- Аналітика

- Новини та інструменти

- Новини ринків

- Gold Price Forecast: XAU/USD rallies on slight doivish tilt at the Fed, all eyes on Powell

Gold Price Forecast: XAU/USD rallies on slight doivish tilt at the Fed, all eyes on Powell

- Gold price is on the bid following a slightly dovish tilt in the Fed's statement.

- The Fed chairman's presser will likely cause greater volatility as investors seek clarity.

The gold price has rallied on the back of the Federal Reserve's interest rate decision which has weighed on the greenback and has left US yields in limbo, slightly lower now after 20 minutes post the statement's release in the 2 and 10-year yields.

XAU/USD popped to a session high of $1,727.09 from a low of $1,711.56 as the central bank downgrades the economy but remains focussed on inflation risks, as per the statement, repeating that it is `highly attentive' to inflation risks.

Main takeaways from the statement

- The Fed says recent indicators of spending and production have softened.

- Fed says job gains have been robust, unemployment rate has remained low.

- Fed says inflation remains elevated, reflecting pandemic-related imbalances, higher food and energy prices, and broader price pressures.

The Fed funds rate futures forecast 3.4% in December after a 75 basis point hike. That leaves 107 basis points of tightening for the remainder of 2022.

Overall, the outcome is somewhat dovish for the September meeting. The fact that the Fed is acknowledging risks to spending and production, the markets will be tuned in to the Fed's chairman's presser at the bottom of the hour for further insight and what the implications are for the labour sector.

If Powell confirms the market's lowering of rate hike expectations for later this year and early next year, that would likely cement the bearish sentiment around US yields and potentially weigh on the US dollar, lifting risk assets and commodities, including gold. With that being said, the US dollar can benefit from safe-haven flows as well in the face of a global slowdown.

''Barring a dovish scenario, we expect participants to return their attention to the massive and complacent position held by prop traders, which still hold the title as the dominant speculative force in gold,'' analysts at TD Securities said with respect to today's Fed outcome.

'' We have yet to see capitulation in gold, suggesting the pain trade is still to the downside and that the recent rally will ultimately fade when faced with a wall of offers.''

Watch Fed Powell Live

Jerome Powell, Chairman of the Federal Reserve System, will be delivering his remarks on the monetary policy outlook at a press conference following the meeting of the Board of Governors. Powell's speech will start at 18:30 GMT.

Follow our live coverage of the Fed's policy announcements and the market reaction.

Fed, looking forward

''In terms of the Fed policy outlook, we don't anticipate inflation will offer any respite in the short term, keeping the Fed in check regarding expectations for additional rate hikes this year,'' analysts at TD Securities argued.

''As Fed officials have repeatedly underscored, policymakers are looking for compelling evidence that inflation is abating before pausing its ongoing tightening process. If our forecast proves correct, this can happen at the end of Q4/beginning of 2023 at the earliest.''

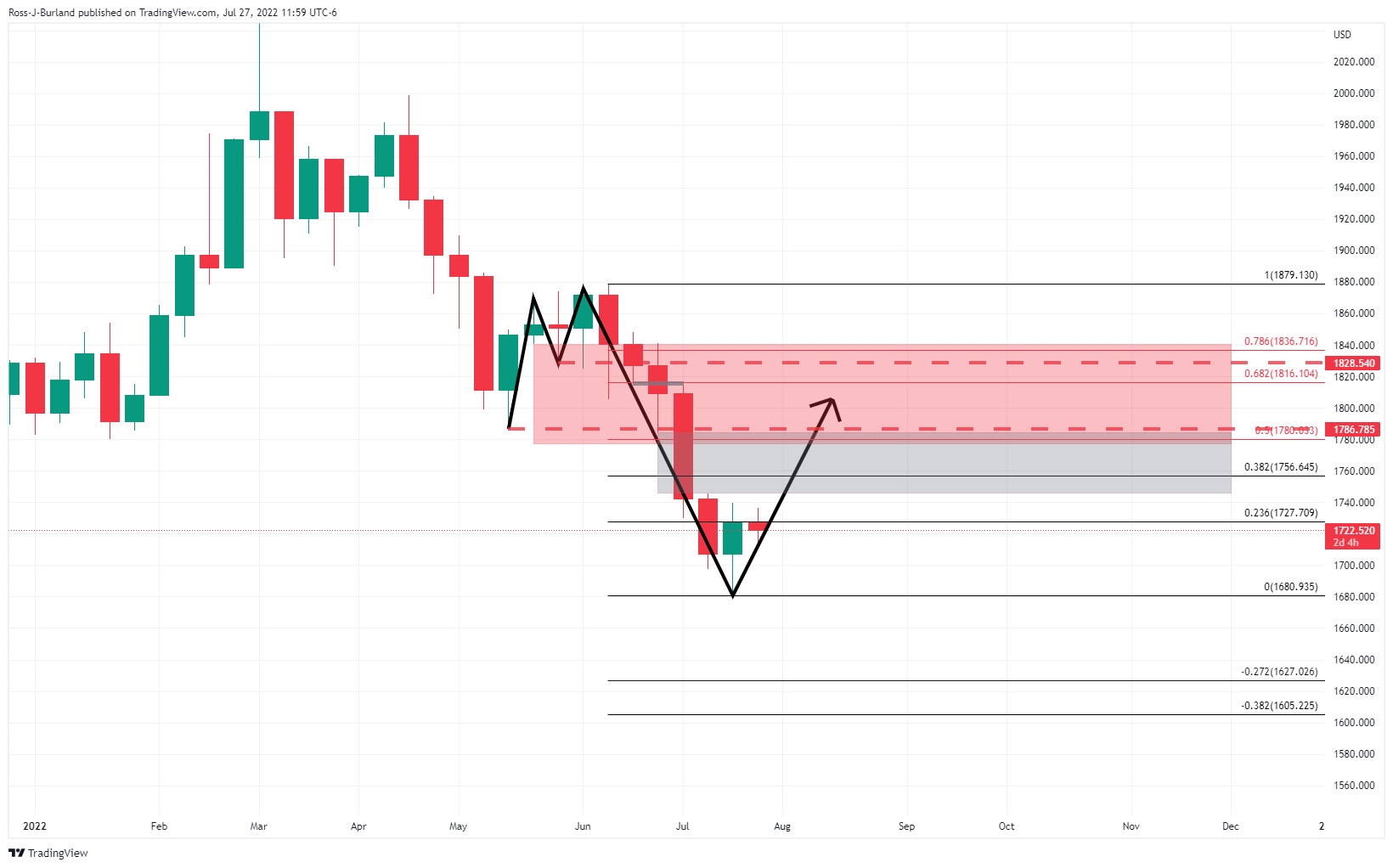

Gold, technical analysis

From a weekly perspective, the bulls are hunting down a critical area of resistance as marked out below:

The greyed areas are price imbalances that will be mitigated at some stage while the Fibonaccis align with the prior pivots.

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.