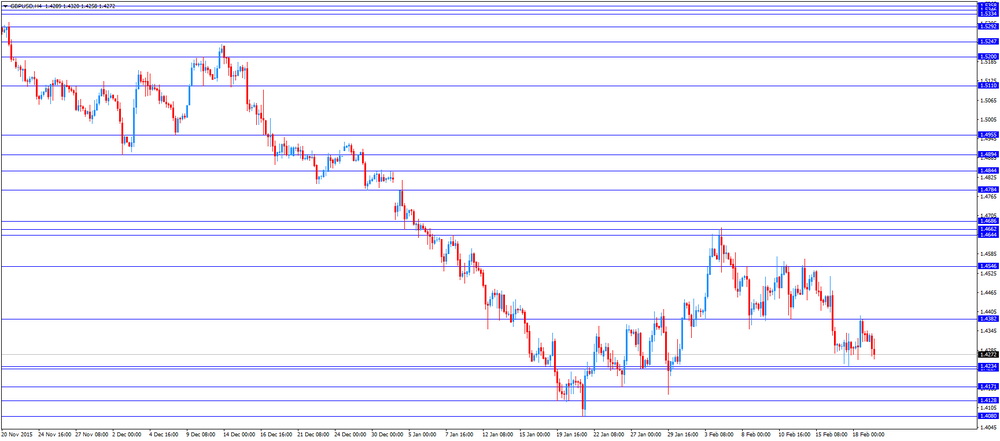

The British pound traded lower against the U.S. dollar despite the better-than-expected U.K. retail sales data. The Office for National Statistics released its retail sales data for the U.K. on Friday. Retail sales in the U.K. climbed 2.3% in January, exceeding expectations for a 0.8% gain, after a 1.4% drop in December. December's figure was revised down from a 1.0% decrease.

The increase was driven by lower demand for clothing and computer.

On a yearly basis, retail sales in the U.K. jumped 5.2% in January, beating forecasts of 3.6% increase, after a 2.3% rise in December. December's figure was revised down from a 2.6% gain.

Public sector net borrowing excluding banks rose to £11.2 billion in January from £10.2 billion in January last year. It was the biggest surplus since 2008.

The increase was driven by the high level of tax receipts.

The Canadian dollar traded lower against the U.S. dollar ahead of the release of the Canadian economic data. The consumer price index in Canada is expected to climb 1.7% year-on-year in January from 1.6% in December.

The core consumer price index in Canada is expected to remain unchanged at 1.9% year-on-year in January.

Canadian retail sales are expected to decrease 0.6% in December, after a 1.7% rise in November.

EUR/USD: the currency pair decreased to $1.1076

GBP/USD: the currency pair fell to $1.4258

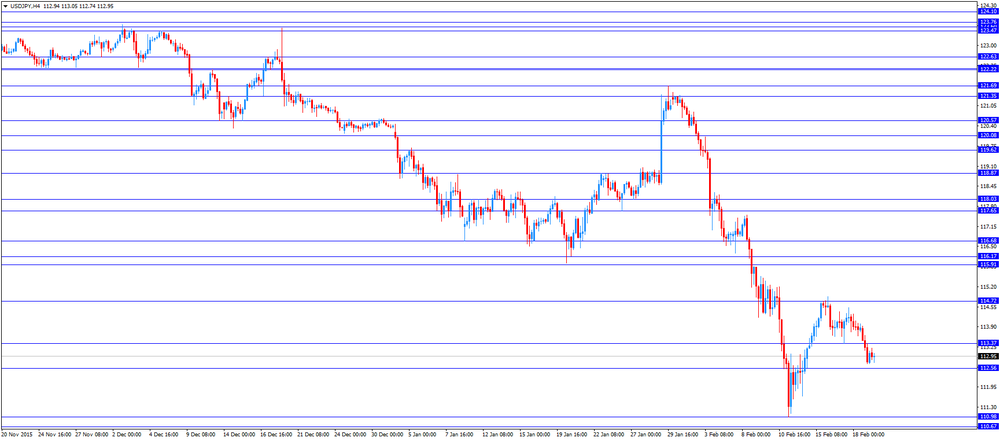

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

13:30 Canada Retail Sales, m/m December 1.7% -0.6%

13:30 Canada Retail Sales YoY December 3.2%

13:30 Canada Retail Sales ex Autos, m/m December 1.1% -0.5%

13:30 Canada Consumer Price Index m / m January -0.5% -0.1%

13:30 Canada Consumer price index, y/y January 1.6% 1.7%

13:30 Canada Bank of Canada Consumer Price Index Core, y/y January 1.9% 1.9%

13:30 U.S. CPI, m/m January -0.1% -0.1%

13:30 U.S. CPI, Y/Y January 0.7% 1.3%

13:30 U.S. CPI excluding food and energy, m/m January 0.2% 0.2%

13:30 U.S. CPI excluding food and energy, Y/Y January 2.1% 2.1%

15:00 Eurozone Consumer Confidence (Preliminary) February -6.3 -6.7

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.