- Аналітика

- Новини та інструменти

- Новини ринків

- European session review: the US dollar weakened

European session review: the US dollar weakened

The following data was published:

(Time / country / index / period / previous value / forecast)

6:00 Germany Consumer Price Index m / m (final data) September 0.0% 0.1% 0.1%

6:00 Germany CPI, y / y (final data) September 0.4% 0.7% 0.7%

The US dollar fell against major currencies, as unexpectedly weak data on China's trade balance had a negative impact on market sentiment. Such weak export data reinforced concerns about the deterioration in the global economy. Against this background, some may weaken expectations of tighter monetary policy at the Fed meeting in December, and it may temporarily suspend the observed recent strengthening of the US currency.

Also, the focus is on the FOMC minutes. Although the document has not been oversupplied with new information, it was noted that the members of the committee expected rate hikes, while the overall tone of the minutes was fairly neutral. To date, the federal funds futures assess the probability of rate hikes at a meeting in December to 69.5% (64.0% to the range of 0.50% -0.75%, and 5.5% to 0.75% -1 range, 0.0%).

Today markets will primarily monitor the data on unemployment in the US, which will be published at 12:30 GMT, as well as statistics on crude oil inventories, at 15:00 GMT.

German CPI accelerated to a 16-month high in September, showed on Thursday the final Destatis data.

Consumer prices advanced 0.7 percent year on year and faster than the growth of 0.4 percent in the previous month.

Last inflation rate was the highest since May 2015.

Consumer prices rose 0.1 percent in September after last month remained unchanged. Monthly inflation is also consistent with the preliminary estimate published on 29 September.

The harmonized index of consumer prices, HICP, advanced 0.5 percent annually after rising 0.3 percent in August. The index thus reached its highest level in the year.

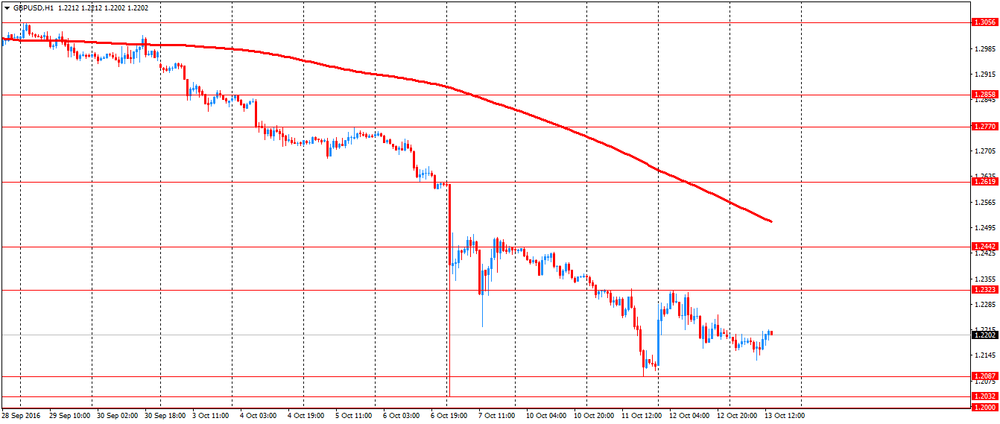

The pound rose against the dollar, recovering all the ground lost earlier in the day. Little influenced by data from the RICS, that have indicated that house prices in the UK rose in September by 17% compared to the same month a year earlier. In addition, in the August value of 12% was revised upward to + 13%. It should be noted that most analysts expect to see the index increase by only 14%.

In general, the pound remains under pressure due to concerns about Brexit. Recently, French President Francois Hollande joined the negative sentiment of EU official, encouraging tough negotiations with Britain. The view from France is important because the EU's position is determined mainly by Germany and France.

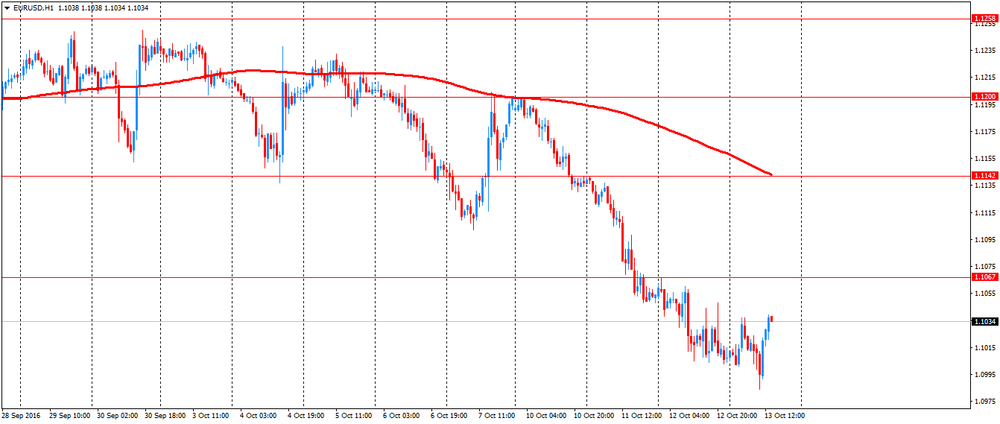

EUR / USD: during the European session, the pair fell to $ 1.0984, and then rose to $ 1.1039

GBP / USD: during the European session, the pair rose to $ 1.2216

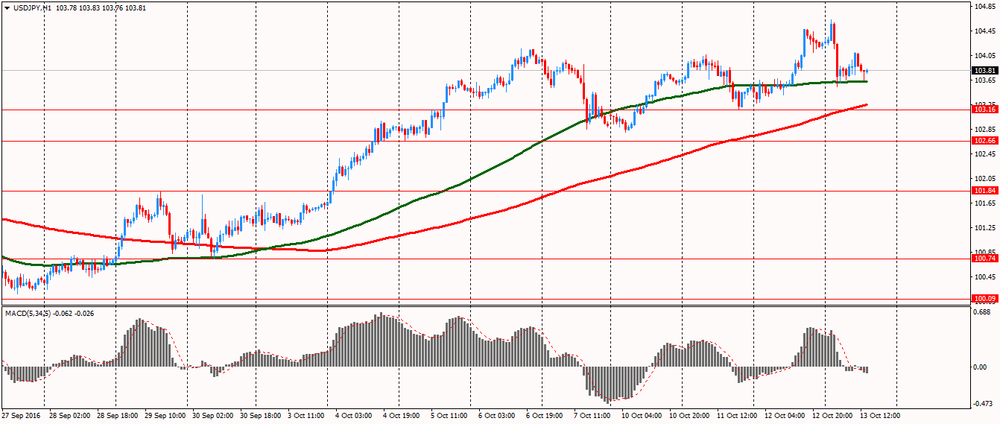

USD / JPY: during the European session, the pair fell to Y103.64

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.