- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

(pare/closed(GMT +2)/change, %)

EUR/USD $1,2316 +0,22%

GBP/USD $1,5651 +0,51%

USD/CHF Chf0,9759 -0,29%

USD/JPY Y120,68 -0,62%

EUR/JPY Y148,59 -0,42%

GBP/JPY Y188,87 -0,11%

AUD/USD $0,8281 -0,52%

NZD/USD $0,7650 -0,77%

USD/CAD C$1,1477 +0,41%

(time / country / index / period / previous value / forecast)

00:01 United Kingdom BRC Retail Sales Monitor y/y November 0.0%

00:30 Australia National Australia Bank's Business Confidence November 4

06:00 Japan Prelim Machine Tool Orders, y/y November +30.8% Revised From +31.2%

06:45 Switzerland Unemployment Rate November 3.2% 3.2%

07:00 Germany Current Account October 22.3

07:00 Germany Trade Balance October 18.5 18.1

07:45 France Trade Balance, bln October -4.7 -4.5

09:30 United Kingdom Industrial Production (MoM) October +0.6% +0.3%

09:30 United Kingdom Industrial Production (YoY) October +1.5% +1.8%

09:30 United Kingdom Manufacturing Production (MoM) October +0.4% +0.2%

09:30 United Kingdom Manufacturing Production (YoY) October +2.9% +3.2%

10:00 Eurozone ECOFIN Meetings

15:00 United Kingdom NIESR GDP Estimate November +0.7%

15:00 U.S. Wholesale Inventories October +0.3% +0.1%

15:00 U.S. JOLTs Job Openings October 4735 4820

21:30 U.S. API Crude Oil Inventories December -6.5

23:30 Australia Westpac Consumer Confidence December +1.9%

23:50 Japan BSI Manufacturing Index Quarter IV 12.7 13.1

The U.S. dollar traded mixed against the most major currencies. The greenback remained supported by Friday's U.S. labour market data. The U.S. economy added 321,000 jobs in November, exceeding expectations for a rise of 225,000 jobs, after a gain of 243,000 jobs in October. October's figure was revised up from a rise of 214,000 jobs.

The U.S. unemployment rate remained unchanged at 5.8% in November, in line with expectations.

The U.S. currency was also supported by weak Chinese trade data. China's imports dropped 6.7% in November, after a 4.6% rise in October. Exports climbed 4.7% in November, after 11.6% gain in October.

There were released no major economic reports in the U.S. today.

The euro traded higher against the U.S. dollar. The Sentix investor confidence index for the Eurozone increased to -2.5 in December from -11.9 in November. Analysts had expected the index to climb to -9.9.

German industrial production rose 0.2% in October, in line with expectations, after a 1.1% gain in September. September's figure was revised down from a 1.4% increase.

The British pound traded mixed against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded lower against the U.S. dollar after the weaker-than-expected Canadian housing market data. Building permits in Canada rose 0.7% in October, missing expectations for a 2.1% gain, after a 12.5% rise in September. September's figure was revised down from a 12.7% increase.

Housing starts in Canada increased to a seasonally adjusted annualized rate of 195,620 units in November from a revised reading of 183,659 units in October. Analysts had expected an increase to 201,000 units.

The Swiss franc increased against the U.S. dollar. Switzerland's consumer price index was flat in November, in line with expectations.

On a yearly basis, Switzerland's consumer price index declined 0.1% in November, missing expectations for a flat reading, after the flat reading in October.

Retail sales in Switzerland increased at an annual rate of 0.3% in October, missing expectations for a 0.9% rise, after a 0.5% gain in September. September's figure was revised up from a 0.3% increase.

The New Zealand dollar traded higher against the U.S. dollar in the absence of any major economic reports from New Zealand. In the overnight trading session, the kiwi declined against the greenback due to stronger the U.S. currency.

The Australian dollar traded higher against the U.S. dollar. In the overnight trading session, the Aussie fell against the greenback despite the solid economic data from Australia. Job advertisements in Australia increased 0.7% in November, after a 0.2% rise in October.

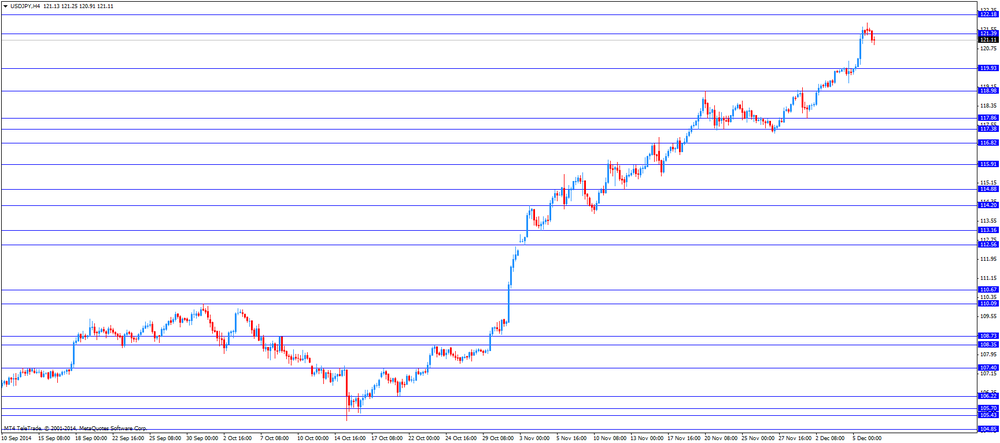

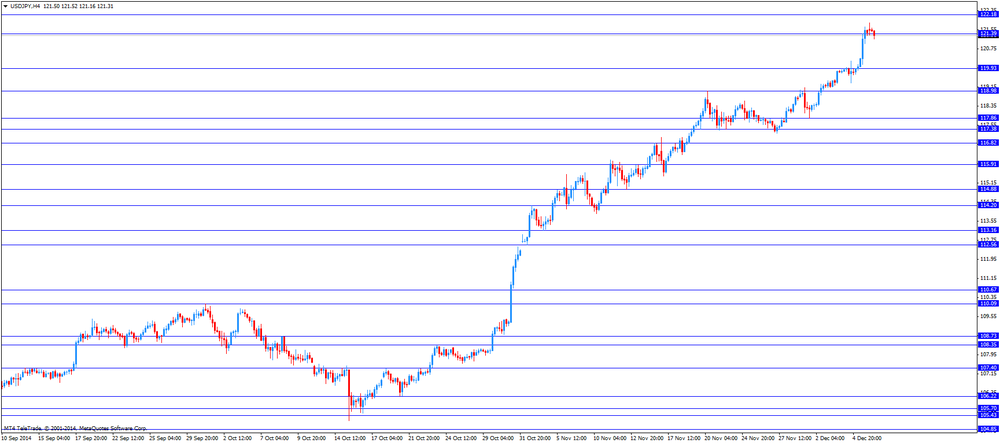

The Japanese yen traded higher against the U.S. dollar. In the overnight trading session, the yen traded mixed against the greenback after the mostly weak economic data from Japan. Japan's gross domestic product (GDP) was revised down to an annual fall of 1.9% in the third quarter from the preliminary estimate of a 1.6% decrease.

Japan's adjusted current account surplus rose to 947.0 billion yen in October from 414.4 billion yen in September.

Japan's economy watchers' current conditions index declined to 41.5 in November from 44.0 in October, missing expectations for an increase to 45.9.

Japan's economy watchers' future conditions index dropped to 44.0 in November from 46.6 in October.

The Canada Mortgage and Housing Corporation (CMHC) released housing starts data on Monday. Housing starts in Canada increased to a seasonally adjusted annualized rate of 195,620 units in November from a revised reading of 183,659 units in October.

Analysts had expected an increase to 201,000 units.

The CMHC's Chief Economist Bob Dugan that new home building is "concentrated in multiple starts, particularly in Quebec, British Columbia and Ontario".

Statistics Canada released housing market on Monday. Building permits in Canada rose 0.7% in October, missing expectations for a 2.1% gain, after a 12.5% rise in September. September's figure was revised down from a 12.7% increase.

Building permits for non-residential construction climbed 2.4% in October, while permits in the residential sector decreased 0.4%.

EUR/USD: $1.2200(E900mn), $1.2240-50(E1.0bn), $1.2300(E1.5bn), $1.2320-25(E1.1bn), $1.2350(E387mn), $1.2400-10(E3.3bn), $1.2435(E1.1bn), $1.2450(E1.88bn)

USD/JPY: Y120.00($2.4bn), Y121.50(Y2.0bn)

GBP/USD: $1.5700(stg330mn)

EUR/GBP: stg0.7805-15(E1.0bn)

EUR/CHF: Chf1.2075(E600mn)

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:01 United Kingdom BOE Quarterly Bulletin

00:30 Australia ANZ Job Advertisements (MoM) November +0.2% +0.7%

02:00 China Trade Balance, bln November 45.4 44.3 54.5

05:00 Japan Eco Watchers Survey: Current November 44.0 45.9 41.5

05:00 Japan Eco Watchers Survey: Outlook November 46.6 44.0

07:00 Germany Industrial Production s.a. (MoM) October +1.1% Revised From +1.4% +0.2% +0.2%

07:00 Germany Industrial Production (YoY) October -0.1% +0.8%

08:15 Switzerland Retail Sales Y/Y October +0.5% +0.9% +0.3%

08:15 Switzerland Consumer Price Index (MoM) November 0.0% 0.0% 0.0%

08:15 Switzerland Consumer Price Index (YoY) November 0.0% 0.0% -0.1%

09:30 Eurozone Sentix Investor Confidence December -11.9 -9.9 -2.5

10:00 Eurozone Eurogroup Meetings

The U.S. dollar traded mixed against the most major currencies. The greenback remained supported by Friday's U.S. labour market data. The U.S. economy added 321,000 jobs in November, exceeding expectations for a rise of 225,000 jobs, after a gain of 243,000 jobs in October. October's figure was revised up from a rise of 214,000 jobs.

The U.S. unemployment rate remained unchanged at 5.8% in November, in line with expectations.

The U.S. currency was also supported by weak Chinese trade data. China's imports dropped 6.7% in November, after a 4.6% rise in October. Exports climbed 4.7% in November, after 11.6% gain in October.

There will be released no major economic reports in the U.S. today.

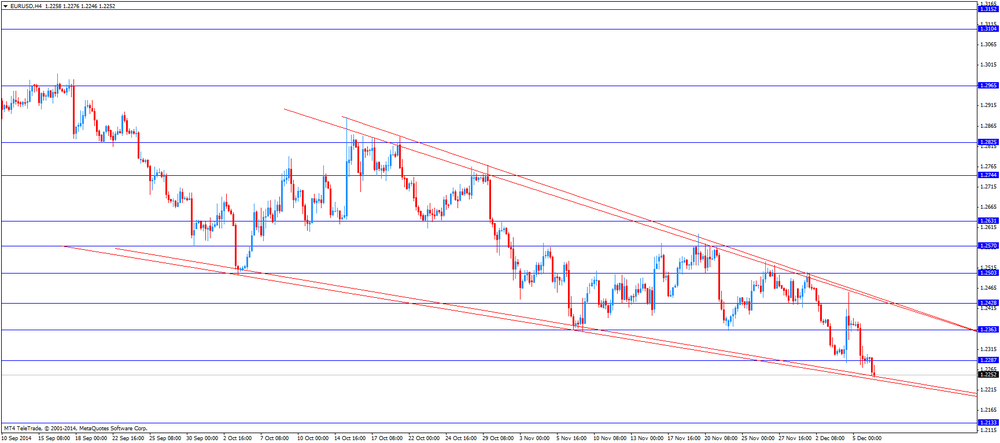

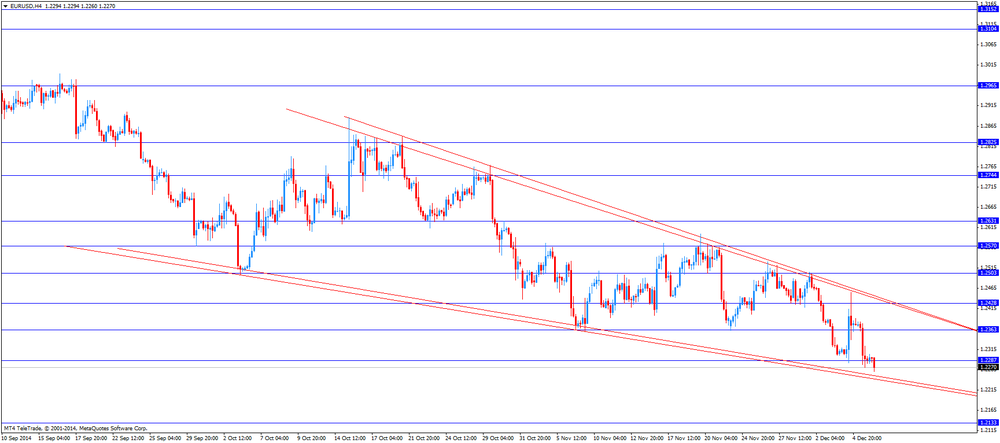

The euro traded lower against the U.S. dollar. The Sentix investor confidence index for the Eurozone increased to -2.5 in December from -11.9 in November. Analysts had expected the index to climb to -9.9.

German industrial production rose 0.2% in October, in line with expectations, after a 1.1% gain in September. September's figure was revised down from a 1.4% increase.

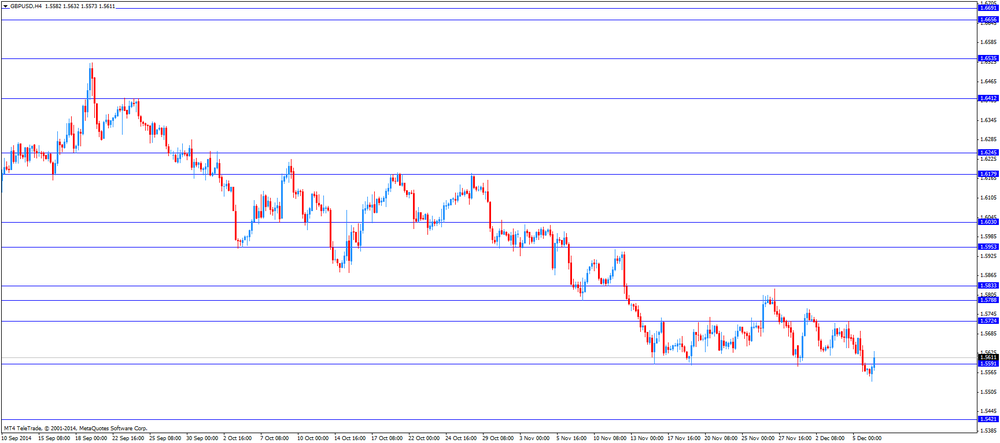

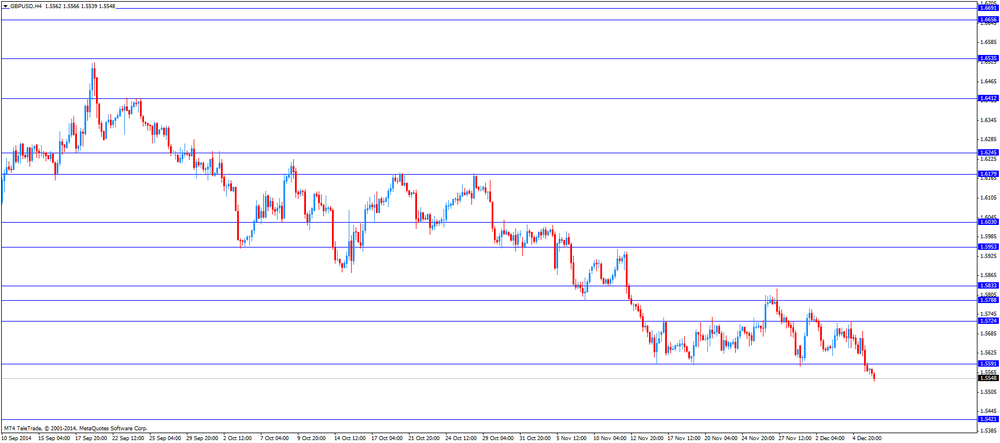

The British pound rose against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded mixed against the U.S. dollar ahead of the Canadian housing market data. Housing starts in Canada are expected to rise by 201,000 units in November, after 184,000 units in October.

Building permits in Canada are expected to climb 2.1% in October, after a 12.7% increase in September.

The Swiss franc traded lower against the U.S. dollar. Switzerland's consumer price index was flat in November, in line with expectations.

On a yearly basis, Switzerland's consumer price index declined 0.1% in November, missing expectations for a flat reading, after the flat reading in October.

Retail sales in Switzerland increased at an annual rate of 0.3% in October, missing expectations for a 0.9% rise, after a 0.5% gain in September. September's figure was revised up from a 0.3% increase.

EUR/USD: the currency pair fell to $1.2246

GBP/USD: the currency pair rose to $1.5632

USD/JPY: the currency pair decreased to Y120.91

The most important news that are expected (GMT0):

13:15 Canada Housing Starts November 184 201

13:30 Canada Building Permits (MoM) October +12.7% +2.1%

EUR/USD

Offers $1.2450, $1.2410/20, $1.2400, $1.2350/45, $1.2300

Bids $1.2250, $1.2200

GBP/USD

Offers $1.5780/00, $1.5750, $1.5720, $1.5650

Bids $1.5550/40, $1.5520, $1.5500

AUD/USD

Offers $0.8540/50, $0.8500, $0.8450, $0.8400, $0.8355

Bids $0.8260/50, $0.8200

EUR/JPY

Offers Y150.50, Y150.00, Y149.80

Bids Y148.00, Y147.55/50

USD/JPY

Offers Y122.00, Y121.80

Bids Y120.00, Y119.50, Y119.00, Y118.50

EUR/GBP

Offers stg0.8020, stg0.8000, stg0.7980, stg0.7950, stg0.7920

Bids stg0.7830/20, stg0.7800

Bloomberg

Dollar Gauge at Five-Year High as Kiwi, Aussie Decline on China

A gauge of the dollar headed for its highest close in more than five years after China said imports unexpectedly fell in November, underpinning demand for the currency of the U.S. where growth is beating forecasts.

Reuters

Bank on 'Super Mario' to give Europe a monetary jolt

(Reuters) - From his office on the 41st floor of the gleaming new European Central Bank headquarters, Mario Draghi's view stretches far beyond Frankfurt's high-rise financial centre and he doesn't like what he sees.

The darkening outlook for the euro zone's flat and nearly inflation-less economy, exacerbated by tumbling oil prices, is driving him inexorably towards radical action.

Source:

Reuters

China faces more pressure as November imports shrink unexpectedly, exports slow

(Reuters) - China's imports shrank unexpectedly in November while export growth slowed, fuelling concerns the world's second-largest economy could be facing a sharper slowdown and adding pressure on policymakers to ramp up stimulus measures.

Source: http://uk.reuters.com/article/2014/12/08/uk-china-economy-trade-idUKKBN0JM04O20141208

EUR/USD: $1.2200(E900mn), $1.2240-50(E1.0bn), $1.2300(E1.5bn), $1.2320-25(E1.1bn), $1.2350(E387mn), $1.2400-10(E3.3bn), $1.2435(E1.1bn), $1.2450(E1.88bn)

USD/JPY: Y120.00($2.4bn), Y121.50(Y2.0bn)

GBP/USD: $1.5700(stg330mn)

EUR/GBP: stg0.7805-15(E1.0bn)

EUR/CHF: Chf1.2075(E600mn)

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:01 United Kingdom BOE Quarterly Bulletin

00:30 Australia ANZ Job Advertisements (MoM) November +0.2% +0.7%

02:00 China Trade Balance, bln November 45.4 44.3 54.5

05:00 Japan Eco Watchers Survey: Current November 44.0 45.9 41.5

05:00 Japan Eco Watchers Survey: Outlook November 46.6 44.0

07:00 Germany Industrial Production s.a. (MoM) October +1.1% Revised From +1.4% +0.2% +0.2%

07:00 Germany Industrial Production (YoY) October -0.1% +0.8%

08:15 Switzerland Retail Sales Y/Y October +0.5% +0.9% +0.3%

08:15 Switzerland Consumer Price Index (MoM) November 0.0% 0.0% 0.0%

08:15 Switzerland Consumer Price Index (YoY) November 0.0% 0.0% -0.1%

09:30 Eurozone Sentix Investor Confidence December -11.9 -9.9 -2.5

The U.S. dollar traded mixed to higher against the most major currencies. The greenback was supported by Friday's U.S. labour market data. The U.S. economy added 321,000 jobs in November, exceeding expectations for a rise of 225,000 jobs, after a gain of 243,000 jobs in October. October's figure was revised up from a rise of 214,000 jobs.

The U.S. unemployment rate remained unchanged at 5.8% in November, in line with expectations.

The U.S. currency was also supported by weak Chinese trade data. China's imports dropped 6.7% in November, after a 4.6% rise in October. Exports climbed 4.7% in November, after 11.6% gain in October.

The New Zealand dollar declined against the U.S. dollar due to stronger the U.S. currency. No major market reports were released in New Zealand.

The Australian dollar fell against the U.S. dollar despite the solid economic data from Australia. Job advertisements in Australia increased 0.7% in November, after a 0.2% rise in October.

The Japanese yen traded mixed against the U.S. dollar after the mostly weak economic data from Japan. Japan's gross domestic product (GDP) was revised down to an annual fall of 1.9% in the third quarter from the preliminary estimate of a 1.6% decrease.

Japan's adjusted current account surplus rose to 947.0 billion yen in October from 414.4 billion yen in September.

Japan's economy watchers' current conditions index declined to 41.5 in November from 44.0 in October, missing expectations for an increase to 45.9.

Japan's economy watchers' future conditions index dropped to 44.0 in November from 46.6 in October.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair fell to $1.5554

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

10:00 Eurozone Eurogroup Meetings

13:15 Canada Housing Starts November 184 201

13:30 Canada Building Permits (MoM) October +12.7% +2.1%

EUR / USD

Resistance levels (open interest**, contracts)

$1.2447 (1635)

$1.2400 (129)

$1.2353 (87)

Price at time of writing this review: $ 1.2290

Support levels (open interest**, contracts):

$1.2254 (1418)

$1.2221 (2231)

$1.2200 (2639)

Comments:

- Overall open interest on the CALL options with the expiration date January, 9 is 39107 contracts, with the maximum number of contracts with strike price $1,2500 (5301);

- Overall open interest on the PUT options with the expiration date January, 9 is 47052 contracts, with the maximum number of contracts with strike price $1,2000 (7143);

- The ratio of PUT/CALL was 1.20 versus 0.92 from the previous trading day according to data from December, 5

GBP/USD

Resistance levels (open interest**, contracts)

$1.5804 (967)

$1.5707 (1211)

$1.5611 (275)

Price at time of writing this review: $1.5563

Support levels (open interest**, contracts):

$1.5490 (660)

$1.5393 (819)

$1.5296 (1134)

Comments:

- Overall open interest on the CALL options with the expiration date January, 9 is 12379 contracts, with the maximum number of contracts with strike price $1,5700 (1211);

- Overall open interest on the PUT options with the expiration date January, 9 is 13433 contracts, with the maximum number of contracts with strike price $1,5200 (1497);

- The ratio of PUT/CALL was 1.09 versus 0.94 from the previous trading day according to data from December, 5

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.