- Аналітика

- Новини та інструменти

- Новини ринків

- NZDUSD corrects, but trapped longs up high point to further downside

NZDUSD corrects, but trapped longs up high point to further downside

- NZDUSD bears could be about to sink in their teeth again.

- Central bank sentiment is the key driving force as the US Dollar attempts to correct.

NZDUSD has corrected the session's sell-off. The bird rallied from a low of 0.6064 and is testing 0.6120 towards the close on Wall Street. However, longs are still trapped up high near the pair's strongest levels in nearly three months.

The day was mixed on Thursday and two-way business made for a range of between 0.6064 and 0.6167. The US Dollar was supported by stronger-than-expected US Retail Sales data on Wednesday and hawkish remarks from Federal Reserve speakers. However, sentiment and Fed rhetoric have been mixed as data continues to conflict from one day to the next, clouding the path for interest rates.

Tuesday's producer price inflation data was below expectations and this mirrored last week's cooler-than-expected consumer price inflation, signaling that it was not a one-off. This in turn has been fueling hopes that the US Federal Reserve can slow aggressive rate hikes that had sent the US Dollar higher. However, Fed Governor Christopher Waller came to the bull's rescue again when he said the Fed will still need increases into next year although. St Louis Fed President James Bullard spoke at the start of the New York day and said rates should lift to at least 5%-5.25% which is 25bp higher than he previously stated. He also indicated that rates will need to be between 5 to 7% to be sufficiently restrictive to curb inflation.

The US dollar index, DXY, and US yields were firmer on the hawkish sentiment. DXY was recently up 0.4% sitting at 106.70 and between the day's range of 106.1 and 107.24. The 2-year yield sat comfortably around 4.45% and 2% higher on the day. Nev3ertheless, there was a late session dip in both US yields and the greenback which made way for a recovery in the Kiwi.

RBNZ to hike 75bps

Domestically, stubbornly high inflation expectations reinforced the case for more aggressive rate hikes from the Reserve Bank of New Zealand. The latest central bank survey showed that inflation expectations moved higher across the curve and the market is pricing higher rates, expecting a larger increment of 75 basis points next week after delivering a half-percentage point increase in October. RBNZ officials have been outspoken of late, explaining that high inflation and a tight labor market in the country call for demand to be cooled, though they flagged downside risks to the global economy.

NZDUSD technical analysis

As per the prior sessions' bearish thesis, NZDUSD bears eye a break below 0.6130, the pair dropped to target:

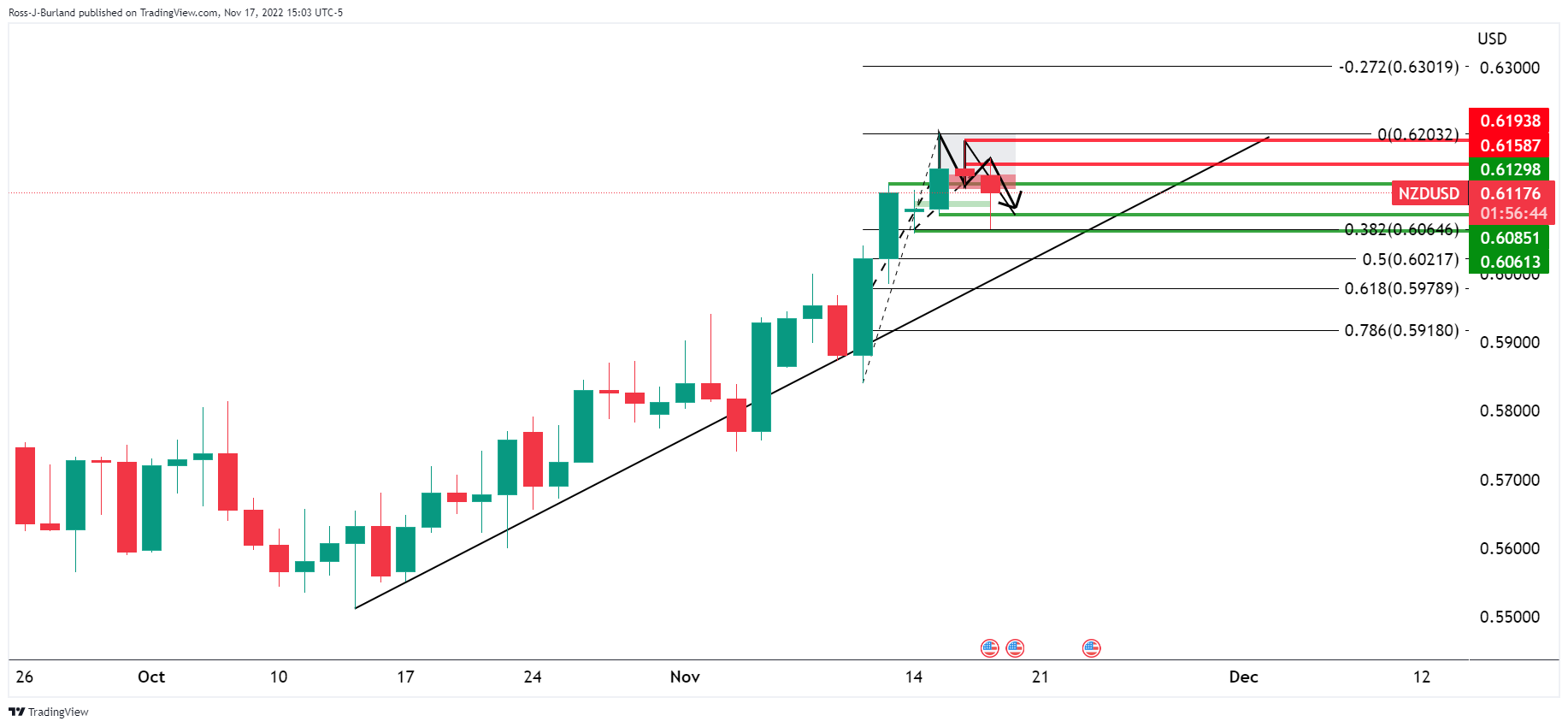

Prior analysis:

The price was topping out on the time frames as per the hourly chart above and the 4-hour chart below:

On the 4-hour chart, however, there were prospects of a triple-top scenario as illustrated above.

NZDUSD update

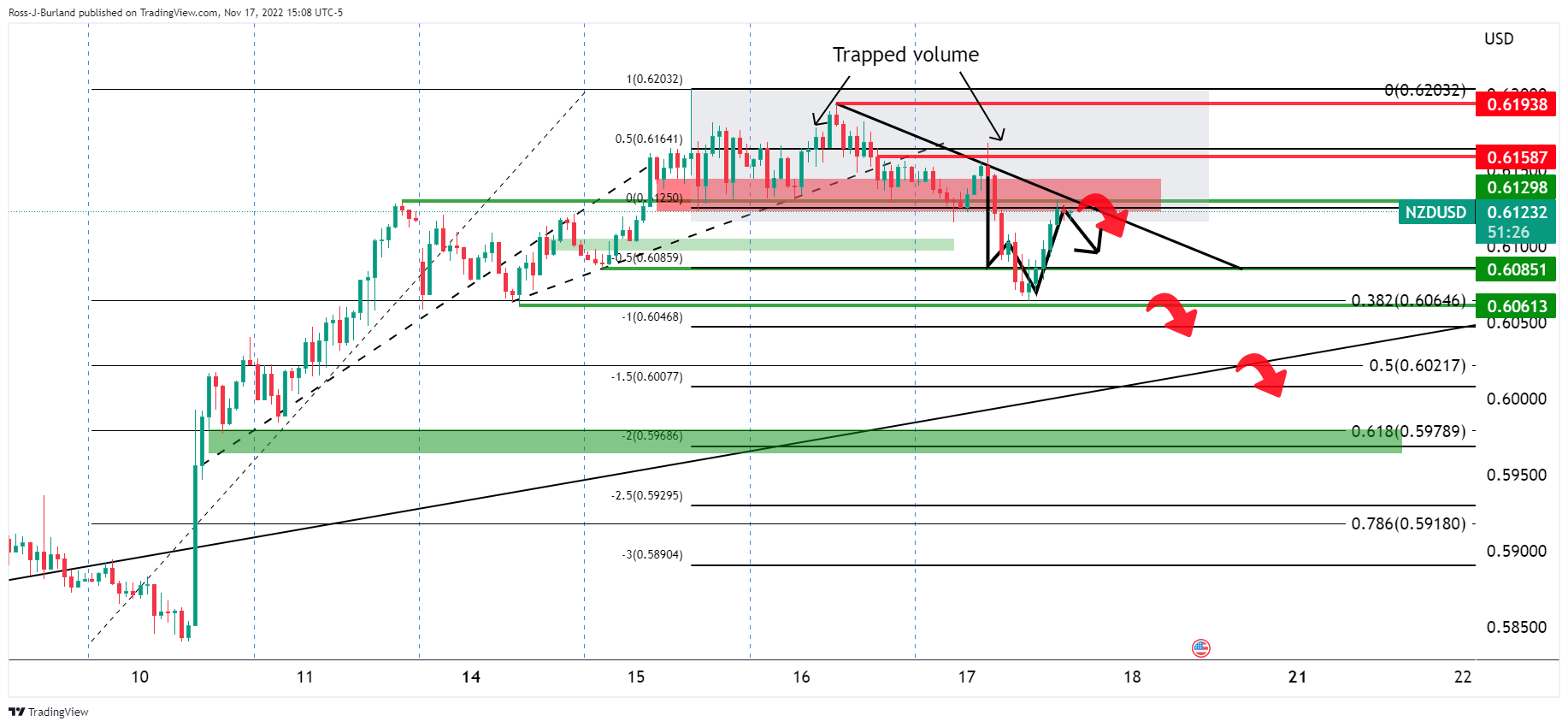

H4 H&S played out.

As illustrated, the H&S played out but the daily 38.2% Fibonacci has supported a bounce back into the breakout territory. However, this might just give the trapped longs up top a lifeline and their subsequent breakeven stop losses could eventuate a move to the downside again when coupled with fresh sellers taking advantage of the discount:

With the price on the front side of the bearish trendline, the W-formation is a reversion pattern that would be expected to be a drag on the recent rally. A retest of the lows could see a push below and on to the 61.8% golden ratio that aligns with prior support in a 200% measured expansion of the trapped volume up top.

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.