- Аналітика

- Новини та інструменти

- Новини ринків

- Foreign exchange market. European session: the euro traded lower against the U.S. dollar after the negative economic data from the Eurozone

Foreign exchange market. European session: the euro traded lower against the U.S. dollar after the negative economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

03:05 Australia RBA's Governor Glenn Stevens Speech

06:00 Germany GDP (QoQ) (Finally) Quarter I 0.3% 0.7% 0.7%

06:00 Germany GDP (YoY) (Finally) Quarter I 2.1% 1.6% 1.3%

08:30 United Kingdom PSNB, bln April -6.11 Revised From -4.16 -6.2 -6.58

09:00 Eurozone ZEW Economic Sentiment May 21.5 16.8

09:00 Germany ZEW Survey - Economic Sentiment May 11.2 12 6.4

10:00 United Kingdom CBI retail sales volume balance May -13 7 7

The U.S. dollar traded mixed against the most major currencies ahead of the release of the U.S. economic data. New home sales in the U.S. are expected to rise to 523,000 units in April from 511,000 units in March.

The euro traded lower against the U.S. dollar after the negative economic data from the Eurozone. The ZEW Center for European Economic Research released its economic sentiment index for Germany and the Eurozone on Tuesday. Germany's ZEW economic sentiment index decreased to 6.4 in May from 11.2 in April, missing expectations for a rise to 12.0.

"The strong growth of the German economy in the first quarter of 2016 appears to have surprised the financial market experts. However, they seem not to expect the economic situation to improve at the same pace going forward," ZEW president, Professor Achim Wambach, said.

Eurozone's ZEW economic sentiment index declined to 21.5 in May from 21.5 in April.

Destatis released its final gross domestic product (GDP) growth for Germany on Tuesday. Germany's final GDP gained by 0.7% in the first quarter, in line with the preliminary reading, after a 0.3% increase in the fourth quarter.

The increase was driven by domestic final consumption expenditure. Household consumption expenditure rose by 0.4% in the first quarter, while government spending increased by 0.5%.

Exports of goods and services were up 1.0% in first quarter, while imports climbed 1.4%.

On a yearly basis, Germany's final GDP fell to 1.3% in the first quarter from 2.1% in the fourth quarter, in line with the preliminary reading.

The British pound traded higher against the U.S. dollar on the ORB poll. According to the latest ORB poll published by The Telegraph on Tuesday, 55% of respondents would vote for the "Remain" campaign, while 42% would support Britain's exit from the European Union.

The Office for National Statistics released public sector net borrowing for the U.K. on Tuesday. The UK public sector net borrowing requirement (PSNB) was £6.58 billion in April, exceeding forecasts of £6.2 billion, up from £6.11 billion in March. March's figure was revised up from £4.16 billion.

The Confederation of British Industry (CBI) released its retail sales balance data on Tuesday. The CBI retail sales balance climbed to 7 in May from -13% in April, in line with expectations. The increase was driven by rises in sectors, such as hardware & DIY, clothing and recreational goods. Sales are expected to decline slightly next month.

EUR/USD: the currency pair fell to $1.1163

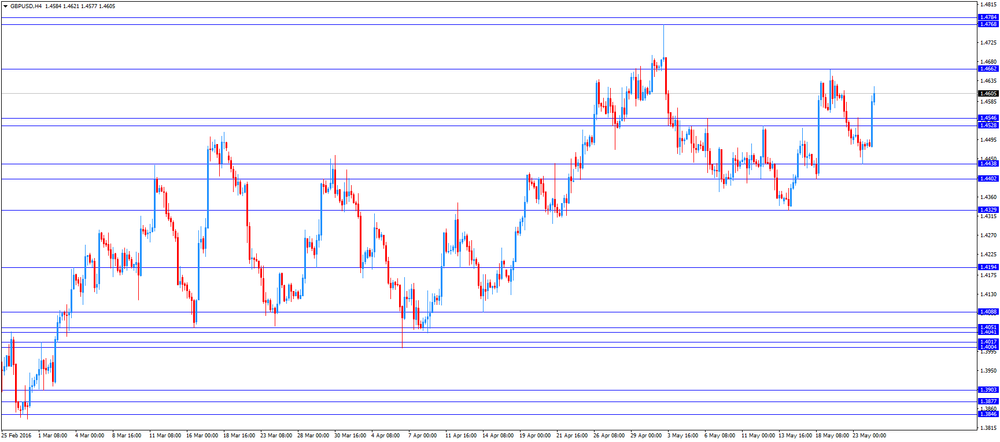

GBP/USD: the currency pair climbed to $1.4621

USD/JPY: the currency pair rose to Y109.76

The most important news that are expected (GMT0):

14:00 U.S. Richmond Fed Manufacturing Index May 14

14:00 U.S. New Home Sales April 511 523

22:45 New Zealand Trade Balance, mln April 117 60

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.