- Аналітика

- Новини та інструменти

- Новини ринків

- Foreign exchange market. European session: the euro traded lower against the U.S. dollar after the release of the weak economic data from the Eurozone

Foreign exchange market. European session: the euro traded lower against the U.S. dollar after the release of the weak economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:05 United Kingdom Gfk Consumer Confidence February 4 3 0

03:15 United Kingdom BOE Gov Mark Carney Speaks

07:45 France GDP, q/q (Finally) Quarter IV 0.3% 0.2% 0.3%

07:45 France GDP, Y/Y (Finally) Quarter IV 1.1% 1.4%

10:00 Eurozone Industrial confidence February -3 Revised From -3.2 -3.5 -4

10:00 Eurozone Economic sentiment index February 105 104.4 103.8

10:00 Eurozone Consumer Confidence (Finally) February -6.3 Revised From -8.8 -7 -9

10:00 Eurozone Business climate indicator February 0.29 0.28 0.07

13:00 Germany CPI, m/m (Preliminary) February -0.8% 0.5% 0.4%

13:00 Germany CPI, y/y (Preliminary) February 0.5% 0.1% 0%

The U.S. dollar traded mixed to higher against the most major currencies ahead of the release of the U.S. economic data. The personal consumer expenditures (PCE) price index excluding food and energy is expected to increase 0.2% in January, after a flat reading in December.

Personal income in the U.S. is expected to rise 0.4% in January, after a 0.3% gain in December.

Personal spending in the U.S. is expected to gain 0.3% in January, after a flat reading in December.

The revised U.S. GDP is expected to rise 0.4% in the fourth quarter, after a 2.0% growth in the third quarter.

The euro traded lower against the U.S. dollar after the release of the weak economic data from the Eurozone. The European Commission released its economic sentiment index for the Eurozone on Friday. The index slid to 103.8 in February from 106.7 in January. January's figure was revised up from 105.0.

Analysts had expected the index to decline to 104.4.

The drop was driven by a fall in confidence among consumers and in all business sectors but construction.

The industrial confidence index fell to -4.0 in February from -3.0 in January, missing expectations for a drop to -3.5.

The final consumer confidence index was down to -9.0 in February from -6.3 in January, missing expectations for a decline to -7.0.

The business climate index decreased to 0.1 in February from 0.29 in January. Analysts had expected the index to fall to 0.28.

The decline in business climate index was driven by a less favourable managers' assessment of past production, total order books and production expectations.

The British pound traded lower against the U.S. dollar in the absence of any major economic reports from the U.K.

Bank of England (BoE) Governor Mark Carney warned major central banks at the G20 summit on Friday that implementing negative rates was the wrong answer to the slowdown in the global economy.

"To the extent it pushes greater savings onto the global markets, global short-term equilibrium rates would fall further, pulling the global economy closer to a liquidity trap. At the global zero bound, there is no free lunch," he said.

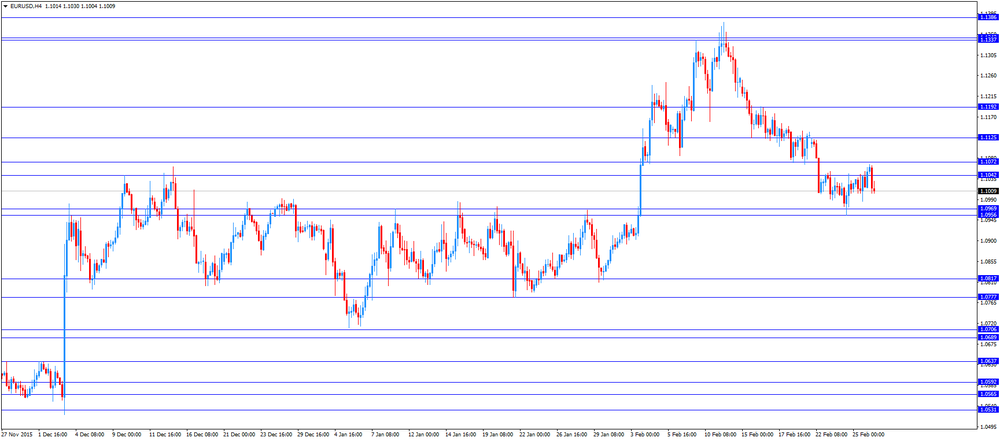

EUR/USD: the currency pair decreased to $1.1004

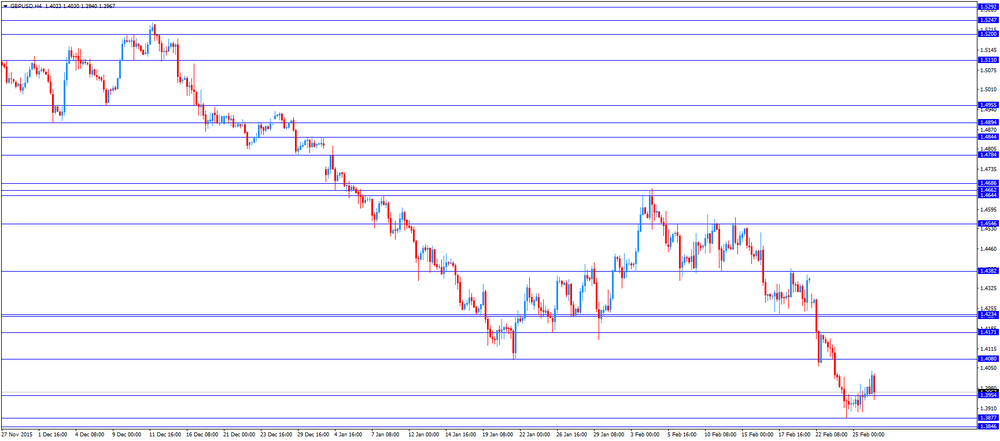

GBP/USD: the currency pair fell to $1.3940

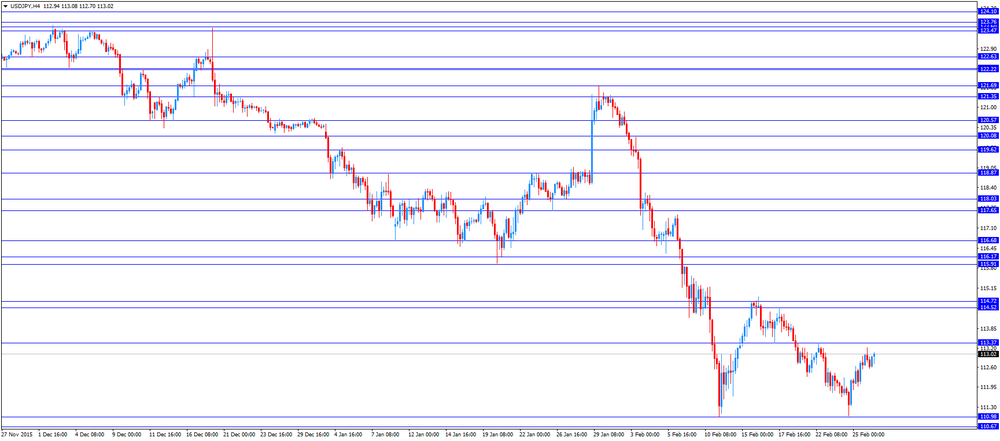

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

13:30 U.S. Personal Income, m/m January 0.3% 0.4%

13:30 U.S. Personal spending January 0.0% 0.3%

13:30 U.S. PCE price index ex food, energy, m/m January 0.0% 0.2%

13:30 U.S. PCE price index ex food, energy, Y/Y January 1.4%

13:30 U.S. PCE price index, q/q (Revised) Quarter IV 1.3% 0.1%

13:30 U.S. PCE price index ex food, energy, q/q (Revised) Quarter IV 1.4% 1.2%

13:30 U.S. GDP, q/q (Revised) Quarter IV 2.0% 0.4%

15:00 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) February 92 91

15:15 U.S. FOMC Member Jerome Powell Speaks

18:30 U.S. FOMC Member Brainard Speaks

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.