- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

The euro fell against the U.S. dollar after the release of macroeconomic data on applications for unemployment insurance in the United States. The dollar has grown, despite the negative data on GDP for the third quarter, where the value was 1.8% versus 2.0%. Significant impact on the market have data on the labor market, where the value was 364 thousand vs. 376 thousand in government in Italy, Mario Monti won a confidence vote in the Senate on measures of austerity.

The British pound rose against the U.S. dollar after the published statistics showed thatUK GDP has exceeded the preliminary estimate. GDP grew in the third quarter of 2011 by 0.6% over the previous three months. Bank of England, King said that the prospects for growth and market conditions have deteriorated, and he is concerned about the threat posed by the debt crisis. In this case, the dependence on central bank has increased.King believes that banks need to raise capital without reducing the volume of lending.

European stocks advanced, extending this week’s gains, after U.S. jobless claims unexpectedly fell last week to the lowest since April 2008, indicating the recovery in the world’s largest economy is on track.

U.S. jobless claims unexpectedly dropped last week to the lowest since April 2008, a sign that the U.S. labor market is strengthening. Jobless claims fell by 4,000 to 364,000 in the week ended Dec. 17, Labor Department figures showed today in Washington. The median forecast of 45 economists surveyed by Bloomberg News projected an increase to 380,000.

Another report showed American consumer confidence rose more than forecast in December, to a six-month high. The Thomson Reuters/University of Michigan final index of consumer sentiment climbed to 69.9 from 64.1 at the end of November. The median estimate in a Bloomberg News survey called for 68 after a preliminary reading of 67.7.

In the U.K., economic growth accelerated more than previously estimated in the third quarter in an increase that the Bank of England says is unlikely to be repeated as the euro- area debt crisis curbs bank lending and dents confidence. Gross domestic product rose 0.6 percent from the previous quarter, faster than the 0.5 percent previously estimated, the Office for National Statistics said today in London.

National benchmark indexes climbed in 15 of the 18 western- European (SXXP) stock markets. The U.K.’s FTSE 100 Index rose 1.3 percent, Germany’s DAX advanced 1.1 percent and France’s CAC 40 gained 1.4 percent.

IAG advanced 3.3 percent to 149.9 pence after agreeing to buy Lufthansa’s BMI unit in the U.K. for 172.5 million pounds ($270.5 million), fending off a counterbid from Virgin Atlantic Airways Ltd. IAG said the acquisition will boost its operating profit by 100 million euros in 2015. Lufthansa added 1.9 percent to 9.20 euros.

Deutsche Bank, Germany’s largest lender, rose 3.2 percent to 29.29 euros. BNP Paribas, France’s biggest, added 3.4 percent to 30.24 euros. A gauge of banks was the best performer among the 19 industry groups on the Stoxx 600, gaining 2 percent.

BHP Billiton Ltd, the world’s largest mining company, increased 1.9 percent to 1,870 pence as copper climbed on the London Metal Exchange.

Stagecoach, the operator of Britain’s biggest rail-commuter franchise, retreated 3.4 percent to 260.9 pence after the shares were downgraded to “underweight” from “overweight” at JPMorgan by equity analyst David Pitura, who set the six-month target price at 280 pence.

Canada's provinces need to implement austerity measures

BoC rate policy should continue to be "accommodative"

U.S. stocks rose, sending the Standard & Poor’s 500 Index higher for a third day, as better- than-estimated jobless claims, consumer confidence and leading indicators bolstered optimism in the world’s largest economy.

Stocks rose today as the number of applications for unemployment benefits unexpectedly dropped last week to the lowest since April 2008. Confidence among U.S. consumers rose more than forecast in December, to a six-month high, according to the Thomson Reuters/University of Michigan sentiment index, as Americans began wrapping up their holiday spending. The index of U.S. leading indicators climbed more than estimated in November, a sign that the economy will keep growing in 2012.

Dow 12,160.15 +52.41 +0.43%, Nasdaq 2,597.73 +19.76 +0.77%, S&P 500 1,251.54 +7.82 +0.63%

The KBW Bank Index gained 1.8 percent. Morgan Stanley added 3.8 percent to $15.48. Citigroup gained 4.7 percent to $27.32. JPMorgan rose 2.3 percent, the second-most in the Dow, to $33.07. Bank of America Corp. (BAC) advanced 2.1 percent to $5.34.

Akamai surged 18 percent to $31.39. Cotendo, founded in 2008 and based in Sunnyvale, California, has about 100 employees, half of them in Israel, where the company has a technology center, according to a statement today.

Yahoo! Inc. rallied 1.4 percent to $16.22. The company is considering cutting its 40 percent stake in Alibaba Group Holding Ltd. to about 15 percent, two people briefed on the matter said. Dana Lengkeek, a spokeswoman for Sunnyvale, California-based Yahoo, and Alibaba spokesman John Spelich both declined to comment.

Gold declined in New York for the third time in four days on signs of a strengthening U.S. job market and a drop in holdings by exchange-traded fund investors.

Applications for unemployment benefits unexpectedly dropped last week to the lowest since April 2008, the government reported today, boosting the dollar and reducing demand for gold as an alternative asset. Holdings in bullion-backed ETFs fell for a fifth day to the lowest level since Nov. 16, as investors sold the metal to cover losses in other markets, data compiled by Bloomberg show.

Gold futures for February delivery fell to $1,599.10 an ounce on the Comex in New York. Before today, the metal was up 14 percent this year. Prices dropped 6.9 percent last week after the Federal Reserve refrained from taking new action to boost economic growth.

Bullion-backed ETF holdings, which reached an all-time high of 2,360.81 metric tons on Dec. 14, fell to 2,329.921 tons yesterday.

Oil rose a fourth day in New York as the number of applications for unemployment benefits in the U.S. fell to the lowest level since April 2008, bolstering optimism that economic growth will accelerate.

Futures advanced as much as 0.7 percent after the Labor Department said that jobless claims dropped by 4,000 to 364,000 last week. The median forecast of 45 economists surveyed by Bloomberg News projected an increase to 380,000. U.S. oil supplies declined the most in a decade last week, an Energy Department report showed yesterday.

Crude oil for February delivery rose 80 cents, or 0.8 percent, to $99.47 a barrel at 9:38 a.m. on the New York Mercantile Exchange. Futures touched $99.50, the highest level since Dec. 14. Prices have risen 8.9 percent this year after climbing 15 percent in 2010.

Brent oil for February settlement increased 43 cents, or 0.4 percent, to $108.14 a barrel on the London-based ICE Futures Europe exchange.

U.S. crude oil stockpiles fell 10.6 million barrels last week, the largest decrease since February 2001, yesterday’s Energy Department report showed.

New York oil will average a record $100 a barrel next year as the U.S. averts recession, while Brent will decline from the 2011 mean, according to a Bloomberg News survey of analysts.

The $100 forecast for West Texas Intermediate oil, the U.S. benchmark, is based on the median of 27 analyst estimates compiled by Bloomberg, topping the all-time high of $99.75 set in 2008. WTI is on course to average $95 a barrel this year. Brent will average $109 next year, compared with $110.98 so far this year, a survey of 28 analysts showed.

Oil is up 25 percent this quarter, the biggest gain since the second quarter of 2009, as the European Union and the U.S. seek support from the Middle East and Asia for sanctions against Iran, the second-biggest producer in the Organization of Petroleum Exporting Countries.

EU nations, the U.S. and Asia-Pacific allies discussed possible measures in Rome on Dec. 20 and vowed to increase pressure on Iran to abandon a suspected nuclear weapons program, according to an Italian Foreign Ministry statement.

China to grow by 7% in 2012

US to grow between 0% and 1% in 2012

Expect Euro zone recession in 2012

EUR/USD $1.3000(large), $1.3050, $1.3060, $1.3100, $1.2900, $1.2825

USD/JPY Y77.75, Y78.00, Y78.25, Y78.75AUD/USD $1.0125, $1.0000(very large), $0.9950, $0.9900

EUR/CHF Chf1.2140

EUR/GBP stg0.8300

GBP/USD $1.5710, $1.5585, $1.5510, $1.5400, $1.5380, $1.5850

EUR/JPY Y100.00

USD/CHF Chf0.9300, Chf0.9400

EUR/USD

Offers $1.3200, $1.3145/50, $1.3130/35, $1.3100/05

Bids $1.3020, $1.3000/990, $1.2980, $1.2960/45

GBP/USD

Offers $1.5795/800, $1.5775/80, $1.5745/50

Bids $1.5648, $1.5620, $1.5600

Resistance 3: Y79.00 (Nov 1 high)

Resistance 2: Y78.30/45 (area of Nov 1-4 highs)

Resistance 1: Y78.15 (Dec 14-15 and 19 highs)

Current price: Y78.07

Support 1:Y77.60 (Dec 13 and 16 lows)

Support 2:Y77.50 (Dec 9 low)

Support 3:Y77.10 (Dec 8 low)

Resistance 3: Chf0.9545 (Dec 15 high)

Resistance 2: Chf0.9430 (61,8 % FIBO Chf0,9545-Chf0,9242)

Resistance 1: Chf0.9390/00 (area of Dec 19 and 21 highs and 50,0 % FIBO Chf0,9545-Chf0,9242)

Current price: Chf0.9355

Support 1: Chf0.9300 (area of session low)

Support 1: Chf0.9240 (Dec 21 low)

Support 2: Chf0.9180 (area of Dec 8-9 low)

Resistance 3 : $1.5890 (Nov 18 high)

Resistance 2 : $1.5770/80 (area of Nov 30, Dec 8 and 21 highs)

Resistance 1 : $1.5730 (session high)

Current price: $1.5690

Support 1 : $1.5650 (area of session low and Dec 21 low)

Support 2 : $1.5620 (low of american session on Dec 20)

Support 3 : $1.5560 (Dec 16 high, МА (200) for Н1)

Resistance 3: $ 1.3200 (area of Dec 21 high)

Resistance 2: $ 1.3120/30 (session high, resistance line from Oct 27)

Resistance 1: $ 1.3070 (intraday high)

Current price: $1.3067

Support 1 : $1.3020 (Dec 21 low)

Support 2 : $1.2980 (Dec 19 low)

Support 3 : $1.2945 (Dec 14 low)

EUR/USD $1.3000(large), $1.3050, $1.3060, $1.3100, $1.2900, $1.2825

USD/JPY Y77.75, Y78.00, Y78.25, Y78.75AUD/USD $1.0125, $1.0000(very large), $0.9950, $0.9900

EUR/CHF Chf1.2140

EUR/GBP stg0.8300

GBP/USD $1.5710, $1.5585, $1.5510, $1.5400, $1.5380, $1.5850

EUR/JPY Y100.00

USD/CHF Chf0.9300, Chf0.9400

The dollar traded 0.8 percent from an 11-month high versus the euro before European Central Bank President Mario Draghi speaks today amid concern policy makers are struggling to contain the euro region’s debt crisis.

Euro held yesterday’s decline as France and Italy prepare to sell debt next week amid speculation Standard & Poor’s will cut the credit ratings of European countries. France will auction bills on Dec. 27, while Italy will offer debt maturing in 2014, 2018, 2021 and 2022 on Dec. 29. S&P said this month it may cut the credit grades of 15 euro nations, including Germany and France, the region’s biggest economies.

New Zealand’s dollar fell after the data. New Zealand’s economy grew faster than analysts estimated last quarter on Rugby World Cup spending, a boost the central bank may look past as it awaits more lasting recovery signs before raising record-low interest rates. Gross domestic product rose 0.8 percent in the three months ended Sept. 30 from the previous quarter, when it increased 0.1 percent, Statistics New Zealand said in a report released today in Wellington. Growth was faster than the 0.6 percent median projection in a Bloomberg News survey of 14 economists.

Australia’s dollar weakened against most its major counterparts as Asian stocks retreated, sapping demand for higher-yielding currencies.

EUR/USD: on Asian session the pair gain.

GBP/USD: on Asian session the pair gain.

USD/JPY: on Asian session the pair holds in range Y78.00-Y78.15.

On Thursday UK data sees the third release of Q3 GDP data at 0930GMT along with Q3 Balance of Payments data where the Current Account Balance is expected at -stg6.3 billion. There is no major core-European data due on Thursday but at 1600GMT, the ESRB is due to hold a press conference, including Mario Draghi and Mervyn King as well as Andrea Enria.

US data starts at 1130GMT when initial jobless claims are expected to rise 14,000 to 380,000 in the December 17 employment survey week. US data at 1500GMT includes leading indicators, the FHFA Home Price Index and also BLS mass layoffs. This is followed at 1530GMT by the weekly EIA Natural Gas Stocks data. Later US data sees the 2000GMT release of Treasury Allotments by Class and the 2130GMT release of M2 money supply data.

The euro fell against most of its major peers amid concern that European Central Bank measures to support its banking sector won’t be enough to arrest region’s worsening sovereign-debt crisis.

The 17-nation currency erased an earlier advance as the ECB said it had awarded 489 billion euros ($637 billion) in 1,134- day loans to banks, more than the 293 billion euros forecast by economists, as investors bet the euro-region debt crisis is far from done. The euro-area economy will probably fail to grow next year after expanding 1.6 percent in 2011, while the U.S. is forecast to accelerate to 2.1 percent from 1.8 percent, according to Bloomberg surveys of economists.

The franc weakened 0.3 percent to 1.2222 per euro and 0.5 percent to 93.64 centimes per dollar.

Yields on Italian two-year notes rose as much as 27 basis points, or 0.27 percentage point, to 5.25 percent, snapping four-straight days of declining borrowing costs, while Spanish debt yields with the same maturity increased 27 basis points to 3.5 percent, after falling for eight days.

EUR/USD: yesterday the pair has grown on a figure, however fell later.

GBP/USD: yesterday the pair has grown, but have lost the won positions later.

USD/JPY: yesterday the pair advanced.

On Thursday UK data sees the third release of Q3 GDP data at 0930GMT along with Q3 Balance of Payments data where the Current Account Balance is expected at -stg6.3 billion. There is no major core-European data due on Thursday but at 1600GMT, the ESRB is due to hold a press conference, including Mario Draghi and Mervyn King as well as Andrea Enria.

US data starts at 1130GMT when initial jobless claims are expected to rise 14,000 to 380,000 in the December 17 employment survey week. US data at 1500GMT includes leading indicators, the FHFA Home Price Index and also BLS mass layoffs. This is followed at 1530GMT by the weekly EIA Natural Gas Stocks data. Later US data sees the 2000GMT release of Treasury Allotments by Class and the 2130GMT release of M2 money supply data.

Resistance 3: Y79.00 (Nov 1 high)

Resistance 2: Y78.30/45 (area of Nov 1-4 high)

Resistance 1: Y78.15 (Dec 15 high)

The current price: Y78.05

Support 1:Y77.85 (MA (233) H1)

Support 2:Y77.70 (area of Dec 20-21 low)

Support 3:Y77.50 (Dec 9 low)

Comments: the pair is consolidated in range Y77.70-Y78.15. In focus resistance Y78.15.

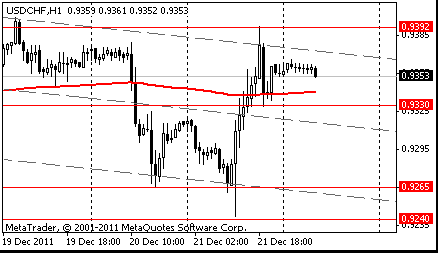

Resistance 3: Chf0.9545 (Dec 15 high)

Resistance 2: Chf0.9480 (Dec 13 high)

Resistance 1: Chf0.9390 (Dec 21 high)

The current price: Chf0.9353

Support 1: Chf0.9330 (low of the American session on Dec 21)

Support 2: Chf0.9265 (Dec 20 low)

Support 3: Chf0.9240 (Dec 21 low)

Comments: the pair is on downtrend. In focus support Chf0.9330.

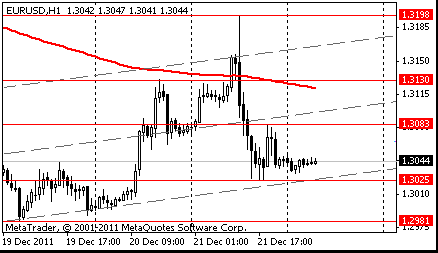

Resistance 3: $1.3200 (Dec 21 high)

Resistance 2: $1.3130 (MA (233) H1)

Resistance 1: $1.3085 (high of the American session on Dec 21)

The current price: $1.3044

Support 1 : $1.3025 (Dec 21 low)

Support 2 : $1.2980 (Dec 19 low)

Support 3 : $1.2944 (Jan 14 low)

Comments: the pair is on uptrend. In focus resistance $1.3085.

Change % Change Last

Nikkei 225 8,460 +123.50 +1.48%

Hang Seng 18,416 +336.25 +1.86%

S&P/ASX 200 4,140 +86.42 +2.13%

Shanghai Composite 2,191 -24.78 -1.12%

FTSE 100 5,381 -38.98 -0.72%

CAC 40 3,028 -27.70 -0.91%

DAX 5,782 -65.04 -1.11%

Dow 12,107.74 +4.16 +0.03%

Nasdaq 2,577.97 -25.76 -0.99%

S&P 500 1,243.71 +2.41 +0.19%

10 Year Yield 1.97% +0.04 --

Oil $98.87 +0.20 +0.20%

Gold $1,615.30 +1.70 +0.11%

05:00 Japan BoJ monthly economic report December

09:30 United Kingdom Current account, bln Quarter III -2.0 -5.2

09:30 United Kingdom GDP final Quarter III +0.5% +0.5%

09:30 United Kingdom GDP final, y/y Quarter III +0.5% +0.5%

13:30 U.S. Initial Jobless Claims 17.12.2011 366 376

13:30 U.S. GDP, final, y/y Quarter III +2.0% +2.0%

13:30 U.S. PCE price index, q/q Quarter III +2.3% +2.3%

13:30 U.S. PCE price index ex food, energy, q/q Quarter III +2.0% +2.0%

14:45 U.S. Reuters/Michigan Consumer Sentiment Index (Final) December 67.7 68.1

15:00 U.S. Leading Indicators November 0.9% 0.2%

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.