- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

European stocks retreated, snapping two days of gains, as Greece moved closer to a possible exit from the euro currency union and German Chancellor Angela Merkel’s party lost a state election.

Greece’s President, Karolos Papoulias, failed to secure agreement on a unity government and avert new elections. Syriza, the left-wing group opposed to spending cuts, defied overtures to join the government yesterday.

Merkel’s party lost an election in Germany’s most populous state, helping the Social Democrats tighten their grip on the country’s regional governments.

National benchmark indexes fell in all of the 18 western- European markets. The U.K.’s FTSE 100 declined 2 percent. France’s CAC 40 lost 2.3 percent. Germany’s DAX dropped 1.9 percent. Greece’s ASE Index plunged 4.6 percent to the lowest level since November 1992.

A gauge of European banking shares was among the second- worst performer of the 19 industry groups in the Stoxx 600. HSBC tumbled 1.5 percent to 545.8 pence. Deutsche Bank AG and BNP Paribas SA dropped 4.1 percent to 29.88 euros and 3.7 percent to 27.62 euros, respectively.

Nokia Oyj declined 7.3 percent to 2.33 euros after Andy Perkins, an analyst at Societe Generale, downgraded the stock to sell from hold. This is the lowest price for stock since November 1996.

Lonmin Plc, the world’s third-largest platinum producer, slumped 5.2 percent to 854 pence after posting an unexpected first-half loss. The loss excluding one-time items was 6.9 cents a share in the six months through March. That compares with the median estimate for profit of 9 cents.

The euro dropped to its lowest level in almost four months against the dollar as a leadership vacuum in Greece prompted European officials to weigh prospects for the currency union’s first

Alexis Tsipras, who heads Greece’s anti-bailout Syriza party, wouldn’t attend a meeting called by President Karolos Papoulias today, the Athens-based party said in a statement. Syriza rejected a unity government last week following inconclusive elections on May 6. Greece may face another vote unless leaders can agree on a new coalition.

Australia’s currency dropped below parity with the greenback for the first time this year as global stocks and commodities fell.

Sterling rallied against all of its 16 most-traded peers as investors sought an alternative to the shared currency. The pound gained as much as 0.9 percent to 79.63 pence per euro, the most since November 2008, before trading at 79.75 pence, up 0.8 percent. It rose 0.3 percent to $1.6109.

U.S. stocks declined, following the biggest weekly retreat in 2012 for the Dow Jones Industrial Average, as Greece struggled to form a new government amid growing speculation the nation may leave the euro region.

Global stocks fell as Greece’s political deadlock went into a second week after President Karolos Papoulias failed to secure agreement on a unity government and avert new elections with the country heading toward a possible exit from the euro area. Greece’s biggest anti-bailout party defied overtures to join the government yesterday, deepening the impasse.

Equities pared losses as Alexis Tsipras said his Syriza party wants Greece to stay in the euro and Europe must reexamine its policy of austerity.

American banks slumped as a measure of European lenders tumbled 2.8 percent. JPMorgan (JPM), which plunged 9.3 percent on May 11, lost 2.1 percent to $36.20. Bank of America (ВАС) fell 1.7 percent to $7.42. Citigroup Inc. retreated 2.7 percent to $28.57.

Symantec slid 0.8 percent to $15.32. Goldman Sachs cut its rating to sell from neutral, citing worsening margins and cash flows. The share-price estimate was lowered to $14 from $16.

Chesapeake Energy Corp. surged 7.8 percent to $15.97. The company reached a $3 billion loan agreement with a unit of Goldman Sachs Group Inc. and affiliates of Jefferies Group Inc. to help ease a cash shortfall that threatens to curtail its development of oil and natural-gas wells.

Avon Products Inc. rallied 3.9 percent to $20.97 as the company said it will respond within a week to Coty Inc., the perfume-maker that last week boosted its takeover offer for Avon to $10.7 billion.

Yahoo! Inc. rose 2.6 percent to $15.58. Chief Executive Officer Scott Thompson is stepping down after failing to correct errors in his credentials and the company is revamping its board, handing a victory to activist investor Daniel Loeb, who had pushed for the overhaul.

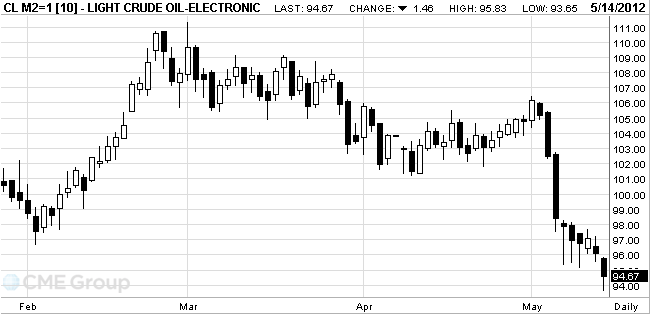

Oil fell to the lowest level in almost five months amid growing speculation Greece may leave the euro currency union and as Saudi Arabia’s oil minister said prices should decline further.

Futures dropped as much as 2.6 percent after Greece failed to agree on a unity government and European Union officials considered its possible exit from the euro. Saudi Arabia wants crude prices lower than they are now, Oil Minister Ali al-Naimi said yesterday in Adelaide, Australia. The kingdom is pumping at its highest rate in almost three decades, OPEC data show.

Crude for June delivery fell to $93.65, the lowest front-month intraday price since Dec. 19. on the New York Mercantile Exchange. Futures are down 14 percent from this year’s closing high of $109.77 on Feb. 24.

Brent for June settlement tumbled $1.16, or 1 percent, to $111.10 a barrel on the London-based ICE Futures Europe exchange.

The price of gold falls as investors transfer funds to the dollar as the most reliable asset,for fear of aggravating the situation in Europe, where output increased risks of Greece from the eurozone.

In Greece, after the parliamentary elections of May 6 has not yet formed a coalition government. The leaders of the Greek political parties said on Sunday that the contradictions between them do not allow a coalition, so that the country is likely to face new elections.

This situation calls into question the future of Greece agreements with international lenders on behalf of the EU and the IMF. Among market participants are increasingly sounding the assumption that Greece still leaves the treatment area the single European currency.

The cost of the June gold futures on the COMEX fell today to $ 1555.0 an ounce.

Cable offers to $1.6120 erased, further supply $1.6150.

EUR/USD $1.2840, $1.2900, $1.2970, $1.2975, $1.3000

USD/JPY Y79.50, Y80.00, Y81.00

GBP/USD $1.6125

EUR/GBP stg0.8065

AUD/USD $1.0190, $1.0200

NZD/USD $0.7925

U.S. stock futures declined as Greece struggled to form a government amid growing speculation the nation may leave the euro region.

Global stocks fell as Greece’s political deadlock went into a second week after President Karolos Papoulias failed to secure agreement on a unity government and avert new elections with the country heading toward a possible exit from the euro area. Greece’s biggest anti-bailout party defied overtures to join the government yesterday, deepening the impasse.

Global Stocks:

Nikkei 8,973.84 +20.53 +0.23%

Hang Seng 19,735.04 -229.59 -1.15%

Shanghai Composite 2,380.73 -14.26 -0.60%

FTSE 5,464.25 -111.27 -2.00%

CAC 3,055.22 -74.55 -2.38%

DAX 6,445.52 -134.41 -2.04%

Crude oil $94.25 (-1.96%)

Gold $1560.70 (-1.47%)

Data:

07:15 Switzerland Producer & Import Prices, m/m April +0.3% +0.4% -0.1%

07:15 Switzerland Producer & Import Prices, y/y April -2.0% -2.1% -2.3%

09:00 Eurozone Industrial production, (MoM) March +0.5% +0.5% -0.3%

09:00 Eurozone Industrial Production (YoY) March -1.8% -1.4% -2.2%

The euro dropped as a leadership vacuum in Greece prompted European officials to weigh prospects for the currency union’s first-ever departure of a member state.

The common currency slid after Greece’s biggest anti-bailout party defied overtures to join the government. The euro also weakened after euro-area industrial production unexpectedly declined in March.

Alexis Tsipras, who heads Greece’s anti-bailout Syriza party, won’t attend a meeting called by President Karolos Papoulias today, the Athens-based party said in a statement. Syriza rejected a unity government last week following inconclusive elections on May 6. Greece may face another vote unless leaders can agree on a new coalition.

The European Union’s statistics office said industrial production in the region contracted in March. Output slipped 0.3% from February, when it advanced 0.8%. Economists forecast a gain of 0.4%.

EUR/USD: the pair decreased, showed low in $1,2830 area.

GBP/USD: during European session the pair was limited $1,6050-$ 1,6085.

USD/JPY: the rate showed high in Y80,20 area. But later the pair fell, reached area of May 11 low Y79,70.

EUR/USD

Offers $1.2980, $1.2960, $1.2935, $1.2895/05, $1.2880

Bids $1.2860/50

GBP/USD

Offers $1.6200/05, $1.6150/55, $1.6115/20, $1.6100

Bids $1.6055/40, $1.6010/00, $1.5980, $1.5965/60

AUD/USD

Offers $1.0100, $1.0080/85, $1.0065/70, $1.0040/50, $1.0025/30, $1.0015/20

Bids $0.9960, $0.9950, $0.9920/10, $0.9885/80, $0.9850

USD/JPY

Offers Y81.00, Y80.85/90, Y80.60/70, Y80.50/55, Y80.35/40, Y80.20

Bids Y79.65/60, Y79.50, Y79.40/35, Y79.25, Y79.00

EUR/JPY

Offers Y103.90/00, Y103.80, Y103.70, Y103.55/60, Y103.50

Bids Y102.60, Y102.50, Y102.20/15, Y102.00, Y101.85/80

EUR/GBP

Offers stg0.8080, stg0.8060/65, stg0.8050

Bids stg0.7975/70, stg0.7950, stg0.7925/20

Resistance 3: Y80.55/60 (area of May 2-3 highs)

Resistance 2: Y80.30 (resistance line from Mar 23)

Resistance 1: Y80.20 (session high)

Current price: Y79.88

Support 1: Y79.70 (May 11 low)

Support 2: Y79.40 (May 9 low)

Support 3: Y79.15 (61,8 % FIBO Y76.00-Y84.20)

Resistance 3: Chf0.9400 (psychological level)

Resistance 2: Chf0.9380 (Jan 23 high)

Resistance 1: Chf0.9340 (session high)

Current price: Chf0.9327

Support 1: Chf0.9300 (earlier resistance, area of May 9 and 11 highs)

Support 2: Chf0.9255 (May 10 low)

Support 3: Chf0.9220 (МА (200) for Н1)

Resistance 3 : $1.6200 (area of May 7-8 high)

Resistance 2 : $1.6150/60 (resistance line from May 7, МА (200) for Н1)

Resistance 1 : $1.6080 (session high)

Current price: $1.6069

Support 1 : $1.6050 (session low)

Support 2 : $1.6000 (61,8 % FIBO $1,5820-$ 1,6300, Apr 19 low, psychological level, support line from Jan 13)

Support 3 : $1.5900 (psychological level)

Resistance 3 : $1.3070/80 (area of May 4 low, May 7-8 highs)

Resistance 2 : $1.2980 (May 10 high)

Resistance 1 : $1.2900 (session high)

Current price: $1.2873

Support 1 : $1.2860 (session low)

Support 2 : $1.2800 (psychological level)

Support 3 : $1.2620 (low of January)

Asian stocks fell as speculation heightened Greece may exit from the single European currency, countering China’s efforts to shore up economic growth by cutting the level of cash banks must set aside as reserves.

Nikkei 8,973.84 +20.53 +0.23%

S&P/ASX 4,297 +11.93 +0.28%

Hang Seng 19,742.39 -222.24 -1.11%

Shanghai Composite 2,380.73 -14.26 -0.60%

Nippon Sheet Glass Co., a glassmaker that counts Europe as its No. 1 market, slid 3 percent in Tokyo.

China Longyuan Power Group Corp., a wind-farm operator, sank 11 percent in Hong Kong after saying it plans to issue new shares.

NCsoft Corp., an online-game maker, dropped 12 percent before the release of a new game by its rival.

EUR/USD $1.2840, $1.2900, $1.2970, $1.2975, $1.3000

USD/JPY Y79.50, Y80.00, Y81.00

GBP/USD $1.6125

EUR/GBP stg0.8065

AUD/USD $1.0190, $1.0200

NZD/USD $0.7925

01:30 Australia Home Loans March -2.5% -1.7% +0.3%

02:25 Australia RBA Assist Gov Lowe Speaks -

06:00 Japan Prelim Machine Tool Orders, y/y April +2.4% +0.5%

The euro fell to its lowest level in more than three months as European officials begin to weigh the prospect of Greece withdrawing from the currency union. The 17-nation euro weakened versus most of its 16 major counterparts before Greek President Karolos Papoulias is set to continue discussions with political party leaders on forming a national unity government. Greece’s Papoulias will meet with party leaders today, state-run NET TV said, without citing anyone. Syriza’s Alexis Tsipras, who heads the largest anti-bailout party and rejected a unity government following last week’s inconclusive elections, won’t attend the meeting, NET TV reported. Greece may face new national elections unless a government is formed.

In Germany, Chancellor Angela Merkel’s Christian Democratic Union party received its weakest share of the vote since World War II in a North Rhine-Westphalia ballot yesterday. The state is Merkel’s biggest electoral test this year before the federal vote due in the second half of 2013. She is due to give a press conference on the election results today in Berlin.

A report due today may show the euro area’s industrial production growth moderated in March. Europe’s shared currency also weakened before a report that may show industrial production in the 17-nation region rose 0.4 percent in March after a revised increase of 0.8 percent in the previous month, according to the median estimate in a Bloomberg News survey. The European Union’s statistics office reports the figures today. From a year earlier, output is predicted to have decreased 1.4 percent.

The Australian dollar declined even after the People’s Bank of China said May 12 that reserve ratios will fall 50 basis points, effective May 18. That was the third reduction in six months. China is Australia’s largest trading partner.

China’s reserve ratio cut “provided some support to the Aussie,” said Emma Lawson, a currency strategist in Sydney at National Australia Bank Ltd. (NAB) “But I think broader global concerns around Europe are probably a stronger driver for today.”

EUR/USD: the pair fell, updated a monthly low.

GBP/USD: the pair traded in a range $1.6050-$1.6085.

USD/JPY: the pair rose above Y80.00.

European data for Monday starts at 0900GMT, at the same time as EMU industrial output data. At 1100GMT, German Chancellor Angela Merkel gives a press conference in Berlin, which follows elections in the region of North Rhine Westphalia at the weekend.

On Monday the euro weakened to a more than three-month low after Francois Hollande was elected president of France and as Greek voters flocked to anti-bailout parties, stoking concern austerity efforts in Europe may be derailed. The 17-nation currency slid for a sixth day, its longest series of declines since September, dropping as much as 1 percent before paring losses. Hollande, who becomes the first Socialist in 17 years to control Europe’s second-biggest economy, pledged to push for less austerity and more growth in the region.

On Tuesday the euro weakened for a seventh day against the dollar as Greek politicians struggled to form a new government after elections on the weekend raised the prospect of the country withdrawing from the currency bloc. The pound dropped against the dollar as a report showed U.K. house prices fell in April. The pound declined from within two U.S. cents of an eight- month high against the dollar after an industry report showed a gauge of house prices declined.

On Wednesday the euro weakened for an eighth day against the dollar as Greek politicians struggled to form a new government, fueling concern the nation will leave Europe’s currency union. The 17-nation currency extended its run of losses to the longest since September 2008 as Spain’s 10-year bond yields climbed back above 6 percent. Euro area leaders from the European Central Bank’s Joerg Asmussen to German Finance Minister Wolfgang Schaeuble have begun to raise doubts that Greece can stay in the monetary union. Growth in German exports slowed to 0.9 percent in March from 1.5 percent in February, the Federal Statistics Office in Wiesbaden said.

On Thursday the euro rose from a three-month low as Europe’s bailout fund confirmed that aid to Greece had been received and officials said progress was made forming a government, easing concern the nation will leave the monetary union. Greece’s socialist leader Evangelos Venizelos said he saw the first “good omen” in four days of attempts to form a coalition government and avert a new election. Greece “can continue to function with the disbursement,” commission spokesman Olivier Bailly told reporters in Brussels after yesterday’s European Financial Stability Facility decision to disburse immediately only 4.2 billion euros ($5.4 billion) of a 5.2 billion-euro loan tranche. The remaining 1 billion euros will be “disbursed in due time to cover future needs.”

On Friday the euro weakened for a second week, touching a three-month low versus the dollar, as concern builds that Greece may be forced to withdraw from the currency union with the nation’s politicians unable to form a government. The 17-nation currency rose earlier after the leader of Greece’s New Democracy Party said four parties have vowed to remain in the euro if they form part of the next administration. Gross domestic product in the euro area will drop 0.3 percent this year, the European Commission said, reiterating a February forecast. Greece will have the deepest contraction, with GDP shrinking 4.7 percent, while the economies of Spain and Italy are seen falling 1.8 percent and 1.4 percent, respectively.

Resistance 3: Y81.20 (area of 38,2% FIBO Y84,20-Y79,40, МА (200) on Н4)

Resistance 2: Y80.50/55 (area of May 2-3 high)

Resistance 1: Y80.15 (session high)

The current price: Y80.02

Support 1: Y79.70 (May 11 low)

Support 2: Y79.40 (May 9 low)

Support 3: Y79.15 (61,8% FIBO Y76.00-Y84.20)

Asia Pacific stocks ended session mixed as speculation heightened Greece may exit from the single European currency, countering China’s efforts to shore up economic growth by cutting the level of cash banks must set aside as reserves.

Nikkei 8,973.84 +20.53 +0.23%

S&P/ASX 4,297 +11.93 +0.28%

Hang Seng 19,742.39 -222.24 -1.11%

Shanghai Composite 2,380.73 -14.26 -0.60%

Shares of China Longyuan Power tumbled 11% after saying it plans to issue no more than 1.36 billion new H- shares, representing as much as 50 percent of total issued shares.

Shares of NCsoft Corp., an online-game maker, dropped 11%. Its rival Blizzard Entertainment, plans to launch its Diablo III game tomorrow.

Shares of NGK Insulators Ltd., a ceramic maker, jumped 8.1% after the Nikkei newspaper said the company plans to resume sodium-battery production as early as July.

Shares of Westgold Resources Ltd., an Australian goldminer, surged 17% in Sydney after saying it will merge with a tin and nickel miner Metals X Ltd., which dropped 8.1%.

Asian stocks dropped after JPMorgan Chase & Co. said it had a $2 billion trading loss and China’s industrial output grew at a slower pace, while production at Indian factories unexpectedly contracted.

Сhina’s industrial output growth slowed to 9.3% percent last month from 11.9% in March, missing economist’s estimates, according to data released today by the government. A separate report showed the country’s inflation rate was below the government’s target for a third month.

Sony Corp. tumbled 6.4% in Tokyo, heading for its lowest close since 1980, after the maker of Bravia televisions and PlayStation game consoles forecast half as much profit as analysts were expecting.

Genting Singapore Plc sank 3.6% as the theme park and casino operator posted lower first-quarter net income.

Noble Group Ltd. lost 1.7% in Singapore after Asia’s biggest listed commodities trader posted first- quarter earnings that missed analysts’ estimates.

European stocks gained for a second day, rallying from earlier losses, as U.S. consumer confidence rose to a four-year high in May and talks continued on forming a Greek government.

In the U.S., consumer confidence rose in May to the highest level in four years, indicating falling fuel costs are helping households look past weaker employment growth.

In Greece, Evangelos Venizelos, the socialist Pasok leader, will press counterparts on a proposal for a unity government that would avert a new election.

Stocks earlier fell after Spain said it will force the country’s banks to increase provisions against losses on real estate loans by 30 billion euros ($38 billion) and will hire two auditors to gauge all the assets of lenders in the government’s fourth attempt to clean up the financial system.

A gauge of European banks was the second-worst performer of the 19 industry groups in the Stoxx 600, with Barclays Plc dropping 2.9 percent to 202.8 pence.

Credit Agricole SA, France’s third-largest bank by market value, lost 1 percent to 3.46 euros after it said first-quarter profit fell to 252 million euros from 1 billion euros a year earlier, hurt by Greek losses.

Telefonica SA, Spain’s largest phone company, declined 1.3 percent to 11.17 euros. First-quarter operating income before depreciation and amortization was 5.08 billion euros, falling short of the 5.23 billion-euro analyst estimate. Revenue in the first quarter was 15.51 billion euros, more than the average analyst estimate of 15.43 billion euros. The company reiterated its full-year targets.

A gauge of European carmakers was the best performing group in the Stoxx 600. Renault SA and Pirelli & C SpA jumped 5 percent to 33.19 euros, and 4.3 percent to 8.90 euros, respectively. Nissan Motor Co., Japan’s second-biggest automaker, forecast profit will rise to the highest in five years, helped by rising demand for its vehicles in the U.S. and China.

U.S. stocks fell, sending the Standard & Poor’s 500 Index to a two-month low, as a slump in banks driven by JPMorgan (JPM) Chase & Co.’s $2 billion trading loss overshadowed an increase in a gauge of consumer confidence.

Stocks fell as JPMorgan’s chief investment office, run by Ina Drew, 55, took flawed positions on synthetic credit securities that remain volatile and may cost an additional $1 billion this quarter or next. Concern about the financial industry overshadowed data showing consumer confidence rose in May to the highest level in four years.

Financial shares, which comprise 15 percent of the S&P 500, dropped 1.2 percent for the biggest decline among 10 industries. JPMorgan sank 9.3 percent as Chief Executive Officer Jamie Dimon said the lender made “egregious” mistakes and trading losses were “self inflicted.” More than 216 million JPMorgan shares traded, breaking the prior one-day record set in 2008. Bank of America Corp. (BAC) and Citigroup Inc. fell at least 1.9 percent.

Nordstrom Inc. dropped 4.8 percent to $50.96. The U.S. chain with more than 100 namesake department stores posted first-quarter profit that trailed analysts’ estimates as expenses for e-commerce investments increased.

Nvidia Corp. jumped 6.4 percent to $13.21 after predicting second-quarter sales that exceeded analysts’ estimates, bolstered by demand for its new graphics chips and mobile-phone processors.

Bed Bath & Beyond Inc. gained 4.1 percent to $71.55. The company was raised to the equivalent of buy at Credit Suisse Group AG. The share-price estimate is $91.

Resistance 3: Chf0.9410 (Jan 19 high)

Resistance 2: Chf0.9380 (Jan 23 high)

Resistance 1: Chf0.9330 (high of Mar)

The current price: Chf0.9319

Support 1: Chf0.9305 (session low)

Support 2: Chf0.9255/70 (area of May 10-11 low)

Support 3: Chf0.9190/80 (area of May 4 high, May 7-8 low)

Resistance 3 : $1.6240 (May 1-2 high)

Resistance 2 : $1.6180/00 (area of May 7-10 high)

Resistance 1 : $1.6130 (a high of the European session on May 11)

The current price: $1.6067

Support 1 : $1.6050 (session low)

Support 2 : $1.6035 (Apr 20 low)

Support 3 : $1.6000 (61,8% FIBO $1,5820-$1,6300, Apr 19 low, psychological level)

Resistance 3 : $1.3120 (МА (100) for D1)

Resistance 2 : $1.3070/80 (area of May 4 low, May 7-8 high)

Resistance 1 : $1.2960/80 (area of May 10-11 high)

The current price: $1.2888

Support 1 : $1.2870 (Jan 23 low)

Support 2 : $1.2810 (Jan 17 high)

Support 3 : $1.2730 (Jan 18 high)

01:30 Australia Home Loans March -2.5% -1.7%

02:25 Australia RBA Assist Gov Lowe Speaks -

06:00 Japan Prelim Machine Tool Orders, y/y April +2.4%

07:15 Switzerland Producer & Import Prices, m/m April +0.3% +0.4%

07:15 Switzerland Producer & Import Prices, y/y April -2.0% -2.1%

09:00 Eurozone Industrial production, (MoM) March +0.5% +0.5%

09:00 Eurozone Industrial Production (YoY) March -1.8% -1.4%

15:45 Switzerland SNB Chairman Jordan Speaks

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.