- Аналітика

- Новини та інструменти

- Новини ринків

- The main US stock indexes finished trading without a single dynamics

The main US stock indexes finished trading without a single dynamics

Major US stock indexes ended the session in different directions, as investors were concerned about the resignation of the chief economic adviser to the US president and confident free-trade supporter Gary Cohn from the White House.

The negative trend began on Tuesday night after Cohn, the tax reform architect, in December, said he would retire, which, according to sources, was due to the fact that he could not convince President Trump to drop the introduction high import tariffs on metals.

In addition, the focus of investors' attention was data on the United States. The report Automatic Data Processing (ADP) reported that the growth rate of employment in the private sector of the US slightly accelerated in February, and were stronger than projected. In February, the number of employed increased by 235 thousand people compared to the figure for January at 234 thousand. Analysts had expected that the number of employed will increase by 195 thousand.

At the same time, the US trade deficit in January rose to more than 9-year high, and the deficit with China expanded dramatically, which suggests that Trump's trading strategy, "America first" is unlikely to have a significant impact on the deficit. The Department of Trade said that the deficit jumped 5.0% to 56.6 billion. This was the highest level since October 2008 and followed the revised with a small increase in deficit of 53.9 billion in December.

In addition, the Beige Book review of the Fed indicated that in all 12 regions of the US, economic growth rates ranged from modest to moderate. It also became known that in many of the 12 regions wage growth accelerated to moderate rates, and employment growth was moderate compared to the previous several months, which indicates the preservation of unused labor resources. In addition, the report indicated an acceleration in consumer price growth. According to reports from most regions, inflation has accelerated from "modest" to moderate.

Most components of the DOW index finished trading in the red (18 out of 30). Outsider were shares of Exxon Mobil Corporation (XOM, -2.65%). The leader of growth was the shares of International Business Machines Corporation (IBM, + 1.71%).

Most S & P sectors recorded a decline. The largest drop was shown by the base materials sector (-0.9%). The technological sector grew most (+ 0.8%)

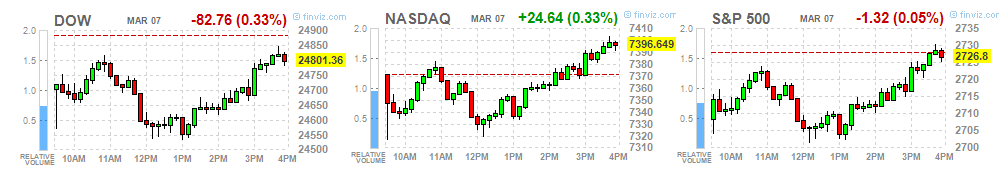

At closing:

Dow -0.33% 24,801.36 -82.76

Nasdaq + 0.33% 7.396.65 +24.64

S & P -0.05% 2,726.86 -1.26

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.