- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

(raw materials / closing price /% change)

Oil 48.45 +1.53%

Gold 1,198.20 -0.37%

(index / closing price / change items /% change)

Nikkei -24.25 19609.50 -0.12%

TOPIX -2.50 1574.90 -0.16%

Hang Seng -1.72 23827.95 -0.01%

CSI 300 -1.41 3456.69 -0.04%

Euro Stoxx 50 -16.06 3399.43 -0.47%

FTSE 100 -9.23 7357.85 -0.13%

DAX -1.24 11988.79 -0.01%

CAC 40 -25.34 4974.26 -0.51%

DJIA -44.11 20837.37 -0.21%

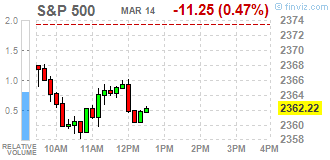

S&P 500 -8.02 2365.45 -0.34%

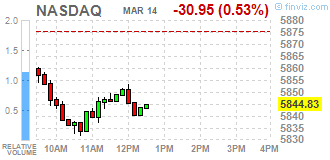

NASDAQ -18.97 5856.82 -0.32%

S&P/TSX -165.21 15379.61 -1.06%

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0608 -0,41%

GBP/USD $1,2155 -0,53%

USD/CHF Chf1,0097 +0,26%

USD/JPY Y114,74 -0,08%

EUR/JPY Y121,71 -0,50%

GBP/JPY Y139,46 -0,60%

AUD/USD $0,7558 -0,15%

NZD/USD $0,6920 -0,01%

USD/CAD C$1,3482 +0,27%

00:30 Australia New Motor Vehicle Sales (YoY) February -0.9%

00:30 Australia New Motor Vehicle Sales (MoM) February 0.6%

04:30 Japan Industrial Production (MoM) (Finally) January 0.7% -0.8%

04:30 Japan Industrial Production (YoY) (Finally) January 3.2% 3.2%

07:45 France CPI, m/m (Finally) February -0.2% 0.1%

07:45 France CPI, y/y (Finally) February 1.3% 1.2%

08:15 Switzerland Producer & Import Prices, y/y February 0.8% 1.8%

08:15 Switzerland Producer & Import Prices, m/m February 0.4% 0.4%

09:00 U.S. IEA Monthly Report

09:30 United Kingdom Average Earnings, 3m/y January 2.6% 2.4%

09:30 United Kingdom ILO Unemployment Rate January 4.8% 4.8%

10:00 Eurozone Employment Change Quarter IV 0.2% 0.2%

12:30 U.S. Retail sales excluding auto February 0.8% 0.2%

12:30 U.S. NY Fed Empire State manufacturing index March 18.7 15

12:30 U.S. Retail Sales YoY February 5.6%

12:30 U.S. Retail sales February 0.4% 0.1%

12:30 U.S. CPI excluding food and energy, Y/Y February 2.3% 2.2%

12:30 U.S. CPI, Y/Y February 2.5% 2.7%

12:30 U.S. CPI, m/m February 0.6% 0.1%

12:30 U.S. CPI excluding food and energy, m/m February 0.3% 0.2%

14:00 U.S. Business inventories January 0.4% 0.3%

14:00 U.S. NAHB Housing Market Index March 65 65

14:30 U.S. Crude Oil Inventories March 8.209

18:00 U.S. Fed Interest Rate Decision 0.75% 1%

18:00 U.S. FOMC Economic Projections

18:30 U.S. Federal Reserve Press Conference

20:00 U.S. Total Net TIC Flows January -42.8

20:00 U.S. Net Long-term TIC Flows January -12.9

21:45 New Zealand GDP y/y Quarter IV 3.5% 3.1%

21:45 New Zealand GDP q/q Quarter IV 1.1% 0.7%

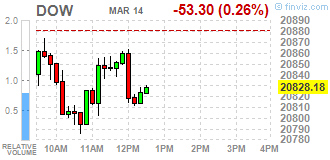

Major US stock indexes declined on Tuesday amid falling oil prices and expectations of the Fed meeting.

Investors focused on the Fed meeting, which is expected to raise interest rates. At the moment, the chances of a decision to raise rates at this meeting according to the dynamics of futures on federal funds are estimated at 93%. The head of the Federal Reserve, Janet Yellen, said earlier that the regulator is likely to raise the rate in March. However, investors are most interested in the Fed's signals about how quickly it is planned to raise rates this year. Now the probability of raising rates three or more times this year, they estimate in 64%.

The volume of trading was low, as the northeastern US state caught a snowstorm, leaving people at home.

The focus of investors' attention was also data on changes in producer prices last month. As it became known, in February, producer prices rose by 0.3% m / m, which is above the average forecast of analysts at + 0.1%. The base producer prices also rose by 0.3%, while analysts had expected growth of 0.2%.

The components of the DOW index mostly decreased (20 out of 30). The shares of Chevron Corporation fell more than others (CVX, -1.55%). Leader of growth were shares of Wal-Mart Stores, Inc. (WMT, + 1.34%).

All sectors of the S & P index ended the session in negative territory. Most of all, the main materials sector fell (-1.4%).

At closing:

Dow -0.21% 20,837.54 -43.94

Nasdaq -0.32% 5,856.82 -18.96

S & P-0.34% 2,365.38 -8.09

Major U.S. stock-indexes lower on Tuesday as oil prices fell and investors focused on the Federal Reserve's policy meeting, where it is widely expected to raise interest rates. Trading volumes were light as a blizzard in the northeastern United States grounded flights and kept people indoors.

Most of Dow stocks in negative area (21 of 30). Top loser - Chevron Corporation (CVX, -1.49%). Top gainer - Wal-Mart Stores, Inc. (WMT, +1.58%).

All S&P sectors in negative area. Top loser - Basic Materials (-1.4%).

At the moment:

Dow 20783.00 -60.00 -0.29%

S&P 500 2358.25 -13.50 -0.57%

Nasdaq 100 5373.75 -25.50 -0.47%

Oil 47.35 -1.05 -2.17%

Gold 1204.20 +1.10 +0.09%

U.S. 10yr 2.59 -0.01

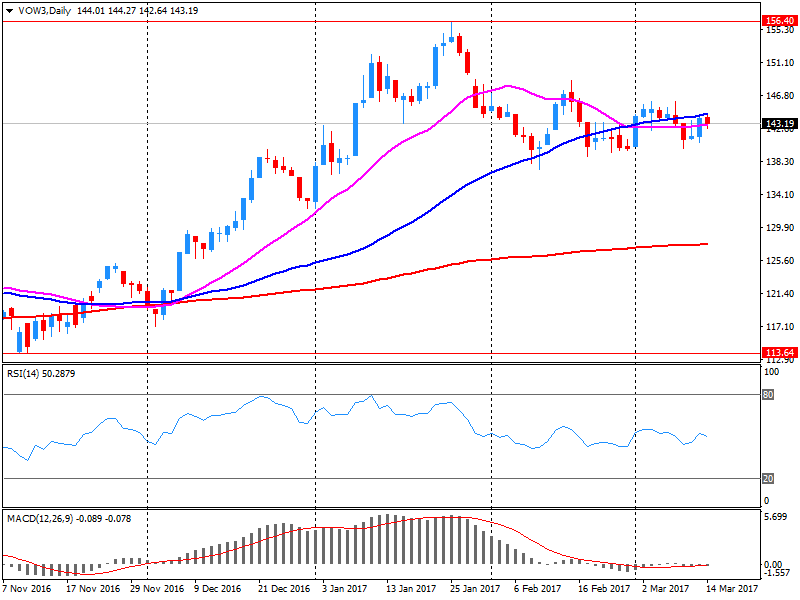

Volkswagen's investors gathered in Wolfsburg, Germany, for an annual meeting with the automaker.

During the meeting, Matthias Mueller, the general director of the auto concern, said he sees a good chance of maintaining the positive dynamics recorded last year, when the company managed to get a record base profit, which was promoted by sales of prestigious cars Audi and Porsche.

The company expects that the group's revenue in 2017 will exceed last year's figure of 217 billion euros by as much as 4%, and sales will amount to more than 10.3 million cars.

Vow3 shares are trading at 143.25 euros (-0.62%).

This index is designed to predict the direction of the economy, but it tends to have a muted impact because most of the indicators used in the calculation are released previously;

The Conference Board Leading Economic Index(LEI) for the U.K. increased 0.4 percent in January 2017 to 113.5 (2010=100).

The Conference Board Coincident Economic Index(CEI) for the U.K. was unchanged in January 2017 at 108.7 (2010=100).

EURUSD:1.050 (EUR 1.66bln) 1.0550 (430m) 1.0580-90 (1.3bln) 1.0600 (235m) 1.0630 (433m) 1.0650 (456m) 1.0700-10 (735m)

USDJPY: 114.00 (USD 901m) 114.30 (730m) 114.50 (646m) 114.75 (330m) 115.00 (1.1bln) 115.50 (700m)

AUDUSD: 0.7400 (AUD 354m) 0.7500 (389m) 0.7545 (1.3bln)

USDCAD 1.3430 (USD 25 2m) 1.3500 (200m)

NZDUSD 0.6935 (NZD 200m)

U.S. stock-index futures fell ahead of the Federal Reserve's closely watched two-day meeting, where it is widely expected to raise interest rates.

Global Stocks:

Nikkei 19,609.50 -24.25 -0.12%

Hang Seng 23,827.95 -1.72 -0.01%

Shanghai 3,238.62 +1.60 +0.05%

FTSE 7,355.68 -11.40 -0.15%

CAC 4,971.34 -28.26 -0.57%

DAX 11,952.13 -37.90 -0.32%

Crude $47.83 (-1.18%)

Gold $1,204.80 (+0.14%)

-

Will return to parliament before end of month to notify that I have triggered article 50 to launch Brexit talks

-

Told ministers leaving EU is big project but govt must not lose sight of its plans for economic and social reform

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 191.1 | -0.42(-0.22%) | 500 |

| Amazon.com Inc., NASDAQ | AMZN | 852.04 | -2.55(-0.30%) | 1942 |

| Apple Inc. | AAPL | 138.9 | -0.30(-0.22%) | 25795 |

| Caterpillar Inc | CAT | 92.01 | -0.63(-0.68%) | 2312 |

| Chevron Corp | CVX | 108.53 | -0.82(-0.75%) | 4330 |

| Citigroup Inc., NYSE | C | 61.15 | -0.38(-0.62%) | 36839 |

| Exxon Mobil Corp | XOM | 81.15 | -0.27(-0.33%) | 22462 |

| Facebook, Inc. | FB | 139.25 | -0.35(-0.25%) | 27554 |

| Ford Motor Co. | F | 12.51 | -0.03(-0.24%) | 32778 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 12.45 | -0.11(-0.88%) | 102636 |

| General Electric Co | GE | 29.79 | -0.07(-0.23%) | 16499 |

| Goldman Sachs | GS | 247 | -1.16(-0.47%) | 2906 |

| Intel Corp | INTC | 35.1 | -0.06(-0.17%) | 25593 |

| International Business Machines Co... | IBM | 176.07 | -0.39(-0.22%) | 2233 |

| JPMorgan Chase and Co | JPM | 90.9 | -0.46(-0.50%) | 6112 |

| Merck & Co Inc | MRK | 64.17 | 0.02(0.03%) | 1350 |

| Microsoft Corp | MSFT | 64.58 | -0.13(-0.20%) | 6569 |

| Nike | NKE | 56.7 | 0.03(0.05%) | 3202 |

| Tesla Motors, Inc., NASDAQ | TSLA | 246.35 | 0.18(0.07%) | 7933 |

| Twitter, Inc., NYSE | TWTR | 15.15 | -0.06(-0.39%) | 13301 |

| Verizon Communications Inc | VZ | 49.42 | -0.05(-0.10%) | 13148 |

| Visa | V | 89.91 | -0.20(-0.22%) | 3819 |

| Wal-Mart Stores Inc | WMT | 70.55 | 0.60(0.86%) | 13607 |

| Walt Disney Co | DIS | 111.7 | 0.18(0.16%) | 7996 |

| Yandex N.V., NASDAQ | YNDX | 23 | -0.24(-1.03%) | 2020 |

Upgrades:

Walt Disney (DIS) upgraded to Buy from Neutral at Guggenheim

Downgrades:

Other:

FedEx (FDX) initiated with a Outperform at Wells Fargo

Wal-Mart (WMT) added to US 1 List at BofA/Merrill

The Producer Price Index for final demand increased 0.3 percent in February, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. Final demand prices rose 0.6 percent in January and 0.2 percent in December. On an unadjusted basis, the final demand index climbed 2.2 percent for the 12 months ended February 2017, the largest advance since a 2.4-percent increase in the 12 months ended March 2012.

In February, over 80 percent of the advance in the final demand index is attributable to a 0.4-percent increase in prices for final demand services. The index for final demand goods moved up 0.3 percent.

Prices for final demand less foods, energy, and trade services rose 0.3 percent in February, the largest increase since a 0.3-percent advance in April 2016. For the 12 months ended in February, the index for final demand less foods, energy, and trade services climbed 1.8 percent.

-

Charlotte Hogg says has recognised that "being sorry is not enough" in letter to BoE Governor Carney

In January 2017 compared with December 2016, seasonally adjusted industrial production rose by 0.9% in the euro area (EA19) and by 0.5% in the EU28, according to estimates from Eurostat, the statistical office of the European Union. In December 2016 industrial production fell by 1.2% in the euro area and by 0.7% in the EU28. In January 2017 compared with January 2016, industrial production increased by 0.6% in the euro area and by 1.3% in the EU28.

The increase of 0.9% in industrial production in the euro area in January 2017, compared with December 2016, is due to production of capital goods rising by 2.8% and energy by 1.9%, while production of non-durable consumer goods fell by 0.7% and both intermediate goods and durable consumer goods by 0.4%. In the EU28, the increase of 0.5% is due to production of capital goods rising by 2.4% and energy by 1.5%, while production of non-durable consumer goods fell by 1.5%, durable consumer goods by 0.9% and intermediate goods by 0.4%.

The ZEW Indicator of Economic Sentiment for Germany improved slightly by 2.4 points in March 2017, with the indicator now standing at 12.8 points. The long-term average, which has been calculated since the survey was begun, is 23.9 points.

"The fact that the ZEW Indicator of Economic Sentiment only shows a slight upward movement is a reflection of the current uncertainty surrounding future economic development. With regard to the economic situation in Germany, no clear conclusions can be drawn from the most recent economic signals for January 2017. While industrial production and exports witnessed a positive development, the figures for incoming orders and retail sales were less favourable. The political risks resulting from upcoming elections in a number of EU countries are keeping uncertainty surrounding the German economy at a relatively high level," comments ZEW President Professor Achim Wambach.

EUR/USD has been in demand as of late mainly following its positive reaction to last week' President Draghi's press conference.

In that regard, Nomura Research notes that President Draghi communicated that the Bank had removed the reference to using all instruments to signal that the sense of urgency is gone, and as the ECB's risk assessment has likely become more balanced, these communications supported EUR for now.

Nonetheless, over the next few months, Nomura argues that French elections and the Fed policy stance will likely be more important drivers of EUR/USD, as they pose near-term downside risks.

Beyond that, Nomura expects the EUR to benefit from the reflation in the medium term and target 1.15 for EUR/USD by year-end.

EUR/USD is trading at 1.0652 as of writing.

Source: Nomura Securities Research, efxnews.

EUR/USD

Resistance levels (open interest**, contracts)

$1.0828 (989)

$1.0801 (117)

$1.0762 (43)

Price at time of writing this review: $1.0638

Support levels (open interest**, contracts):

$1.0558 (482)

$1.0507 (654)

$1.0447 (1365)

Comments:

- Overall open interest on the CALL options with the expiration date June, 9 is 38457 contracts, with the maximum number of contracts with strike price $1,1450 (4227);

- Overall open interest on the PUT options with the expiration date June, 9 is 39576 contracts, with the maximum number of contracts with strike price $1,0350 (3901);

- The ratio of PUT/CALL was 1.03 versus 1.00 from the previous trading day according to data from March, 13

GBP/USD

Resistance levels (open interest**, contracts)

$1.2417 (297)

$1.2322 (407)

$1.2227 (218)

Price at time of writing this review: $1.2133

Support levels (open interest**, contracts):

$1.2083 (561)

$1.1986 (741)

$1.1889 (788)

Comments:

- Overall open interest on the CALL options with the expiration date June, 9 is 12975 contracts, with the maximum number of contracts with strike price $1,3000 (1227);

- Overall open interest on the PUT options with the expiration date June, 9 is 15389 contracts, with the maximum number of contracts with strike price $1,1500 (3130);

- The ratio of PUT/CALL was 1.19 versus 1.17 from the previous trading day according to data from March, 13

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

Consumer prices in Germany were 2.2% higher in February 2017 than in February 2016. The inflation rate as measured by the consumer price index continued to increase (January 2017: +1.9%; December 2016: +1.7%). An inflation rate of more than two percent was last recorded in August 2012 (also +2.2%). Compared with January 2017, the consumer price index rose by 0.6% in February 2017. The Federal Statistical Office (Destatis) thus confirms its provisional overall results of 1 March 2017.

Energy prices as a whole were markedly up in February 2017 compared with a year earlier (+7.2%) and again had a strong upward effect on the overall inflation rate. The price increases for energy in recent months (January 2017: +5.9%; December 2016: +2.5%) were mainly due to the low level of energy prices a year ago. In 2016, the lowest level was reached in February 2016. As a result of this base effect, the prices of especially heating oil (+43.8%) and motor fuels (+15.6%) were markedly up in February 2017 compared with a year earlier. The year-on-year price changes for other energy products were much smaller (e.g. electricity: +1.6%; gas: −3.2%; charges for central and district heating: −4.7%). Excluding energy prices, the inflation rate in February 2017 would have been +1.7%; excluding the prices of mineral oil products, it would have been only +1.5%.

"With the rate decision likely to be a nonevent, attention turns to the Summary of Economic Projections and the press conference at this week's FOMC meeting," BofAML adds.

In this regard, BofAML believes that the combination of a shift higher in the dots and language changes in the statement will send a hawkish signal, but suspects that Chair Yellen will sound more balanced in her press conference.

As such, BofA argues that depending on how hawkish the Fed sounds this week, 'there is room for repricing in rates and further strengthening in the USD.'

USD is tarding at 1.0654 vs EUR and at 114.81 vs JPY as of writing.

Source: Bank of America Merrill Lynch Rates and Currencies Research. efxnews.

China's industrial production and fixed asset investment growth accelerated more-than-expected at the start of the year, while retail sales grew at a slower pace from a year ago, according to rttnews.

Data from the National Bureau of Statistics showed that industrial production climbed 6.3 percent in January to February from the same period of last year, faster than the 6.0 percent increase seen in December and the 6.2 percent rise economists had forecast.

A similar faster growth was last seen in August 2016. Data for the first two months of the year are combined to even out the impact of the Lunar New Year holiday.

European stocks climbed in volatile trade Monday, but with investors trading cautiously ahead of potentially market-moving events this week, including the Dutch election, the U.K.'s Brexit bill vote and a U.S. interest-rate decision.

Stocks closed marginally higher after switching between small gains and losses on Monday as investors refrained from making sizable bets ahead of a Federal Reserve meeting that is widely expected to deliver an interest-rate increase.

Stocks closed marginally higher after switching between small gains and losses on Monday as investors refrained from making sizable bets ahead of a Federal Reserve meeting that is widely expected to deliver an interest-rate increase.

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.