- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

The European Central Bank Executive Board member Benoit Coeure said on Friday in a newspaper interview that the bond-buying programme must be big to be efficient.

He also said that the European Central Bank (ECB) is studying the experiences of the U.S. and Britain with quantitative easing to decide what volume of bond-buying programme it may have.

The U.S. dollar traded mixed against the most major currencies after the U.S. better-than-expected Thomson Reuters/University of Michigan preliminary consumer sentiment index. The Thomson Reuters/University of Michigan preliminary consumer sentiment index rose to 98.2 in January from a final reading of 93.6 in December, exceeding expectations for an increase to 94.2. That was the highest level since January 2004.

The increase was driven by falling gasoline prices and a strengthening labour market.

The U.S. consumer price inflation fell 0.4% in December, missing expectations for a 0.3% decrease, after a 0.3% decline in November. That was largest decline since December 2008.

The declines was driven by lower gasoline prices.

On a yearly basis, the U.S. consumer price index fell to 0.8% in December from 1.3% in November, missing forecasts of a decline to 1.0%.

The U.S. consumer price inflation excluding food and energy was flat in December, missing expectations for a 0.1% gain, after a 0.1% rise in November.

On a yearly basis, the U.S. consumer price index excluding food and energy decreased to 1.6% in December from a 1.7% gain in November. Analysts had expected consumer inflation to remain unchanged at 1.7%.

The U.S. industrial production decreased 0.1% in December, missing expectations for a 0.1% rise, after a 1.3% gain in November.

The decline was driven by lower output of utilities.

Capacity utilisation rate declined to 79.7% in December from 80.0% in November. November's figure was revised up from 80.1%. Analysts had expected a capacity utilisation rate of 80.2%.

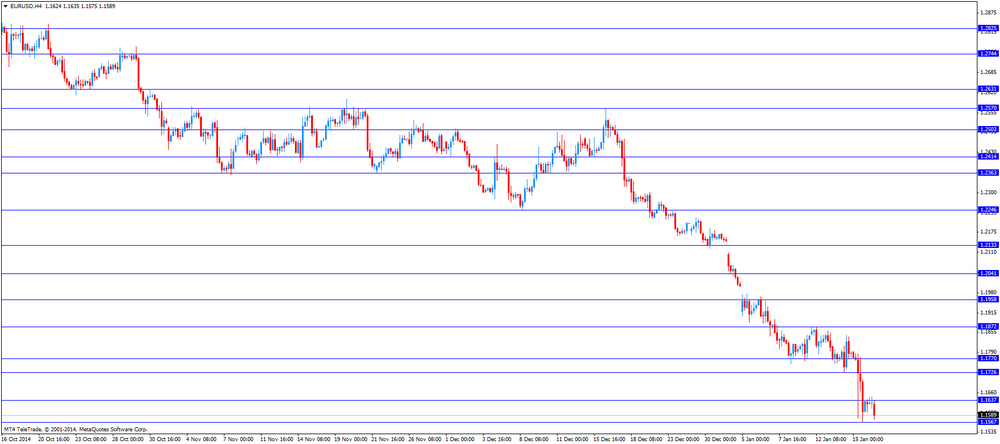

The euro traded lower against the U.S. dollar. Eurozone's consumer price index dropped 0.1% in December, beating expectations for a 0.2% decline, after a 0.2% decrease in November.

On a yearly basis, Eurozone's consumer price inflation remained unchanged at 0.2% in December, in line with expectations.

Eurozone's consumer price inflation excluding food, energy, alcohol and tobacco declined to an annual rate of 0.7% in December from 0.8% in November. Analysts had expected inflation to remain unchanged.

Germany's final consumer price index was flat in December, in line with expectations.

On a yearly basis, German final consumer price index remained at 0.2% in December, in line with expectations.

The British pound fell against the U.S. dollar in the absence of any major economic reports from the U.K.

The Swiss franc traded higher against the U.S. dollar. Retail sales in Switzerland decreased at an annual rate of 1.2% in November, missing expectations for a 1.1% rise, after a 0.3% gain in October.

The Swiss Franc plunged against the greenback yesterday as the Swiss National Bank announced today that it will discontinue the 1.20 per euro exchange rate floor. But the SNB added that will remain active in the foreign exchange market.

The New Zealand dollar traded lower against the U.S. dollar in the absence of any major economic reports from New Zealand. In the overnight trading session, the kiwi traded higher against the greenback.

The Australian dollar traded lower against the U.S. dollar in the absence of any major economic reports from Australia. In the overnight trading session, the Aussie rose against the greenback.

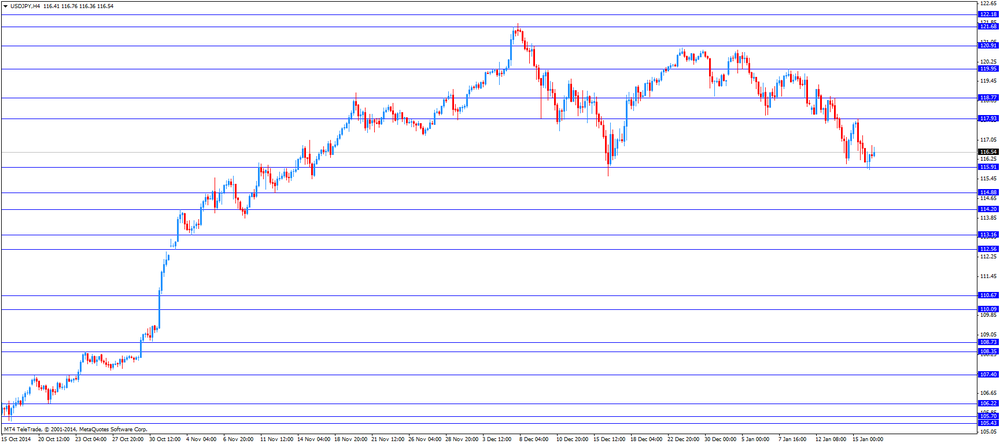

The Japanese yen traded lower against the U.S. dollar in the absence of any major economic reports from Japan.

The Thomson Reuters/University of Michigan preliminary consumer sentiment index rose to 98.2 in January from a final reading of 93.6 in December, exceeding expectations for an increase to 94.2. That was the highest level since January 2004.

The increase was driven by falling gasoline prices and a strengthening labour market.

A gauge of consumers' current expectations climbed to 108.3 in January from 104.8 in December.

The Federal Reserve released its industrial production report on Friday. The U.S. industrial production decreased 0.1% in December, missing expectations for a 0.1% rise, after a 1.3% gain in November.

The decline was driven by lower output of utilities. The output of utilities dropped 7.3% in December "as warmer-than-usual temperatures reduced demand for heating".

Capacity utilisation rate declined to 79.7% in December from 80.0% in November. November's figure was revised up from 80.1%.

Analysts had expected a capacity utilisation rate of 80.2%.

The U.S. Labor Department released consumer price inflation data on Friday. The U.S. consumer price inflation fell 0.4% in December, missing expectations for a 0.3% decrease, after a 0.3% decline in November. That was largest decline since December 2008.

The declines was driven by lower gasoline prices.

On a yearly basis, the U.S. consumer price index fell to 0.8% in December from 1.3% in November, missing forecasts of a decline to 1.0%.

The U.S. consumer price inflation excluding food and energy was flat in December, missing expectations for a 0.1% gain, after a 0.1% rise in November.

On a yearly basis, the U.S. consumer price index excluding food and energy decreased to 1.6% in December from a 1.7% gain in November. Analysts had expected consumer inflation to remain unchanged at 1.7%.

Energy costs dropped 4.7% in December, the largest drop in six years.

Gasoline prices declined 9.4% in December, while food prices rose 0.3%, the largest rise since September 2014.

EUR/USD: $1.1700(E1.0bn), $1.1725(E417mn), $1.1750(E2.6bn), $1.1800(E809mn), $1.1850(E350mn), $1.1900(E470mn), $1.1890-1.1910(E2.3bn)

USD/JPY: Y114.00($1.65bn), Y116.00($1.6bn), Y116.50($576mn), Y117.00($848mn), Y117.65-75($600mn), Y118.00($560mn), Y118.25($630mn), Y119.00($582mn), Y119.50($1.0bn)

GBP/USD: $1.5100(stg418mn), $1.5300(stg530mn)

AUD/USD: $0.7950(A$1.0bn), $0.8125(A$221mn), $0.8150(A$422mn), $0.8165(A$282mn), $0.8205(A$1.57bn)

NZD/USD: $0.7800(NZ$766mn)

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

07:00 Germany CPI, m/m (Finally) December 0.0% 0.0% 0.0%

07:00 Germany CPI, y/y (Finally) December +0.2% +0.2% +0.2%

08:15 Switzerland Retail Sales Y/Y November +0.3% +1.1% -1.2%

10:00 Eurozone Harmonized CPI (Finally) December -0.2% -0.2% -0.1%

10:00 Eurozone Harmonized CPI, Y/Y (Finally) December -0.2% -0.2% -0.2%

10:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Finally) December +0.8% +0.8% +0.7%

The U.S. dollar traded mixed to higher against the most major currencies ahead of the U.S. economic data. The U.S. consumer price inflation is expected to decline 0.3% in December, after a 0.3% drop in November.

The U.S. consumer price index excluding food and energy is expected to rise 0.1% in December, after a 0.1% gain in November.

The U.S. industrial production is expected to rise 0.1% in December, after a 1.3% increase in November.

The euro fell against the U.S. dollar after consumer price inflation from the Eurozone. Eurozone's consumer price index dropped 0.1% in December, beating expectations for a 0.2% decline, after a 0.2% decrease in November.

On a yearly basis, Eurozone's consumer price inflation remained unchanged at 0.2% in December, in line with expectations.

Eurozone's consumer price inflation excluding food, energy, alcohol and tobacco declined to an annual rate of 0.7% in December from 0.8% in November. Analysts had expected inflation to remain unchanged.

Germany's final consumer price index was flat in December, in line with expectations.

On a yearly basis, German final consumer price index remained at 0.2% in December, in line with expectations.

The British pound traded mixed against the U.S. dollar in the absence of any major economic reports from the U.K.

The Swiss franc traded mixed against the U.S. dollar. Retail sales in Switzerland decreased at an annual rate of 1.2% in November, missing expectations for a 1.1% rise, after a 0.3% gain in October.

The Swiss Franc plunged against the greenback yesterday as the Swiss National Bank announced today that it will discontinue the 1.20 per euro exchange rate floor. But the SNB added that will remain active in the foreign exchange market.

EUR/USD: the currency pair declined to $1.1575

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair rose to $116.76

The most important news that are expected (GMT0):

13:30 U.S. CPI, m/m December -0.3% -0.3%

13:30 U.S. CPI, Y/Y December +1.3% +1.0%

13:30 U.S. CPI excluding food and energy, m/m December +0.1% +0.1%

13:30 U.S. CPI excluding food and energy, Y/Y December +1.7% +1.7%

14:15 U.S. Industrial Production (MoM) December +1.3% +0.1%

14:15 U.S. Capacity Utilization December 80.1% 80.2%

14:55 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) January 93.6 94.2

A report form Eurostat said that harmonized Consumer Price Inflation on a yearly basis remained unchanged and in line with estimates at -0.2%. Harmonized CPI ex EFAT, excluding the volatile energy and food items costs, was 0.1% below expectations at +0.7%. CPI for December was at -0.1%. Analysts expected data to show a reading of -0.2%.

EUR/USD: $1.1700(E1.0bn), $1.1725(E417mn), $1.1750(E2.6bn), $1.1800(E809mn), $1.1850(E350mn), $1.1900(E470mn), $1.1890-1.1910(E2.3bn)

USD/JPY: Y114.00($1.65bn), Y116.00($1.6bn), Y116.50($576mn), Y117.00($848mn), Y117.65-75($600mn), Y118.00($560mn), Y118.25($630mn), Y119.00($582mn), Y119.50($1.0bn)

GBP/USD: $1.5100(stg418mn), $1.5300(stg530mn)

AUD/USD: $0.7950(A$1.0bn), $0.8125(A$221mn), $0.8150(A$422mn), $0.8165(A$282mn), $0.8205(A$1.57bn)

NZD/USD: $0.7800(NZ$766mn)

REUTERS

Brent crude oil holds above $48, few analysts see quick recovery

(Reuters) - Brent crude oil futures edged higher on Friday, holding above $48 a barrel as analysts said prices were well supported around current levels, although few expect a strong rebound anytime soon as global output continues to outweigh demand.

Benchmark Brent crude futures were trading at $48.38 per barrel at 0802 GMT, up 11 cents since their last settlement. U.S. crude was trading at $46.50 a barrel, up 25 cents.

"Our forecast seems to point towards a consolidation stage in the weeks to come," Phillip Futures said in a note. "Therefore, we expect crude prices to trade range bound between $44.75-$50.69 for WTI Mar'15 and $46.4-52.89 for Brent Mar'15."

Source: http://www.reuters.com/article/2015/01/16/us-markets-oil-idUSKBN0KP06L20150116

BLOOMBERG

SNB Officials Eating Words Risk Lasting Investor Aches

Brace for $40-a-barrel oil.

Switzerland's central bank officials have just eaten their words, risking lingering indigestion in financial markets.

Just three days after SNB Vice President Jean-Pierre Danthine called the franc cap a "pillar" of monetary policy, the SNB yesterday dropped the minimum exchange rate of 1.20 per euro.

The shock abandonment of the SNB's primary policy of the past three years may now leave investors warier of taking officials' words at face value, according to economists including Karsten Junius, chief economist at Bank J. Safra Sarasin AG in Zurich. By scrapping one tool, the franc cap, SNB President Thomas Jordan risks blunting the effects of another.

BLOOMBERG

Gold Heads for Second Weekly Advance as Swiss Shock Boosts SPDR

Gold traded near a four-month high, set for a second weekly gain, on haven demand after Switzerlands's unexpected currency move. Assets in the largest exchange-traded product expanded the most since 2011.

Bullion for immediate delivery was at $1,259.29 an ounce at 3:37 p.m. in Singapore from $1,262.75 a day earlier, when prices jumped 2.8 percent for the biggest increase this year, according to Bloomberg generic pricing. The metal rallied on Jan. 15 to $1,266.85, the highest since Sept. 8, as the SNB ended the franc's cap versus the euro. Gold traded at its most expensive relative to platinum since April 2013.

Gold rose 3 percent this week, extending a 2.9 percent increase a week earlier, as the Swiss bank's move roiled currency and equity markets. That spurred demand for the bullion as a haven as investors returned to ETPs, according to Australia & New Zealand Banking Group Ltd. The SNB's decision comes a week before European Central Bank policy makers meet on Jan. 22 to discuss introducing new stimulus amid concern Greece may exit the currency bloc after a Jan. 25 election.

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

07:00 Germany CPI, m/m (Finally) December 0.0% 0.0% 0.0%

07:00 Germany CPI, y/y (Finally) December +0.2% +0.2% +0.2%

The U.S. dollar traded mixed against its major peers during the Asian session after mixed U.S. data published yesterday. Markets were highly volatile after the Swiss National Bank shocked market participants by scrapping its exchange rate cap against the single currency and cutting rates to minus 0.75%. The euro is heading for a fifth weekly decline against the greenback currently trading at USD1.1642 before ECB policy makers meet on January 22nd to decide on further stimulus.

Today investors look ahead to data on CPI, Industrial Production, Capacity Utilization and the Reuters/Michigan Consumer Sentiment Index.

The Australian dollar further strengthenedtowards a one-month in the absence of any major economic news.

New Zealand's dollar traded higher against the greenback after rising 1.4% yesterday with no major data on the cards.

The Japanese yen rose versus the greenback as investors bought the yen as safe-have asset. After the SNB news abandoning its three-year-old cap of 1.20 per euro on the franc the highly volatile markets led to risk-off trades. Japan's Tertiary industry Index for November rose by +0.2% missing expectations of n increase by +0.3% with a previous reading of -0.2% in October.

EUR/USD: the euro traded almost flat against the greenback

(time / country / index / period / previous value / forecast)

08:15 Switzerland Retail Sales Y/Y November +0.3% +1.1%

10:00 Eurozone Harmonized CPI (Finally) December -0.2% -0.2%

10:00 Eurozone Harmonized CPI, Y/Y (Finally) December -0.2% -0.2%

10:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Finally) December +0.8% +0.8%

13:30 U.S. CPI, m/m December -0.3% -0.3%

13:30 U.S. CPI, Y/Y December +1.3% +1.0%

13:30 U.S. CPI excluding food and energy, m/m December +0.1% +0.1%

13:30 U.S. CPI excluding food and energy, Y/Y December +1.7% +1.7%

14:15 U.S. Industrial Production (MoM) December +1.3% +0.1%

14:15 U.S. Capacity Utilization December 80.1% 80.2%

14:55 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) January 93.6 94.2

21:00 U.S. Net Long-term TIC Flows November -1.4 27.3

21:00 U.S. Total Net TIC Flows November 178.4

EUR / USD

Resistance levels (open interest**, contracts)

$1.1857 (613)

$1.1802 (619)

$1.1756 (103)

Price at time of writing this review: $ 1.1628

Support levels (open interest**, contracts):

$1.1549 (1650)

$1.1494 (6970)

$1.1444 (5755)

Comments:

- Overall open interest on the CALL options with the expiration date February, 6 is 53873 contracts, with the maximum number of contracts with strike price $1,2100 (4802);

- Overall open interest on the PUT options with the expiration date February, 6 is 63272 contracts, with the maximum number of contracts with strike price $1,1700 (6970);

- The ratio of PUT/CALL was 1.17 versus 1.13 from the previous trading day according to data from January, 15

GBP/USD

Resistance levels (open interest**, contracts)

$1.5404 (416)

$1.5307 (393)

$1.5212 (1001)

Price at time of writing this review: $1.5167

Support levels (open interest**, contracts):

$1.5090 (1687)

$1.4993 (1160)

$1.4895 (1506)

Comments:

- Overall open interest on the CALL options with the expiration date February, 6 is 15353 contracts, with the maximum number of contracts with strike price $1,5800 (1108);

- Overall open interest on the PUT options with the expiration date February, 6 is 17165 contracts, with the maximum number of contracts with strike price $1,5100 (1687);

- The ratio of PUT/CALL was 1.12 versus 1.12 from the previous trading day according to data from January, 15

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.