- Аналітика

- Новини та інструменти

- Новини ринків

- When is the UK Q3 GDP and how could it affect GBP/USD?

When is the UK Q3 GDP and how could it affect GBP/USD?

The UK Economic Data Overview

The British economic calendar is all set to entertain the cable traders during the dull hours of early Thursday, at 07:00 GMT with the preliminary GDP figures for the Q3 2021. Also increasing the importance of that time are monthly GDP figures for September, Trade Balance, Manufacturing Production and Industrial Production details for the stated period.

Having witnessed a 5.5% jump in economic activities during the previous quarter, market players will be interested in the first estimation of the Q3 GDP figures, expected +1.5% QoQ, to confirm the economic transition amid the covid resurgence fears. Market expectations back +6.8% YoY figures versus +23.6% previous readouts. On the other hand, the GBP/USD traders also eye the Index of Services (3M/3M) for the same period, +3.7% prior, for further insight.

Meanwhile, Manufacturing Production, which makes up around 80% of total industrial production, is expected to ease from +0.5% to +0.2% MoM in September. Further, the total Industrial Production is expected to ease from 0.8% to 0.2% MoM during the stated month.

Considering the yearly figures, the Industrial Production for September is expected to have eased to +3.1% versus +3.7% previous while the Manufacturing Production is also anticipated to have softened to 3.1% in the reported month versus 4.1% last.

Separately, the UK Goods Trade Balance will be reported at the same time and is expected to show a deficit of £14.30 billion versus a £14.92 billion deficit reported in the last month.

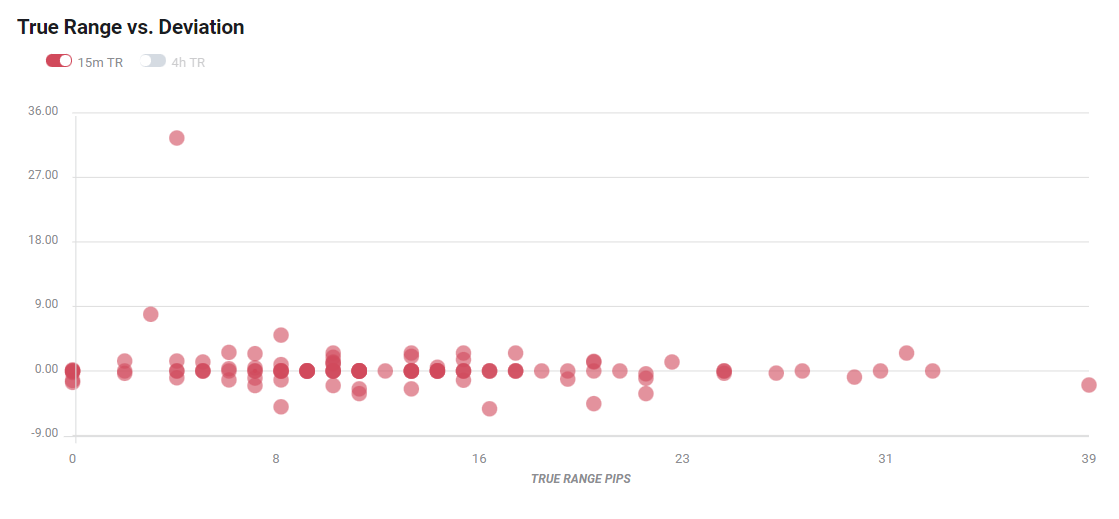

Deviation impact on GBP/USD

Readers can find FX Street's proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined around 10-pips in deviations up to + or -2, although in some cases, if notable enough, a deviation can fuel movements over 60-70 pips.

How could affect GBP/USD?

GBP/USD picks up bids to poke intraday high around 1.3815, up 0.05% on a day while heading into Thursday’s London open. In doing so, the cable pair reacts to the US dollar pullback amid a lackluster day and mildly positive market sentiment.

Given the latest covid resurgence and variant fears in the UK, today’s British data dump will be the key to gauge the economic recovery. Also highlighting the importance of the data is the latest shift in the Bank of England (BOE) policymakers’ bullish bias from strong to moderate. Hence, the UK data will offer additional clues to the tapering chatters but are less likely to move the GBP/USD prices unless portraying a notable move from the previous quarter.

Ahead of the release, TD Securities said,

We look for a flat month for September GDP (market forecast: 0.5% m/m) as staycations ended and the petrol crisis weighed on activity. Manufacturing likely fell relatively sharply (-1.5%, expectations: 0.2%) on supply constraints, while the service sector was likely flat in the month (market consensus: 0.6%) as activity returned to normal after the summer holidays. This would leave Q3 GDP growth tracking 1.3% q/q, just a couple of ticks below the BoE's recent forecast and the market consensus of 1.5% q/q.

Technically, the cable pair’s corrective pullback may aim for 50% Fibonacci retracement (Fibo.) of a run-up from September 2020 to June 2021, around 1.3460. However, the rebound remains doubtful until staying below July’s bottom near 1.3575, a break of which will direct the quote towards the 50-DMA level of 1.3677.

Key notes

UK flash Q3 GDP growth may not be a game changer for pound

GBP/USD: Five scenarios for trading UK Q3 growth figures + technical levels

About the UK Economic Data

The Gross Domestic Product released by the Office for National Statistics (ONS) is a measure of the total value of all goods and services produced by the UK. The GDP is considered as a broad measure of the UK economic activity. Generally speaking, a rising trend has a positive effect on the GBP, while a falling trend is seen as negative (or bearish).

The Manufacturing Production released by the Office for National Statistics (ONS) measures the manufacturing output. Manufacturing Production is significant as a short-term indicator of the strength of UK manufacturing activity that dominates a large part of total GDP. A high reading is seen as positive (or bullish) for the GBP, while a low reading is seen as negative (or bearish).

The trade balance released by the Office for National Statistics (ONS) is a balance between exports and imports of goods. A positive value shows trade surplus, while a negative value shows trade deficit. It is an event that generates some volatility for the GBP.

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.