- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

(raw materials / closing price /% change)

Oil 47.89 +0.36%

Gold 1,275.50 +0.10%

(index / closing price / change items /% change)

Nikkei 225 16,466.4 +54.19 +0.33 %

Hang Seng 19,883.95 +164.66 +0.84 %

S&P/ASX 200 5,358.95 +29.96 +0.56 %

Shanghai Composite 2,850.93 +23.83 +0.84 %

FTSE 100 6,151.4 +12.90 +0.21 %

CAC 40 4,312.28 -7.71 -0.18 %

Xetra DAX 9,952.9 +90.78 +0.92 %

S&P 500 2,066.66 +20.05 +0.98 %

NASDAQ Composite 4,775.46 +57.78 +1.22 %

Dow Jones 17,710.71 +175.39 +1.00 %

(pare/closed(GMT +3)/change, %)

EUR/USD $ 1,1314 +0,07%

GBP/USD $1,4408 +0,35%

USD/CHF Chf0,9774 +0,21%

USD/JPY Y109,06 +0,40%

EUR/JPY Y123,39 +0,45%

GBP/JPY Y157,13 +0,75%

AUD/USD $0,7289 +0,30%

NZD/USD $0,6782 +0,24%

USD/CAD C$1,2893 -0,34%

(time / country / index / period / previous value / forecast)

01:30 Australia New Motor Vehicle Sales (MoM) April 2.2%

01:30 Australia New Motor Vehicle Sales (YoY) April 4.2%

01:30 Australia RBA Meeting's Minutes

04:30 Japan Industrial Production (MoM) (Finally) March -5.2% 3.6%

04:30 Japan Industrial Production (YoY) (Finally) March -1.2% 0.1%

07:15 Switzerland Producer & Import Prices, m/m April 0%

07:15 Switzerland Producer & Import Prices, y/y April -4.7%

08:30 United Kingdom Producer Price Index - Output (MoM) April 0.3% 0.3%

08:30 United Kingdom Producer Price Index - Output (YoY) April -0.9% -0.8%

08:30 United Kingdom Producer Price Index - Input (MoM) April 2.0% 1.1%

08:30 United Kingdom Producer Price Index - Input (YoY) April -6.5%

08:30 United Kingdom Retail Price Index, m/m April 0.4%

08:30 United Kingdom Retail prices, Y/Y April 1.6% 1.5%

08:30 United Kingdom HICP, m/m April 0.4% 0.3%

08:30 United Kingdom HICP, Y/Y April 0.5% 0.5%

08:30 United Kingdom HICP ex EFAT, Y/Y April 1.5% 1.4%

09:00 Eurozone Trade balance unadjusted March 19 22.5

10:00 Germany Bundesbank Monthly Report

12:30 Canada Manufacturing Shipments (MoM) March -3.3% -1.3%

12:30 U.S. Housing Starts April 1089 1130

12:30 U.S. Building Permits April 1076 1140

12:30 U.S. CPI, m/m April 0.1% 0.3%

12:30 U.S. CPI excluding food and energy, Y/Y April 2.2% 2.1%

12:30 U.S. CPI, Y/Y April 0.9% 1.1%

12:30 U.S. CPI excluding food and energy, m/m April 0.1% 0.2%

13:15 U.S. Capacity Utilization April 74.8% 75%

13:15 U.S. Industrial Production (MoM) April -0.6% 0.3%

13:15 U.S. Industrial Production YoY April -2%

22:45 New Zealand PPI Input (QoQ) Quarter I -1.2%

22:45 New Zealand PPI Output (QoQ) Quarter I -0.8%

23:50 Japan GDP, q/q (Preliminary) Quarter I -0.3% 0.1%

23:50 Japan GDP, y/y (Preliminary) Quarter I -1.1% 0.2%

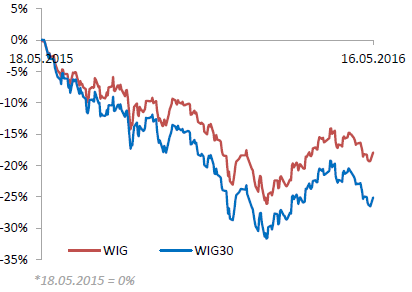

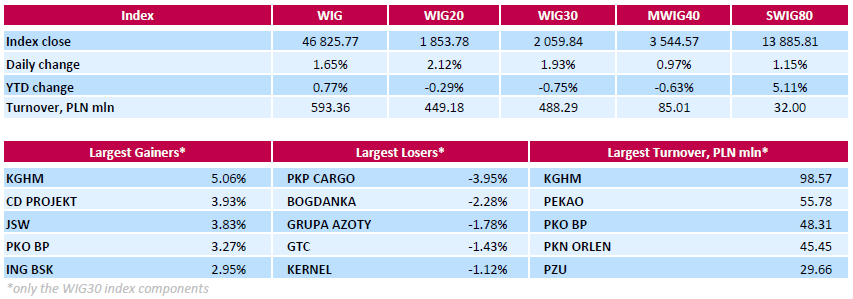

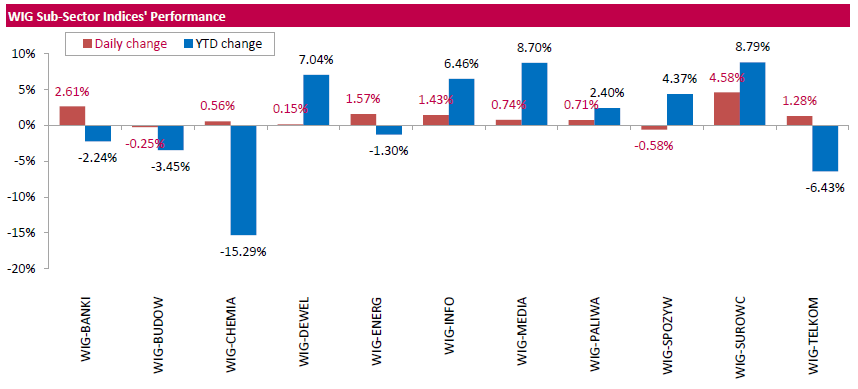

Polish equity market closed higher on Monday. The broad market measure, the WIG Index, surged by 1.65%. Except for food sector (-0.58%) and construction (-0.25%), every sector in the WIG Index rose, with materials (+4.58%) outperforming.

The large-cap stocks' measure, the WIG30 Index, rose by 1.93%. There were only five decliners among the index components. Railway freight transport operator PKP CARGO (WSE: PKP) was the worst-performing name, tumbling by 3.95% after the company reported Q1 net loss of PLN 66 mln, deeper than the expected loss of PLN 44 mln. Other laggards were thermal coal miner BOGDANKA (WSE: LWB), chemical producer GRUPA AZOTY (WSE: ATT), property developer GTC (WSE: GTC) and agricultural producer KERNEL (WSE: KER), losing between 1.12% and 2.28%. At the same time, copper producer KGHM (WSE: KGH) became the strongest advancer with a 5.06% gain. On Friday, the company reported its net profit reached PLN 161 mln in Q1, above the analysts' forecasts of PLN 101 mln. KGHM also stated it was delaying the next phase of expansion at its key overseas mine in Chile as stubbornly low metals prices more than halved its net profit in Q1. Oher major outperformers were videogame developer CD PROJEKT (WSE: CDR), coking coal producer JSW (WSE: JSW) and banking name PKO BP (WSE: PKO), climbing by 3.93%, 3.83% and 3.27% respectively.

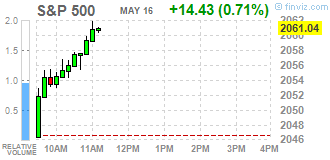

Major U.S. stock-indexes higher on Monday, following a bruising week, helped by Apple and a surge in oil prices. Apple (AAPL) shares rose more 3% after Warren Buffett's Berkshire Hathaway reported a stake worth about $1 billion in the iPhone maker. Oil jumped near 3% to its highest since November 2015 on growing Nigerian output disruptions and after Goldman Sachs said the market had ended almost two years of oversupply and flipped to a deficit.

Most of Dow stocks in positive area (25 of 30). Top looser - The Walt Disney Company (DIS, -0,71). Top gainer - Apple Inc. (AAPL, +3,34%).

All S&P sectors also in positive area. Top gainer - Basic Materials (+2,3%).

At the moment:

Dow 17608.00 +113.00 +0.65%

S&P 500 2057.00 +13.50 +0.66%

Nasdaq 100 4358.00 +34.00 +0.79%

Oil 47.57 +1.36 +2.94%

Gold 1276.50 +3.80 +0.30%

U.S. 10yr 1.75 +0.04

In the afternoon, we met the weaker reading from the US - NY Empire State index. This index starts a series of regional data on the economic situation in the industry. Its May reading was not quite successful, as clearly go down from nearly 10 to -9. It might seem that a weaker dollar should support the economic situation in industry, and as we may see is not so easy. Same regional data are not so relevant, however after Friday break (related to better reporting of sales) a return to the negative trend on the front of macroeconomic data would be detrimental to the stock market bulls.

U.S. Stocks open: Dow +0.15%, Nasdaq +0.27%, S&P +0.18%

The market in the United States opens with a cosmetic upward. The market on Wall Street on one side weakens, but on the other maintains consolidation. However, the chance of the pit out grows, which would pose quite negative consequences also for the Warsaw Stock Exchange.

USDJPY 109.10 (USD 503m) 111.00 (1.82bln)

EURUSD: 1.1255 (EUR 299m) 1.1300 (225m) 1.1350 (251m) 1.1395-1.1400 (854m) 1.1430 (556m)

GBPUSD 1.14450 (GBP 319m)

EURGBP 0.7802 (EUR 269m)

USDCHF 0.9600 (USD 320m)

AUDUSD 0.7200 (AUD 381m) 0.7260 (381m) 0.7235 (229m) 0.7450 (353m) 0.7500 (395m)

U.S. stock-index futures were little changed.

Global Stocks:

Nikkei 16,466.4 +54.19 +0.33%

Hang Seng 19,883.95 +164.66 +0.84%

Shanghai Composite 2,850.93 +23.83 +0.84%

FTSE 6,111.62 -26.88 -0.44%

CAC 4,283.61 -36.38 -0.84%

DAX Closed

Crude $47.30 (+2.36%)

Gold $1287.90 (+1.19%)

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 9.26 | 0.06(0.6522%) | 38045 |

| Amazon.com Inc., NASDAQ | AMZN | 712 | 2.08(0.293%) | 24354 |

| Apple Inc. | AAPL | 92 | 1.48(1.635%) | 1331192 |

| AT&T Inc | T | 38.86 | -0.29(-0.7407%) | 21268 |

| Barrick Gold Corporation, NYSE | ABX | 18.85 | 0.44(2.39%) | 152918 |

| Boeing Co | BA | 131 | -1.12(-0.8477%) | 1018 |

| Caterpillar Inc | CAT | 70.12 | 0.05(0.0714%) | 1600 |

| Chevron Corp | CVX | 101.5 | 0.76(0.7544%) | 5049 |

| Cisco Systems Inc | CSCO | 26.55 | 0.02(0.0754%) | 2881 |

| Citigroup Inc., NYSE | C | 43.09 | -0.02(-0.0464%) | 21981 |

| E. I. du Pont de Nemours and Co | DD | 63.17 | 0.26(0.4133%) | 400 |

| Exxon Mobil Corp | XOM | 89.1 | 0.44(0.4963%) | 4124 |

| Facebook, Inc. | FB | 119.96 | 0.15(0.1252%) | 94099 |

| Ford Motor Co. | F | 13.25 | 0.03(0.2269%) | 50113 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 10.7 | 0.29(2.7858%) | 455524 |

| General Electric Co | GE | 29.57 | -0.07(-0.2362%) | 12407 |

| General Motors Company, NYSE | GM | 30.57 | 0.05(0.1638%) | 5432 |

| Goldman Sachs | GS | 155.11 | -0.23(-0.1481%) | 970 |

| Home Depot Inc | HD | 133.61 | 0.48(0.3606%) | 6812 |

| Intel Corp | INTC | 29.92 | 0.01(0.0334%) | 801 |

| International Business Machines Co... | IBM | 147.7 | -0.02(-0.0135%) | 3388 |

| McDonald's Corp | MCD | 129.25 | 0.42(0.326%) | 1360 |

| Microsoft Corp | MSFT | 51.04 | -0.04(-0.0783%) | 3431 |

| Nike | NKE | 57.51 | 0.20(0.349%) | 500 |

| Pfizer Inc | PFE | 33 | -0.19(-0.5725%) | 7433 |

| Procter & Gamble Co | PG | 80.4 | -0.83(-1.0218%) | 4948 |

| Starbucks Corporation, NASDAQ | SBUX | 55.94 | 0.12(0.215%) | 2770 |

| Tesla Motors, Inc., NASDAQ | TSLA | 208.5 | 0.89(0.4287%) | 13493 |

| The Coca-Cola Co | KO | 45.25 | -0.10(-0.2205%) | 348 |

| Twitter, Inc., NYSE | TWTR | 14.21 | 0.11(0.7801%) | 11867 |

| UnitedHealth Group Inc | UNH | 129 | 0.00(0.00%) | 320 |

| Verizon Communications Inc | VZ | 50.95 | 0.01(0.0196%) | 1725 |

| Visa | V | 76.9 | 0.07(0.0911%) | 4383 |

| Wal-Mart Stores Inc | WMT | 64.7 | -0.24(-0.3696%) | 5384 |

| Walt Disney Co | DIS | 100.55 | 0.03(0.0298%) | 1527 |

| Yahoo! Inc., NASDAQ | YHOO | 37 | 0.52(1.4254%) | 89287 |

| Yandex N.V., NASDAQ | YNDX | 19.52 | 0.00(0.00%) | 2050 |

Upgrades:

Downgrades:

Bank of America (BAC) downgraded to Mkt Perform from Outperform at Keefe Bruyette

Other:

Microsoft (MSFT) initiated with a Hold at Canaccord Genuity

Freeport-McMoRan (FCX) target raised to $15 from $10 at Cowen

EUR/USD

Offers 1.1325-30 1.1350 1.1380 1.1400 1.1430 1.1450-60 1.1475-80 1.1500

Bids 1.1300 1.1280-85 1.1270 1.1250 1.1230 1.1200 1.1185 1.1165 1.1150

GBP/USD

Offers 1.4375-85 1.4400 1.4420 1.4435 1.4450 1.4460 1.4480 1.4500 1.4530 1.4550

Bids 1.4330 1.4300-10 1.4275-80 1.4250 1.4230 1.4200 1.14180 1.4150

EUR/GBP

Offers 0.7900 0.7920 0.7930 0.7950 0.7980 0.8000 0.8020 0.8050

Bids 0.7865-70 0.7845-50 0.7830 0.7820 0.7800 0.7780 0.7760 0.7735 0.7700

EUR/JPY

Offers 123.80 124.00 124.30 124.50 124.70-75 125.00 125.30 125.50 126.00

Bids 123.00 122.80 122.50 122.00 121.70121.50 121.00

USD/JPY

Offers 108.85 109.00 109.20109.50 109.80 110.00 110.30 110.50

Bids 108.50 108.30 108.20 108.00 107.85 107.60 107.20-25 107.00

AUD/USD

Offers 0.7300 0.7325 0.7340 0.7380 0.7400 0.7420-25 0.7450

Bids 0.7280 0.7270 0.7250 0.7200 0.7185 0.7165 0.7150 0.7100

Characteristics of today's trading on the Warsaw Stock Exchange are quite different from those of the environment. The German market is closed, which reduces the activity on other floors of Euroland. London is not too active today, but nevertheless looks better than Paris. In Warsaw, the WIG20 maintains levels close to session highs. If the result of the session are sustained till the end of the session, this could signify a change of market's attitude and direction, albeit on a less than impressive turnover.

In the mid-session, the WIG 20 index reached the level of 1,950 points (+1,93%) with turnover of PLN 190 mln.

USD/JPY 109.10 (USD 503m) 111.00 (1.82bln)

EUR/USD: 1.1255 (EUR 299m) 1.1300 (225m) 1.1350 (251m) 1.1395-1.1400 (854m) 1.1430 (556m)

GBP/USD 1.14450 (GBP 319m)

EUR/GBP 0.7802 (EUR 269m)

USD/CHF 0.9600 (USD 320m)

AUD/USD 0.7200 (AUD 381m) 0.7260 (381m) 0.7235 (229m) 0.7450 (353m) 0.7500 (395m)

Warsaw futures market (WSE: FW20M16) began from increase by 0.88% to 1,838 points. So we opened up with a gap above the main volatility of the last three sessions and in the vicinity of the next psychological level of 1,850 points.

WIG20 index opened at 1829.37 points (+0.77%)*

WIG 46463.09 0.87%

WIG30 2042.66 1.08%

mWIG40 3515.79 0.15%

*/ - change to previous close

Due to Moody's, we have a good chance to create today trade on their own, in complete isolation from the environment. Due to closed markets (Pentecost) in Germany, Switzerland, Hungary and Norway we may say that will saves us a bit of the skin. In "normal" conditions it will mean for our parquet likely solid apathy. With Moody's we have a chance to avoid the stagnation today.

On Saturday early morning we met a long-awaited decision by Moody's rating on the Polish debt. In the context of the same expectations veer between the credit rating declines we may speak about a positive surprise, as the same rating remained unchanged. It has been reduced only his perspective, to negative.

Such a turn of events the morning is positively reflected in the domestic currency, which abruptly strengthened to most currencies of approx. 0.7%.

The positive impact should also be seen on the stock exchange, which should be supported in the defense area level of 1,800 points. As a rule, the impact of the rating on the stock exchange should be less than what is observed in the case of currency or bonds.

Another factor affecting the Warsaw Stock Exchange is the external situation. This is heterogeneous. Friday's session on Wall Street was poor and characterized by a decline of nearly 0.9%. As shown the last Thursday, it does not necessarily mean clearly a difficult session in Europe, although the start probably will not belong to particularly successful ones. As a support can be a neutral behavior of Asian parquets despite weaker economic data from China indicated during the weekend. The beginning of the Asian session was even positive, but the end of it runs in bad moods.

EUR / USD

Resistance levels (open interest**, contracts)

$1.1454 (5065)

$1.1424 (2680)

$1.1378 (1218)

Price at time of writing this review: $1.1310

Support levels (open interest**, contracts):

$1.1262 (3773)

$1.1218 (5748)

$1.1154 (9281)

Comments:

- Overall open interest on the CALL options with the expiration date June, 3 is 67303 contracts, with the maximum number of contracts with strike price $1,1600 (5173);

- Overall open interest on the PUT options with the expiration date June, 3 is 88433 contracts, with the maximum number of contracts with strike price $1,1200 (9281);

- The ratio of PUT/CALL was 1.31 versus 1.38 from the previous trading day according to data from May, 13

GBP/USD

Resistance levels (open interest**, contracts)

$1.4605 (2313)

$1.4508 (2398)

$1.4412 (554)

Price at time of writing this review: $1.4362

Support levels (open interest**, contracts):

$1.4290 (2350)

$1.4193 (2842)

$1.4095 (1355)

Comments:

- Overall open interest on the CALL options with the expiration date June, 3 is 30621 contracts, with the maximum number of contracts with strike price $1,4500 (2398);

- Overall open interest on the PUT options with the expiration date June, 3 is 32737 contracts, with the maximum number of contracts with strike price $1,4200 (2842);

- The ratio of PUT/CALL was 1.07 versus 1.11 from the previous trading day according to data from May, 13

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

European stocks finished higher on Friday as a better-than-expected report on U.S. retail sales lifted sentiment, easing fears that the world's largest economy isn't heading for a slowdown. The weekly advance comes even as investors world-wide this week have been wrestling with a crop of lackluster corporate earnings, including a run of poor results from U.S. retailers.

U.S stocks tumbled Friday, notching another weekly loss for the three main benchmarks. Shares dropped as a strong report on U.S. retail sales failed to assuage investor worries about the troubled sector. Meanwhile, a drop in crude-oil futures weighed on energy shares and deflated investors' appetite for risky assets.

Buoyant Japanese stocks led Asian stocks to modest gains on Monday, helping to offset some of the gloom from soft Chinese data, while the dollar firmed against the euro and yen after receiving a boost from upbeat U.S. indicators. It held the gains despite a denial by Japan's top government spokesman on Monday that Prime Minister Shinzo Abe has decided to delay the tax hike.

Based on MarketWatch materials

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.