- Аналітика

- Новини та інструменти

- Новини ринків

- US dollar dives despite sentiment of a March Fed hike

US dollar dives despite sentiment of a March Fed hike

- Bears move in to take the US dollar to fresh breakout lows in the DXY.

- US CPI continues to run hot, but investors are cautious to price Fed too hawkish.

The US dollar has buckled under pressure from the bears that sent the greenback over a cliff on Wednesday. As measured by the DXY index, the US dollar is down some 0.6% at the time of writing. The index is trading at 95 the figure but off from the lows of that day that were made in the last hour of trade at 94.953.

US government bond yields retreated from a two-year high after the annualized inflation rate for December hit the highest level in four decades. The 10-year US Treasury yield fell 3.3 basis points to 1.71% despite the Bureau of Labor Statistics saying that the seasonally adjusted consumer price index rose 0.5% in December, ahead of expectations for a 0.4% increase. However, this was below the 0.8% increase in November. The year-over-year rate advanced to 7% from 6.8% in the previous month and the overall rate is the highest since 1982.

''There is no evidence whatsoever that inflation pressures are abating,'' analysts at ANZ Bank argued. ''Energy prices declined slightly in December, but pressures have broadened significantly beyond this, with core goods and services prices all surging.''

Moreover, the analysts explained that inflation pressures are likely to intensify as the labour market tightens further and wage pressures grow. ''The peak in US inflation is not in yet, and the Fed will be grappling with inflation in a 7.0-8.0% YoY range for quite a few months to come.''

However, stocks on Wall Street remained in the green, buoyed by the fact that Fed Chair Powell did not mention the prospect of a March rate rise in his Senate confirmation hearing. Markets are of the mind that the US dollar is a crowded trade and that there are risks that the market is pricing the Fed too hawkish.

Meanwhile, Fed speakers enter blackout on communications this weekend, but they have already given the nod to a rate hike as soon as March.

''We agree with that assessment, and expect that the Fed will hike 25bps in March (once they’ve halted further asset purchases), delivering a total of five hikes over 2022,'' the analysts at ANZ Bank said. ''Capping inflation is the Fed’s key priority for 2022.''

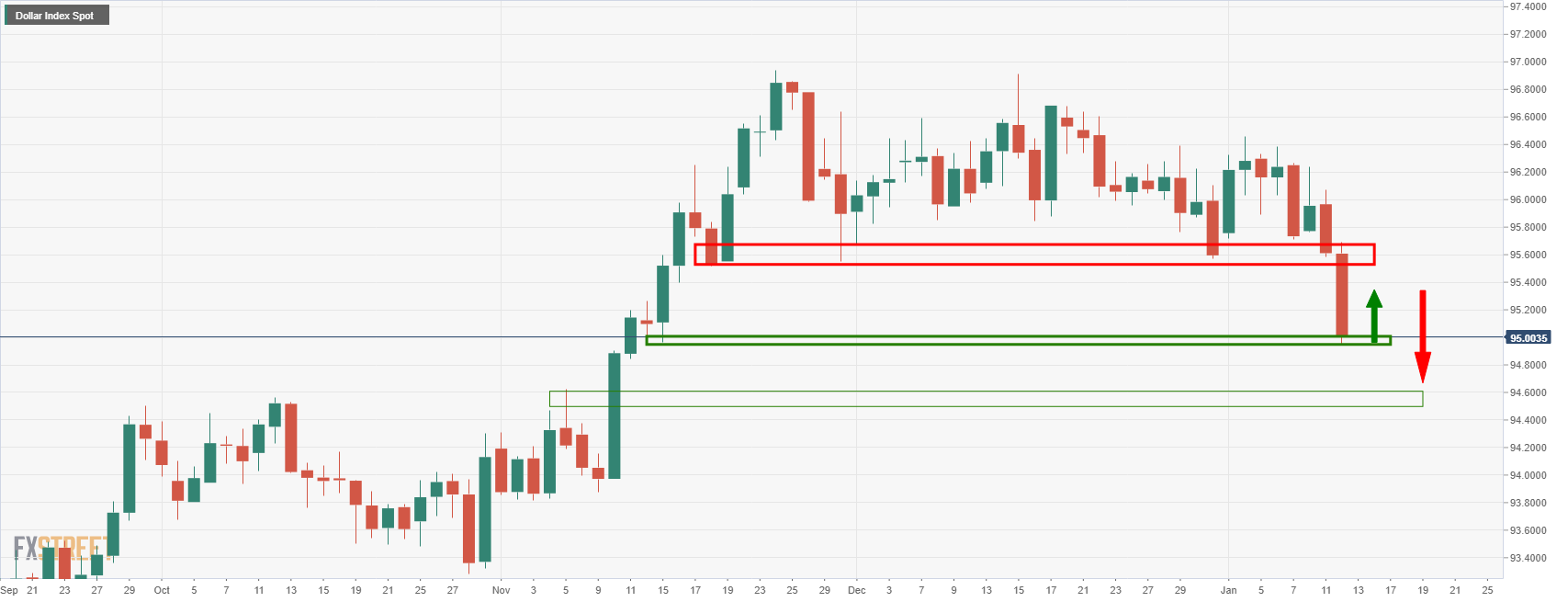

DXY daily chart

The price is moving in on the next level of the critical support structure on the daily chart. A break here would open the way to the midpoint of the 94 area. What we could see, in the meantime, is a bullish correction back into the midpoint of the 95 handle prior to any further downside.

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.