- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

(pare/closed(GMT +2)/change, %)

EUR/USD $1,2469 +0,24%

GBP/USD $1,5728 +0,58%

USD/CHF Chf0,9644 -0,16%

USD/JPY Y118,39 -0,23%

EUR/JPY Y147,62 0,00%

GBP/JPY Y186,2 +0,36%

AUD/USD $0,8488 -0,26%

NZD/USD $0,7863 +0,33%

USD/CAD C$1,1328 -0,95%

(time / country / index / period / previous value / forecast)

00:30 Australia Building Permits, m/m October -11.0% +5.2%

00:30 Australia Building Permits, y/y October -13.4%

00:30 Australia Current Account, bln Quarter III -13.7 -13.5

01:30 Japan Labor Cash Earnings, YoY October +0.7% Revised From +0.8% +0.8%

03:30 Australia Announcement of the RBA decision on the discount rate 2.50% 2.50%

03:30 Australia RBA Rate Statement

09:30 United Kingdom PMI Construction November 61.4 61.2

10:00 Eurozone Producer Price Index, MoM October +0.2% +0.3%

10:00 Eurozone Producer Price Index (YoY) October -1.4%

13:10 U.S. FED Vice Chairman Stanley Fischer Speaks

13:30 U.S. Fed Chairman Janet Yellen Speaks

15:00 U.S. Construction Spending, m/m November -0.4% +0.6%

17:00 U.S. FOMC Member Brainard Speaks

19:30 U.S. Total Vehicle Sales, mln November 16.5 16.5

21:30 U.S. API Crude Oil Inventories November +2.8

22:30 Australia AIG Services Index November 43.6

The U.S. dollar traded mixed to lower against the most major currencies after the better-than-expected ISM manufacturing purchasing managers' index. The Institute for Supply Management manufacturing purchasing managers' index for the U.S. declined to 58.7 in November from 59.0 in October, beating expectations for a decline to 57.9.

The Markit final manufacturing purchasing managers' index rose to 54.8 in November from a previous reading of 54.7, missing expectations for a rise to 55.0.

The euro traded higher against the U.S. dollar after the mostly weaker-than-expected economic data from the Eurozone. Eurozone' final manufacturing purchasing managers' index (PMI) fell to 50.1 in November from a preliminary reading of 50.4. Analysts had expected the final index to remain at 50.4.

Germany's final manufacturing PMI declined to 49.5 in November from a preliminary reading of 50.0. Analysts had expected the final index to remain at 50.0.

France's final manufacturing PMI climbed to 48.4 in November from a preliminary reading of 47.6. Analysts had expected the final index to remain at 47.6.

The British pound traded higher against the U.S. dollar. The U.K. manufacturing PMI increased to 53.5 in November from 53.3 in October, beating expectations for a decline to 53.1. October's figure was revised up from 53.2.

Net lending to individuals in the U.K. increased by £2.6 billion in October, missing expectations for a £2.8 billion rise, after a £2.7 billion gain in September.

The number of mortgages approvals in the U.K. fell to 59,426 in October from 61,234 in September. That was the lowest level since June 2013. Analysts had expected the number of mortgages approvals to decline to 59,000.

The Swiss franc traded higher against the U.S. dollar. The manufacturing purchasing managers' index in Switzerland decreased to 52.1 in November from 55.3 in October, missing expectations for a decline to 52.9.

The New Zealand dollar increased against the U.S. dollar. In the overnight trading session, the kiwi traded lower against the greenback after the weak Chinese economic data. China's manufacturing purchasing managers' index fell to 50.3 in November from 50.8 in October, missing expectations for a fall to 50.5.

The HSBC final manufacturing PMI for China remained unchanged at 50.0 in November, in line with expectations.

New Zealand's overseas trade index decreased 4.4% in the third quarter, after a 0.1% increase in the second quarter. The second quarter's figure was revised down from a 0.3 gain.

The Australian dollar traded higher against the U.S. dollar. In the overnight trading session, the Aussie decreased against the greenback after the weak Chinese economic data.

Company operating profits in Australia increased 0.5% in the third quarter, beating expectations for a 1.2% fall, after 7.5% drop in the second quarter. The second quarter's figure was revised down from a 6.9% decline.

The Japanese yen dropped against the U.S. dollar. In the overnight trading session, the yen traded lower against the greenback due to stronger U.S. currency.

In the morning trading session, the yen traded rose against the greenback. Moody's cuts Japan's rating to A1 from AA3.

Capital spending in Japan climbed 5.5% in the third quarter, after a 3.0% in the second quarter.

The Institute for Supply Management released its manufacturing purchasing managers' index for the U.S. on Monday. The index declined to 58.7 in November from 59.0 in October, beating expectations for a decline to 57.9.

The index was driven by strong demand and new orders. The new orders index rose to 66.0 in November.

The gauge of prices paid declined to 44.5 November from 53.5 in October. That was the lowest level since July 2012.

EUR/USD: $1.2400(E2.0bn), $1.2450(E1.0bn), $1.2475(E1.0bn), $1.2550(E642mn)

USD/JPY: Y117.75($300mn), Y118.75

GBP/USD: $1.5800(stg791mn)

AUD/USD: $0.8500(A$390mn), $0.8550(A$1.0bn)

USD/CHF Chf0.9500($604mn), Chf0.9525, Chf0.9650($445mn)

EUR/GBP: stg0.7750, stg0.7900

EUR/JPY: Y148.00

NZD/USD: $0.8000(NZ$1.4bn)

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Company Operating Profits Quarter III -7.5% Revised From -6.9% -1.2% +0.5%

01:00 China Manufacturing PMI November 50.8 50.5 50.3

01:35 Japan Manufacturing PMI (Finally) November 52.1 52.1 52.0

01:45 China HSBC Manufacturing PMI (Finally) November 50.0 50.0 50.0

05:30 Australia RBA Commodity prices, y/y November -16.9% -18.6%

08:30 Switzerland Manufacturing PMI November 55.3 52.9 52.1

08:48 France Manufacturing PMI (Finally) November 47.6 47.6 48.4

08:53 Germany Manufacturing PMI (Finally) November 50.0 50.0 49.5

08:58 Eurozone Manufacturing PMI (Finally) November 50.4 50.4 50.1

09:30 United Kingdom Purchasing Manager Index Manufacturing November 53.3 Revised From 53.2 53.1 53.5

09:30 United Kingdom Net Lending to Individuals, bln October 2.7 2.8 2.6

09:30 United Kingdom Mortgage Approvals October 61 59 59

The U.S. dollar traded lower against the most major currencies ahead of the ISM manufacturing purchasing managers' index. The index is expected to decline to 57.9 in November from 59.0 in October.

The greenback remained supported by falling oil prices.

The euro traded higher against the U.S. dollar after the mostly weaker-than-expected economic data from the Eurozone. Eurozone' final manufacturing purchasing managers' index (PMI) fell to 50.1 in November from a preliminary reading of 50.4. Analysts had expected the final index to remain at 50.4.

Germany's final manufacturing PMI declined to 49.5 in November from a preliminary reading of 50.0. Analysts had expected the final index to remain at 50.0.

France's final manufacturing PMI climbed to 48.4 in November from a preliminary reading of 47.6. Analysts had expected the final index to remain at 47.6.

The British pound rose against the U.S. dollar after the better-than-expected manufacturing PMI from the U.K. The U.K. manufacturing PMI increased to 53.5 in November from 53.3 in October, beating expectations for a decline to 53.1. October's figure was revised up from 53.2.

Net lending to individuals in the U.K. increased by £2.6 billion in October, missing expectations for a £2.8 billion rise, after a £2.7 billion gain in September.

The number of mortgages approvals in the U.K. fell to 59,426 in October from 61,234 in September. That was the lowest level since June 2013. Analysts had expected the number of mortgages approvals to decline to 59,000.

The Swiss franc traded higher against the U.S. dollar. The manufacturing purchasing managers' index in Switzerland decreased to 52.1 in November from 55.3 in October, missing expectations for a decline to 52.9.

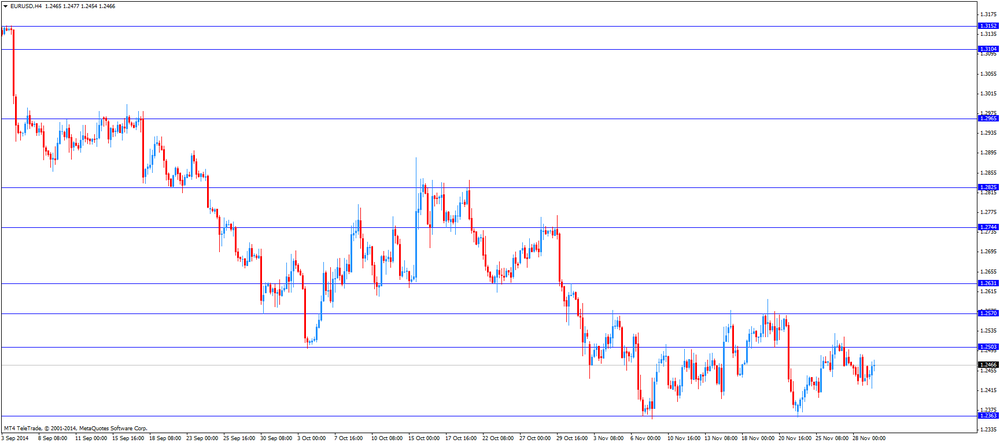

EUR/USD: the currency pair rose to $1.2477

GBP/USD: the currency pair increased to $1.5731

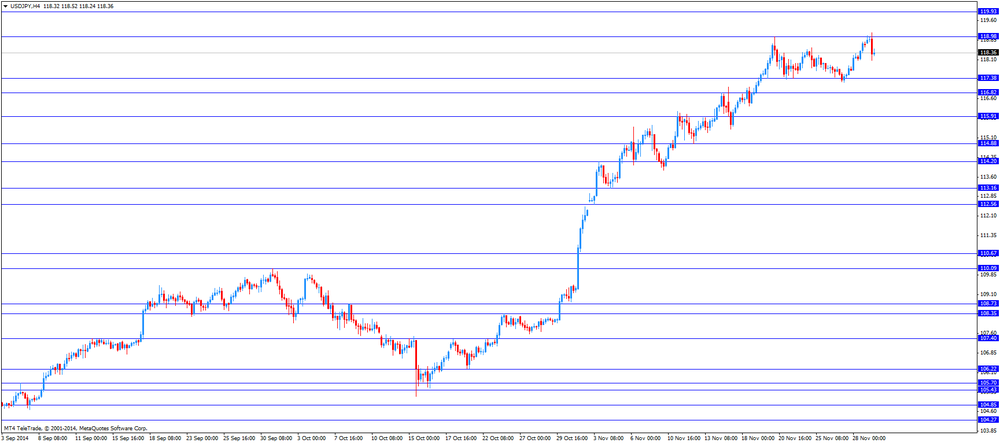

USD/JPY: the currency pair fell to Y118.07

The most important news that are expected (GMT0):

15:00 U.S. ISM Manufacturing November 59.0 57.9

17:15 U.S. FOMC Member Dudley Speak

18:00 U.S. FED Vice Chairman Stanley Fischer Speaks

EUR/USD

Offers $1.2550, $1.2500

Bids $1.2400, $1.2350

GBP/USD

Offers $1.5850, $1.5780/00, $1.5750

Bids $1.5680/60, $1.5610/00, $1.5580, $1.5550

AUD/USD

Offers $0.8580/00, $0.8550, $0.8500

Bids $0.8445/40, $0.8400, $0.8380, $0.8350

EUR/JPY

Offers Y149.50, Y149.00, Y148.50

Bids Y147.00, Y146.50, Y146.20

USD/JPY

Offers Y120.00, Y119.50, Y119.20

Bids Y118.00, Y117.80, Y117.50

EUR/GBP

Offers stg0.8050, stg0.8000, stg0.7980

Bids stg0.7900, stg0.7885/75, stg0.7860/50

EUR/USD: $1.2400(E2.0bn), $1.2450(E1.0bn), $1.2475(E1.0bn), $1.2550(E642mn

USD/JPY: Y117.75($300mn), Y118.75

GBP/USD: $1.5800(stg791mn)

AUD/USD: $0.8500(A$390mn), $0.8550(A$1.0bn)

USD/CHF Chf0.9500($604mn), Chf0.9525, Chf0.9650($445mn)

EUR/GBP: stg0.7750, stg0.7900

EUR/JPY: Y148.00

NZD/USD: $0.8000(NZ$1.4bn)

BLOOMBERG

OPEC Inaction Spurs Survival of Fittest as Oil Below $65

West Texas Intermediate tumbled below $65 a barrel to the lowest level since July 2009 amid speculation prices have further to drop before OPEC's decision to maintain output slows U.S. shale supply.

Benchmark futures in New York and London slumped more than 3 percent after capping their biggest monthly loss in about six years as the Organization of Petroleum Exporting Countries signaled the group will leave it to the market to reduce a global glut. Current prices are no guarantee of a significant decline in U.S. shale output, Iran's Oil Minister Bijan Namdar Zanganeh said in an interview on Nov. 28.

Source: http://www.bloomberg.com/news/2014-11-30/oil-slumps-below-65-amid-opec-inaction-to-stem-glut.html

BLOOMBERG

SNB Pledges Steps to Supplement Cap 'Immediately' If Needed

The Swiss National Bank will defend its cap on the franc via currency interventions and is prepared to take additional steps if needed.

"The SNB will continue to enforce the minimum exchange rate with the utmost determination and is prepared to buy foreign currency in unlimited quantities," the central bank, based in Bern and Zurich, said in a statement yesterday. "The SNB will take further measures immediately if required."

The comment came in response to voters rejecting an initiative that would have required the SNB to hold at least 20 percent of its assets in gold. The central bank said it was "pleased to hear" of yesterday's referendum outcome.

REUTERS

Fed rattled by elusive inflation, but loath to sound alarm yet

(Reuters) - With the U.S. economy humming along at its fastest clip in more than a decade, the Federal Reserve should be confident about its ability to weather a global slowdown and start lifting interest rates around the middle of next year.

But then there is inflation.

Interviews with Fed officials and those familiar with its thinking show the mood inside is more somber than the central bank's reassuring statements and evidence of robust economic health would suggest. The reason is the central bank's failure to nudge price growth up to its 2 percent target and, more importantly, signs that investors and consumers are losing faith it can get there any time soon.

Source: http://www.reuters.com/article/2014/12/01/us-usa-fed-inflation-insight-idUSKCN0JF1BV20141201

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia Company Operating Profits Quarter III -6.9% -1.2% +0.5%

01:00 China Manufacturing PMI November 50.8 50.5 50.3

01:35 Japan Manufacturing PMI (Finally) November 52.1 52.1 52.0

01:45 China HSBC Manufacturing PMI (Finally) November 50.0 50.0 50.0

05:30 Australia RBA Commodity prices, y/y November -16.9% -18.6%

The U.S. dollar traded stronger against its major peers. The greenback was supported by declining oil prices that have a positive effect on the U.S. economy. Markets are awaiting the Manufacturing PMI, ISM Manufacturing and speeches of FOMC Member Dudley and FED Vice Chairman Stanley Fischer later in the day.

The Australian dollar fell sharply against the greenback in Asian trading making new four-year lows although Company Operating Profits rose unexpectedly by +0.5% beating forecast of a decline of -1.2%. But RBA Commodity prices declined -18.6% in November, compared to -16.9% in October. The negative outcome of the Swiss referendum that would have forced the SNB to hold more physical gold put further pressure on the aussie fuelling fears that demand for gold will further slowdown. Australia is the second largest producer of gold. Chinas Manufacturing PMI for November was positive reading 50.3 but lower than the 50.6 expected. The HSBC manufacturing index was in line with expectations at 50. China is the most important trade partner of Australia.

The New Zealand dollar traded weaker against the U.S. dollar for a third consecutive day. New Zealand's Overseas Trade Index for the third quarter declined -4.4% yesterday, after an increase of +0.1% in the last quarter.

The Japanese yen dropped against the U.S. dollar making new lows at USD119.03 in Asian trade. The lowest since August 2007. Yesterday data on Capital Spending showed an increase from +3.0% in the previous quarter to +5.5% in the third quarter. Data on the Manufacturing PMI was published early today reading 52.0, analysts expected 52.1. The OPEC's decision to not cut quotas made oil prices decline heavily fuelling fears that Japan will not reach its inflation targets.

EUR/USD: the euro declined against the greenback

USD/JPY: the U.S. dollar traded at new highs against the yen

GPB/USD: The British pound traded weaker against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:30 Switzerland Manufacturing PMI November 55.3 52.9

08:48 France Manufacturing PMI (Finally) November 47.6 47.6

08:53 Germany Manufacturing PMI (Finally) November 50.0 50.0

08:58 Eurozone Manufacturing PMI (Finally) November 50.4 50.4

09:30 United Kingdom Purchasing Manager Index Manufacturing November 53.2 53.1

09:30 United Kingdom Net Lending to Individuals, bln October 2.7 2.8

09:30 United Kingdom Mortgage Approvals October 61 59

14:45 U.S. Manufacturing PMI (Finally) November 54.7 55.0

15:00 U.S. ISM Manufacturing November 59.0 57.9

17:15 U.S. FOMC Member Dudley Speak

18:00 U.S. FED Vice Chairman Stanley Fischer Speaks

23:50 Japan Monetary Base, y/y November +36.9% +37.2%

EUR / USD

Resistance levels (open interest**, contracts)

$1.2544 (4747)

$1.2516 (1794)

$1.2575 (358)

Price at time of writing this review: $ 1.2448

Support levels (open interest**, contracts):

$1.2408 (2543)

$1.2392 (6553)

$1.2370 (4202)

Comments:

- Overall open interest on the CALL options with the expiration date December, 5 is 112662 contracts, with the maximum number of contracts with strike price $1,2800 (6183);

- Overall open interest on the PUT options with the expiration date December, 5 is 113905 contracts, with the maximum number of contracts with strike price $1,2000 (7754);

- The ratio of PUT/CALL was 1.01 versus 1.12 from the previous trading day according to data from November, 28

GBP/USD

Resistance levels (open interest**, contracts)

$1.5900 (1085)

$1.5801 (1004)

$1.5703 (1560)

Price at time of writing this review: $1.5612

Support levels (open interest**, contracts):

$1.5595 (2406)

$1.5498 (1298)

$1.5399 (1004)

Comments:

- Overall open interest on the CALL options with the expiration date December, 5 is 41665 contracts, with the maximum number of contracts with strike price $1,6900 (1881);

- Overall open interest on the PUT options with the expiration date December, 5 is 41547 contracts, with the maximum number of contracts with strike price $1,6000 (2020);

- The ratio of PUT/CALL was 1.00 versus 0.98 from the previous trading day according to data from November, 28

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

(pare/closed(GMT +2)/change, %)

EUR/USD $ 1,2439 -0,22%

GBP/USD $1,5636 -0,63%

USD/CHF Chf0,9659 +0,20%

USD/JPY Y118,66 +0,81%

EUR/JPY Y147,62 +0,60%

GBP/JPY Y185,53 +0,18%

AUD/USD $0,8510 -0,39%

NZD/USD $0,7837 -0,36%

USD/CAD C$1,1436 +0,94%

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.