- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

European stocks climbed the most in a month amid speculation that China and the euro area will do more to stimulate global economic growth.

China plans to speed up approval of infrastructure projects and allocate construction funding faster to aid growth, the China Securities Journal reported.

Germany’s Chancellor, Angela Merkel, said she may disagree with France’s President, Francois Hollande, on how to tackle the sovereign-debt crisis at a meeting on May 23.

Germany will consider all ideas on bolstering euro-area growth, Finance Minister Wolfgang Schaeuble said as he and his French counterpart, Pierre Moscovici, met.

National benchmark indexes climbed in 16 of the 18 western- European markets. The U.K.’s FTSE 100 and France’s CAC 40 advanced 1.9 percent. Germany’s DAX increased 1.7 percent.

Vodafone gained 4.2 percent to 172 pence. Europe’s largest mobile-phone company said fourth-quarter service revenue excluding currency swings and acquisitions increased 2.3 percent. It rose 0.9 percent in the previous quarter. Analysts had estimated growth of 1.7 percent.

Sonova tumbled 9.9 percent to 84.10 francs. The maker of Phonak hearing aids reported full-year earnings that missed analysts’ estimates as the strength of the Swiss franc reduced the value of sales from outside its domestic market.

The yen weakened the most in a month against the dollar after Fitch Ratings cut Japan’s credit ranking, saying the nation isn’t acting quickly enough to tackle its public debt burden. Fitch lowered Japan’s long-term, foreign-currency ranking to A+ from AA, and cut the local-currency grade to A+ from AA-, the company said in a statement. The outlooks on both are negative, it said. Japan’s currency fell versus all its 16 major peers as the central bank started a two-day meeting amid speculation it will boost stimulus measures to spur flagging growth. Japanese Finance Minister Jun Azumi told reporters today he expects the Bank of Japan to take appropriate steps in a timely manner. He said he regards highly the steps taken by the central bank since February. The BOJ expanded its asset-purchase program in February and April.

The euro dropped toward a four-month low against the greenback after the Organization for Economic Cooperation and Development said Europe’s debt crisis risks spiraling. Gross domestic product in the euro region will shrink 0.1 percent this year and expand 0.9 percent in 2013 instead of posting growth of 0.2 percent and 1.4 percent as predicted last November, the Paris-based organization said. German Chancellor Angela Merkel said yesterday she won’t shy away from disagreeing with French President Francois Hollande at the European Union summit beginning tomorrow in Brussels.

The pound snapped a two-day gain versus the dollar as the IMF said more stimulus such as quantitative easing, or QE, was needed to boost the economy. A government report showed inflation slowed in April more than economists forecast.

U.S. stocks rose, following the biggest gain in two months for the Standard & Poor’s 500 Index, amid economic optimism as housing data beat estimates while investors speculated China and Europe will stimulate growth.

Stocks gained today as purchases of previously owned houses increased to a 4.62 million annual rate. The China Securities Journal said the nation plans to speed up approval of infrastructure projects and allocate construction funding faster to improve growth. European Union leaders are preparing to gather in Brussels tomorrow to discuss how to revive growth.

JPMorgan (JPM) climbed 4.2 percent to $34.18. It had tumbled 20 percent since it announced $2 billion in trading losses on May 10. Citigroup Inc. gained 3.1 percent to $27.07. Bank of America Corp. (BAC) rose 2.9 percent to $7.03.

Urban Outfitters Inc. climbed 6.2 percent to $27.78. The retailer that rehired co-founder Richard Hayne as chief executive officer this year reported first-quarter profit that beat analysts’ estimates on record sales.

Ralph Lauren Corp. added 1.3 percent to $148.17. The retailer of its namesake brand clothing reported profit that beat analysts’ estimates because of sales gains at its own shops and department stores.

Facebook, the social networking site that raised $16 billion in an initial public offering, fell 4.5 percent to $32.50. The offering valued Facebook at 107 times trailing 12- month earnings, more than every S&P 500 member except Amazon.com Inc. and Equity Residential. The slump reinforces concern that the IPO was priced too high.

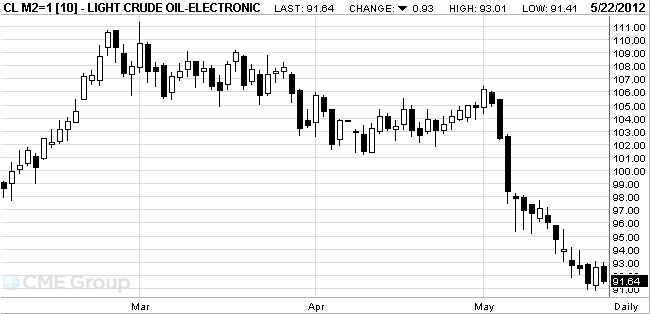

Crude slipped as Iran agreed to let Western nuclear inspectors into the country, easing concern that the conflict over its atomic energy program would disrupt Mideast supplies.

Prices fell as much as 0.8 percent after Yukiya Amano, secretary-general of the International Atomic Energy Agency, announced the accord with Iran today in Vienna. The agreement between Iran and the IAEA will be signed “quite soon,” Amano told journalists in Vienna after returning from Tehran, where the deal was reached yesterday. Negotiators are set to head to Baghdad tomorrow for a second round of talks over Iran’s nuclear program.

The Organization for Economic Cooperation and Development said Europe’s debt crisis risks spiraling and seriously damaging the world economy. Oil also fell after OECD Chief Economist Pier Carlo Padoan said “the risk is increasing of a vicious circle, involving high and rising sovereign indebtedness, weak banking systems, excessive fiscal consolidation and lower growth.”

U.S. crude inventories probably rose 1.5 million barrels last week, a Bloomberg News survey showed before an Energy Department report tomorrow. It would be the ninth week of gains. Gasoline supplies probably fell 500,000 barrels and distillate fuels, which include heating oil and diesel, also dropped 500,000, according to the survey.

Oil for June delivery slid to $91.41 a barrel on the New York Mercantile Exchange. Brent oil for July settlement gained 4 cents to $108.85 a barrel on the London-based ICE Futures Europe exchange.

Gold under pressure from cheaper strong dollar. Euro weakens against the dollar on the eve of an informal meeting of EU leaders, which will be held on Wednesday and will be dedicated to the fight with the debt crisis in the eurozone.

French President Francois Hollande has combined debts of European countries, and German Chancellor Angela Merkel against the idea.

Gold typically moves in one direction with the euro, so the weakness of the single currency in the region led investors to sell gold in a position to realize profits in local currency.

The cost of the June gold futures on the COMEX fell today to $ 1572.0 an ounce.

Resistance 3:1346 (May 15 high)

Resistance 2:1340 (May 16 high)

Resistance 1:1330 (May 17 high)

Current price: 1323,00

Support 1:1312 (session low)

Support 2:1293 (area of May 18, 21 European session lows)

Support 3:1240 (area of May 18, 21 lows)

EUR/USD $1.2700, $1.2750, $1.2790 $1.2800, $1.2825.

USD/JPY Y79.25, Y79.50, Y80.00

GBP/USD $1.5800, $1.5900

EUR/GBP stg0.8075, stg0.7960

AUD/USD $0.9930, $1.0000

USD/CAD C$1.0200, C$1.0000

U.S. stock futures were little changed as investors speculated China and Europe will stimulate growth.

Global Stocks:

Nikkei 8,729.29 +95.40 +1.10%

Hang Seng 19,039.15 +116.83 +0.62%

Shanghai Composite 2,373.31 +25.01 +1.06%

FTSE 5,363.37 +58.89 +1.11%

CAC 3,061.55 +34.40 +1.14%

DAX 6,393.89 +62.85 +0.99%

Crude Oil $92.18 (-0.42%)

Gold $1579.50 (-0.58%)

Data:

08:30 United Kingdom HICP, m/m April +0.3% +0.6% +0.6%

08:30 United Kingdom HICP, Y/Y April +3.5% +3.1% +3.0%

08:30 United Kingdom HICP ex EFAT, Y/Y April +2.5% +2.2% +2.1%

08:30 United Kingdom Retail Price Index, m/m April +0.4% +0.6% +0.7%

08:30 United Kingdom Retail prices, Y/Y April +3.6% +3.5% +3.5%

08:30 United Kingdom RPI-X, Y/Y April +3.7% +3.5% +3.5%

08:30 United Kingdom PSNB, bln April 15.9 -5.4 -18.8

The yen weakened after Fitch Ratings cut Japan’s credit ranking, saying the nation isn’t acting quickly enough to tackle its public debt burden.

The euro dropped after the Organization for Economic Cooperation and Development said Europe’s debt crisis risks spiraling.

The pound weakened as the International Monetary Fund said the U.K. needs more monetary easing.

EUR/USD: the pair fell in $1,2740 area.

GBP/USD: the pair decreased, reached $1,5770 area.

USD/JPY: the pair rose in Y79.80 area.

US data starts at 1400GMT with NAR existing home sales data, the Richmond Fed Manufacturing Index and also BLS Mass Layoffs data.

TeleTrade Company technical specialists developed the “TeleTRADE Analytics” application which helps to follow the changes in exchange rates, news updates as well as receive current market data analytics in real-time mode.

The application is totally for free and designed for such mobile devices as smartphones and tablet PCs with iOS and Android.

Features:

Quotations in main currencies with the list of display symbols and update rates set-up.

Economic calendar – tool for fundamental analyses which provides insight into upcoming market events

News line – crucial macroeconomic data and news that affect markets

Officials’ commentaries that include statements of leaders of major world countries, central banks and main financial world institutions spokesmen.

Analytical reviews provided by TeleTRADE Company experts regarding the world main trading floors situations

Interest rates – central banks current rates and their dynamics

Desktop widgets (2х1, 2х2).

In order to start using the application please download and install it onto your mobile device. Let us remind you that the “ TeleTRADE Analytics” is totally free and its users do not have to pay any subscription fee.

Use Google Play and Apple AppStore for downloading and installing this application

EUR/USD

Offers $1.2875, $1.2850, $1.2840/45, $1.2810

Bids $1.2710/00, $1.2685/80, $1.2640, $1.2625

GBP/USD

Offers $1.6000, $1.5950/55, $1.5900/10, $1.5880, $1.5850/60, $1.5795/805

Bids $1.5760/50, $1.5835/30, $1.5720, $1.5700

USD/JPY

Offers Y80.00

Bids Y78.80, Y78.55/50, Y78.00

EUR/JPY

Offers Y102.70/75, Y102.50, Y102.30/40, Y102.00

Bids Y100.90/85, Y100.50, Y100.00, Y99.80

Resistance 3: Y81.00 (38,2 % FIBO Y84,20-Y79,00)

Resistance 2: Y80.55/60 (area of high of May)

Resistance 1: Y79.85 (session high, May 18 high)

Current price: Y79.28

Support 1: Y79.50 (earlier resistance, May 18-21 highs)

Support 2: Y79.00 (session high)

Support 3: Y78.55 (МА(200) for D1)

Resistance 3: Chf0.9600 (area of high of January)

Resistance 2: Chf0.9500 (May 18 high)

Resistance 1: Chf0.9440 (May 21 high)

Current price: Chf0.9416

Support 1: Chf0.9370 (area of session low, May 21 low and МА (200) for Н1)

Support 2: Chf0.9330 (May 15 low, 38,2 % FIBO Chf0,9040-Chf0,9500)

Support 3: Chf0.9300 (earlier resistance, area of May 9-11 high)

Комментарии: пара не сумела закрепится выше линии сопротивления от ноября 2010 года и отступила (для ее преодоления паре необходимо было прошлую неделю выше уровня Chf0,9440, однако сил покупателей было не достаточно и пара завершили неделю на отметке Chf0,9397).

Resistance 3 : $1.6020 (50,0 % FIBO $1,6300-$ 1,5730)

Resistance 2 : $1.5950 (38,2 % FIBO $1,6300-$ 1,5730)

Resistance 1 : $1.5840 (area of session high, May 18-21 highs, МА (200) and МА (100) for D1)

Current price: $1.5770

Support 1 : $1.5730 (May 18 low)

Support 2 : $1.5700 (psychological level)

Support 3 : $1.5600 (psychological level, low of March)

”Downgrades and negative outlooks reflect growing risks to Japan sovereign credit profile as a result of high and rising public debt ratios!”

EUR/USD $1.2700, $1.2750, $1.2790 $1.2800, $1.2825.

USD/JPY Y79.25, Y79.50, Y80.00

GBP/USD $1.5800, $1.5900

EUR/GBP stg0.8075, stg0.7960

AUD/USD $0.9930, $1.0000

USD/CAD C$1.0200, C$1.0000

Sold E2.526bln vs target E1.5-E2.5bln

- E1.505bln 3-month T-bill; bid-to-cover 3.95 (7.61), at avg yield 0.846% vs 0.634% prev

- E1.021bln 6-month T-bill; bid-to-cover 4 30 (3.25), at avg yield 1.737% vs 1.58% prev

Asian stocks rose for a second day on speculation China and Europe will do more to bolster economic growth, boosting the outlook for the region’s exporters.

Nikkei 225 8,729.29 +95.40 +1.10%

S&P/ASX 200 4,121 +47.38 +1.16%

Shanghai Composite 2,369.97 +21.67 +0.92%

LG Electronics Inc., South Korea’s electronics maker that depends on Europe for 16 percent of its sales, rose 7.6 percent.

Guangzhou R&F Properties Co. led Chinese developers higher as a leading index rose and after a report the country will bring forward infrastructure investment.

Woori Finance Holdings Co. jumped 6.5 percent in Seoul as South Korea’s top financial regulator said the government needs to cut its stake in the company.

03:00 New Zealand Expected Annual Inflation 2y from now Quarter II +2.5% +2.4%

The euro fell against most of its major peers before data that may show consumer sentiment slid to a four-month low amid Europe’s debt woes. A gauge of household sentiment in the euro area probably dropped to minus 20.5 this month from minus 19.9 in April, according to the median economist estimate in a Bloomberg News survey before the European Commission reports the figure today. That would be the lowest level since January.

The 17-nation currency snapped a two-day advance against the dollar as European Union leaders prepare for a summit to discuss the fiscal crisis. German Chancellor Angela Merkel said yesterday she won’t shy away from disagreeing with French President Francois Hollande at the EU summit beginning tomorrow in Brussels. Good cooperation “doesn’t exclude differing positions,” Merkel said in Chicago during a meeting of the North Atlantic Treaty Organization. Elsewhere in Europe, Greece is preparing for June 17 elections following an inconclusive May 6 ballot.

The yen remained weaker as the Bank of Japan starts a two-day meeting today amid speculation it will boost stimulus measures. Japanese Finance Minister Jun Azumi said in Tokyo today he regards highly the steps taken by the central bank since February. The BOJ expanded its asset-purchase program in February and April. Japan probably had a trade shortfall of 470.8 billion yen ($5.9 billion) last month after a revised deficit of 84.5 billion yen in March, according to the median estimate in a Bloomberg survey before the data tomorrow.

EUR/USD: during the Asian session the pair fell, receded from yesterday's low.

GBP/USD: during the Asian session the pair traded in a range $1.5805-$1.5830.

USD/JPY: during the Asian session the pair traded in range Y79.30-Y79.45.

UK data includes inflation data and also the Public Sector Finances at 0830GMT. If it comes in above 3.0% King's letter will be out at 0930 GMT, but it is only likely to echo the analysis in the May Inflation Report, that while high inflation will persist near term it is still expected to fall back below target further out. At 1000GMT, the German government gives a briefing on the upcoming EU summit, taking place in Berlin, while at 1040GMT, ECB Vice President Vitor Constancio and Atlanta Fed President Dennis Lockhart take part in a panel debate, in Hong Kong. EMU data in the European afternoon session sees the 1400GMT release of flash consumer morale data. US data starts at 1400GMT with NAR existing home sales data, the Richmond Fed Manufacturing Index and also BLS Mass Layoffs data.

03:00 New Zealand Expected Annual Inflation 2y from now Quarter II +2.5% +2.4%

The euro fell against most of its major peers before data that may show consumer sentiment slid to a four-month low amid Europe’s debt woes. A gauge of household sentiment in the euro area probably dropped to minus 20.5 this month from minus 19.9 in April, according to the median economist estimate in a Bloomberg News survey before the European Commission reports the figure today. That would be the lowest level since January.

The 17-nation currency snapped a two-day advance against the dollar as European Union leaders prepare for a summit to discuss the fiscal crisis. German Chancellor Angela Merkel said yesterday she won’t shy away from disagreeing with French President Francois Hollande at the EU summit beginning tomorrow in Brussels. Good cooperation “doesn’t exclude differing positions,” Merkel said in Chicago during a meeting of the North Atlantic Treaty Organization. Elsewhere in Europe, Greece is preparing for June 17 elections following an inconclusive May 6 ballot.

The yen remained weaker as the Bank of Japan starts a two-day meeting today amid speculation it will boost stimulus measures. Japanese Finance Minister Jun Azumi said in Tokyo today he regards highly the steps taken by the central bank since February. The BOJ expanded its asset-purchase program in February and April. Japan probably had a trade shortfall of 470.8 billion yen ($5.9 billion) last month after a revised deficit of 84.5 billion yen in March, according to the median estimate in a Bloomberg survey before the data tomorrow.

EUR/USD: during the Asian session the pair fell, receded from yesterday's low.

GBP/USD: during the Asian session the pair traded in a range $1.5805-$1.5830.

USD/JPY: during the Asian session the pair traded in range Y79.30-Y79.45.

UK data includes inflation data and also the Public Sector Finances at 0830GMT. If it comes in above 3.0% King's letter will be out at 0930 GMT, but it is only likely to echo the analysis in the May Inflation Report, that while high inflation will persist near term it is still expected to fall back below target further out. At 1000GMT, the German government gives a briefing on the upcoming EU summit, taking place in Berlin, while at 1040GMT, ECB Vice President Vitor Constancio and Atlanta Fed President Dennis Lockhart take part in a panel debate, in Hong Kong. EMU data in the European afternoon session sees the 1400GMT release of flash consumer morale data. US data starts at 1400GMT with NAR existing home sales data, the Richmond Fed Manufacturing Index and also BLS Mass Layoffs data.

Yesterday the yen declined on speculation the Bank of Japan will add to stimulus measures this week to support growth and weaken the nation’s foreign-exchange rates. Japan’s currency slid as speculation European officials may step up efforts to tackle the debt crisis damped demand for haven assets.

The euro fell before German and French officials meet today to discuss ways to contain Europe’s financial turmoil.

Australia’s dollar snapped a six-day drop against the greenback and an index of implied volatility fell.

The euro erased losses against the dollar as German Finance Minister Wolfgang Schaeuble said Germany and France will do “everything necessary” to keep Greece in the shared currency. German Finance Minister Wolfgang Schaeuble met with his newly installed French counterpart, Pierre Moscovici, in Berlin today as European Union leaders prepare for a summit meeting in Brussels on May 23.

EUR/USD: yesterday the pair gain, updated a week’s high.

GBP/USD: yesterday the pair traded in a range $1.5780-$1.5840.

USD/JPY: yesterday the pair rose and touched Friday’s high.

UK data includes inflation data and also the Public Sector Finances at 0830GMT. If it comes in above 3.0% King's letter will be out at 0930 GMT, but it is only likely to echo the analysis in the May Inflation Report, that while high inflation will persist near term it is still expected to fall back below target further out. At 1000GMT, the German government gives a briefing on the upcoming EU summit, taking place in Berlin, while at 1040GMT, ECB Vice President Vitor Constancio and Atlanta Fed President Dennis Lockhart take part in a panel debate, in Hong Kong. EMU data in the European afternoon session sees the 1400GMT release of flash consumer morale data. US data starts at 1400GMT with NAR existing home sales data, the Richmond Fed Manufacturing Index and also BLS Mass Layoffs data.

Asian stocks rose, with the regional index rebounding from its biggest drop in six months, after Premier Wen Jiabao said China will focus more on bolstering economic growth.

Nikkei 225 8,633.89 +22.58 +0.26%

S&P/ASX 200 4,073.6 +27.14 +0.67%

Shanghai Composite 2,348.3 +3.78 +0.16%

China Overseas Land & Investment Ltd., a developer controlled by the nation’s construction ministry, rose 1.5 percent in Hong Kong.

BHP Billiton Ltd. climbed 2 percent in Sydney after RBC Capital Markets said the world’s largest mining company may start a new share buyback.

Nintendo Co., a manufacturer of game consoles that gets a third of its sales in Europe, fell 1.2 percent in Tokyo. OCI Co., a petro and coal chemicals maker, slumped 4.4 percent in Seoul after delaying expansion plans because of Europe’s debt crisis.

European stocks climbed, rebounding from last week’s biggest selloff since September, as China’s pledge to boost growth outweighed concern that Greece may be forced to leave the euro area.

In China, Premier Wen Jiabao called for “putting stabilizing growth in a more important position” and refrained from mentioning concern about inflation in remarks published yesterday by the official Xinhua News Agency. China may announce stimulus actions in the near term, according to a front-page commentary today in the China Securities Journal, published by Xinhua.

German Finance Minister Wolfgang Schaeuble will, for the first time, discuss the euro at a meeting with his newly installed French counterpart, Pierre Moscovici, in Berlin today as European Union leaders prepare to meet in Brussels on May 23.

Group of Eight leaders on May 19 urged Greece to stay within the euro area as polls in the country showed a close race between parties supporting and opposing austerity measures linked to the EU-led bailout.

National benchmark indexes climbed in 12 of the 18 western European markets. The U.K.’s FTSE 100 gained 0.7 percent and Germany’s DAX increased 1 percent, while France’s CAC 40 rose 0.6 percent. Italy’s FTSE MIB lost 0.3 percent as 29 of the gauge’s companies traded without the right to their latest dividends.

Carmakers were among the biggest gainers of the 19 industry groups on the Stoxx 600, rebounding from a five-day selloff. Renault rallied 4.7 percent to 32.02 euros as UBS AG added the French carmaker to its European “key calls” list.

Fiat climbed 8.6 percent to 3.64 euros in Milan, the biggest gain in more than two months. Sanford C. Bernstein & Co. upgraded the carmaker to outperform, the equivalent of a buy recommendation, from market perform with a price estimate of 5 euros. That’s 51 percent above last week’s close.

Barclays rose 2.2 percent to 180 pence after the lender said it plans to sell its entire holding in BlackRock before the latest round of Basel rules stops it from counting the holding as capital.

Banco Popolare SC surged 19 percent to 1.04 euro cents, the biggest jump since at least July 2007, as analysts from Bank of America Corp. to Exane BNP Paribas upgraded the shares after Italy’s fourth-biggest bank said regulatory approval to use internal risk models boosted its Tier 1 capital.

Man Group Plc gained 4.7 percent to 78.8 pence, recouping some of last week’s 14 percent slump. The world’s largest publicly traded hedge fund has agreed to buy FRM Holdings Ltd., adding $8 billion of assets invested in other hedge fund managers as its own stock price sinks.

U.S. stocks rose, giving the Standard & Poor’s 500 Index its biggest rally in more than two months, after China signaled it would support growth while German and French officials said they will work to keep Greece in the euro.

Stocks rebounded from a four-month low as Chinese Premier Wen Jiabao pledged to focus more on bolstering growth. Germany and France agree that they will do “everything necessary” to ensure Greece remains in Europe’s single currency, Finance Minister Wolfgang Schaeuble said after a meeting with French Finance Minister Pierre Moscovici.

Cooper Industries jumped 25 percent, the most in almost 11 years, to $69.88. Each Cooper share will be exchanged for $39.15 in cash and 0.77479 Eaton share. That offer is valued at $72 a share based on Eaton’s May 18 closing price, 29 percent more than Cooper’s price that day.

Yahoo! Inc. advanced 1 percent to $15.58. Alibaba Group Holding Ltd., China’s largest e-commerce provider, agreed to repurchase about a 20 percent stake in itself from the U.S. Web portal for about $7.1 billion.

Facebook tumbled 11 percent to $34.03. It rose 0.6 percent in its first day of trading on May 18.

A gauge of diversified financial shares in the S&P 500 retreated. David Trone, an analyst at JMP Securities LLC, downgraded some banks including JPMorgan and Bank of America. He said risk/reward is “highly unattractive.” JPMorgan (JPM) fell 2.9 percent to $32.51. Bank of America (ВАС) slumped 2.7 percent to $6.83.

Lowe’s Cos. slumped 10 percent, the most since 2009, to $25.60. The second-largest U.S. home-improvement retailer reduced its forecast for full-year earnings to a range of $1.73 to $1.83 from $1.75 to $1.85 because of a smaller increase in profit margins than it had previously expected.

Campbell Soup Co. fell 2 percent to $32.75 after posting a decline in third-quarter profit as the company works to revive its struggling soup business.

Resistance 3: Y80.20 (May 16 low)

Resistance 2: Y79.65 (May 14 low)

Resistance 1: Y79.45 (May 18 low)

The current price: Y79.38

Support 1: Y79.00 (May 18-21 low)

Support 2: Y78.70 (Feb 15 high)

Support 3: Y78.15 (Feb 15 low)

Resistance 3: Chf0.9500 (May 18 high)

Resistance 2: Chf0.9440 (May 21 high)

Resistance 1: Chf0.9415 (May 16 low)

The current price: Chf0.9390

Support 1: Chf0.9365 (May 21 low)

Support 2: Chf0.9330 (May 15 low)

Support 3: Chf0.9305 (May 14 low)

Resistance 3 : $1.5930 (May 17 high)

Resistance 2 : $1.5885 (May 16 low)

Resistance 1 : $1.5840 (May 21 high)

The current price: $1.5814

Support 1 : $1.5780 (May 21 low)

Support 2 : $1.5730 (Mar 18 low)

Support 3 : $1.5695 (Mar 16 low)

Resistance 3 : $1.2905 (May 11 low, May 14 high)

Resistance 2 : $1.2870 (May 15 high)

Resistance 1 : $1.2825 (May 21 high)

The current price: $1.2785

Support 1 : $1.2755 (May 16 high)

Support 2 : $1.2725 (May 21 low)

Support 3 : $1.2640 (Jan 18 low)

Change % Change Last

Gold 1,594 +2 +0.10%

Oil 92.81 +1.33 +1.45%

Change % Change Last

Nikkei 225 8,633.89 +22.58 +0.26%

S&P/ASX 200 4,073.6 +27.14 +0.67%

Shanghai Composite 2,348.3 +3.78 +0.16%

FTSE 100 5,304.48 +36.86 +0.70%CAC 40 3,027.15 +19.15 +0.64%

DAX 6,331.04 +59.82 +0.95%

Dow 12,504 +135 +1.09%

Nasdaq 2,847 +68 +2.46%

S&P 500 1,316 +21 +1.60%

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,2807 -0,27%

GBP/USD $1,5820 -0,82%

USD/CHF Chf0,9378 +0,27%

USD/JPY Y79,30 -1,27%

EUR/JPY Y101,54 -1,55%

GBP/JPY Y125,44 -2,12%

AUD/USD $0,9913 -0,23%

NZD/USD $0,7646 -0,13%

USD/CAD C$1,0175 +0,74%

03:00 New Zealand Expected Annual Inflation 2y from now Quarter II +2.5%

08:30 United Kingdom HICP, m/m April +0.3% +0.6%

08:30 United Kingdom HICP, Y/Y April +3.5% +3.1%

08:30 United Kingdom HICP ex EFAT, Y/Y April +2.5% +2.2%

08:30 United Kingdom Retail Price Index, m/m April +0.4% +0.6%

08:30 United Kingdom Retail prices, Y/Y April +3.6% +3.5%

08:30 United Kingdom RPI-X, Y/Y April +3.7% +3.5%

08:30 United Kingdom PSNB, bln April 15.9 -5.4

09:30 United Kingdom BOE Inflation Letter May

10:15 U.S. FOMC Member Dennis Lockhart Speaks -

14:00 U.S. Existing Home Sales April 4.48 4.64

14:00 Eurozone Consumer Confidence May -19.9 -20.5

14:00 U.S. Richmond Fed Manufacturing Index May 14 12

23:50 Japan Adjusted Merchandise Trade Balance, bln April -621.3 -617.2

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.