- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

The S&P 500 and the Nasdaq Composite have slowly trimmed some of their losses, but both are still stuck in negative territory. Meanwhile, the Dow is trying to reclaim lost gains. Strength among blue chips remains modest, though.

Although the Dow's gain has been limited all day, it has steadily outperformed its counterparts. Most of its relative strength stems from buying interest in Travelers (TRV 60.52, +0.94) and Kraft (KFT 32.04, +0.37), both of which are up more than 1%.

EUR/JPY continues to respect bids ahead of Y122.00 but weighing heavily on those as euro remains with a weak tone. Risk may be for tight stops below.

EUR/USD trades around $1.4435 as USD/JPY scores a slight bounce to Y84.68 after seeing lows at Y84.51. Bids remain $1.4415/20, stops possible below.

The yen gained Monday, rising from an 11-month low against the euro, after an aftershock of Japan’s March 11 earthquake discouraged demand for higher-yielding assets.

The dollar remained lower versus the yen as Federal Reserve Vice Chairman Janet Yellen said the gain in food and fuel costs doesn’t warrant a reversal of monetary stimulus.

The euro fell against the dollar on speculation the European Central Bank’s recent interest-rate increase may make it harder for nations including Ireland and Portugal to contain debt.

The euro has gained 8% against the dollar since the start of this year as improving economic growth in Germany and accelerating inflation boosted speculation that interest rates would be lifted.

European Central Bank President Jean-Claude Trichet and colleagues raised the main refinancing rate last week to 1.25% from a record low 1%, where it had been since 2009, and left the door open for further rate increases.

Portugal will start negotiations with the European Union and the International Monetary Fund this week on a rescue package estimated at 80 billion euros ($115 billion.)

The Dollar Index dropped 0.2% to 74.940 after falling on April 8 to as low as 74.838, the least since December 2009.

U.S. congressional leaders and President Barack Obama averted a government shutdown by reaching an agreement on April 8, less than two hours before the government’s funding authority was due to expire.

Increased selling pressure recently took the broad market to a fresh session low, which actually came with a slight loss. It has since worked its way back above the flat line.

Materials stocks are falling more sharply out of favor. The sector was already one of the worst performers this past Friday, but today the sector is down another 0.5%. The sector's weakness comes even though both Monsanto (MON 67.20, +0.98) and BHP Billiton (BHP 10320, +1.88) are boasting impressive gains in response to a couple of analyst upgrades.

Recent selling pressure knocked the Nasdaq into the red, but it has recovered since than. It remains well below its opening level, though. As for the Dow and S&P 500, both were pressured, but neither suffered any kind of an actual loss. Their gains remain modest.

EUR/GBP recovered off lows at stg0.8790 to the figure. Resistance remains at stg0.8825 (stg0.88265 38.2% stg0.88600/065. If rate can hold below stg0.8830 seen keeping attention focused on the downside with next support noted between stg0.8800/0.8795.

USD/CAD holds C$0.9565 area in thin market, about the middle of a tight C$0.9555/75 range seen since the start of the local session. Pair still seen as a sell on rallies. Offers around C$0.9600. Bids back at C$0.9520 area.

EUR/JPY 118.75

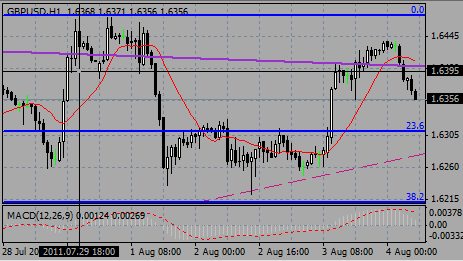

GBP/USD $1.6050

EUR/CHF Chf1.3250

Hang Seng -0.38% 24,303.07

Shanghai Composite -0.24% 3022.75

Nikkei -0.50% 9719.70

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.