- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

Major US stock indices are moderately higher after data showed that employment in December increased less than expected, but the rebound wages signaled steady growth in the labor market.

As it became known, job creation slowed in December and the unemployment rate rose slightly, but wage growth was the strongest since 2009, pointing to a tightening of the labor market for more than seven years after the beginning of the expansion. The number of people employed in non-agricultural sectors of the economy rose to a seasonally adjusted 156 000 in December from the previous month, the Labor Department said Friday. The unemployment rate rose slightly to 4.7% last month from 4.6% in November, reflecting more Americans entering the labor market. Economists had expected 178,000 new jobs, and the unemployment rate to 4.7%.

In addition, new orders for manufactured goods in the US fell by reducing the pressure in November in a volatile category of civilian aircraft, but the underlying trend suggests that production is gradually being strengthened. The US Commerce Department said today that production orders for goods decreased by 2.4%, after a revised increase of up to 2.8% in October. The November decline followed a growth for four consecutive months and was the biggest drop since December 2015. Economists predicted that factory orders decline by 2.2% in November after being shown previously reported increase of 2.7% in October.

DOW index components closed mostly in positive territory (23 of 30). Most remaining shares rose NIKE, Inc. (NKE, + 1.78%). Outsider were shares of Verizon Communications Inc. (VZ, -2.56%).

Sector S & P index also ended the day mostly in positive territory. The leader turned out to be the technology sector (+ 0.3%). Most of the basic materials sector fell (-0.3%).

Major U.S. stock-indexes slightly hgigh on Friday after data showed employment in December rose less than expected but a rebound in wages suggested sustained growth in the labor market. The public and private sectors together added 156000 jobs last month, a U.S. Labor Department report showed, compared with 204000 jobs added in November. Average hourly earnings increased 10 cents, or 0,4%, after slipping 0,1% in November. That pushed the year-on-year increase in average hourly earnings to 2,9%, the largest increase since June 2009.

Most of Dow stocks in negative area (17 of 30). Top gainer - The Walt Disney Company (DIS, +1.51%). Top loser - Verizon Communications Inc. (VZ, -2.26%).

Most of S&P sectors also in negative area. Top gainer - Conglomerates (+0.4%). Top loser - Basic Materials (-0.6%).

At the moment:

Dow 19852.00 +31.00 +0.16%

S&P 500 2267.00 +2.75 +0.12%

Nasdaq 100 4990.25 +28.25 +0.57%

Oil 53.47 -0.29 -0.54%

Gold 1174.70 -6.60 -0.56%

U.S. 10yr 2.41 +0.04

New orders for manufactured durable goods in November decreased $11.0 billion or 4.6 percent to $228.2 billion, the U.S. Census Bureau announced today. This decrease, down following four consecutive monthly increases, followed a 4.8 percent October increase. Excluding transportation, new orders increased

0.5 percent. Excluding defense, new orders decreased 6.6 percent.

Transportation equipment, also down following four consecutive monthly increases, drove the decrease, $11.7 billion or 13.2 percent to $76.6 billion.

U.S. stock-index futures were flat as investors assessed mixed data on the U.S. labour market .

Global Stocks:

Nikkei 19,454.33 -66.36 -0.34%

Hang Seng 22,503.01 +46.32 +0.21%

Shanghai 3,154.29 -11.12 -0.35%

FTSE 7,199.81 +4.50 +0.06%

CAC 4,897.45 -3.19 -0.07%

DAX 11,586.13 +1.19 +0.01%

Crude $54.22 (+0.86%)

Gold $1,179.20 (-0.18%)

(company / ticker / price / change ($/%) / volume)

| Amazon.com Inc., NASDAQ | AMZN | 780.53 | 0.08(0.0103%) | 18058 |

| American Express Co | AXP | 75 | -0.32(-0.4249%) | 5025 |

| AMERICAN INTERNATIONAL GROUP | AIG | 65.9 | 0.30(0.4573%) | 500 |

| Apple Inc. | AAPL | 116.58 | -0.03(-0.0257%) | 89918 |

| AT&T Inc | T | 42.22 | 0.06(0.1423%) | 31522 |

| Barrick Gold Corporation, NYSE | ABX | 17.16 | -0.21(-1.209%) | 109432 |

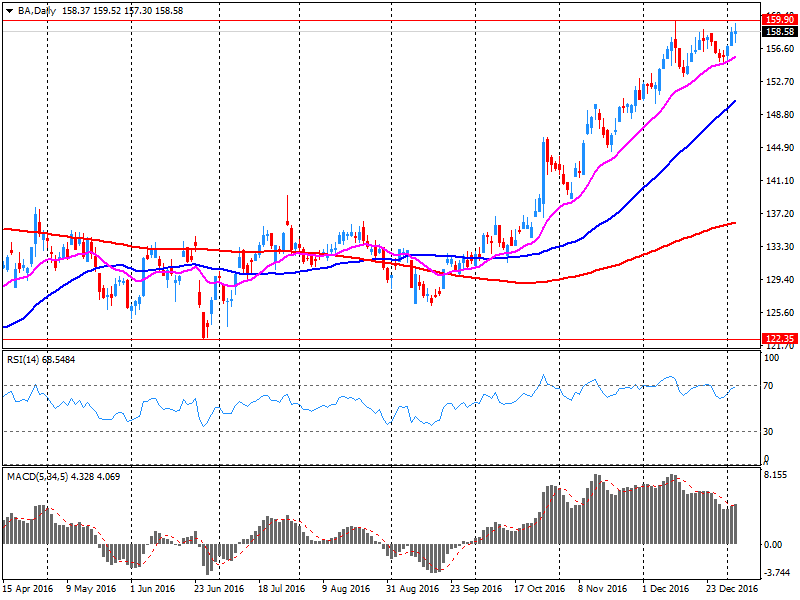

| Boeing Co | BA | 158.9 | 0.19(0.1197%) | 241 |

| Chevron Corp | CVX | 117.5 | 0.19(0.162%) | 342 |

| Cisco Systems Inc | CSCO | 30.24 | 0.07(0.232%) | 4625 |

| Exxon Mobil Corp | XOM | 88.89 | 0.34(0.384%) | 808 |

| Facebook, Inc. | FB | 120.83 | 0.16(0.1326%) | 38037 |

| Ford Motor Co. | F | 12.81 | 0.04(0.3132%) | 37564 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 14.7 | 0.08(0.5472%) | 103689 |

| General Electric Co | GE | 31.53 | 0.01(0.0317%) | 2557 |

| General Motors Company, NYSE | GM | 36.7 | 0.31(0.8519%) | 1294 |

| Goldman Sachs | GS | 241.99 | 0.67(0.2776%) | 4357 |

| Google Inc. | GOOG | 794.9 | 0.88(0.1108%) | 1838 |

| Intel Corp | INTC | 36.4 | 0.05(0.1376%) | 2481 |

| International Business Machines Co... | IBM | 168.2 | -0.50(-0.2964%) | 110 |

| Johnson & Johnson | JNJ | 117 | 0.14(0.1198%) | 998 |

| McDonald's Corp | MCD | 118.73 | -0.97(-0.8104%) | 1960 |

| Merck & Co Inc | MRK | 60.54 | 0.43(0.7154%) | 190 |

| Microsoft Corp | MSFT | 62.4 | 0.10(0.1605%) | 2207 |

| Nike | NKE | 53.01 | -0.05(-0.0942%) | 2511 |

| Pfizer Inc | PFE | 33.7 | 0.09(0.2678%) | 350 |

| Starbucks Corporation, NASDAQ | SBUX | 168.2 | -0.50(-0.2964%) | 110 |

| Tesla Motors, Inc., NASDAQ | TSLA | 226.25 | -0.50(-0.2205%) | 7929 |

| Travelers Companies Inc | TRV | 117.02 | -1.31(-1.1071%) | 1282 |

| Twitter, Inc., NYSE | TWTR | 17.19 | 0.10(0.5851%) | 24932 |

| United Technologies Corp | UTX | 112 | 0.65(0.5837%) | 175 |

| Verizon Communications Inc | VZ | 54.03 | -0.0325(-0.0601%) | 6388 |

| Wal-Mart Stores Inc | WMT | 158.9 | 0.19(0.1197%) | 241 |

| Walt Disney Co | DIS | 108.02 | 0.64(0.596%) | 9818 |

| Yahoo! Inc., NASDAQ | YHOO | 41.19 | -0.15(-0.3628%) | 6900 |

| Yandex N.V., NASDAQ | YNDX | 21.58 | -0.30(-1.3711%) | 15040 |

Upgrades:

Deere (DE) upgraded to Hold from Sell at Vertical Research

Walt Disney (DIS) upgraded to Outperform at RBC Capital Mkts; target raised to $130

Downgrades:

Travelers (TRV) downgraded to Underweight from Neutral at Atlantic Equities

McDonald's (MCD) downgraded to Neutral from Buy at UBS

Other:

EUR/USD 1.0500 (EUR 2.42bln) 1.0600 (505m) 1.0700 (2.41bln) 1.0800 (281m) 1.0850 (690m)

USD/JPY 115.00 (USD 1.3bln) 116.00 (700m) 117.00 (420m) 117.25 (380m) 118.00 (839m)

USD/CAD 1.3245 (USD 300m) 1.3300 (1.26bln)

NZD/USD 0.7005 (NZD 173m)

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through the Department of Commerce, announced today that the goods and services deficit was $45.2 billion in November, up $2.9 billion from $42.4 billion in October, revised. November exports were $185.8 billion, $0.4 billion less than October exports. November imports were $231.1 billion, $2.4 billion more than October imports.

Employment rose by 54,000 (+0.3%) in December, the result of gains in full-time work. The unemployment rate increased 0.1 percentage points to 6.9%, as more people participated in the labour market.

In the fourth quarter of 2016, employment increased by 108,000 (+0.6%), the largest increase since the second quarter of 2010. This followed a gain of 62,000 (+0.3%) in the third quarter.

In the 12 months to December, employment gains totalled 214,000 or 1.2%, compared with a growth rate of 0.9% observed over the same period one year earlier. A year-end review is presented in a separate section below.

In December, average hourly earnings for all employees on private nonfarm payrolls increased by 10 cents to $26.00, after edging down by 2 cents in November. Over the year, average hourly earnings have risen by 2.9 percent. In December, average hourly earnings of private-sector production and nonsupervisory employees increased by 7 cents to $21.80

Total nonfarm payroll employment rose by 156,000 in December, and the unemployment rate was little changed at 4.7 percent, the U.S. Bureau of Labor Statistics reported today. Job growth occurred in health care and social assistance.

The unemployment rate, at 4.7 percent, and the number of unemployed persons, at 7.5 million, changed little in December. However, both measures edged down in the fourth quarter, after showing little net change earlier in the year.

EUR/USD

Offers: 1.0600-05 1.0620 1.0650 1.0680 1.0700 1.0730 1.0750 1.0775-80 1.0800

Bids: 1.0550-60 1.0520 1.0500 1.0480 1.0450 1.0420 1.0400 1.0380-85 1.0365 1.0350

GBP/USD

Offers: 1.2400 1.2430-35 1.2450 1.2480 1.2500 1.2520 1.2550

Bids: 1.2350-60 1.2320 1.2300 1.2280 1.2265 1.2250 1.2220 1.2200

EUR/GBP

Offers: 0.8565 0.8580-85 0.8600 0.8620 0.8650 0.8685 0.8700

Bids: 0.8540 0.8520-25 0.8500 0.8485 0.8450 0.8430 0.8400

EUR/JPY

Offers: 122.85 123.00 123.30 123.60 123.85 124.00-10

Bids: 122.50 122.30 122.00 121.75 121.50 121.00

USD/JPY

Offers: 116.50 116.80 117.00 117.20-30 117.50 117.80 118.00

Bids: 116.00 115.75-80 115.50 115.20 115.00 114.80 114.50 114.30 114.00

AUD/USD

Offers: 0.7350-55 0.7375-80 0.7400 0.7420-25 0.7450 0.7475-80 0.7500

Bids: 0.7300 0.7280 0.7250 0.7230 0.7200

"We estimate non-farm payrolls increased by 170,000 in December in line with the recent trend and more or less in line with the consensus of 178,000. We estimate private services was the main contributor to job growth with 150,000 new jobs. After four months in decline, we estimate manufacturing employment was unchanged in December as manufacturing activity has recovered. Construction employment probably increased 8,000 in December. We estimate the unemployment rate rose to 4.7% and that average hourly earnings increased 0.2% m/m, implying a small increase in the wage growth rate of 2.6% y/y".

In November 2016 compared with October 2016, the seasonally adjusted volume of retail trade fell by 0.4% in the euro area (EA19) and by 0.1% in the EU28, according to estimates from Eurostat, the statistical office of the European Union. In October the retail trade volume increased by 1.4% in the euro area and by 1.3% in the EU28. In November 2016 compared with November 2015 the calendar adjusted retail sales index increased by 2.3% in the euro area and by 3.4% in the EU28.

This morning, the New York futures for Brent rose 0.14% to $ 56.97 and WTI rose 0.17% to $ 53.85. Thus, the black gold supported by yesterday's data on US inventories. Over the past week inventories declined by 7.1 million barrels. Most analysts forecast a decline in production by only 2 million barrels. Additional support for the black gold has provided information on the reduction of production by Saudi Arabia. Oil production in the country decreased by about 10 million barrels per day.

EUR/USD 1.0500 (EUR 2.42bln) 1.0600 (505m) 1.0700 (2.41bln) 1.0800 (281m) 1.0850 (690m)

USD/JPY 115.00 (USD 1.3bln) 116.00 (700m) 117.00 (420m) 117.25 (380m) 118.00 (839m)

USD/CAD 1.3245 (USD 300m) 1.3300 (1.26bln)

NZD/USD 0.7005 (NZD 173m)

Информационно-аналитический отдел TeleTrade

-

At 11:15 GMT the ECB member Yves Mersch will make a speech

-

At 17:15 GMT FOMC member Charles Evans will give a speech

-

At 18:00 GMT FOMC member Jeffrey Lacker will give a speech

-

Italy celebrates the Day of the Epiphany

EUR/USD

Resistance levels (open interest**, contracts)

$1.0736 (2297)

$1.0719 (585)

$1.0679 (254)

Price at time of writing this review: $1.0578

Support levels (open interest**, contracts):

$1.0530 (1104)

$1.0492 (1087)

$1.0444 (2270)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 51290 contracts, with the maximum number of contracts with strike price $1,1500 (3372);

- Overall open interest on the PUT options with the expiration date March, 13 is 58004 contracts, with the maximum number of contracts with strike price $1,0000 (5263);

- The ratio of PUT/CALL was 1.13 versus 1.17 from the previous trading day according to data from January, 5

GBP/USD

Resistance levels (open interest**, contracts)

$1.2613 (1291)

$1.2517 (544)

$1.2422 (253)

Price at time of writing this review: $1.2380

Support levels (open interest**, contracts):

$1.2285 (679)

$1.2188 (889)

$1.2091 (469)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 14983 contracts, with the maximum number of contracts with strike price $1,2800 (3003);

- Overall open interest on the PUT options with the expiration date March, 13 is 17563 contracts, with the maximum number of contracts with strike price $1,1500 (2982);

- The ratio of PUT/CALL was 1.17 versus 1.18 from the previous trading day according to data from January, 5

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

According to estimates of the Federal Statistical Office (Destatis), retail turnover 2016 in Germany is expected to be in real terms between 1.8% and 2.1% larger than that in 2015. In nominal terms turnover is expected to increase by between 2.4% and 2.6%.

This estimation is based on data for the first eleven months of 2016. In this period retail turnover was in real terms 1.9% and in nominal terms 2.2% larger than that in the corresponding period of the previous year.

Based on provisional data, the Federal Statistical Office (Destatis) reports that price-adjusted new orders in manufacturing had decreased in November 2016 a seasonally and working-day adjusted 2.5% on October 2016. For October 2016, revision of the preliminary outcome resulted in an increase of 5.0% compared with September 2016 (primary +4.9%). Price-adjusted new orders without major orders in manufacturing had decreased in November 2016 a seasonally and working-day adjusted 0.6% on October 2016.

In November 2016, domestic orders decreased by 2.8% and foreign orders by 2.3% on the previous month. New orders from the euro area were down 2.7% on the previous month, new orders from other countries decreased by 2.0% compared to October 2016.

Wages increased by 0.2% year on year, which is slightly higher than the previous value of 0.1%, and coincided with the forecast of economists. This was reported today by the Ministry of Health, Labour and Welfare of Japan. Changes in salary levels - an indicator showing the average full-time employee's pre-tax income. This indicator takes into account compensation for overtime work and bonuses, but do not take into account the income received in the form of interest on financial assets or capital gains. Earnings contributes to consumption, and therefore the upward trend is considered to be an inflationary factor for the Japanese economy.

The Secretary General intends to hold informal talks with Oil Minister of Saudi Arabia and six other countries that accepted production cuts.

In trend terms, the balance on goods and services was a deficit of $16m in November 2016, a decrease of $503m (97%) on the deficit in October 2016.

In seasonally adjusted terms, the balance on goods and services was a surplus of $1,243m in November 2016, a turnaround of $2,362m on the deficit in October 2016.

In seasonally adjusted terms, goods and services credits rose $2,322m (8%) to $30,083m. Non-rural goods rose $2,010m (12%) and rural goods rose $588m (17%). Non-monetary gold fell $305m (18%). Net exports of goods under merchanting remained steady at $5m. Services credits rose $29m.

U.K. stocks pushed further into record territory in bouncy trade on Thursday, supported by a rally in shares of house builders on the back of upbeat news from Persimmon PLC. The index was hovering around the flatline for most of the session as traders digested minutes from the U.S. Federal Reserve's meeting in December, released after Wednesday's close in London.

The tech-heavy Nasdaq closed at a record Thursday, as the broader stock market finished lower, dragged down by a steep slide in the financial sector and major retailers. Mixed data on jobs also raised concerns a day before the closely watched December employment report due Friday.

Japanese shares dropped Friday on yen-strengthening as traders awaited U.S. jobs data for clues on Federal Reserve rate actions. The yen's gain against the dollar comes as investors grow cautious about the U.S. economic outlook, and as traders second-guessed their once unshakeable belief in a continuous greenback rally driven by Fed rate rises.

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.