- Аналітика

- Новини та інструменти

- Новини ринків

- GBP/USD bulls embarking on a correction of strong weekly downtrend

GBP/USD bulls embarking on a correction of strong weekly downtrend

- Bulls hit a 1.3210 high into the BoE meeting in anticipation of a hawkish tilt to the likely 25bps rise in rates.

- The weekly 38.2% Fibonacci retracement level near 1.3245 was a stone's throw away.

GBP/USD is back to trading around flat the day as the US dollar firms within a bearish phase. GBP/USD has travelled with a 1.3087 and 1.3210 range and at 1.3150 currently, the price is 0.03% in the green. The drivers in markets are central banks and the Ukraine crisis.

Markets have been momentarily distracted from the calamity of the Russian invasion by the Federal Reserve and Bank of England central bank meetings. The US dollar has been unwound and the pound has been thrown around by mixed sentiment on the outcomes of both meetings and subsequent reactions in global financial markets.

On Wednesday, there were no tougher surprises from the Fed that might have added to the greenback's weeks-long momentum. Instead, the bar for a hawkish surprise at the Fed was high and given how much was priced in, the US dollar has unwound.

The dollar index (DXY), which measures the US dollar vs. a basket of currencies, fell as much as 0.6% following the Fed. The follow-through Today took the index down 0.8% as traders parse the Fed's chairman's less hawkish statements from the press conference:

- “We do anticipate inflation will move back down. It may take longer than we’d like.”

- “I guess I would say the expectation still is that inflation will come down in the second half of this year, but we still expect inflation to be high this year.”

- We expect inflation to remain high through the middle of the year, begin to come down, then begin to come down more sharply next year.”

The Fed was undeniably hawkish, with the Fed's dot plot suggesting that the committee is looking to overshoot the neutral rate by the end of 2023. However, the convergence of central banks is what has driven the greenback lower which had gained 3% since the start of the Russia-Ukraine war on Feb. 24 and 10% since May 2021.

There had been signs that the pond was on the verge of a comeback earlier in the week when it shot higher against the dollar on strong jobs data. This had supported the prospect of a Bank of England rate hike, while optimism around talks between Russia and Ukraine weighed on the US dollar safe-haven demand. Britain's unemployment rate fell more than expected to 3.9% in the three months to January, official figures showed, while vacancies hit a record high in the three months to February.

However, despite the BoE raising Bank Rate to 0.75% from 0.5%, its third consecutive hike since the COVID-19 pandemic, it softened its language on the need for more increases. This led to a significant drop in the pound on Thursday on the knee-jerk in response to the dovish dissent and cautious tone of the minutes. A deteriorating growth outlook is becoming more of a concern to the MPC which has formed the Policymakers to push back against investors' bets that the Bank Rate will rise sharply to around 2% by the end of this year.

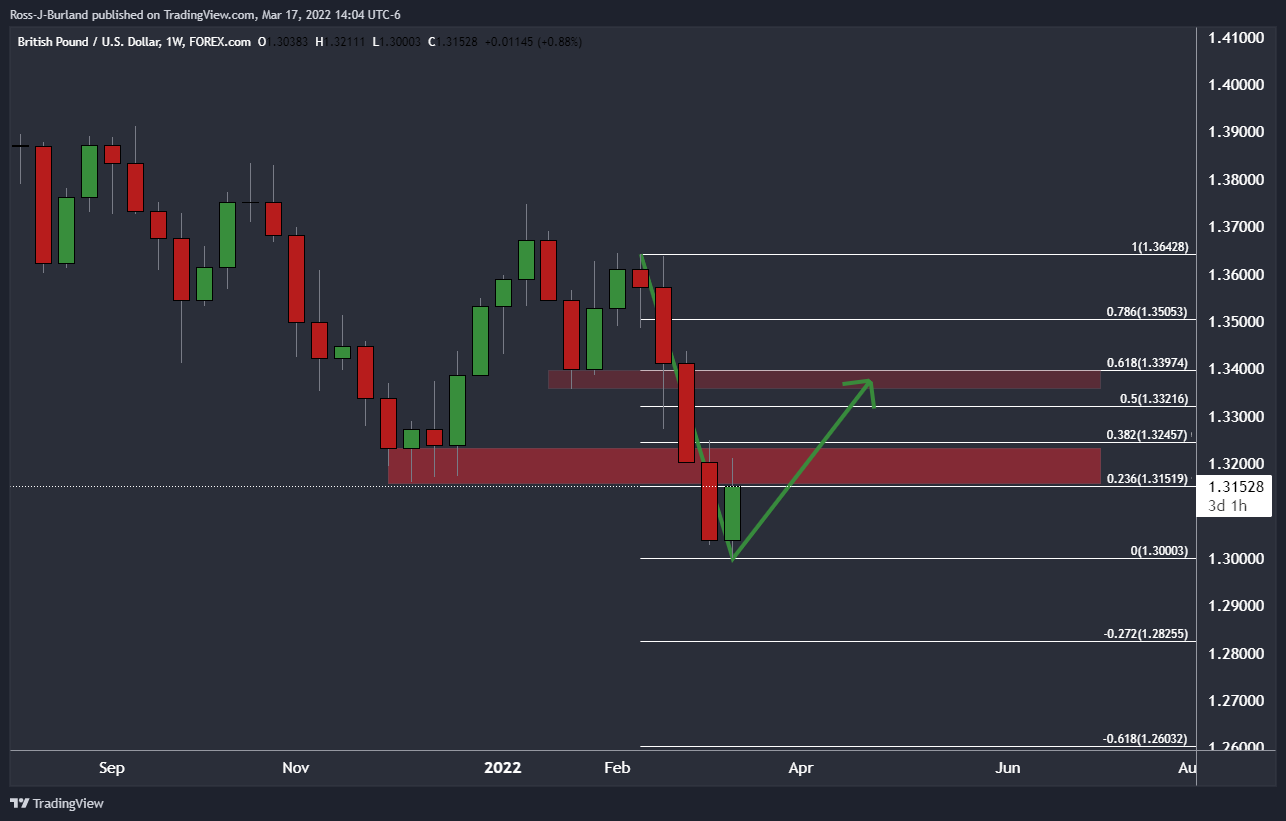

GBP/USD technical analysis

From a weekly perspective, the M-formation is a compelling feature on the charts. The price is currently moving in on the winter 2021 lows near a 23.6% Fibonacci retracement around 1.3150. However, they reached as high as 1.3210 into the BoE meeting in anticipation of a hawkish tilt to the likely 25bps rise in rates. This was close to a 38.2% Fibonacci retracement level near 1.3245. However, the neckline of the M-formation could be appealing which aligns with a golden ratio of the 61.8% target neat 1.34 the figure.

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.