- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

The U.S. dollar traded lower against the most major currencies after the mixed U.S. labour market data. The U.S. economy added 214,000 jobs in October, missing expectations for a rise of 229,000 jobs, after a gain of 256,000 jobs in September. September's figure was revised up from a rise of 248,000 jobs.

The U.S. unemployment rate declined to 5.8% in October from 5.9% in September. Analysts had expected the unemployment rate to remain unchanged.

Average hourly earnings climbed 0.1% in October, missing forecasts of a 0.2% gain, after the flat reading in September.

These figures are signs that the labour market in the U.S. is strengthening.

The euro climbed against the U.S. dollar. Germany's trade surplus climbed to €18.5 billion in September from €17.5 billion in August, exceeding expectations for a rise to €18.3 billion.

German adjusted industrial production rose 1.4% in September, missing expectations for a 2.1% gain, after a 3.1% drop in August. August's figure was revised up from a 4.0% fall.

France's trade deficit narrowed to €4.7 billion in September from €5.0 billion in August, beating expectations for an increase to a deficit of €5.2 billion. August's figure was revised up from a deficit of €5.8 billion

French industrial production was flat in September, beating expectations for a 0.1% decline, after a 0.2% fall in August.

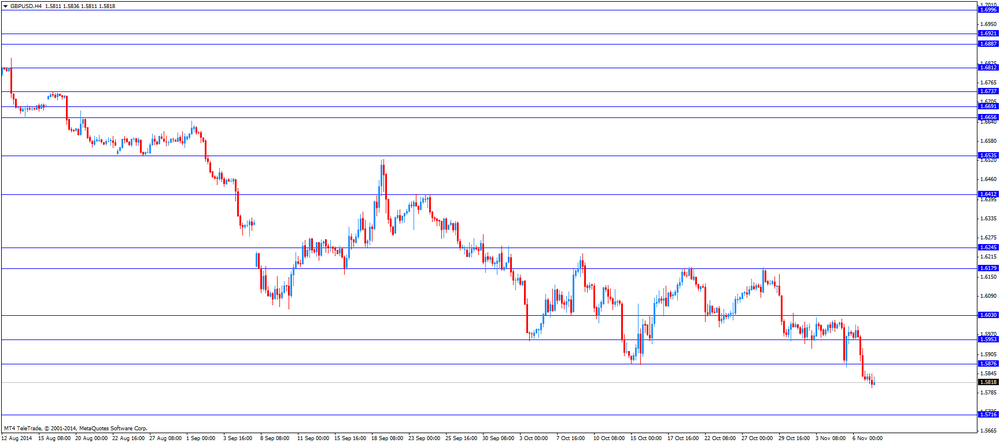

The British pound traded higher against the U.S. dollar. The U.K. trade deficit rose to £9.8 billion in September from £8.95 billion in August, missing expectations for a deficit of £9.4 billion. August's figure was revised from a deficit of £9.10 billion.

The Canadian dollar increased against the U.S. dollar ahead of the Canadian labour market data. Canada's unemployment rate fell to 6.5% in October from 6.8% in September. That was the lowest level since November 2008. Analysts had expected the unemployment rate to remain unchanged at 6.8%.

The number of employed people increased by 43,100 in October, exceeding expectations for a gain of 400, after a 74,100 rise in September.

The Swiss franc rose against the U.S. dollar. Retail sales in Switzerland increased at an annual rate of 0.3% in September, missing expectations for a 2.2% rise, after a 1.4% gain in August. August's figure was revised down from a 1.9% increase.

Switzerland's unemployment rate remained unchanged at 3.2% in October.

The Swiss National Bank's foreign exchange reserves declined to 460.427 billion Swiss francs in October from 462.117 billion francs in September. September's figure was revised from 462.194 billion Swiss francs.

The New Zealand dollar traded higher against the U.S. dollar in the absence of any major economic reports from New Zealand.

The Australian dollar was up against the U.S. dollar. In the overnight trading session, the Aussie traded mixed against after the release of the Reserve Bank of Australia's (RBA) quarterly monetary policy statement. The central bank said that the Australian gross domestic product is expected to grow below trend until mid-2015.

The RBA reiterated that the Aussie remains high by historical standards despite the recent declines.

The AiG (Australian Industry Group) performance of construction index declined to 53.4 in October from 59.1 in September.

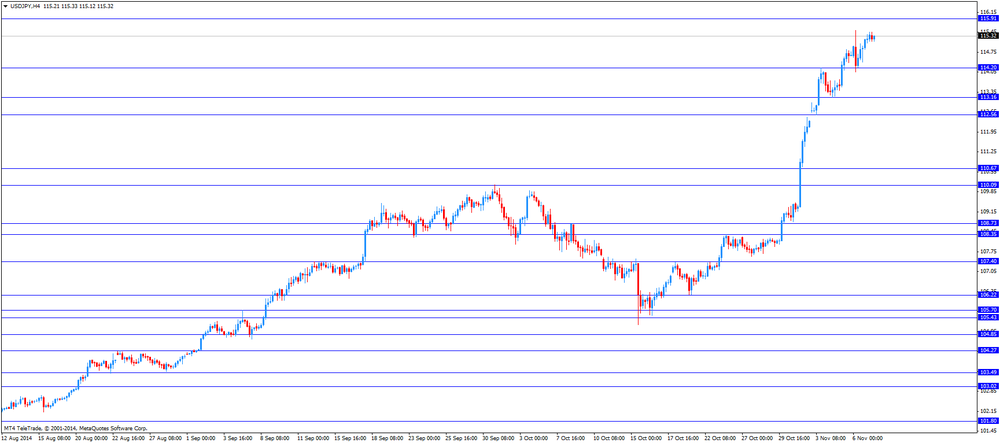

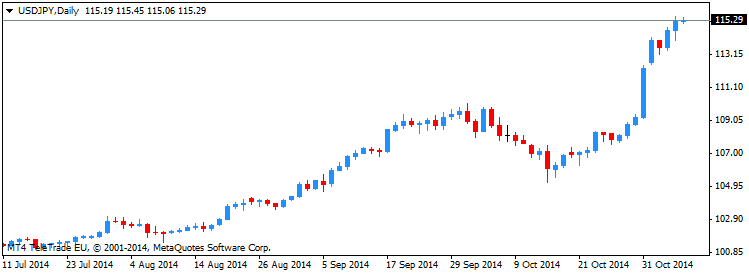

The Japanese yen increased against the U.S. dollar in the absence of any major economic reports from Japan.

The Reserve Bank of Australia (RBA) released its quarterly monetary policy statement on Friday:

- Australian gross domestic product is expected to grow below trend until mid-2015;

- "The very accommodative monetary policy settings will continue to provide support to demand and help growth to strengthen, in time";

- The Australian dollar remains high by historical standards despite the recent declines;

- "A gradual strengthening of economic growth should, in time, lead to stronger growth of employment;

- Inflation is expected to be within the RBA's 2-3% target over the next two years.

The Bank of Japan (BoJ) Governor Haruhiko Kuroda said at a Bank of France conference in Paris on Friday that Japan's government had committed to provide short-term fiscal support and to implement structural reforms.

Kuroda also said that there is some progress made by Japan's government, but "this path is somewhat delayed".

The BoJ governor reiterated that the central bank want to achieve its 2% inflation target in two years.

The U.S. Labor Department released the labour market data today. The U.S. economy added 214,000 jobs in October, missing expectations for a rise of 229,000 jobs, after a gain of 256,000 jobs in September. September's figure was revised up from a rise of 248,000 jobs.

The U.S. unemployment rate declined to 5.8% in October from 5.9% in September. Analysts had expected the unemployment rate to remain unchanged.

Average hourly earnings climbed 0.1% in October, missing forecasts of a 0.2% gain, after the flat reading in September.

The labour-force participation rate was up to 62.8% in October from 62.7% in September. The rate remained near the lowest level since the late 1970s.

These figures are signs that the labour market in the U.S. is strengthening.

Statistics Canada released the labour market data today. Canada's unemployment rate fell to 6.5% in October from 6.8% in September. That was the lowest level since November 2008.

Analysts had expected the unemployment rate to remain unchanged at 6.8%.

The number of employed people increased by 43,100 in October, exceeding expectations for a gain of 400, after a 74,100 rise in September.

Full-time jobs climbed by 26,500 in October, while part-time positions increased by 16,500.

Retail and wholesale trade, finance, insurance and real estate and manufacturing added jobs, while public administration and natural resources lost jobs.

EUR/USD: $1.2400(E1.3bn), $1.2450(E525mn), $1.2500(E5.5bn), $1.2550(E4.6bn)

USD/JPY: Y114.00($525mn), Y115.00($300mn)

GBP/USD: $1.5900-05(stg440mn)

EUR/GBP: stg0.7750(E200mn), stg0.7900(E100mn), stg0.7950(E220mn)

USD/CHF: Chf0.9460($1.65bn)

AUD/USD: $0.8600(A$1.1bn), $0.8650(A$700mn), $0.8675(A$796mn), $0.8700(A$467mn), $0.8750 A$2.1bn

NZD/USD: $0.7720(NZ$200mn), $0.7800(NZ$201mn)

USD/CAD: C$1.1300($1.2bn), C$1.1350($600mn), C$1.1500($675mn)

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:05 U.S. FOMC Member Mester Speaks

00:30 Australia RBA Monetary Policy Statement

06:45 Switzerland Unemployment Rate October 3.2% 3.2% 3.2%

07:00 Germany Current Account September 10.3 22.3

07:00 Germany Industrial Production s.a. (MoM) September -3.1% Revised From -4.0% +2.1% +1.4%

07:00 Germany Industrial Production (YoY) September -2.8% -0.1%

07:00 Germany Trade Balance September 17.5 18.3 18.5

07:45 France Trade Balance, bln September -5.8 -5.2 -4.7

07:45 France Industrial Production, m/m September -0.2% Revised From 0.0% -0.1% 0.0%

07:45 France Industrial Production, y/y September -0.3% -0.3%

08:00 Switzerland Foreign Currency Reserves October 462.2 460.4

08:15 Switzerland Retail Sales Y/Y September +1.4% Revised From +1.9% +2.2% +0.3%

09:30 United Kingdom Trade in goods September -9.0 Revised From -9.1 -9.4 -9.8

10:00 Eurozone ECOFIN Meetings

The U.S. dollar traded mixed to lower against the most major currencies ahead of the U.S. labour market data. The U.S. unemployment rate is expected to remain unchanged at 5.9% in October. The U.S. economy is expected to add 229,000 jobs in October.

The euro traded higher against the U.S. dollar after the mostly better-than-expected economic data from the Eurozone. Germany's trade surplus climbed to €18.5 billion in September from €17.5 billion in August, exceeding expectations for a rise to €18.3 billion.

German adjusted industrial production rose 1.4% in September, missing expectations for a 2.1% gain, after a 3.1% drop in August. August's figure was revised up from a 4.0% fall.

France's trade deficit narrowed to €4.7 billion in September from €5.0 billion in August, beating expectations for an increase to a deficit of €5.2 billion. August's figure was revised up from a deficit of €5.8 billion

French industrial production was flat in September, beating expectations for a 0.1% decline, after a 0.2% fall in August.

The British pound traded mixed against the U.S. dollar after the trade data from the U.K. The U.K. trade deficit rose to £9.8 billion in September from £8.95 billion in August, missing expectations for a deficit of £9.4 billion. August's figure was revised from a deficit of £9.10 billion.

The Canadian dollar traded mixed against the U.S. dollar ahead of the Canadian labour market data. The unemployment rate in Canada is expected to remain unchanged at 6.8% in October.

Canada's economy is expected to add 400 jobs in October.

The Swiss franc traded higher against the U.S. dollar. Retail sales in Switzerland increased at an annual rate of 0.3% in September, missing expectations for a 2.2% rise, after a 1.4% gain in August. August's figure was revised down from a 1.9% increase.

Switzerland's unemployment rate remained unchanged at 3.2% in October.

The Swiss National Bank's foreign exchange reserves declined to 460.427 billion Swiss francs in October from 462.117 billion francs in September. September's figure was revised from 462.194 billion Swiss francs.

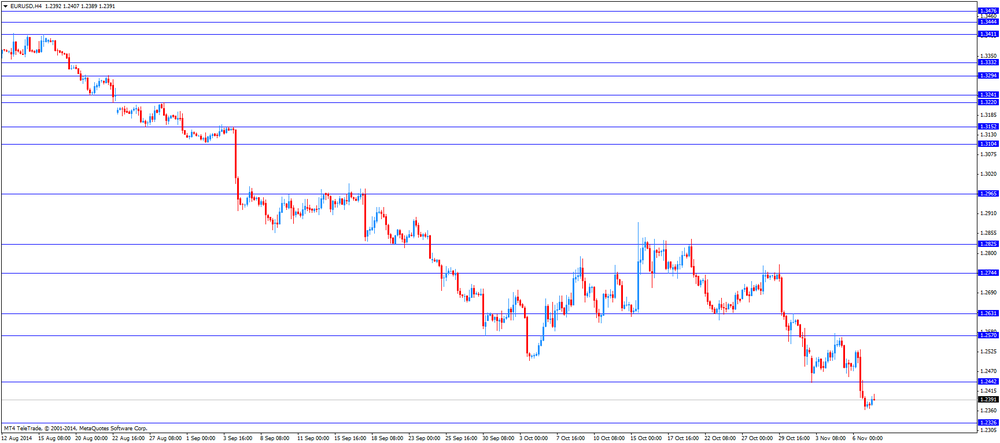

EUR/USD: the currency pair rose to $1.2407

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

13:30 Canada Employment October 74.1 0.4

13:30 Canada Unemployment rate October 6.8% 6.8%

13:30 U.S. Average hourly earnings October 0.0% +0.2%

13:30 U.S. Nonfarm Payrolls October 248 229

13:30 U.S. Unemployment Rate October 5.9% 5.9%

EUR/USD

Offers $1.2550, $1.2500, $1.2425

Bids $1.2350/40, $1.2300, $1.2250

GBP/USD

Offers $1.5950/60, $1.5930/35, $1.5900/10

Bids $1.5800

AUD/USD

Offers $0.8750, $0.8700, $0.8640/50

Bids 0.8520, $0.8500, 0.8450

EUR/JPY

Offers Y144.50

Bids Y142.00, Y141.55/50, Y141.00, Y140.50

USD/JPY

Offers Y116.50, Y116.00

Bids Y115.10/00, Y113.80/70, Y113.50/40

EUR/GBP

Offers

Bids stg0.7755/45, stg0.7700

EUR/USD: $1.2400(E1.3bn), $1.2450(E525mn), $1.2500(E5.5bn), $1.2550(E4.6bn)

USD/JPY: Y114.00($525mn), Y115.00($300mn)

GBP/USD: $1.5900-05(stg440mn)

EUR/GBP: stg0.7750(E200mn), stg0.7900(E100mn), stg0.7950(E220mn)

USD/CHF: Chf0.9460($1.65bn)

AUD/USD: $0.8600(A$1.1bn), $0.8650(A$700mn), $0.8675(A$796mn), $0.8700(A$467mn), $0.8750 A$2.1bn

NZD/USD: $0.7720(NZ$200mn), $0.7800(NZ$201mn)

USD/CAD: C$1.1300($1.2bn), C$1.1350($600mn), C$1.1500($675mn)

REUTERS

U.S. regulators to join UK in forex fines for banks

U.S. regulators plan to join their UK peers in a multi-billion-dollar settlement with a group of the biggest global banks accused of manipulating the foreign exchange market, sources familiar with the matter said, adding the deal could come as early as next week.

Source: http://www.reuters.com/article/2014/11/07/forex-manipulation-fines-idUSL1N0SX02M20141107

BLOOMBERG

Dollar Set for Biggest Weekly Gain in 16 Months Before Payrolls

A gauge of the dollar headed for its biggest weekly gain in more than 16 months before a U.S. government report forecast to show employers added more jobs in October than this year's average.

The U.S. currency approached a seven-year high against the yen set yesterday after Bank of JapanGovernor Haruhiko Kuroda said this week the central bank will maintain stimulus as long as needed. The euro was poised for a third weekly decline after European Central Bank President Mario Draghi deepened his commitment to stimulus yesterday.

REUTERS

SNB forex reserves down in October

The Swiss National Bank's foreign exchange reserves fell in October, data showed on Friday.

The SNB held 460.427 billion Swiss francs in foreign currency at the end of October, compared with 462.117 billion francs in September, revised from an originally reported 462.194 billion francs, preliminary data calculated according to the standards of the International Monetary Fund showed.

Source: http://www.reuters.com/article/2014/11/07/swiss-snb-forex-idUSL6N0SW4O420141107

REUTERS

OPEC concerned, not panicking about oil price: Badri

Fundamental factors do not justify the sharp drop in oil prices, OPEC Secretary-General Abdullah al-Badri said on Thursday, forecasting a price rebound by the second half of 2015.

"We are concerned but we are not panicking," he told reporters at a news conference on the group's 2014 World Oil Outlook.

Source: http://www.reuters.com/article/2014/11/06/us-opec-oil-badri-idUSKBN0IQ1QR20141106

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/

Actual

00:05 U.S. FOMC Member Mester Speaks

00:30 Australia RBA Monetary Policy Statement

06:45 Switzerland Unemployment Rate October 3.2% 3.2% 3.2%

07:00 Germany Current Account September 10.3 22.3

07:00 Germany Industrial Production s.a. (MoM) September -4.0% +2.1%

+1.4%

07:00 Germany Industrial Production (YoY) September -2.8% -0.1%

07:00 Germany Trade Balance September 17.5 18.3 18.5

The U.S. dollar traded stronger against its

major peers. Investors are awaiting U.S. Nonfarm Payrolls as employment rates

are projected to go up which could lead to further speculation the FED is going

to increase interest rates in the future. The euro traded at USD1.2363 near its two-year low after European

Central Bank President Mario Draghi is expected to take more easing steps to

help economic growth in the euro zone leaving interest rates at the current

record-low level of 0.05%. As long as there is a risk of ECB additional easing

the euro will be under pressure.

The New Zealand dollar currently trading at

USD0.7686 continued to fall after breaching the important support level of

USD0.7700

The Australian dollar reached new record

lows since 2010 against the U.S. dollar

as the Australian Central Bank forecasts weak domestic growth.

The Japanese yen currently trading at

USD115.17 close to its new record-low of USD115.51 after the BoJ’s economic

stimulus from last week.

EUR/USD: the currency pair declined to USD1.2381

USD/JPY: the U.S. dollar appreciated

against the Japanese yen and is currently trading at Y115.29

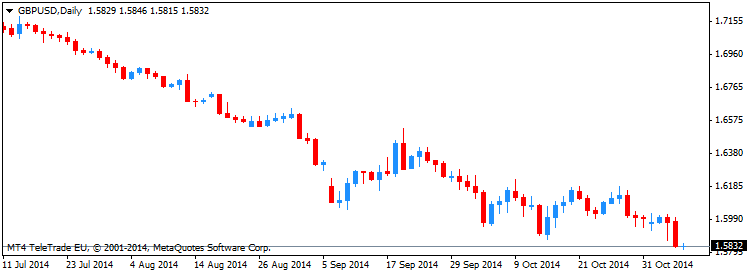

GPB/USD: the currency pair decreased to

USD1.5832

The most important news that are

expected (GMT0):

07:45 France Trade Balance, bln September

-5.8 -5.2

07:45 France Industrial Production, m/m

September 0.0% -0.1%

07:45 France Industrial Production, y/y September -0.3%

08:00 Switzerland Foreign Currency Reserves

October 462.2

08:15 Switzerland Retail Sales Y/Y

September +1.9% +2.2%

09:30 United Kingdom Trade in goods

September -9.1 -9.4

10:00 Eurozone ECOFIN Meetings

13:30 Canada Employment October 74.1 0.4

13:30 Canada Unemployment rate October 6.8%

6.8%

13:30 U.S. Average hourly earnings October

0.0% +0.2%

13:30 U.S. Nonfarm Payrolls October 248 229

13:30 U.S. Unemployment Rate October 5.9% 5.9%

19:00 U.S. Consumer Credit September 13.5

16.6

EUR / USD

Resistance levels (open interest**, contracts)

$1.2555 (3169)

$1.2512 (2853)

$1.2445 (1129)

Price at time of writing this review: $ 1.2377

Support levels (open interest**, contracts):

$1.2345 (8165)

$1.2312 (4720)

$1.2283 (4173)

Comments:

- Overall open interest on the CALL options with the expiration date November, 7 is 71395 contracts, with the maximum number of contracts with strike pric $1,2900 (6968);

- Overall open interest on the PUT options with the expiration date November, 7 is 68618 contracts, with the maximum number of contracts with strike price $1,2400 (8165);

- The ratio of PUT/CALL was 0.96 versus 0.98 from the previous trading day according to data from November, 6

GBP/USD

Resistance levels (open interest**, contracts)

$1.6100 (1620)

$1.6001 (606)

$1.5902 (506)

Price at time of writing this review: $1.5830

Support levels (open interest**, contracts):

$1.5797 (1815)

$1.5699 (1481)

$1.5600 (1086)

Comments:

- Overall open interest on the CALL options with the expiration date November, 7 is 30066 contracts, with the maximum number of contracts with strike price $1,6200 (2849);

- Overall open interest on the PUT options with the expiration date November, 7 is 36545 contracts, with the maximum number of contracts with strike price $1,5900 (4447);

- The ratio of PUT/CALL was 1.22 versus 1.19 from the previous trading day according to data from November, 6

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.