- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

(raw materials / closing price /% change)

Oil 49.40 -0.16%

Gold 1,219.80 -0.05%

(index / closing price / change items /% change)

Nikkei 225 16,772.46 +15.11 +0.09 %

Hang Seng 20,397.11 +29.06 +0.14 %

S&P/ASX 200 5,388.09 +15.58 +0.29 %

Shanghai Composite 2,822.57 +7.49 +0.27 %

FTSE 100 6,265.65 +2.80 +0.04 %

CAC 40 4,512.64 +31.00 +0.69 %

Xetra DAX 10,272.71 +67.50 +0.66 %

S&P 500 2,090.1 -0.44 -0.02 %

NASDAQ Composite 4,901.77 +6.88 +0.14 %

Dow Jones 17,828.29 -23.22 -0.13 %

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1192 +0,34%

GBP/USD $1,4664 -0,26%

USD/CHF Chf0,989 -0,22%

USD/JPY Y109,75 -0,38%

EUR/JPY Y122,83 -0,05%

GBP/JPY Y160,91 -0,66%

AUD/USD $0,7223 +0,48%

NZD/USD $0,6740 +0,34%

USD/CAD C$1,2974 -0,35%

(time / country / index / period / previous value / forecast)

12:30 U.S. PCE price index, q/q Quarter I 0.3% 0.3%

12:30 U.S. PCE price index ex food, energy, q/q Quarter I 2.1% 2.1%

12:30 U.S. GDP, q/q Quarter I 1.4% 0.9%

14:00 U.S. Reuters/Michigan Consumer Sentiment Index May 89 95.4

17:15 U.S. Fed Chairman Janet Yellen Speaks

The dollar rose modestly against the euro, returning to the level of opening of the session. Support currency was positive US data. The US Commerce Department reported that orders for durable goods rose in April on strong demand for transportation equipment and a range of other products, but the continuing weakness of the planned business spending suggests that the decline in production is far from complete. According to the data, orders for durable goods jumped 3.4 percent after a revised upward growth of 1.9 percent in March. Earlier it was reported that orders for durable goods rose 1.3 percent in March. Non-defense capital goods orders excluding aircraft, which are closely monitored by the sensor of the planned business spending, fell 0.8 percent after an upwardly revised decline of 0.1 percent in the previous month. Earlier it was reported that they fell by 0.8 percent in March. Economists forecast that orders for durable goods rise by 0.5 percent last month and core capital goods orders to rise by 0.4 per cent.

Meanwhile, the Labor Department report showed that the number of Americans applying for unemployment benefits fell last week, suggesting that employers continue to expand moderately and the labor market in the world's largest economy remains strong. Primary applications for unemployment benefits, a measure of layoffs throughout the US, fell by 10 000 and amounted to a seasonally adjusted 268,000 for the week ended May 21. This was below economists' forecast of 275 000. Last week, the 64th week was marked by a row when treatment remained below 300,000, the longest such streak since 1973. The four-week moving average, which smooths out weekly fluctuations, rose by 2,750 to 278.500. The report showed that repeated applications for unemployment benefits rose by 10,000 to 2.16 million in the week ended May 14.

On the trading dynamics also affect expectations of Fed Chairman Yellen speech, scheduled for Friday, which may to some extent clarify the prospects of tighter monetary policy of the Central Bank. Currently, futures on interest rates Fed indicate that the probability of a rate hike in June is 30% against 4% last Monday. Meanwhile, the chances increase rate estimated at 57% in July.

The pound dropped significantly against the dollar, having lost almost all of yesterday earned position. The reason for such dynamics were comments by the Fed Powell, signaling the possibility of a rate hike in the near future. Recall, higher interest rates are favorable for the US dollar as make it more attractive to investors. Powell noted that the increase in interest rates may be appropriate "fairly soon." However, he added that the pace of rate increases should be gradual. "Global risks and increased market sensitivity to changes in policy speak in favor of a gradual increase in interest rates", - said the politician. - Reduce global risks pleases, but underlying risks on the part of the UK from the EU exit threats and challenges in China saved the US economy is on the right track, "He also said that the situation in the labor market continues to improve, there are tentative signs of increasing wages.." allowing the Fed to fulfill its dual mandate. I expect that the economy will continue to show growth by approximately 2%. Meanwhile, inflation should return to 2% when the price of oil and the US dollar, on the whole, will remain stable ", - Powell said experts note, despite speculation that the Fed may raise interest rates in June, investors will scrutinize tomorrow. comments Fed chief Janet Yellen.

The Canadian dollar fell considerably against the US dollar, almost entirely offset by the growth, said earlier today. The pressure on the currency has resumed its decline in oil prices against the background of US dollar rate growth. In recent weeks, crude oil rose in price against the background of supply disruptions, mainly due to the decrease in supply of raw materials from Canada due to raging forest fires and Nigeria because of the unrest. Reduction of oil reserves in the US also increased the hopes of beginning to restore the balance in the market. However, analysts note that many of the supply disruptions are temporary. Higher prices could also hinder the recovery in the long term, as they encourage US producers to increase production. Important market participants also switched to the meeting of representatives of the OPEC countries, which is scheduled for June 2nd. Discussion will focus on the possibilities of raising prices and stabilize the market.

Oil prices rose above $ 50 a barrel for the first time in nearly seven months, but then again returned to negative territory on the background growth of the US dollar.

In recent weeks, crude oil rose in price against the background of supply disruptions, mainly due to the decrease in supply of raw materials from Canada due to raging forest fires and Nigeria because of the unrest. Reduction of oil reserves in the US also increased the hopes of beginning to restore the balance in the market. Yesterday the US Department of Energy reported that in the week ended May 20, commercial crude oil inventories fell by 4.2 million barrels, while analysts had expected a decline of 2.5 million barrels. However, gasoline stocks last week rose unexpectedly, as demand declined. After Memorial Day in the US should begin the season of active road trips, and a relatively low consumption can put pressure on prices. Gasoline inventories in the US rose by 2.043 million barrels to 240.111 million barrels. Distillate stocks fell by 1.284 million barrels to 150.878 million barrels. Workload refinery in the United States decreased to 89.7% from 90.5% a week earlier. Oil in the US last week fell the 11th week in a row, reaching 8.8 million barrels per day.

However, analysts note that many of the supply disruptions are temporary. Higher prices could also hinder the recovery in the long term, as they encourage US producers to increase production. Meanwhile, experts believe that when the levels of $ 51- $ 52 oil prices may fall again by about $ 6- $ 10. In this case, investors may be more prone to alignment positions or profit.

Important market participants also switched to the meeting of representatives of the OPEC countries, which is scheduled for June 2nd. Discussion will focus on the possibilities of raising prices and stabilize the market.

WTI for delivery in July fell to $49.65 a barrel. Brent for July fell to $49.50 a barrel.

Quotes of gold increased significantly at the beginning of the session, but then fell back to the opening level, which was caused by the strengthening of the dollar in response to the strong US data.

The US Commerce Department reported that orders for long-term industrial goods increased in April against the background of the high demand for transport equipment and a number of other products, but the continuing weakness of the planned business spending suggests that the decline in production is far from complete. According to the data, orders for durable goods jumped 3.4 percent last month after a revised upward growth of 1.9 percent in March. Earlier it was reported that orders for durable goods rose 1.3 percent in March. Non-defense capital goods orders excluding aircraft, which are closely monitored by the sensor of the planned business spending, fell 0.8 percent after an upwardly revised decline of 0.1 percent in the previous month. Earlier it was reported that they fell by 0.8 percent in March. Economists forecast that orders for durable goods rise by 0.5 percent last month and core capital goods orders to rise by 0.4 per cent.

The growth of long-term orders was another signal that the economy is gaining momentum after the growth slowed down to 0.5 per cent per annum in the 1st quarter. So far, reports on retail sales, industrial production and housing have offered a favorable opinion on the economy at the beginning of the second quarter.

In anticipation of its meeting the Fed is looking for signs that economic growth is accelerating, and the economic situation abroad has stabilized. More positive data may give some confidence the leadership of the Central Bank. Now investors are waiting for Fed Chairman Yellen speech, scheduled for Friday, which may to some extent make it clear whether the Central Bank will raise rates soon. Futures on interest rates Fed indicate that the probability of increase is 30% rate in June, and is estimated at 60% in July. Recall, higher interest rates have a downward pressure on the price of gold, which brings its holders to interest income and that is difficult to compete with the assets, bringing that income against the background of increasing interest rates.

"Gold has entered a phase of consolidation due to expectations that the Fed will raise rates this summer - said Carlo Alberto de Casa, chief analyst at ActivTrades -. Today, we have seen only a technical rebound after yesterday precious metal touched a high of $ 1217."

Gold rose more than 15 percent since the beginning of the year, as investors bought the metal amid concerns over global economic growth and stock market volatility. But physical demand from China and India, the major markets, which accounted for more than half of world consumption, was weak.

The cost of the June gold futures on the COMEX fell to $ 1222.4 per ounce.

Major U.S. stock-indexes little changed on Thursday, taking a breather from their robust two-day run, as investors keenly await a speech from Fed Chair Janet Yellen on Friday. Comments from policymakers in recent days and upbeat U.S. economic data have raised expectations that the Federal Reserve could pull the trigger on a rate increase much sooner than previously thought.

Dow stocks mixed (17in negative, 13 in positive area). Top looser - Microsoft Corporation (MSFT, -1,01%). Top gainer - Wal-Mart Stores Inc. (WMT, +0,68%).

S&P sectors also mixed. Top looser - Basic Materials (-0,4%). Top gainer - Utilities (+0,6%).

At the moment:

Dow 17806.00 -11.00 -0.06%

S&P 500 2086.75 -0.50 -0.02%

Nasdaq 100 4481.25 +6.50 +0.15%

Oil 49.51 -0.05 -0.10%

Gold 1226.60 +2.80 +0.23%

U.S. 10yr 1.85 -0.02

USD/JPY 108.00 (USD 200m) 110.75 (250m)

EUR/USD: 1.1100 (EUR 248m) 1.1150 (660m)

GBP/USD 1.4450 (GBP 526m) 1.4585 (493m)

EUR/GBP 0.7635 (EUR 730m) 0.7750 (875m) 0.7800 (420m)

AUD/USD 0.7210 (AUD 1.08bln) 0.7500 (340m)

USD/CAD 1.3000 (USD 560m) 1.3150 (360m)

U.S. stock-index futures edged higher.

Global Stocks:

Nikkei 16,772.46 +15.11 +0.09%

Hang Seng 20,397.11 +29.06 +0.14%

Shanghai Composite 2,822.57 +7.49 +0.27%

FTSE 6,254.25 -8.60 -0.14%

CAC 4,505.08 +23.44 +0.52%

DAX 10,274.56 +69.35 +0.68%

Crude $50.08 (+1.05%)

Gold $1228.10 (+0.35%)

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 9.78 | 0.18(1.875%) | 82410 |

| Amazon.com Inc., NASDAQ | AMZN | 708.6 | 0.25(0.0353%) | 14441 |

| Apple Inc. | AAPL | 99.46 | -0.16(-0.1606%) | 179026 |

| Barrick Gold Corporation, NYSE | ABX | 17.43 | 0.17(0.9849%) | 81594 |

| Caterpillar Inc | CAT | 73.28 | 0.71(0.9784%) | 28615 |

| Chevron Corp | CVX | 102.08 | 0.31(0.3046%) | 3493 |

| Cisco Systems Inc | CSCO | 29 | 0.08(0.2766%) | 4250 |

| Citigroup Inc., NYSE | C | 47.09 | 0.15(0.3196%) | 55617 |

| Exxon Mobil Corp | XOM | 90.55 | 0.29(0.3213%) | 3136 |

| Facebook, Inc. | FB | 118.06 | 0.17(0.1442%) | 68395 |

| Ford Motor Co. | F | 13.58 | 0.06(0.4438%) | 11475 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 11.92 | 0.27(2.3176%) | 224742 |

| General Electric Co | GE | 30.12 | 0.03(0.0997%) | 5705 |

| Goldman Sachs | GS | 162.48 | 1.23(0.7628%) | 875 |

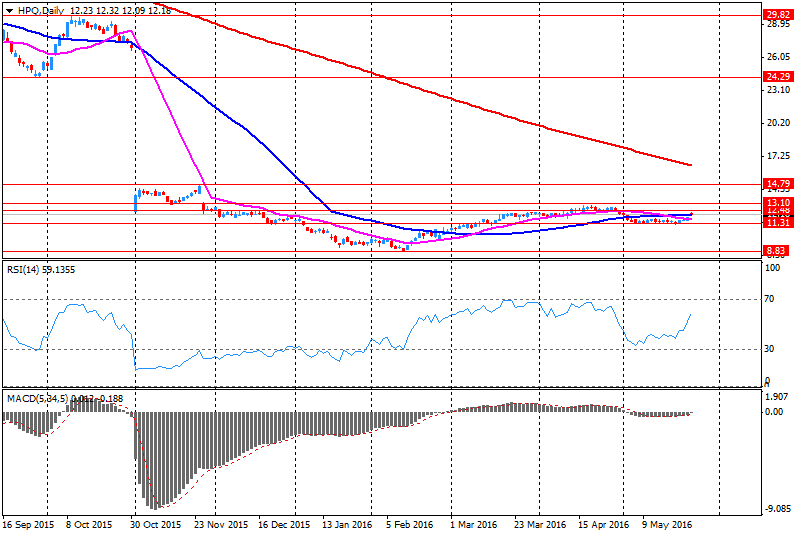

| Hewlett-Packard Co. | HPQ | 12.32 | 0.12(0.9836%) | 8267 |

| Intel Corp | INTC | 31.53 | 0.14(0.446%) | 6157 |

| International Business Machines Co... | IBM | 151.51 | -0.18(-0.1187%) | 1767 |

| JPMorgan Chase and Co | JPM | 65.75 | 0.23(0.351%) | 9731 |

| McDonald's Corp | MCD | 123.3 | 0.04(0.0325%) | 100 |

| Merck & Co Inc | MRK | 56.57 | -0.00(-0.00%) | 1465 |

| Microsoft Corp | MSFT | 52.2 | 0.08(0.1535%) | 2994 |

| Nike | NKE | 56.3 | 0.31(0.5537%) | 4336 |

| Starbucks Corporation, NASDAQ | SBUX | 55.7 | 0.55(0.9973%) | 7365 |

| Tesla Motors, Inc., NASDAQ | TSLA | 219.85 | 0.27(0.123%) | 6275 |

| Twitter, Inc., NYSE | TWTR | 14.48 | 0.07(0.4858%) | 31210 |

| Verizon Communications Inc | VZ | 49.78 | -0.07(-0.1404%) | 1178 |

| Wal-Mart Stores Inc | WMT | 70.4 | -0.08(-0.1135%) | 777 |

| Walt Disney Co | DIS | 100 | 0.14(0.1402%) | 2623 |

| Yahoo! Inc., NASDAQ | YHOO | 36.27 | 0.68(1.9107%) | 124609 |

| Yandex N.V., NASDAQ | YNDX | 20.08 | 0.31(1.568%) | 7430 |

Upgrades:

Downgrades:

Other:

HP Inc. (HPQ) reiterated with a Hold at Needham Research

HP Inc. (HPQ) reiterated with a Neutral at Mizuho Securities

EUR/USD

Offers : 1.1185 1.1200 1.1230 1.1250 1.1280-85 1.1300 1.1325 1.1355-60

Bids: 1.1150-55 1.1125-30 1.1100 1.1080 1.1065 1.1050 1.1030 1.1000

GBP/USD

Offers : 1.4735 1.4750 1.4770 1.4800 1.4820 1.4850

Bids: 1.4700 1.4685 1.4665 1.4650 1.4635 1.4600 1.4585 1.4550 1.4500

EUR/GBP

Offers : 0.7600 0.7630-35 0.7650 0.7675-80 0.7700-05 0.7730 0.7755-60

Bids: 0.7565-70 0.7550 0.7530 0.7500 0.7485 0.7450

EUR/JPY

Offers : 122.80 123.00 123.30 123.60 123.80 124.00 124.30 124.50 124.70-75 125.00

Bids: 122.30 122.00 121.70 121.50 121.20 121.00

USD/JPY

Offers : 109.85 110.00 110.20-25 110.50 110.65 110.80 111.00 111.50

Bids: 109.40-50 109.20 109.00 108.75 108.50 108.30 108.20 108.00

AUD/USD

Offers : 0.7220-25 0.7250 0.7260 0.7280 0.7300 0.7325-30 0.7350

Bids: 0.7200 0.7180-85 0.7150 0.7130 0.7100 0.7080 0.7065 0.7050

HP Inc. reported Q2 FY 2016 earnings of $0.41 per share (versus $0.87 in Q2 FY 2015), beating analysts' consensus of $0.38.

The company's quarterly revenues amounted to $11.588 bln (-10.7% y/y), missing consensus estimate of $11.709 bln.

HP Inc. also issued guidance for Q3 and FY2016, projecting Q3 EPS of $0.37-0.40 (versus analysts' consensus estimate of $0.41) and FY2016 EPS of $1.59-1.65 (versus analysts' consensus estimate of $1.58).

HPQ was traded at $12.20 (0%) in pre-market trading.

Minneapolis Fed President Neel Kashkari said on Wednesday that negative interest rates would only be a last resort for the Fed, noting that negative interest rates were "perverse". He added that the Fed had other tools to stimulate the economy.

Minneapolis Fed president also said that he expected the U.S. economy to expand moderately.

Kashkari is not a voting member of the Federal Open Market Committee (FOMC) this year.

Ratings agency Standard & Poor's (S&P) said on Wednesday that Britain's exit from the European Union (Brexit) could have a negative impact on the pound as an international reserve currency, adding that Brexit could also have a negative impact on the country's credit rating.

S&P analyst Frank Gill said that Brexit could weigh on foreign direct investment and other capital inflows.

Dallas Fed President Robert Kaplan said on Wednesday that he would support an interest rate hike in the "near future" if the U.S. economy continued to improve.

"That may not be June or July," he added.

Kaplan noted that the referendum on Britain's membership in the European Union may weigh on the Fed's interest rate decision in June.

USD/JPY 108.00 (USD 200m) 110.75 (250m)

EUR/USD: 1.1100 (EUR 248m) 1.1150 (660m)

GBP/USD 1.4450 (GBP 526m) 1.4585 (493m)

EUR/GBP 0.7635 (EUR 730m) 0.7750 (875m) 0.7800 (420m)

AUD/USD 0.7210 (AUD 1.08bln) 0.7500 (340m)

USD/CAD 1.3000 (USD 560m) 1.3150 (360m)

Ratings agency Fitch Ratings said in its latest Global Economic Outlook (GEO) on Wednesday that the slowdown in emerging economies and adjustments to energy sector spending continued to weigh on global growth. Fitch Chief Economist Brian Coulton said that near-term risks to the growth of emerging economies eased.

The agency expects the U.S. economy to expand 1.8% in 2016. It is the first sub-2% growth since 2013. Fitch upgraded its growth forecasts for China to 6.3% in 2016 from the previous estimate of 6.2% and to 6.3% in 2017 from the previous estimate of 6.0%.

The agency raised its growth forecasts for the Eurozone. The economy in the Eurozone is expected to expand 1.6% in 2016, up by 0.1% from the previous estimate.

The growth forecast for the U.K. was downgraded. The economy is expected to grow 1.9% in 2016, down by 0.2% from the previous estimate.

Fitch expects the global economy (based on an aggregate of 20 large developed and emerging economies) to expand 2.5% in 2016, unchanged from 2015 and from the previous estimate in March, and around 3% in 2017.

EUR / USD

Resistance levels (open interest**, contracts)

$1.1407 (5098)

$1.1318 (3420)

$1.1247 (3606)

Price at time of writing this review: $1.1177

Support levels (open interest**, contracts):

$1.1121 (8233)

$1.1065 (5438)

$1.0986 (3615)

Comments:

- Overall open interest on the CALL options with the expiration date June, 3 is 70823 contracts, with the maximum number of contracts with strike price $1,1400 (5098);

- Overall open interest on the PUT options with the expiration date June, 3 is 87969 contracts, with the maximum number of contracts with strike price $1,1200 (8233);

- The ratio of PUT/CALL was 1.24 versus 1.24 from the previous trading day according to data from May, 25

GBP/USD

Resistance levels (open interest**, contracts)

$1.5001 (1392)

$1.4903 (2063)

$1.4805 (1775)

Price at time of writing this review: $1.4707

Support levels (open interest**, contracts):

$1.4596 (958)

$1.4498 (1252)

$1.4399 (1790)

Comments:

- Overall open interest on the CALL options with the expiration date June, 3 is 33239 contracts, with the maximum number of contracts with strike price $1,4600 (2475);

- Overall open interest on the PUT options with the expiration date June, 3 is 34866 contracts, with the maximum number of contracts with strike price $1,4200 (3024);

- The ratio of PUT/CALL was 1.05 versus 1.05 from the previous trading day according to data from May, 25

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

The yen surged on Thursday, taking some of the wind out of the sails of the recently buoyant dollar and prompting investors to cover positions against a backdrop of potential event risks, including a speech by Federal Reserve chief Janet Yellen. Some market participants mentioned an interview with Masatsugu Asakawa, Japan's vice-minister of finance for international affairs, who told the Financial Times that direct currency intervention will remain in the ministry's toolbox. Other traders, who did not see any fresh trading catalysts, said they were forced to buy back the Japanese unit as it rapidly shot up against other currency pairs as well as the dollar.

The dollar earlier had stuck close to recent ranges, as investors looked for Yellen to provide clues on Friday as to whether a U.S. rate increase is imminent, and awaited clarity from Japan on whether it would press ahead with planned sales tax hike next year.

Underpinning the single currency, Eurogroup ministers gave Greece its firmest offer yet of debt relief, approving the release of 10.3 billion euros ($11.48 billion) in recognition of painful fiscal reforms pushed through by Prime Minister Alexis Tsipras' leftist-led coalition.

EUR/USD: during the Asian session the pair rose to $1.1180

GBP/USD: during the Asian session the pair traded in the range of $1.4690-20

USD/JPY: during the Asian session the pair dropped to Y109.40

Based on Reuters materials

European stocks closed with strong gains Wednesday, as international creditors reached a deal to unlock more bailout funds for Greece and oil prices gained. Greece is now in line to receive 10.3 billion euros ($11.48 billion) in new loans, if a deal struck early Wednesday is signed off by the 19 countries comprising the eurozone.

U.S. stocks advanced for a second straight session on Wednesday, with the S&P 500 posting its highest close in nearly a month on the back of a rally in energy and materials shares.

Asian stocks rose to a one-week high and the currencies of oil-exporting nations strengthened as Brent crude traded above $50 a barrel for the first time since November. Gold rebounded from a seven-week low as the dollar lost ground versus most of its major peers.

Based on MarketWatch materials

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.