- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

(time / country / index / period / previous value / forecast)

07:00 Germany Retail sales, real adjusted November +1.9% +0.2%

07:00 Germany Retail sales, real unadjusted, y/y November +1.7%

08:00 United Kingdom Halifax house price index December +0.4% +0.3%

08:00 United Kingdom Halifax house price index 3m Y/Y December +8.2%

08:00 Switzerland Foreign Currency Reserves December 462.4

08:55 Germany Unemployment Change December -14 -6

08:55 Germany Unemployment Rate s.a. December 6.6% 6.6%

10:00 Eurozone Unemployment Rate November 11.5% 11.5%

10:00 Eurozone Harmonized CPI, Y/Y (Preliminary) December +0.3% 0.0%

13:15 U.S. ADP Employment Report December 208 227

13:30 Canada Trade balance, billions November 0.1 -0.2

13:30 U.S. International Trade, bln November -43.4 -42.3

15:00 Canada Ivey Purchasing Managers Index December 56.9 52.3

15:30 U.S. Crude Oil Inventories December -1.8

19:00 U.S. FOMC meeting minutes

23:30 U.S. FOMC Member Charles Evans Speaks

The U.S. dollar traded mixed against the most major currencies after the weaker-than-expected U.S. economic data. The ISM non-manufacturing purchasing managers' index fell to 56.2 in December from 59.3 in November, missing expectations for a decline to 58.2.

Factory orders in the U.S. dropped 0.7% in November, missing expectations for a 0.3% decrease, after a 0.7% decline in October. That was the fourth straight decline.

The decline was driven by weaker demand for primary metals, industrial machinery and military aircraft.

The euro traded higher against the U.S. dollar. Eurozone' final services purchasing managers' index (PMI) fell to 51.6 in December from a preliminary reading of 51.9. Analysts had expected the final index to remain at 51.6.

Germany's final services PMI remained rose to 52.1 in December from a preliminary reading of 51.4. Analysts had expected the final index to remain at 51.4.

France's final services PMI increased to 50.6 in December from a preliminary reading of 49.8. Analysts had expected the final index to remain at 49.8.

Political uncertainty in Greece and speculation the European Central Bank will add further stimulus measures still weighed on the euro. There is speculation that Greece could leave the Eurozone. Greeks will elect new parliament later this month. If a left-wing government wins Greek parliament elections, it may cancel austerity measures and may renegotiate Greece's debt.

Investors speculate that the European Central Bank could decide on its policy meeting on January 22 to purchase government bonds.

The British pound traded lower against the U.S. dollar. The weaker-than-expected services data from the U.K. still weighed on the pound. Markit's and the Chartered Institute of Purchasing & Supply's services purchasing managers' index (PMI) for the U.K. fell to 55.8 in December from 58.6 in November, missing expectations for a rise to 58.9. That was the lowest level since May 2013.

The Canadian dollar traded lower against the U.S. dollar after the weaker-than-expected Canadian Canada's raw materials purchase price index. Canada's Raw Materials Price Index (RMPI) dropped 5.8% in November, missing expectations for a 4.6% fall, after a 4.3% decline in October. That was the fifth straight decline.

The Canadian Industrial Product Price Index (IPPI) fell 0.4% in November, beating forecasts for a 0.5% decline, after a 0.5% decrease in October.

The New Zealand dollar rose against the U.S. dollar in the absence of any major market reports from New Zealand.

The Australian dollar traded lower against the U.S. dollar. In the overnight trading session, the Aussie increased against the greenback after the better-than-expected Australian trade data. Australia's trade deficit widened to A$0.93 billion in November from A$0.88 billion in October. October's figure was revised up from a deficit of A$1.32 billion. Analysts had expected the trade deficit to increase to A$1.59 billion.

The Japanese yen rose against the U.S. dollar. In the overnight trading session, the yen increased against the greenback due to increasing demand for safe-haven currency.

Japan's monetary base increased 38.2% in December, beating expectations for a 34.3% rise, after a 36.7% gain in November.

Statistics Canada released its industrial product and raw materials price indexes. The Industrial Product Price Index (IPPI) fell 0.4% in November, beating forecasts for a 0.5% decline, after a 0.5% decrease in October. The decline was driven by lower prices for energy and petroleum products.

The Raw Materials Price Index (RMPI) dropped 5.8% in November, missing expectations for a 4.6% fall, after a 4.3% decline in October. That was the fifth straight decline.

The drop was driven by lower prices for crude energy products.

The U.S. Commerce Department released factory orders data on Tuesday. Factory orders in the U.S. dropped 0.7% in November, missing expectations for a 0.3% decrease, after a 0.7% decline in October. That was the fourth straight decline.

The decline was driven by weaker demand for primary metals, industrial machinery and military aircraft.

Manufacturing in the U.S. is cooling due to a slow economic growth in China and the Eurozone. A recession in Japan also weighed on manufacturing in the U.S.

Factory orders excluding transportation fell 0.6% in November.

The Institute for Supply Management released its non-manufacturing purchasing managers' index for the U.S. on Tuesday. The index fell to 56.2 in December from 59.3 in November, missing expectations for a decline to 58.2.

A reading above 50 indicates a growth in the service sector.

The ISM's new orders index declined to 58.9 in December from 61.4 in November.

The ISM's business activity/production index decreased to 57.2 in December from 64.4 November.

The ISM's employment index fell to 56.0 in December from 56.7 in November.

The Bank of England released its Credit Conditions Survey on Tuesday. The survey reported that household demand for mortgages fell in Q4 to its lowest level since the third quarter of 2008. Lenders expected an increase in mortgage demand.

Demand for credit card lending rose significantly in Q4 to its highest level of yearly 2007.

EUR/USD: $1.2000(E287mn), $1.2050(E605mn)

USD/JPY: Y119.80($600mn), Y120.00($1.25bn)

USD/CHF: Chf1.0000($300mn)

AUD/USD: $0.8200(A$558mn), $0.8250(A$321mn)

AUD/JPY: Y98.00(A$1.4bn)

NZD/USD: $0.7710(NZ$456mn)

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Trade Balance November -0.88 Revised From -1.32 -1.59 -0.93

01:45 China HSBC Services PMI December 53.0 53.4

08:48 France Services PMI (Finally) December 49.8 49.8 50.6

08:53 Germany Services PMI (Finally) December 51.4 51.4 52.1

08:58 Eurozone Services PMI (Finally) December 51.9 51.9 51.6

09:30 United Kingdom Purchasing Manager Index Services December 58.6 58.9 55.8

09:30 United Kingdom BOE Credit Conditions Survey Quarter IV

The U.S. dollar traded higher against the most major currencies ahead of the U.S. economic data. The ISM non-manufacturing purchasing managers' index is expected to decline to 58.2 in December from 59.3 in November.

Factory orders in the U.S. are expected to decline 0.3% in November, after a 0.7% drop in October.

The euro declined against the U.S. dollar after the mixed services purchasing managers' index (PMI) from the Eurozone. Eurozone' final services PMI fell to 51.6 in December from a preliminary reading of 51.9. Analysts had expected the final index to remain at 51.6.

Germany's final services PMI remained rose to 52.1 in December from a preliminary reading of 51.4. Analysts had expected the final index to remain at 51.4.

France's final services PMI increased to 50.6 in December from a preliminary reading of 49.8. Analysts had expected the final index to remain at 49.8.

Political uncertainty in Greece and speculation the European Central Bank will add further stimulus measures still weighed on the euro. There is speculation that Greece could leave the Eurozone. Greeks will elect new parliament later this month. If a left-wing government wins Greek parliament elections, it may cancel austerity measures and may renegotiate Greece's debt.

Investors speculate that the European Central Bank could decide on its policy meeting on January 22 to purchase government bonds.

The British pound dropped against the U.S. dollar after the weaker-than-expected services data from the U.K. Markit's and the Chartered Institute of Purchasing & Supply's services purchasing managers' index (PMI) for the U.K. fell to 55.8 in December from 58.6 in November, missing expectations for a rise to 58.9. That was the lowest level since May 2013.

The Canadian dollar traded lower against the U.S. dollar ahead of Canadian raw materials purchase price index. Canada's raw materials purchase price index is expected to decline 4.6% in November, after a 4.3% drop in October.

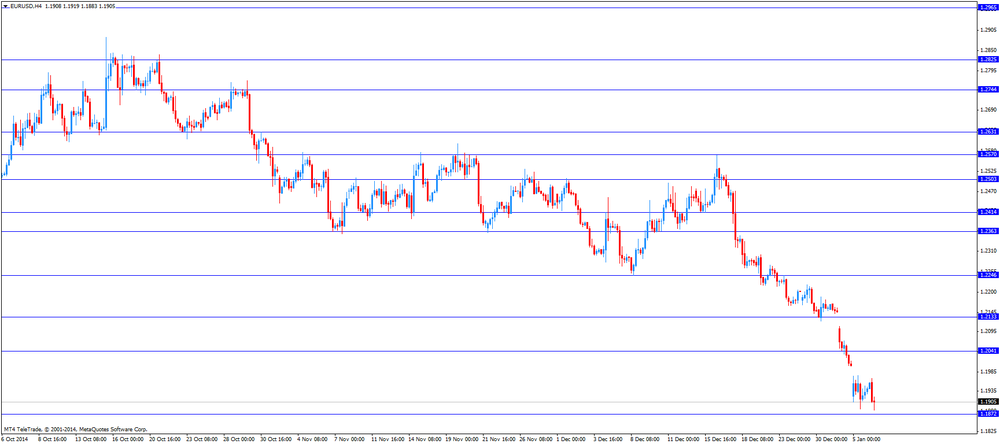

EUR/USD: the currency pair declined to $1.1883

GBP/USD: the currency pair fell to $1.5175

USD/JPY: the currency pair rose to Y119.38

The most important news that are expected (GMT0):

13:30 Canada Raw Material Price Index November -4.3% -4.6%

15:00 U.S. ISM Non-Manufacturing December 59.3 58.2

15:00 U.S. Factory Orders November -0.7% -0.3%

EUR/USD

Offers $1.2200, $1.2150, $1.2125/20, $1.2100, $1.2000

Bids $1.1900, $1.1865, $1.1800

GBP/USD

Offers $1.5620, $1.5545, $1.5485, $1.5430, $1.5400

Bids $1.5175, $1.5100, $1.5000

AUD/USD

Offers $0.8250, $0.8200, $0.8165/60

Bids $0.8080, $0.8035, $0.8000, $0.7950

EUR/JPY

Offers Y146.00/05, Y145.50, Y145.30, Y144.15, Y143.00

Bids Y141.85, Y141.00

USD/JPY

Offers Y121.85, Y121.50, Y121.20, Y120.90/00, Y119.95

Bids Y118.25, Y118.00, Y116.80

EUR/GBP

Offers stg0.7900, stg0.7880/85, stg0.7860-70

Bids stg0.7755/50, stg0.7745, stg0.7720, stg0.7700, stg0.7680

Markit and the Chartered Institute of Purchasing & Supply released their services purchasing managers' index (PMI) for the U.K. on Tuesday. The U.K. services PMI dropped to 55.8 in December from 58.6 in November, missing expectations for a rise to 58.9. That was the lowest level since May 2013.

A reading above 50 indicates growth in the sector.

Markit's chief economist Chris Williamson noted that "the loss of momentum towards the year end will no doubt fuel worries that the upturn is too fragile to withstand higher interest rates".

Bloomberg

European Stocks Fall as Oil Drops Below $50; Yen Gains

European equities extended a global selloff as crude oil sank to the lowest level in almost six years. Asian stocks (MXAP) tumbled the most since March.

Reuters

Brent falls below $52 as oil hits new five-and-a-half year lows

(Reuters) - Oil prices sank to fresh 5-1/2-year lows on Tuesday, extending losses after a 5 percent plunge in the previous session as worries over a global supply glut intensified.

Brent crude fell by 3 percent to below $52 (34 pounds) a barrel as cuts to monthly oil selling prices for European buyers by top OPEC producer Saudi Arabia heightened worries about oversupply.

Source:

RTTNews

Asian Stocks Join Global Selloff

Asian stocks fell for a second consecutive session on Tuesday following heavy losses in the U.S. and European markets overnight. Slumping oil prices and growing concerns that Greece might leave the European currency union left investors fleeing risky assets for the presumed safety of government bonds and the safe-haven Japanese yen.

Source: http://www.rttnews.com/2437836/asian-stocks-join-global-selloff.aspx

EUR/USD: $1.2000(E287mn), $1.2050(E605mn)

USD/JPY: Y119.80($600mn), Y120.00($1.25bn)

USD/CHF: Chf1.0000($300mn)

AUD/USD: $0.8200(A$558mn), $0.8250(A$321mn)

AUD/JPY: Y98.00(A$1.4bn)

NZD/USD: $0.7710(NZ$456mn)

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Trade Balance November -0.88 Revised From -1.32 -1.59 -0.93

01:45 China HSBC Services PMI December 53.0 53.4

08:48 France Services PMI (Finally) December 49.8 49.8 50.6

08:53 Germany Services PMI (Finally) December 51.4 51.4 52.1

08:58 Eurozone Services PMI (Finally) December 51.9 51.9 51.6

09:30 United Kingdom Purchasing Manager Index Services December 58.6 58.9 55.8

09:30 United Kingdom BOE Credit Conditions Survey Quarter IV

The U.S. dollar traded lower against the most major currencies. The greenback was supported by concerns over the economy in the Eurozone and political uncertainty in Greece. Yesterday's inflation data from the Eurozone showed that German preliminary consumer price index decreased to 0.2% in December from 0.6% in November, missing forecasts for a decline to 0.4%. That was the lowest level since October 2009.

There is also speculation that Greece could leave the Eurozone. Greeks will elect new parliament later this month. If a left-wing government wins Greek parliament elections, it may cancel austerity measures and may renegotiate Greece's debt.

The New Zealand dollar rose against the U.S. dollar in the absence of any major market reports from New Zealand.

The Australian dollar increased against the U.S. dollar after the better-than-expected Australian trade data. Australia's trade deficit widened to A$0.93 billion in November from A$0.88 billion in October. October's figure was revised up from a deficit of A$1.32 billion. Analysts had expected the trade deficit to increase to A$1.59 billion.

The Japanese yen gained against the U.S. dollar due to increasing demand for safe-haven currency. Japan's monetary base increased 38.2% in December, beating expectations for a 34.3% rise, after a 36.7% gain in November.

EUR/USD: the currency pair rose to $1.1968

GBP/USD: the currency pair increased to $1.5273

USD/JPY: the currency pair fell to Y118.64

The most important news that are expected (GMT0):

13:30 Canada Raw Material Price Index November -4.3% -4.6%

15:00 U.S. ISM Non-Manufacturing December 59.3 58.2

15:00 U.S. Factory Orders November -0.7% -0.3%

EUR / USD

Resistance levels (open interest**, contracts)

$1.2204 (3971)

$1.2113 (1237)

$1.2036 (2368)

Price at time of writing this review: $ 1.1958

Support levels (open interest**, contracts):

$1.1890 (210)

$1.1862 (7221)

$1.1827 (2014)

Comments:

- Overall open interest on the CALL options with the expiration date January, 9 is 66918 contracts, with the maximum number of contracts with strike price $1,2500 (6660);

- Overall open interest on the PUT options with the expiration date January, 9 is 63785 contracts, with the maximum number of contracts with strike price $1,1900 (7221);

- The ratio of PUT/CALL was 0.95 versus 1.05 from the previous trading day according to data from January, 5

GBP/USD

Resistance levels (open interest**, contracts)

$1.5500 (978)

$1.5401 (901)

$1.5304 (1436)

Price at time of writing this review: $1.5258

Support levels (open interest**, contracts):

$1.5195 (2389)

$1.5098 (704)

$1.4999 (474)

Comments:

- Overall open interest on the CALL options with the expiration date January, 9 is 30361 contracts, with the maximum number of contracts with strike price $1,5850 (4020);

- Overall open interest on the PUT options with the expiration date January, 9 is 23372 contracts, with the maximum number of contracts with strike price $1,5500 (2692);

- The ratio of PUT/CALL was 0.77 versus 0.86 from the previous trading day according to data from January, 5

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.