- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

(raw materials / closing price /% change)

Oil 44.51 +0.43%

Gold 1,279.20 +0.54%

(index / closing price / change items /% change)

Hang Seng 20,449.82 -76.01 -0.37 %

S&P/ASX 200 5,279.06 +7.92 +0.15 %

Shanghai Composite 2,998.14 +6.87 +0.23 %

FTSE 100 6,117.25 +5.23 +0.09 %

CAC 40 4,319.46 -4.77 -0.11 %

Xetra DAX 9,851.86 +23.61 +0.24 %

S&P 500 2,050.63 -0.49 -0.02 %

NASDAQ Composite 4,717.09 -8.55 -0.18 %

Dow Jones 17,660.71 +9.45 +0.05 %

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1402 -0,72%

GBP/USD $1,4484 -0,08%

USD/CHF Chf0,9678 +1,06%

USD/JPY Y107,26 +0,23%

EUR/JPY Y122,30 -0,49%

GBP/JPY Y155,36 +0,15%

AUD/USD $0,7463 +0,08%

NZD/USD $0,6881 +0,01%

USD/CAD C$1,2863 -0,02%

(time / country / index / period / previous value / forecast)

01:30 Australia RBA Monetary Policy Statement

07:00 Switzerland Foreign Currency Reserves April 576

12:30 Canada Unemployment rate April 7.1% 7.2%

12:30 Canada Employment April 40.6 1

12:30 U.S. Average workweek April 34.4 34.5

12:30 U.S. Average hourly earnings April 0.3% 0.3%

12:30 U.S. Nonfarm Payrolls April 215 202

12:30 U.S. Unemployment Rate April 5% 5%

14:00 Canada Ivey Purchasing Managers Index April 50.1 52.5

19:00 U.S. Consumer Credit March 17.22 16

The US dollar rose significantly against the euro and the franc, updating the highs this month. Experts point increase in the demand for the US currency due to expectations the publication of a key US labor market report, which will be released tomorrow. It is expected that the number of people employed in non-agricultural sector increased by 202 thousand. After increasing by 215 thousand. In April. The unemployment rate is likely to remain at around 5.1%. If the forecasts are correct, it will be an additional argument for the Fed in favor of a gradual tightening of monetary policy. It should be emphasized in recent weeks, investors are actively put on the dollar's decline after Fed officials have signaled that they are in no hurry to increase interest rates in the coming months. Expectations of rate hikes tend to exert upward pressure on the dollar, as rising borrowing costs, making the US currency more attractive for investors. According to the quotations of futures on a bet the Fed, traders estimate the probability of a June rate increase of 11%.

The British pound traded mixed against the US dollar, while remaining near the level of opening of the session. Investors' attention was focused on by Britain and the US reports. As it became known, the index of business activity in the UK services sector in April was 52.3, lower than the previous value of 53.7 and analysts' expectations of 53.5. The April index indicator was the lowest in more than three years. Earlier this week, we were also published disappointing data on the index of industrial activity and construction sectors. According to analysts, the uncertainty associated with the outcome of the referendum on UK membership of the issue in the European Union is putting pressure on business sentiment.

With regard to the US data, the Ministry of Labor said the seasonally adjusted number of initial applications for unemployment benefits in the week ended April 30 rose by 17 000 to 274 000 (a five-week high). the last increase in rates were the highest in more than a year. Economists had expected the number of calls will increase only up to 260,000 from 257,000 the previous week. It is worth emphasizing the number of calls is less than 300 000 for 61 consecutive weeks, which is the longest series since 1973. Meanwhile, it became known that the moving average for 4 weeks, which smooths the volatile weekly data, rose by 2000 to 258 000. Meanwhile, the number of people who continue to receive unemployment benefits fell by 8,000 to 2.121 million . for the week ended April 23. The last reading was the lowest since November 2000.

Major U.S. stock indexes slightly rose on Thursday as a rise in oil boosted energy shares, but gains on Nasdaq were limited as Tesla (TSLA) dragged. The electric carmaker's shares reversed premarket gains to trade down 3,4% after analysts expressed doubts about the company's ability to deliver vehicles ahead of schedule. Oil prices jumped about 2,5% as a huge wildfire in Canada's oil sands region and escalating tensions in Libya stoked concerns among investors of a near-term shortage in supply.

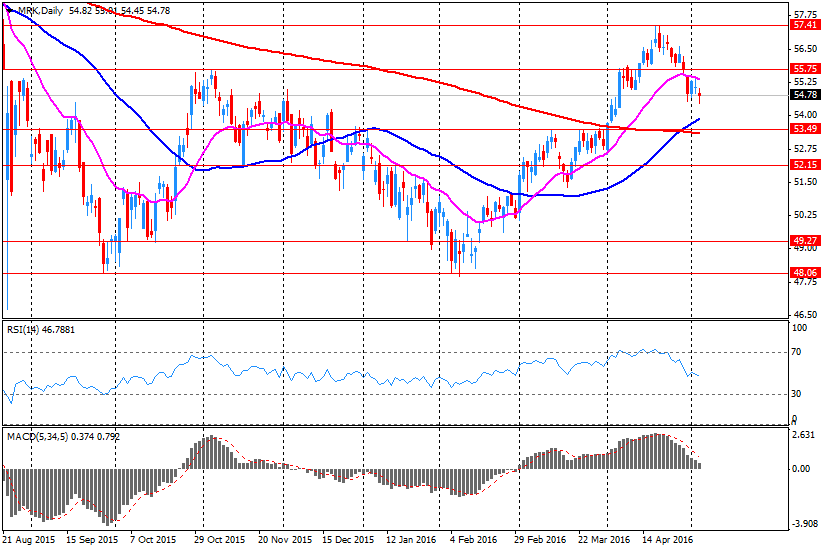

Most of Dow stocks in positive area (21 of 30). Top looser - Merck & Co. Inc. (MRK, -1,61%). Top gainer - International Business Machines Corporation (IBM, +1,55%).

Almost of S&P sectors in positive area. Top looser - Conglomerates (-1,9%). Top gainer - Basic Materials (+0,6%).

At the moment:

Dow 17620.00 +39.00 +0.22%

S&P 500 2049.75 +2.75 +0.13%

Nasdaq 100 4318.00 +8.25 +0.19%

Oil 44.78 +1.00 +2.28%

Gold 1277.00 +2.60 +0.20%

U.S. 10yr 1.77 -0.01

Oil prices jumped nearly 2 percent, resuming a rally last week, due to the persistence of forest fires in Canada and the aggravation of the civil war in Libya.

Forest fire near Fort McMurray in Alberta has increased five-fold compared to the original size and has spread to the south, forcing the 88 th. Of people to flee their homes. Some oil companies in the region have suspended their work as a precautionary measure. "As long as there is no clarity as to how large-scale production will pause and how long they will last," - said an analyst at BNP Paribas Geret Davis.

Meanwhile, experts say that because of the escalation of hostilities in Libya, oil output in the country could fall by 120,000 barrels per day. Opposition rival Eastern and Western political forces in Libya prevents the shipping of Glencore Swiss commodity trader, as the National Oil Company of Libya (NOC), based in Benghazi, block loading of tankers through the eastern port of Marsa el-Hariga.

Investors also drew attention to the message to Bloomberg that the Organization of Petroleum Exporting Countries (OPEC) is currently preparing a proposal to reduce the production of raw materials for the meeting in June, after the failure of negotiations on the "freezing" of oil production in April. According to the agency, the participants of the recent meeting of OPEC in Vienna marked improvement in the supply and demand for oil. In turn, the 2 delegates from countries supporting the "freezing" of oil stated that the proposal to limit oil production is no longer relevant because of changes occurring in the market.

In the course of trading and continue to influence the data from the US Department of Energy, which showed that during the week April 23-29, crude oil inventories rose 2.8 million barrels to 543.4 million barrels, a record high for this time of year. Analysts had expected an increase of 1.444 million. Barrels. On the other hand, the production decline was a record since August 2015. Oil in the US during the week April 23-29, dropped to 8.825 million barrels per day versus 8.938 million barrels per day in the previous week.

WTI for delivery in June rose to $45.05 a barrel. Brent for June rose to $45.73 a barrel.

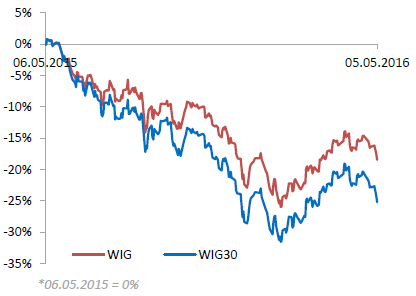

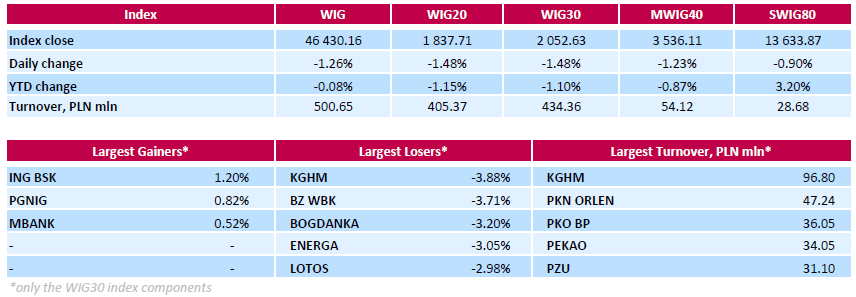

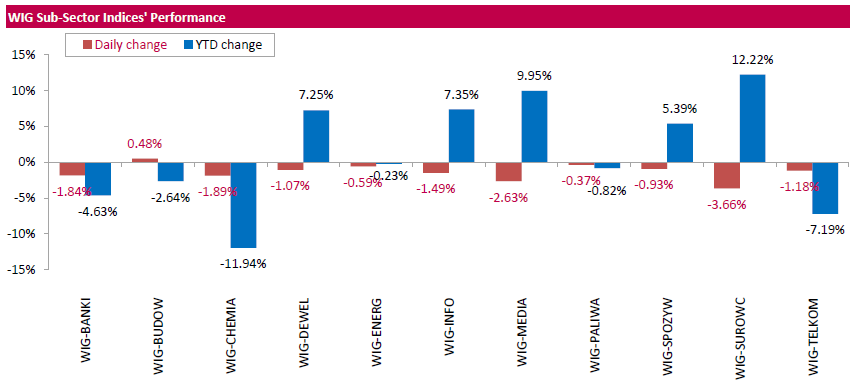

Polish equities closed lower on Thursday. The broad-market measure, the WIG index, lost 1.26%. Construction sector (+0.48%) was sole riser within the WIG Index, while materials (-3.66%) lagged behind.

The large-cap stocks' measure, the WIG30 Index, fell by 1.48%. Only three index constituents managed to generate positive returns: bank ING BSK (WSE: ING), gained 1.2%, oil and gas producer PGNIG (WSE: PGN) added 0.82% and bank MBANK (WSE: MBK) advanced 0.52%. At the same time, copper producer KGHM (WSE: KGH) and bank BZ WBK (WSE: BZW) suffered the steepest declines, plunging by 3.88% and 3.71% respectively. Other biggest laggards were thermal coal miner BOGDANKA (WSE: LWB), genco ENERGA (WSE: ENG), oil refiner LOTOS (WSE: LTS) and media group CYFROWY POLSAT (WSE: CPS), sliding down in the range between 2.88% and 3.2%.

Gold prices rose slightly today, ending a three-day decline. Support for precious metals have data on the US labor market, which indicated a significant increase in the number of initial applications for unemployment benefits.

US Department of Labor said the seasonally adjusted number of initial applications for unemployment benefits in the week ended April 30 rose by 17 000 to 274 000 (a five-week high). the last increase in rates were the highest in more than a year. Economists had expected the number of calls will increase only up to 260,000 from 257,000 the previous week. It is worth emphasizing the number of calls is less than 300 000 for 61 consecutive weeks, which is the longest series since 1973. Meanwhile, it became known that the moving average for 4 weeks, which smooths the volatile weekly data, rose by 2000 to 258 000. Meanwhile, the number of people who continue to receive unemployment benefits fell by 8,000 to 2.121 million . for the week ended April 23. The last reading was the lowest since November 2000.

In the course of trading is also affected by the expectations of tomorrow's publication of a report on employment in the agricultural sector, which is a key barometer of the health of the US economy. "A weaker employment report could push gold prices above $ 1,300," - said an analyst at ABN Amro Georgette Boele. It is expected that the number of employees increased by 202 thousand. After increasing by 215 thousand. In April. The unemployment rate is likely to remain at around 5.1%. If the forecasts are correct, it will be an additional argument for the Fed in favor of a gradual tightening of monetary policy. The increase in rates, in turn, would contribute to the growth of the dollar and have reduced the demand for gold. It is worth emphasizing the gradual increase in rates carries less of a threat to the gold price than a series of sharp climbs.

"Gold is likely to remain in the current range between $ 1,250 and $ 1,300 before the end of the quarter, when we have more clarity on the further increase of the Fed's rate" - the analyst Natixis Dadhad Bernard said.

In general, investor interest in gold remains stable. Gold reserves in the largest investment fund SPDR Gold Trust rose on Wednesday by 0.07 percent, to 825.54 tonnes (the highest value in more than two years).

USDJPY 105.00 (USD 839m) 107.00 (2.17bln) 107.75 (260m) 108.00 (537m) 109.65 (450m) 110.00 (480m)

EURUSD: 1.1320 (EUR 257m) 1.1350 (400m) 1.1400-05 (320m) 1.1420 (315m) 1.1450 (224 m) 1.1475 (811m) 1.1500 (899m) 1.1600 (554m) 1.1640-45 (946m)

GBPUSD 1.4350 (GBP 326m) 1.4550 (303m)

EURGBP 0.7732 (EUR 800m) 0.7900 (330m)

EURCHF 1.0982-83 (EUR 329m)

AUDUSD 0.7350 (AUD 1.02bln) 0.7400 (553m) 0.7500 (477m) 0.7800 (892m)

USDCAD 1.2573 (USD 313m) 1.2900 (231m) 1.3150 (536m)

NZDUSD 0.6950 (NZD 229m) 0.7000 (280m)

AUDJPY 80.50 (AUD 250m)

AUDNZD 1.0960 (AUD 792m) 1.1000 (764m)

U.S. Stocks open: Dow +0.11%, Nasdaq +0.33%, S&P +0.17%

The first bars on Wall Street indicate a slight increase in line with expectations. However, we may not see any additional enthusiasm bulls out of this, which we have already seen in the previous trading hours on the futures market. Thus, there is no support from the Americans for European markets. On the Warsaw market we already have a new daily lows.

U.S. stock-index futures rose.

Nikkei Closed

Hang Seng 20,449.82 -76.01 -0.37%

Shanghai Composite 2,998.14 +6.87 +0.23%

FTSE 6,114.6 +2.58 +0.04%

CAC 4,323.05 -1.18 -0.03%

DAX 9,834.63 +6.38 +0.06%

Crude $45.69 (+4.36%)

Gold $1285.50 (+0.87%)

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 10.36 | 0.12(1.1719%) | 70778 |

| ALTRIA GROUP INC. | MO | 63.14 | -0.09(-0.1423%) | 995 |

| Amazon.com Inc., NASDAQ | AMZN | 675.5 | 4.60(0.6856%) | 38212 |

| Apple Inc. | AAPL | 94.1 | 0.48(0.5127%) | 79264 |

| Barrick Gold Corporation, NYSE | ABX | 17.84 | 0.38(2.1764%) | 100077 |

| Caterpillar Inc | CAT | 73.9 | -0.34(-0.458%) | 5210 |

| Chevron Corp | CVX | 101.76 | 1.17(1.1631%) | 5846 |

| Cisco Systems Inc | CSCO | 26.58 | 0.14(0.5295%) | 10252 |

| Citigroup Inc., NYSE | C | 44.95 | 0.29(0.6494%) | 6571 |

| E. I. du Pont de Nemours and Co | DD | 64.5 | 0.24(0.3735%) | 737 |

| Exxon Mobil Corp | XOM | 88.94 | 1.00(1.1371%) | 14015 |

| Facebook, Inc. | FB | 118.46 | 0.40(0.3388%) | 112694 |

| Ford Motor Co. | F | 13.4 | 0.09(0.6762%) | 224151 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 12.22 | 0.42(3.5593%) | 543178 |

| General Electric Co | GE | 30.22 | 0.15(0.4988%) | 6635 |

| General Motors Company, NYSE | GM | 31.06 | 0.47(1.5364%) | 75778 |

| Goldman Sachs | GS | 160.72 | 0.65(0.4061%) | 338 |

| Google Inc. | GOOG | 700.5 | 4.80(0.69%) | 1590 |

| Home Depot Inc | HD | 135.35 | 0.19(0.1406%) | 65492 |

| HONEYWELL INTERNATIONAL INC. | HON | 113.2 | 0.27(0.2391%) | 500 |

| Intel Corp | INTC | 30 | 0.15(0.5025%) | 2959 |

| JPMorgan Chase and Co | JPM | 61.75 | 0.18(0.2924%) | 1011 |

| McDonald's Corp | MCD | 129.8 | 0.47(0.3634%) | 46932 |

| Merck & Co Inc | MRK | 54.95 | 0.14(0.2554%) | 6880 |

| Microsoft Corp | MSFT | 50.06 | 0.19(0.381%) | 9505 |

| Nike | NKE | 59.2 | 0.09(0.1523%) | 70402 |

| Pfizer Inc | PFE | 33.5 | 0.10(0.2994%) | 2500 |

| Starbucks Corporation, NASDAQ | SBUX | 56.6 | 0.21(0.3724%) | 78190 |

| Tesla Motors, Inc., NASDAQ | TSLA | 228.45 | 5.89(2.6465%) | 106777 |

| Twitter, Inc., NYSE | TWTR | 14.98 | 0.14(0.9434%) | 142785 |

| United Technologies Corp | UTX | 101.2 | 0.53(0.5265%) | 1000 |

| Verizon Communications Inc | VZ | 50.97 | 0.13(0.2557%) | 910 |

| Visa | V | 77.78 | 0.71(0.9212%) | 300 |

| Wal-Mart Stores Inc | WMT | 67.1 | -0.09(-0.134%) | 3100 |

| Walt Disney Co | DIS | 103.67 | -0.00(-0.00%) | 76555 |

| Yahoo! Inc., NASDAQ | YHOO | 37.33 | 1.33(3.6944%) | 435260 |

| Yandex N.V., NASDAQ | YNDX | 20 | 0.03(0.1502%) | 47568 |

Upgrades:

Downgrades:

Other:

Tesla Motors (TSLA) target raised to $338 from $300 at Robert W. Baird

Merck reported Q1 FY 2016 earnings of $0.89 per share (versus $0.85 in Q1 FY 2015), beating analysts' consensus of $0.85.

The company's quarterly revenues amounted to $9.312 bln (-1.2% y/y), slightly missing consensus estimate of $9.445 bln.

Merck issued guidance for FY 2016, raising EPS to $3.65-3.77 from $3.60-3.75 (versus analysts' consensus estimate of $3.72) and revenues to $39-40.2 bln from $38.7-40.2 bln (versus analysts' consensus estimate of $39.85 bln).

MRK rose to $55.25 (+0.8%) in pre-market trading.

Tesla Motors reported Q1 FY 2016 loss of $0.57 per share (versus loss $0.36 in Q1 FY 2015), beating analysts' consensus of -$0.67.

The company's quarterly revenues amounted to $1.602 bln (+45.10% y/y), generally in-line with analysts' consensus estimate of $1.599 bln.

TSLA rose to $232.50 (+4.47%) in pre-market trading.

USD/JPY 105.00 (USD 839m) 107.00 (2.17bln) 107.75 (260m) 108.00 (537m) 109.65 (450m) 110.00 (480m)

EUR/USD: 1.1320 (EUR 257m) 1.1350 (400m) 1.1400-05 (320m) 1.1420 (315m) 1.1450 (224 m) 1.1475 (811m) 1.1500 (899m) 1.1600 (554m) 1.1640-45 (946m)

GBP/USD 1.4350 (GBP 326m) 1.4550 (303m)

EUR/GBP 0.7732 (EUR 800m) 0.7900 (330m)

EUR/CHF 1.0982-83 (EUR 329m)

AUD/USD 0.7350 (AUD 1.02bln) 0.7400 (553m) 0.7500 (477m) 0.7800 (892m)

USD/CAD 1.2573 (USD 313m) 1.2900 (231m) 1.3150 (536m)

NZD/USD 0.6950 (NZD 229m) 0.7000 (280m)

AUD/JPY 80.50 (AUD 250m)

AUD/NZD 1.0960 (AUD 792m) 1.1000 (764m)

WIG20 index opened at 1865.17 points (-0.00%)*

WIG 46939.33 -0.17%

WIG30 2078.46 -0.24%

mWIG40 3565.70 -0.40%

*/ - change to previous close

The cash market opened at a neutral level of 1,865 points on the WIG20 index, with modest turnover and with a focus on smaller companies like Próchnik (WSE: PRC), which reported very good sales figures for the month of April. Surrounded openings are slightly increasing, but not as much as a quarter ago was pointed by future contracts. We can see the weakness not only locally, but also abroad. The WIG20 index is on the line of the lower limit of the downtrend channel. The excess of that line will mean willingness to implement a scenario of accelerated decline towards 1,800 points.

EUR / USD

Resistance levels (open interest**, contracts)

$1.1581 (3797)

$1.1553 (5867)

$1.1523 (4804)

Price at time of writing this review: $1.1486

Support levels (open interest**, contracts):

$1.1430 (1323)

$1.1391 (3276)

$1.1346 (3758)

Comments:

- Overall open interest on the CALL options with the expiration date May, 6 is 43545 contracts, with the maximum number of contracts with strike price $1,1500 (5867);

- Overall open interest on the PUT options with the expiration date May, 6 is 63395 contracts, with the maximum number of contracts with strike price $1,1000 (10024);

- The ratio of PUT/CALL was 1.46 versus 1.46 from the previous trading day according to data from May, 4

GBP/USD

Resistance levels (open interest**, contracts)

$1.4800 (1065)

$1.4701 (1079)

$1.4602 (1260)

Price at time of writing this review: $1.4524

Support levels (open interest**, contracts):

$1.4398 (1548)

$1.4299 (1181)

$1.4200 (1554)

Comments:

- Overall open interest on the CALL options with the expiration date May, 6 is 23624 contracts, with the maximum number of contracts with strike price $1,4400 (2063);

- Overall open interest on the PUT options with the expiration date May, 6 is 36298 contracts, with the maximum number of contracts with strike price $1,3850 (4025);

- The ratio of PUT/CALL was 1.54 versus 1.49 from the previous trading day according to data from May, 4

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

Yesterday's session was not successful, where the Warsaw Stock Exchange had to catch up on weaker global sentiment from Tuesday.

Yesterday, the price index of the entire market (the WIG) lost 0.3%, and the sWIG80 went down less than 0.5%, which contrasts sharply with the decline of the WIG20 by almost 2%, which looks like left for good the area of 1,900 pts.

Morning mood so far do not support the scenario of a simple continuation of declines. Discounts dominate in Asia are not large. Posted at night PMI for China's services sector admittedly surprised negatively, but this information does not have the firepower as the disappointing index of industrial from Tuesday. Furthermore, contracts in the US are slightly on the gain, same as oil prices. In the case of copper, we can talk about stability.

The yen showed signs of fatigue on Thursday after stepping back from recent peaks, while the greenback was supported by optimism the U.S. economy could bounce back after nearly stalling in the first quarter. Prime Minister Shinzo Abe on Wednesday warned Japan will act if necessary to weaken the yen, although many believe the bar is high for any market intervention.

The Australian dollar edged, helped by upbeat Australian data, including a better-than-expected rise in retail sales in March.

Traders said the focus now is on U.S. jobs data on Friday. If U.S. non-farm payrolls show an increase of more than 200,000, that could lend some support to the dollar, said Roy Teo, FX strategist for ABN AMRO Bank in Singapore.

EUR/USD: during the Asian session the pair traded in the range of $1.1480-95

GBP/USD: during the Asian session the pair traded in the range of $1.4495-20

USD/JPY: during the Asian session the pair traded in the range of Y106.90-20

Based on Reuters materials

European stock markets finished sharply lower on Wednesday, as investors assessed a mixed bag of corporate news, with shares in Dialog Semiconductor PLC and London Stock Exchange Group PLC dropping.

U.S. stocks closed down Wednesday, but off their session lows, as weaker-than-expected private-sector jobs data and a slide in worker productivity eclipsed reports of strength in the services industry.

Asian shares slid for a seventh day, their longest losing streak of the year, and the dollar extended gains versus the yen. Crude rallied after data showed U.S. output fell the most in eight months and as wildfires disrupted production in Canada. Financial markets are shut for holidays in Indonesia, Japan, South Korea and Thailand.

Based on MarketWatch materials

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.