- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

The U.S. dollar traded mixed against the most major currencies in quiet trade. No major economic reports will be released in the U.S. on Monday. Markets participants are awaiting the congressional testimony by Federal Reserve Chair Janet Yellen on Tuesday and Wednesday. They expect to hear new information on when the Fed could start to increase its interest rate.

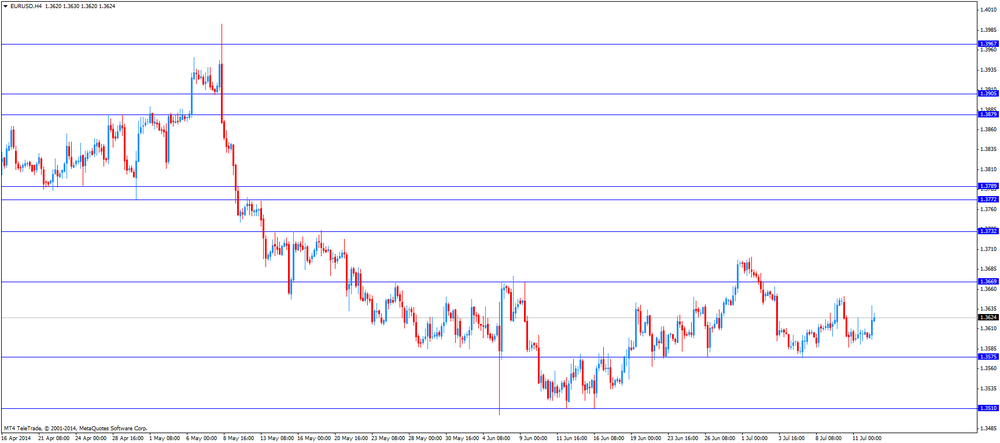

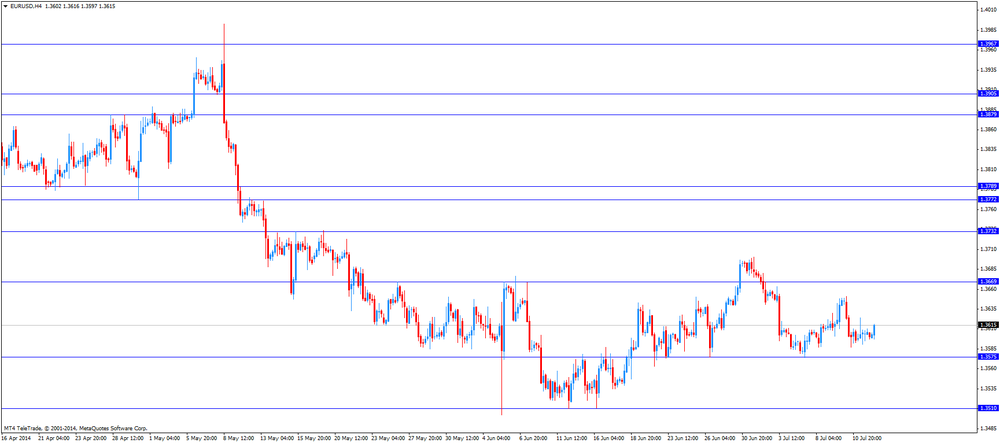

The euro traded higher against the U.S. dollar ahead of testimony by European Central Bank President Mario Draghi later in the day. The euro strengthened after Portugal's central bank eased market fears over the financial health of Banco Espirito Santo.

Eurozone's industrial production declined 3.3% in May, missing expectations for a 0.3% gain, after a 0.7% increase in April. April's figure was revised down from a 0.8 gain.

On a yearly basis, Eurozone's industrial production climbed 0.5% in May, missing expectations for a 1.1% rise, after a 1.4% gain in April.

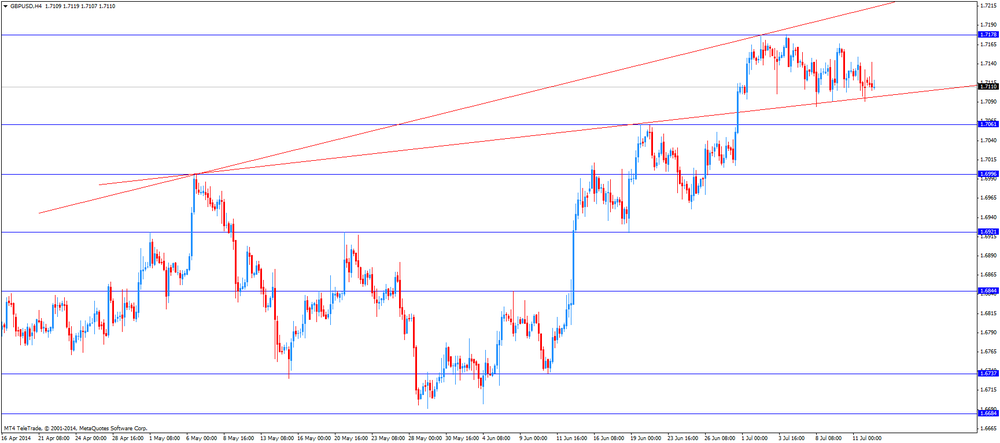

The British pound traded lower against the U.S. dollar in the absence of any major economic reports in the UK.

The Canadian dollar traded higher against the U.S. dollar, recovering a part of Friday's losses. The Canadian currency dropped on Friday due to the weaker-than-expected Canadian labour market data. Canadian unemployment rate climbed to a seasonally adjusted 7.1% in June from 7.0% in May. The Canadian economy unexpectedly lost 9,400 jobs last month.

The New Zealand dollar traded slightly lower against the U.S dollar. The REINZ housing price index declined 0.3% in June, after a 1.2% decrease in May.

The Australian dollar traded mixed against the U.S. dollar in the absence of any major economic reports in Australia.

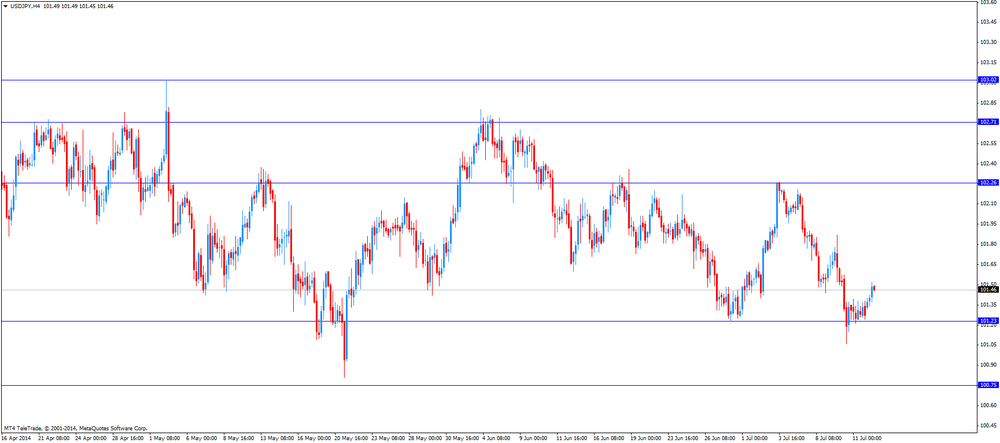

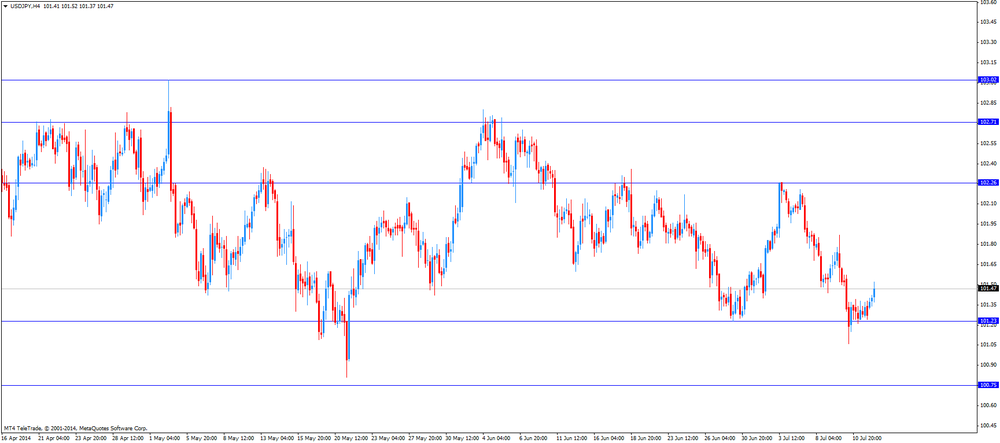

The Japanese yen declined against the U.S. dollar due to decreasing demand for safe-haven yen after Portugal's central bank eased market fears over the financial health of Banco Espirito Santo.

Japan's industrial production rose 1.0% in May, after a 0.8% increase in April. Analysts had expected a 0.5% increase.

On a yearly basis, Japan's industrial production climbed 0.7% in May, after a 0.5% rise in April.

EUR/USD $1.3500, $1.3550, $1.3600, $1.3650

USD/JPY Y101.00, Y101.60, Y102.00

GBP/USD $1.6925

USD/CHF Chf0.8850, Chf0.8890

AUD/USD $0.9400

NZD/USD $0.8650

USD/CAD C$1.0615, C$1.0700

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

04:30 Japan Industrial Production (YoY) (Finally) May +0.8% +0.8% +1.0%

04:30 Japan Industrial Production (MoM) (Finally) May +0.5% +0.5% +0.7%

06:00 France Bank holiday

09:00 Eurozone Industrial production, (MoM) May +0.7% +0.3% -1.1%

09:00 Eurozone Industrial Production (YoY) May +1.4% +1.1% +0.5%

The U.S. dollar traded mixed against the most major currencies in quiet trade. No major economic reports will be released in the U.S. on Monday. Markets participants are awaiting the congressional testimony by Federal Reserve Chair Janet Yellen on Tuesday and Wednesday. They expect to hear new information on when the Fed could start to increase its interest rate.

The euro rose against the U.S. dollar ahead of testimony by European Central Bank President Mario Draghi later in the day. The euro strengthened after Portugal's central bank eased market fears over the financial health of Banco Espirito Santo.

Eurozone's industrial production declined 3.3% in May, missing expectations for a 0.3% gain, after a 0.7% increase in April. April's figure was revised down from a 0.8 gain.

On a yearly basis, Eurozone's industrial production climbed 0.5% in May, missing expectations for a 1.1% rise, after a 1.4% gain in April.

The British pound traded mixed against the U.S. dollar in the absence of any major economic reports in the UK.

EUR/USD: the currency increased to $1.3639

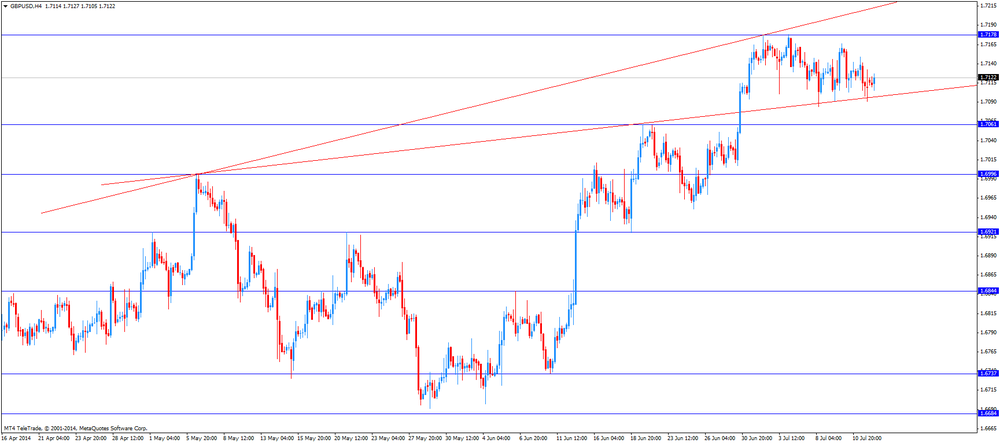

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair was up to Y101.52

The most important news that are expected (GMT0):

17:30 Eurozone ECB President Mario Draghi Speaks

23:01 United Kingdom BRC Retail Sales Monitor y/y June +0.5%

EUR/USD

Offers $1.3700-20, $1.3680/85

Bids $1.3589-88, $1.3576, $1.3570/60, $1.3550/40

GBP/USD

Offers $1.7200, $1.7180

Bids $1.7040/30

AUD/USD

Offers $0.9480, $0.9450

Bids $0.9350, $0.9320, $0.9300

EUR/JPY

Offers Y139.50, Y139.00, Y138.50

Bids Y138.00, Y137.50, Y137.20, Y137.00, Y136.80/70

USD/JPY

Offers Y102.00, Y101.80, Y101.60

Bids Y101.20, Y101.00, Y100.80, Y100.50

EUR/GBP

Offers stg0.8000, stg0.7980

Bids stg0.7905-890

EUR/USD $1.3500, $1.3550, $1.3600, $1.3650

USD/JPY Y101.00, Y101.60, Y102.00

GBP/USD $1.6925

USD/CHF Chf0.8850, Chf0.8890

AUD/USD $0.9400

NZD/USD $0.8650

USD/CAD C$1.0615, C$1.0700

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

04:30 Japan Industrial Production (YoY) (Finally) May +0.8% +0.8% +1.0%

04:30 Japan Industrial Production (MoM) (Finally) May +0.5% +0.5% +0.7%

06:00 France Bank holiday

The U.S. dollar traded mixed against the most major currencies ahead of congressional testimony by Federal Reserve Chair Janet Yellen on Tuesday and Wednesday. Markets participants are awaiting new information on when the Fed could start to increase its interest rate.

The New Zealand dollar traded mixed near 3-year highs against the U.S dollar. The REINZ housing price index declined 0.3% in June, after a 1.2% decrease in May.

The Australian dollar traded mixed against the U.S. dollar in the absence of any major economic reports in Australia.

The Japanese yen traded slightly lower against the U.S. dollar due to decreasing demand for safe-haven yen after Portugal's central bank eased market fears over the financial health of Banco Espirito Santo.

Japan's industrial production rose 1.0% in May, after a 0.8% increase in April. Analysts had expected a 0.5% increase.

On a yearly basis, Japan's industrial production climbed 0.7% in May, after a 0.5% rise in April.

EUR/USD: the currency pair

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair

The most important news that are expected (GMT0):

09:00 Eurozone Industrial production, (MoM) May +0.8% +0.3%

09:00 Eurozone Industrial Production (YoY) May +1.4% +1.1%

17:30 Eurozone ECB President Mario Draghi Speaks

23:01 United Kingdom BRC Retail Sales Monitor y/y June +0.5%

EUR / USD

Resistance levels (open interest**, contracts)

$1.3674 (2712)

$1.3655 (635)

$1.3632 (77)

Price at time of writing this review: $ 1.3604

Support levels (open interest**, contracts):

$1.3581 (370)

$1.3563 (1927)

$1.3538 (3261)

Comments:

- Overall open interest on the CALL options with the expiration date August, 8 is 23686 contracts, with the maximum number of contracts with strike price $1,3800 (3718);

- Overall open interest on the PUT options with the expiration date August, 8 is 32266 contracts, with the maximum number of contracts with strike price $1,3500 (7635);

- The ratio of PUT/CALL was 1.36 versus 1.36 from the previous trading day according to data from July, 11

GBP/USD

Resistance levels (open interest**, contracts)

$1.7401 (1025)

$1.7303 (1460)

$1.7205 (1384)

Price at time of writing this review: $1.7115

Support levels (open interest**, contracts):

$1.6995 (2094)

$1.6897 (1895)

$1.6799 (989)

Comments:

- Overall open interest on the CALL options with the expiration date August, 8 is 15876 contracts, with the maximum number of contracts with strike price $1,7250 (2204);

- Overall open interest on the PUT options with the expiration date August, 8 is 20206 contracts, with the maximum number of contracts with strike price $1,7000 (2094);

- The ratio of PUT/CALL was 1.27 versus 1.28 from the previous trading day according to data from Jule, 11

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

(pare/closed(GMT +2)/change, %)

EUR/USD $1,3606 0,00%

GBP/USD $1,7109 -0,13%

USD/CHF Chf0,8920 -0,04%

USD/JPY Y101,27 -0,04%

EUR/JPY Y 137,77 -0,06%

GBP/JPY Y173,19 -0,21%

AUD/USD $0,9390 0,00%

NZD/USD $0,8812 -0,03%

USD/CAD C$1,0732 +0,75%

(time / country / index / period / previous value / forecast)

01:50 New Zealand REINZ Housing Price Index, m/m June -1.2%

07:30 Japan Industrial Production (YoY) May +0.8% +0.8%

07:30 Japan Industrial Production (MoM) May +0.5% +0.5%

09:00 France Bank holiday

12:00 Eurozone Industrial production, (MoM) May +0.8% +0.3%

12:00 Eurozone Industrial Production (YoY) May +1.4% +1.1%

20:00 Eurozone ECB President Mario Draghi Speaks

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.