- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

(pare/closed(GMT +2)/change, %)

EUR/USD $1,3193 +0,19%

GBP/USD $1,6572 +0,19%

USD/CHF Chf0,9146 -0,28%

USD/JPY Y103,87 -0,20%

EUR/JPY Y137,04 -0,01%

GBP/JPY Y172,13 -0,01%

AUD/USD $0,9332 +0,26%

NZD/USD $0,8374 +0,49%

USD/CAD C$1,0864 -0,81%

(time / country / index / period / previous value / forecast)

01:00 Australia HIA New Home Sales, m/m July +1.2%

01:30 Australia Private Capital Expenditure Quarter II -4.2% -0.8%

07:15 Switzerland Employment Level Quarter II 4.19 4.21

07:55 Germany Unemployment Change August -12 -6

07:55 Germany Unemployment Rate s.a. August 6.7%

08:00 Eurozone M3 money supply, adjusted y/y July +1.5% +1.5%

08:00 Eurozone Private Loans, Y/Y July -1.7% -1.5%

09:00 Eurozone Business climate indicator August 0.17

09:00 Eurozone Industrial confidence August -3.8

09:00 Eurozone Economic sentiment index August 102.2

10:00 United Kingdom CBI retail sales volume balance August 21 25

12:00 Germany CPI, m/m (Preliminary) August +0.3% 0.0%

12:00 Germany CPI, y/y (Preliminary) August +0.8%

12:30 Canada Current Account, bln Quarter II -12.4 -11.4

12:30 U.S. PCE price index, q/q Quarter II +2.5%

12:30 U.S. PCE price index ex food, energy, q/q Quarter II +2.0%

12:30 U.S. Initial Jobless Claims August 298 299

12:30 U.S. GDP, q/q (Revised) Quarter II +4.0% +3.9%

14:00 U.S. Pending Home Sales (MoM) July -1.1% +0.6%

22:45 New Zealand Building Permits, m/m July +3.5%

23:05 United Kingdom Gfk Consumer Confidence August -2 -1

23:30 Japan Unemployment Rate July 3.7% 3.7%

23:30 Japan Tokyo Consumer Price Index, y/y August +2.8%

23:30 Japan Tokyo CPI ex Fresh Food, y/y August +2.8% +2.7%

23:30 Japan Household spending Y/Y July -3.0% -2.7%

23:30 Japan National Consumer Price Index, y/y July +3.6%

23:30 Japan National CPI Ex-Fresh Food, y/y July +3.3% +3.3%

23:50 Japan Retail sales, y/y July -0.6% -0.1%

23:50 Japan Industrial Production (MoM) (Preliminary) July -3.4% +1.4%

23:50 Japan Industrial Production (YoY) (Preliminary) July +3.1%

The U.S. dollar traded mixed to lower against the most major currencies due to profit taking. No major economic reports were released in the U.S.

The euro traded higher against the U.S. after German Finance Minister Wolfgang Schaeuble said comments by European Central Bank (ECB) President Mario Draghi in Jackson Hole were "overinterpreted". Mario Draghi said in Jackson Hole the ECB could add new stimulus measures should inflation decline further.

The Gfk consumer climate index dropped to 8.6 in August from 9.0 in July, missing expectations for a decline to 8.9. That was the first decline since January 2013.

The British pound traded higher against the U.S. dollar in the absence of any major economic data in the UK.

The Swiss franc traded higher against the U.S. dollar. The UBS consumption Indicator fell to 1.66 in July from 2.07 in June. June's figure was revised up from 2.06.

The New Zealand dollar traded mixed against the U.S dollar. In the overnight trading session the kiwi increased after Fonterra, a leading multinational dairy company based in New Zealand, affirmed milk price. The company said it expected global milk prices to improve later in the year. The company also announced a joint venture with Beingmate Group to produce infant formula for the Chinese market.

Fonterra is the world's biggest dairy exporter.

New Zealand's food price index declined 0.7% in July, after 1.4% rise in June.

The Australian dollar traded mixed against the U.S. dollar. In the overnight trading session, the Aussie rose after the weaker-than-expected construction work done data from Australia. Construction work done in Australia declined 1.2% in the second quarter, missing expectations for a 0.4% fall, after a 0.4% decline in the first quarter. The first quarter figure was revised down from a 0.3% increase.

The Japanese yen traded mixed against the U.S. dollar in the absence of any major reports in Japan.

EUR/USD $1.3150(E217mn), $1.3200(E696mn), $1.3215(E302mn), $1.3300(E1.0bn)

GBP/USD $1.6500(stg423mn), $1.6600(stg110mn)

EUR/GBP stg0.7940-50(E160mn), stg0.8000(E280mn)

AUD/USD $0.9220(A$150mn), $0.9250(A$200mn), $0.9275(A$100mn), $0.9305(A$111mn)

NZD/USD $0.8365(NZ$200mn), $0.8425(NZ$410mn)

USD/CAD C$1.1000($1.62bn), C$1.1025

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia Construction Work Done Quarter II +0.3% -0.4% -1.2%

06:00 Germany Gfk Consumer Confidence Survey September 9.0 8.9 8.6

06:00 Switzerland UBS Consumption Indicator July 2.07 Revised From 2.06 1.66

The U.S. dollar traded lower against the most major currencies. Yesterday's mixed U.S. economic data weighed on the greenback. Durable goods orders in the U.S. jumped 22.6% in July, but the increase was driven by increasing demand for new aircraft drove the rise. Orders for civilian aircraft soared 318%, while orders for transportation equipment rose 74.2%.

Durable goods orders, excluding transportation, fell 0.8% in July, missing expectations for a 0.5% increase, after a 3.0% gain in June.

The consumer confidence index rose to 92.4 in August from a 90.3 in July, beating forecasts for a decline to 89.1. That was the highest level since October 2007.

Tensions over Ukraine eased. Russian President Vladimir Putin met Ukrainian President Petro Poroshenko in Minsk yesterday. Russian President Vladimir Putin said talks with Ukrainian president were positive. Ukrainian President Petro Poroshenko aid that Russia, Belarus and Kazakhstan are backing a Ukrainian peace strategy.

The euro increased against the U.S. dollar despite the weaker-than-expected Gfk consumer climate index for Germany. The Gfk consumer climate index dropped to 8.6 in August from 9.0 in July, missing expectations for a decline to 8.9. That was the first decline since January 2013.

The British pound rose against the U.S. dollar in the absence of any major economic data in the UK.

The Swiss franc rose against the U.S. dollar. The UBS consumption Indicator fell to 1.66 in July from 2.07 in June. June's figure was revised up from 2.06.

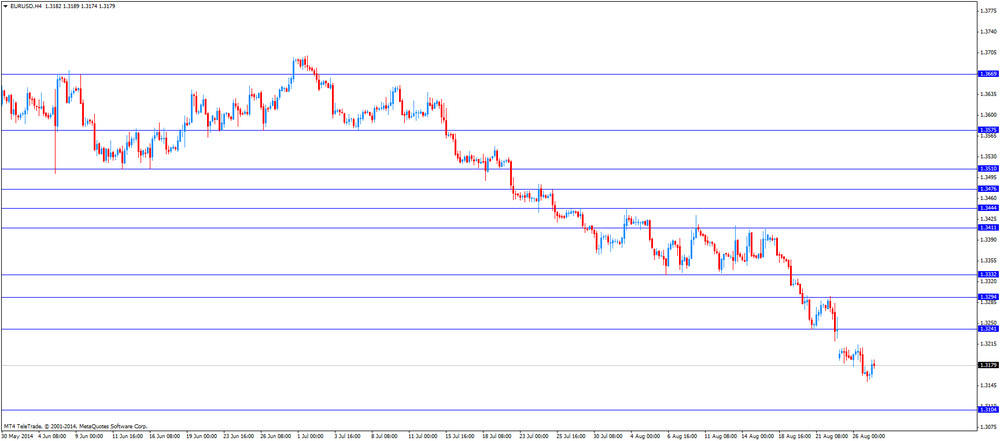

EUR/USD: the currency pair rose to $1.3189

GBP/USD: the currency pair increased to $1.6603

USD/JPY: the currency pair traded mixed

EUR/USD

Offers $1.3300, $1.3250/60, $1.3220-30, $1.3190/200

Bids $1.3150, $1.3135, $1.3110-00, $1.3080

GBP/USD

Offers

Bids $1.6500

AUD/USD

Offers $0.9400, $0.9380, $0.9350

Bids $0.9300, $0.9255/50, $0.9220/00

EUR/JPY

Offers Y138.20, Y137.90/00, Y137.50

Bids Y136.80, Y136.50, Y136.20, Y136.00

USD/JPY

Offers Y105.50, Y105.00, Y104.50, Y104.20/25

Bids Y103.60/50, Y103.20, Y103.00, Y102.50

EUR/GBP

Offers stg0.7980-85

Bids stg0.7900

EUR/USD $1.3150(E217mn), $1.3200(E696mn), $1.3215(E302mn), $1.3300(E1.0bn)

GBP/USD $1.6500(stg423mn), $1.6600(stg110mn)

EUR/GBP stg0.7940-50(E160mn), stg0.8000(E280mn)

AUD/USD $0.9220(A$150mn), $0.9250(A$200mn), $0.9275(A$100mn), $0.9305(A$111mn)

NZD/USD $0.8365(NZ$200mn), $0.8425(NZ$410mn)

USD/CAD C$1.1000($1.62bn), C$1.1025

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia Construction Work Done Quarter II +0.3% -0.4% -1.2%

06:00 Germany Gfk Consumer Confidence Survey September 9.0 8.9 8.6

06:00 Switzerland UBS Consumption Indicator July 2.07 Revised From 2.06 1.66

The U.S. dollar traded lower against the most major currencies. Yesterday's mixed U.S. economic data weighed on the greenback. Durable goods orders in the U.S. jumped 22.6% in July, but the increase was driven by increasing demand for new aircraft drove the rise. Orders for civilian aircraft soared 318%, while orders for transportation equipment rose 74.2%.

Durable goods orders, excluding transportation, fell 0.8% in July, missing expectations for a 0.5% increase, after a 3.0% gain in June.

The consumer confidence index rose to 92.4 in August from a 90.3 in July, beating forecasts for a decline to 89.1. That was the highest level since October 2007.

The New Zealand dollar increased against the U.S dollar after Fonterra, a leading multinational dairy company based in New Zealand, affirmed milk price. The company said it expected global milk prices to improve later in the year. The company also announced a joint venture with Beingmate Group to produce infant formula for the Chinese market.

Fonterra is the world's biggest dairy exporter.

New Zealand's food price index declined 0.7% in July, after 1.4% rise in June.

The Australian dollar traded slightly higher against the U.S. dollar after the weaker-than-expected construction work done data from Australia. Construction work done in Australia declined 1.2% in the second quarter, missing expectations for a 0.4% fall, after a 0.4% decline in the first quarter. The first quarter figure was revised down from a 0.3% increase.

The Japanese yen traded higher against the U.S. dollar in the absence of any major reports in Japan.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair rose to $1.6558

USD/JPY: the currency pair fell to Y103.93

EUR / USD

Resistance levels (open interest**, contracts)

$1.3277 (1741)

$1.3245 (1263)

$1.3203 (67)

Price at time of writing this review: $ 1.3159

Support levels (open interest**, contracts):

$1.3129 (5753)

$1.3103 (3381)

$1.3071 (6159)

Comments:

- Overall open interest on the CALL options with the expiration date September, 5 is 62213 contracts, with the maximum number of contracts with strike price $1,3400 (6991);

- Overall open interest on the PUT options with the expiration date September, 5 is 61842 contracts, with the maximum number of contracts with strike price $1,3100 (6159);

- The ratio of PUT/CALL was 0.99 versus 1.06 from the previous trading day according to data from August, 26

GBP/USD

Resistance levels (open interest**, contracts)

$1.6800 (2557)

$1.6701 (928)

$1.6603 (657)

Price at time of writing this review: $1.6550

Support levels (open interest**, contracts):

$1.6497 (2000)

$1.6399 (987)

$1.6300 (674)

Comments:

- Overall open interest on the CALL options with the expiration date September, 5 is 30222 contracts, with the maximum number of contracts with strike price $1,7000 (2760);

- Overall open interest on the PUT options with the expiration date September, 5 is 29923 contracts, with the maximum number of contracts with strike price $1,6800 (4026);

- The ratio of PUT/CALL was 0.99 versus 1.02 from the previous trading day according to data from August, 26

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.