- Аналітика

- Новини та інструменти

- Новини ринків

- EUR/USD clings to the 1.0750 region ahead of Payrolls

EUR/USD clings to the 1.0750 region ahead of Payrolls

- EUR/USD hovers around the mid-1.0700s on Friday.

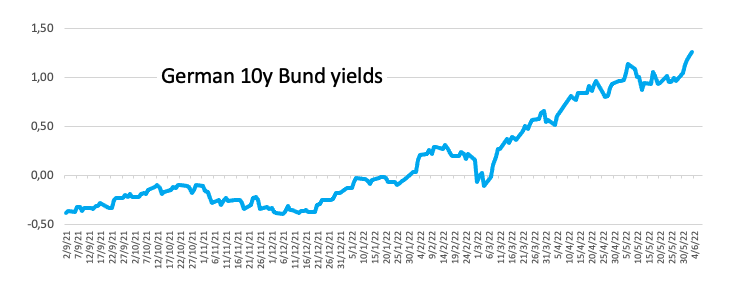

- German 10y bund yields now target the 1.30% level.

- US Nonfarm Payrolls take centre stage later in the NA session.

Price action around EUR/USD falls in line with the generalized side-lined mood in the rest of the global markets at the end of the week.

EUR/USD stays vigilant near 1.0750

EUR/USD trades within a tight range around 1.0750 amidst the prevailing cautious mood among market participants ahead of the key releases due later in the US calendar.

In the meantime, markets continue to bet on potential rate hikes by the ECB and currently price in a 50 bps hike at the October meeting.

In the German money markets, the 10y bund yields extend further the march north and have already left behind the 1.25% mark, an area last traded back in May 2014.

In the euro calendar, the German trade surplus widened to €3.5B in April and the Services PMI eased to 55.0 in May. In the broader Euroland, Retail Sales contracted 1.3% MoM in April and expanded 3.9% from the year earlier, while the final Services PMI receded to 56.1 during last month.

Other than the Nonfarm Payrolls, the US docket will see the Unemployment Rate, the ISM Non-Manufacturing and the final Services PMI.

What to look for around EUR

EUR/USD met quite a solid resistance near 1.0800 so far this week on the back of supportive ECB-speak, which continued to point at an initial rate hike as soon as in July, while the consensus view that the bond-purchase programme should end at some point in early Q3 has also lent legs to the European currency.

In addition, the renewed selling bias in the greenback has also collaborated with the multi-cent upside in the pair, as investors appear to have already pencilled in a couple of 50 bps rate hikes at the June and July gatherings.

However, EUR/USD is still far away from exiting the woods and it is expected to remain at the mercy of dollar dynamics, geopolitical concerns and the Fed-ECB divergence, while higher German yields, elevated inflation and a decent pace of the economic recovery in the euro bloc are also supportive of an improvement in the mood around the euro.

Key events in the euro area this week: Germany Unemployment Change, Unemployment Rate, EMU Flash Inflation Rate (Tuesday) – Germany Retail Sales, Final Manufacturing PMI, EMU Final Manufacturing PMI, ECB Lagarde (Wednesday) – Germany Balance of Trade, Final Services PMI, EMU Retail Sales, Final Services PMI (Friday).

Eminent issues on the back boiler: Speculation of the start of the hiking cycle by the ECB as soon as this summer. Asymmetric economic recovery post-pandemic in the euro area. Impact of the war in Ukraine on the region’s growth prospects.

EUR/USD levels to watch

So far, spot is gaining 0.01% at 1.0746 and faces the immediate up barrier at 1.0786 (monthly high May 30) seconded by 1.0936 (weekly high April 21) and finally 1.0959 (100-day SMA). On the other hand, a breach of 1.0627 (weekly low June 1) would target 1.0532 (low May 20) en route to 1.0459 (low May 18).

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.