- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

The U.S. dollar mixed against the most major currencies ahead of the U.S. economic data. The greenback was supported by yesterday's better-than-expected U.S. economic data. The Philadelphia Federal Reserve Bank' manufacturing index surged to 40.8 in November from 20.7 in October. That was the highest level since December 1993.

Sales of existing homes in the U.S. climbed 1.5% to a seasonally adjusted annual rate of 5.26 million in October from 5.18 million in September. That was the highest level since September 2013.

There were released no major economic reports in the U.S. on Friday.

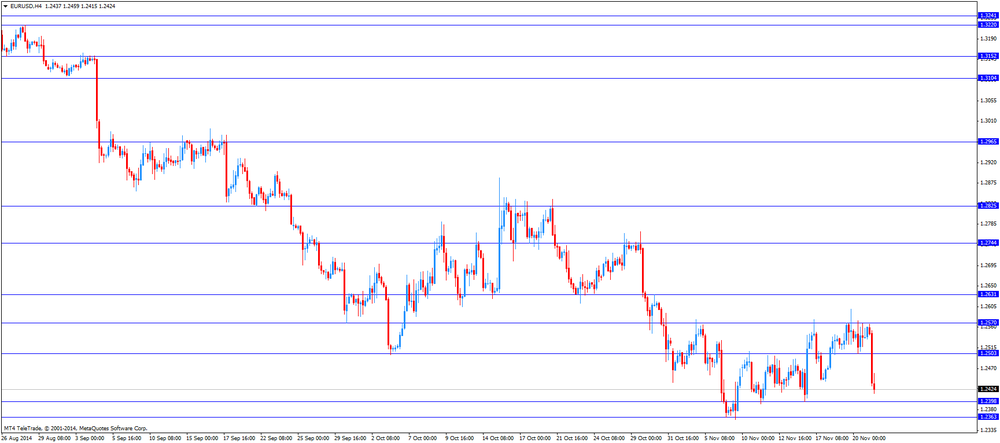

The euro traded lower against the U.S. dollar. In the morning trading session, the euro dropped against the greenback after comments by the European Central Bank (ECB) President Mario Draghi. He reiterated that the ECB is prepared to add further stimulus measures if needed. Investors speculate that the central bank is moving closer to launch the quantitative easing programme.

Draghi also said that inflation expectations were declining.

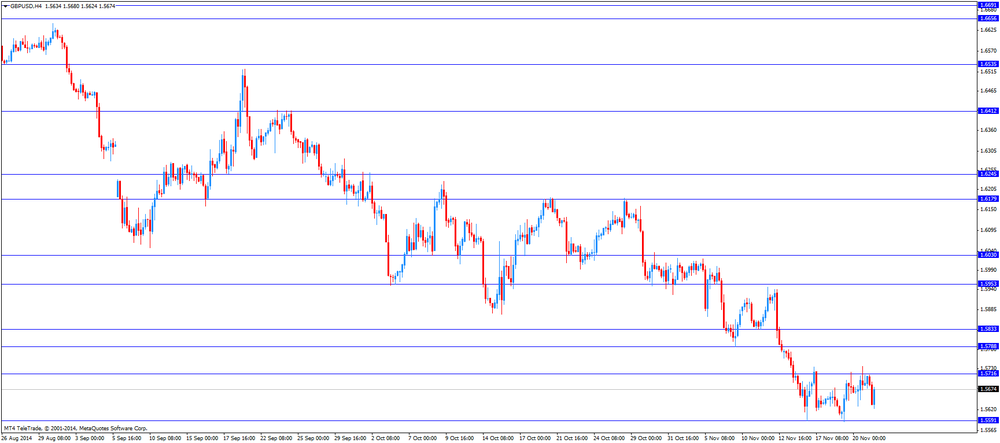

The British pound traded higher against the U.S. dollar. The public sector net borrowing in the U.K. declined to £7.1 billion in October from £10.6 billion in September, but missing expectations for a fall to £6.9 billion. September's figure was revised up from £11.1 billion

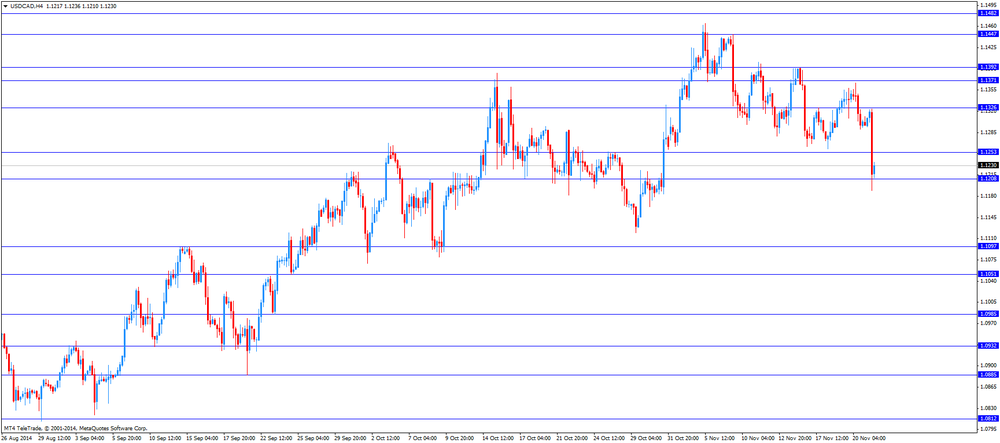

The Canadian dollar surged against the U.S. dollar after the better-than-expected Canadian consumer price inflation. Canadian consumer price inflation increased 0.1% in October, beating expectations for a 0.3% decline, after a 0.1% gain in September.

On a yearly basis, the consumer price index rose to 2.4% October from 2.0% in September. Analysts had expected the index to remain unchanged at 2.0%.

The consumer price index was driven by higher prices in all categories. Shelter and food costs rose 2.8% in October.

Canadian core consumer price index, which excludes some volatile goods, climbed 0.3% in October, exceeding expectations for a 0.2% rise, after a 0.2% increase in September.

On a yearly basis, core consumer price index in Canada climbed to 2.3% in October from 2.1% in September, beating forecasts of a rise to 2.2%.

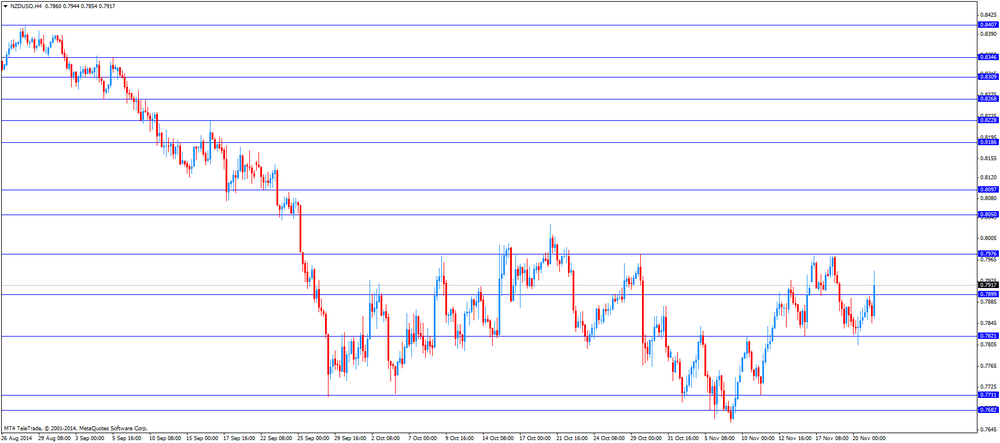

The New Zealand dollar traded higher against the U.S. dollar as the People's Bank of China lowered unexpectedly its interest rate on Friday. China's central bank cut its one year deposit rate to 2.75% from 3.0%. That was the first cut since 2012. It is a try to revive the economy.

The one-year lending rate will also be lowered from 6% to 5.6%.

The changes come into effect on Saturday.

Credit card spending in New Zealand rose 6.7% in October, after a 4.5% gain in September. September's was revised up from a 4.4% increase.

The Australian dollar climbed against the U.S. dollar as the People's Bank of China lowered unexpectedly its interest rate on Friday. There were released no major economic reports in Australia.

The Japanese yen traded mixed against the U.S. dollar. In the overnight trading session, the yen increased against the greenback as Japanese Finance Minister Taro Aso said on Friday that the yen declined too rapid over the past week. That was one of the strongest warnings against a weak yen since Japan's central bank started its stimulus measures in 2012.

Japanese Finance Minister Taro Aso said on Friday that the yen declined too rapid over the past week.

That was one of the strongest warnings against a weak yen since Japan's central bank started its stimulus measures in 2012.

Statistics Canada released consumer price inflation data today. Canadian consumer price inflation increased 0.1% in October, beating expectations for a 0.3% decline, after a 0.1% gain in September.

On a yearly basis, the consumer price index rose to 2.4% October from 2.0% in September. Analysts had expected the index to remain unchanged at 2.0%.

The consumer price index was driven by higher prices in all categories. Shelter and food costs rose 2.8% in October.

Canadian core consumer price index, which excludes some volatile goods, climbed 0.3% in October, exceeding expectations for a 0.2% rise, after a 0.2% increase in September.

On a yearly basis, core consumer price index in Canada climbed to 2.3% in October from 2.1% in September, beating forecasts of a rise to 2.2%.

The Bank of Canada's inflation target is 2.0%.

These figures are adding to speculation that the Bank of Canada won't cut its interest rates.

EUR/USD: $1.2500(E1.1bn), $1.2550(E851mn), $1.2580(E1.3bn), $1.2615/20(E716mn), $1.2650(E2.2bn)

USD/JPY: Y117.50($821mnn), Y118.25($400mn), Y118.50($710mn)

AUD/USD: $0.8600(A$230mn)

USD/CAD: Cad1.1400($310mn), Cad1.1500($921mn)

USD/CHF: Chf0.9675($1.1bn), Chf0.9700($600mn)

EUR/GBP: stg0.7825(E1.1bn), stg0.7850, stg0.7925(E302mn)

The People's Bank of China lowered unexpectedly its interest rate on Friday. China's central bank cut its one year deposit rate to 2.75% from 3.0%. That was the first cut since 2012. It is a try to revive the economy.

The one-year lending rate will also be lowered from 6% to 5.6%.

The changes come into effect on Saturday.

The interest rate cut came after the recent weak economic data from China. China's HSBC preliminary manufacturing purchasing managers' index released on Thursday dropped 50.0 in November from 50.4 in October. A reading below 50.0 indicates contraction.

China's economic growth fell to a five-year low of 7.3% in the third quarter.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

02:00 New Zealand Credit Card Spending October +4.4% +6.7%

08:00 Eurozone ECB President Mario Draghi Speaks

09:30 United Kingdom PSNB, bln October 10.6 6.9 7.1

The U.S. dollar mixed against the most major currencies ahead of the U.S. economic data. The greenback was supported by yesterday's better-than-expected U.S. economic data. The Philadelphia Federal Reserve Bank' manufacturing index surged to 40.8 in November from 20.7 in October. That was the highest level since December 1993.

Sales of existing homes in the U.S. climbed 1.5% to a seasonally adjusted annual rate of 5.26 million in October from 5.18 million in September. That was the highest level since September 2013.

There will be released no major economic reports in the U.S. on Friday.

The euro dropped against the U.S. dollar after comments by the European Central Bank (ECB) President Mario Draghi. He reiterated that the ECB is prepared to add further stimulus measures if needed. Investors speculate that the central bank is moving closer to launch the quantitative easing programme.

Draghi also said that inflation expectations were declining.

The British pound traded lower against the U.S. dollar after the weaker-than-expected public sector net borrowing figures from the U.K. The public sector net borrowing in the U.K. declined to £7.1 billion in October from £10.6 billion in September, but missing expectations for a fall to £6.9 billion. September's figure was revised up from £11.1 billion

The Canadian dollar rose against the U.S. dollar ahead of the Canadian consumer price inflation. The consumer price index in Canada is expected to remain unchanged at an annual rate of 2.0% in October.

The core consumer price index in Canada is expected to rise to an annual rate of 2.2% in October from 2.1% in September.

EUR/USD: the currency pair dropped to $1.2415

GBP/USD: the currency pair fell to $1.5624

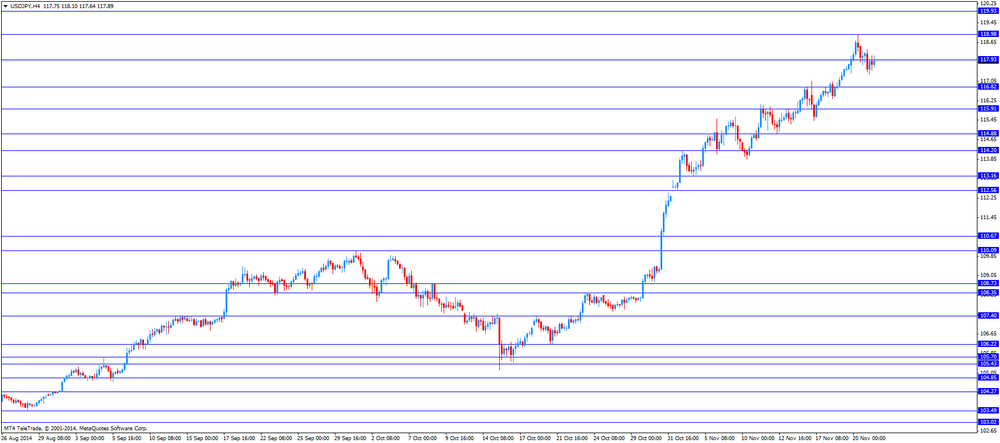

USD/JPY: the currency pair rose to Y118.11

The most important news that are expected (GMT0):

13:30 Canada Consumer price index, y/y October +2.0% +2.0%

13:30 Canada Consumer Price Index m / m October +0.1% -0.3%

13:30 Canada Bank of Canada Consumer Price Index Core, m/m October +0.2% +0.2%

13:30 Canada Bank of Canada Consumer Price Index Core, y/y October +2.1% +2.2%

EUR/USD

Offers $1.2600, $1.2580, $1.2520, $1.2475/80

Bids $1.2400, $1.2380, $1.2350

GBP/USD

Offers $1.5800, $1.5780/85, $1.5745/50

Bids $1.5620/00, $1.5580, $1.5550, $1.5525/20, $1.5500

AUD/USD

Offers $0.8800, $0.8750

Bids $0.8640/20, $0.8600, $0.8550

EUR/JPY

Offers Y148.50, Y148.00, Y147.50, Y147.00

Bids Y146.00, Y145.50, Y145.00

USD/JPY

Offers Y119.50, Y119.20, Y119.00, Y118.60/80

Bids Y117.00, Y116.85/80, Y116.50

EUR/GBP

Offers stg0.8066, stg0.8000, stg0.7980

Bids stg0.7910/00, stg0.7885/75, stg0.7860/50

EUR/USD: $1.2500(E1.1bn), $1.2550(E851mn), $1.2580(E1.3bn), $1.2615/20(E716mn), $1.2650(E2.2bn)

USD/JPY: Y117.50($821mnn), Y118.25($400mn), Y118.50($710mn)

AUD/USD: $0.8600(A$230mn)

USD/CAD: Cad1.1400($310mn), Cad1.1500($921mn)

USD/CHF: Chf0.9675($1.1bn), Chf0.9700($600mn)

EUR/GBP: stg0.7825(E1.1bn), stg0.7850, stg0.7925(E302mn)

After having announced snap elections and postponing a sales tax hike until October 2015, Japans Prime Minister Shinzo Abe said today that he won't postpone it any further than that regardless of Japan's economic condition.

BLOOMBERG

Confused OPEC Watchers Are More Divided Than Ever

To understand just how contentious next week's OPEC meeting will be, take a look at the confusion it's created among professionals paid to predict the outcome.

The 20 analysts surveyed this week by Bloomberg are perfectly divided, with half forecasting the Organization of Petroleum Exporting Countries will cut supply on Nov. 27 in Vienna to stem a plunge in prices while the other half expect no change. In the seven years since the surveys began, it's the first time participants were evenly split. The only episode that created a similar debate was the OPEC meeting in late 2007, when crude was soaring to a record.

Source: http://www.bloomberg.com/news/2014-11-21/confused-opec-watchers-are-more-divided-than-ever.html

BLOOMBERG

SNB Can Take Further Steps to Defend Cap, Zurbruegg Says

The Swiss National Bank will defend its cap of 1.20 per euro on the franc and won't hesitate to enact supplementary measures, Governing Board Member Fritz Zurbruegg said.

"The SNB will continue to enforce the minimum exchange rate with the utmost determination," Zurbruegg said in a speech yesterday in Geneva, reiterating the stance taken by the central bank at its most recent policy decision. "To this end, it is prepared to purchase foreign exchange in unlimited quantities and to take further measures immediately if required."

REUTERS

Iran says will double oil exports in two months if sanctions end

Iran will double its oil exports within two months if sanctions against it end, Oil Minister Bijan Zanganeh told official news agency IRNA.

Zanganeh said he will talk with top oil exporter Saudi Arabia about market share when OPEC meets next week, IRNA said on Thursday.

Source: http://www.reuters.com/article/2014/11/20/us-opec-iran-saudi-idUSKCN0J424120141120

ECB president Mario Draghi just finished his speech at the European banking congress at Frankfurt. At the moment Bundesbank President Jens Weidmann is speaking. Mario Draghi stated that interest rates have reached a low but the ECB will do what is necessary to meet inflation targets if low inflation persists. Size, pace and composition of the economic stimulus can be adjusted. He said that growth outlook for the Eurozone remains weak in the months to come.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

02:00 New Zealand Credit Card Spending October +4.4% +6.7%

The U.S. dollar traded mixed against its peers during Asian Trade despite the mostly better-than-expected U.S. economic data but profit taking took away some gains. The Philadelphia Federal Reserve Bank' manufacturing index surged to 40.8 in November from 20.7 in October to the highest level since December 1993. Beating forecasts that expected the index to decline to 18.9.Sales of existing homes in the U.S. climbed 1.5% to a seasonally adjusted annual rate of 5.26 million in October from 5.18 million in September. That was the highest level since September 2013. September's figure was revised up from 5.17 million units. Analysts had expected an increase to 5.16 million units. The U.S. consumer price inflation was flat in October, beating expectations for a 0.1% decrease, after a 0.1% increase in September.

The Australian dollar recouped some of its losses as China's preliminary PMI stalled and falling iron ore prices weighed on the currency earlier in the week.

The New Zealand dollar could recover losses against the U.S. dollar as lower milk prices pushed down in- and output producer prices in New Zealand and disappointing Chinese PMI data earlier in the week. China is New Zealand's second biggest export partner. Credit Card spending in October went up +6.7% compared to a +4.4% in September.

The Japanese yen strengthened against the U.S. dollar ahead of a three-day weekend as markets are closed on Monday for a public holiday after Japan's Finance Minister Taro Aso stated that the yen has depreciated too fast. Early in yesterday's session the yen traded at a new seven-year low at USD118.98.

EUR/USD: the euro traded mixed against the greenback

USD/JPY: the U.S. dollar traded weaker against the Japanese yen after new seven-year highs

GPB/USD: The British pound traded slightly weaker against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:00 Eurozone ECB President Mario Draghi Speaks

09:30 United Kingdom PSNB, bln October 11.1 6.9

13:30 Canada Consumer price index, y/y October +2.0% +2.0%

13:30 Canada Consumer Price Index m / m October +0.1% -0.3%

13:30 Canada Bank of Canada Consumer Price Index Core, m/m October +0.2% +0.2%

13:30 Canada Bank of Canada Consumer Price Index Core, y/y October +2.1% +2.2%

EUR / USD

Resistance levels (open interest**, contracts)

$1.2696 (4227)

$1.2639 (2223)

$1.2600 (1262)

Price at time of writing this review: $ 1.2544

Support levels (open interest**, contracts):

$1.2506 (2568)

$1.2463 (3163)

$1.2402 (4439)

Comments:

- Overall open interest on the CALL options with the expiration date December, 5 is 103115 contracts, with the maximum number of contracts with strike pric $1,3000 (5322);

- Overall open interest on the PUT options with the expiration date December, 5 is 105831 contracts, with the maximum number of contracts with strike price $1,2500 (6685);

- The ratio of PUT/CALL was 1.03 versus 1.03 from the previous trading day according to data from November, 20

GBP/USD

Resistance levels (open interest**, contracts)

$1.5902 (730)

$1.5804 (635)

$1.5708 (1144)

Price at time of writing this review: $1.5679

Support levels (open interest**, contracts):

$1.5595 (1448)

$1.5497 (844)

$1.5399 (1032)

Comments:

- Overall open interest on the CALL options with the expiration date December, 5 is 39981 contracts, with the maximum number of contracts with strike price $1,6000 (1947);

- Overall open interest on the PUT options with the expiration date December, 5 is 40118 contracts, with the maximum number of contracts with strike price $1,5900 (2304);

- The ratio of PUT/CALL was 1.00 versus 1.01 from the previous trading day according to data from November, 20

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.