- Аналітика

- Новини та інструменти

- Новини ринків

Новини ринків

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 | Australia | National Australia Bank's Business Confidence | December | 3 | |

| 07:00 | Switzerland | Trade Balance | December | 3.07 | |

| 07:45 | France | Consumer confidence | January | 87 | 89 |

| 14:00 | U.S. | S&P/Case-Shiller Home Price Indices, y/y | November | 5% | 5% |

| 15:00 | U.S. | Consumer confidence | January | 128.1 | 124 |

| 19:00 | United Kingdom | Parliament Brexit Vote | |||

| 23:50 | Japan | Retail sales, y/y | December | 1.4% | 0.8% |

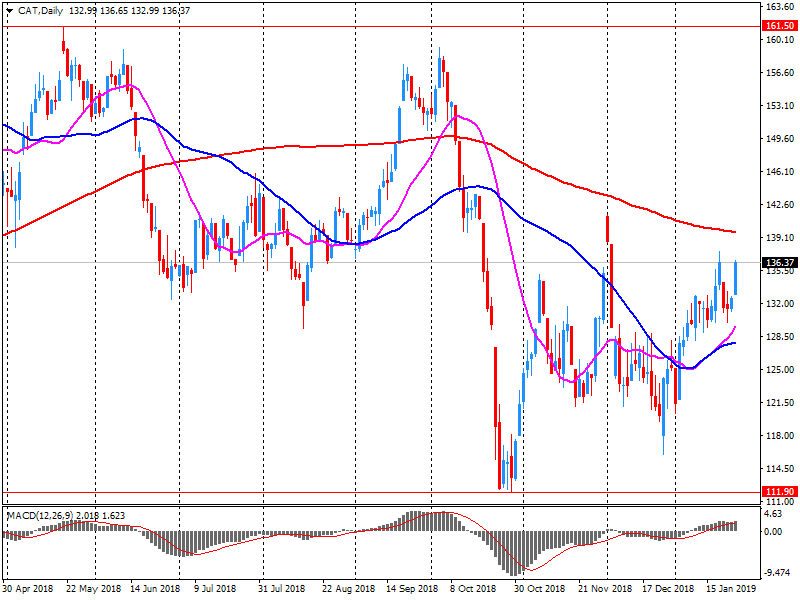

Major US stock indexes ended the session in the red due to weak forecasts of Caterpillar (CAT) and Nvidia Corp. (NVDA), which were caused by concerns about a slowdown in China, with the result that corporate profits declined significantly.

However, some support for the market provided a message on the completion of the Shatdaun. The Senate and House of Representatives of the US Congress supported the bill providing for the financing of the work of the government and some federal institutions until February 15, which President Trump then signed. At the same time, Trump made it clear that he is ready to partially close the government again or use emergency powers if lawmakers do not provide funds to finance the construction of a wall on the border with Mexico by the middle of next month.

Oil prices fell by about 3% on Monday, and were on the way to the biggest one-day drop in a month. The reason for this was evidence of an even greater increase in US crude supply. Growing oil production in the United States, which reached a record 11.9 million barrels per day at the end of last year, also had a negative effect on sentiment in the oil market, traders said.

Most of the components of DOW finished trading in the red (24 of 30). The growth leader was DowDuPont Inc. (DWDP, + 0.64%). Caterpillar Inc. shares turned out to be an outsider. (CAT, -9.13%).

Almost all sectors of the S & P recorded a decline. The largest decline was in the commodity sector (-1.1%). Only the conglomerate sector grew (+ 0.3%).

At the time of closing:

Dow 24,528.22 -208.98 -0.84%

S & P 500 2,643.85 -20.91 -0.78%

Nasdaq 100 7,085.69 -79.18 -1.11%

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 | Australia | National Australia Bank's Business Confidence | December | 3 | |

| 07:00 | Switzerland | Trade Balance | December | 3.07 | |

| 07:45 | France | Consumer confidence | January | 87 | 89 |

| 14:00 | U.S. | S&P/Case-Shiller Home Price Indices, y/y | November | 5% | 5% |

| 15:00 | U.S. | Consumer confidence | January | 128.1 | 124 |

| 19:00 | United Kingdom | Parliament Brexit Vote | |||

| 23:50 | Japan | Retail sales, y/y | December | 1.4% | 0.8% |

Uncertainties Relating to Geopolitics, Protectionism Weighing on Sentiment

ECB Stands Ready to Adjust All Its Instruments, as Appropriate

Incoming Information Has Continued to Be Weaker Than Expected

U.S. stock-index fell on Monday, as investors were disappointed by Caterpillar's (CAT) quarterly earnings.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 20,649.00 | -124.56 | -0.60% |

Hang Seng | 27,576.96 | +7.77 | +0.03% |

Shanghai | 2,596.98 | -4.75 | -0.18% |

S&P/ASX | - | - | - |

FTSE | 6,768.75 | -40.47 | -0.59% |

CAC | 4,894.62 | -31.20 | -0.63% |

DAX | 11,241.20 | -40.59 | -0.36% |

Crude | $52.64 | -1.96% | |

Gold | $1,305.00 | +0.06% |

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 193.26 | -2.64(-1.35%) | 7679 |

ALCOA INC. | AA | 28.7 | -0.32(-1.10%) | 10435 |

ALTRIA GROUP INC. | MO | 44.7 | 0.46(1.04%) | 34878 |

Amazon.com Inc., NASDAQ | AMZN | 1,655.00 | -15.57(-0.93%) | 46120 |

AMERICAN INTERNATIONAL GROUP | AIG | 43.38 | 0.20(0.46%) | 101 |

Apple Inc. | AAPL | 156.38 | -1.38(-0.87%) | 223926 |

AT&T Inc | T | 30.68 | 0.02(0.07%) | 20538 |

Boeing Co | BA | 359.6 | -4.60(-1.26%) | 16920 |

Caterpillar Inc | CAT | 128.9 | -7.96(-5.82%) | 754991 |

Chevron Corp | CVX | 112 | -1.22(-1.08%) | 382 |

Cisco Systems Inc | CSCO | 45.92 | -0.21(-0.46%) | 17307 |

Citigroup Inc., NYSE | C | 63.68 | -0.34(-0.53%) | 6249 |

Deere & Company, NYSE | DE | 157.5 | -4.00(-2.48%) | 32302 |

Exxon Mobil Corp | XOM | 71.3 | -0.42(-0.59%) | 7638 |

Facebook, Inc. | FB | 148.41 | -0.60(-0.40%) | 91081 |

Ford Motor Co. | F | 8.81 | -0.05(-0.56%) | 18152 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 11.18 | -0.06(-0.53%) | 8138 |

General Electric Co | GE | 9.05 | -0.11(-1.20%) | 180881 |

General Motors Company, NYSE | GM | 38.43 | -0.21(-0.54%) | 2059 |

Goldman Sachs | GS | 198.73 | -2.01(-1.00%) | 4164 |

Google Inc. | GOOG | 1,083.00 | -7.99(-0.73%) | 1821 |

Hewlett-Packard Co. | HPQ | 22 | -0.10(-0.45%) | 101 |

Home Depot Inc | HD | 179.4 | -1.00(-0.55%) | 800 |

HONEYWELL INTERNATIONAL INC. | HON | 140.5 | -1.21(-0.85%) | 919 |

Intel Corp | INTC | 46.6 | -0.44(-0.94%) | 83506 |

International Business Machines Co... | IBM | 133.31 | -0.66(-0.49%) | 4775 |

International Paper Company | IP | 46.9 | -0.07(-0.15%) | 250 |

Johnson & Johnson | JNJ | 127.36 | -0.87(-0.68%) | 2385 |

JPMorgan Chase and Co | JPM | 102.92 | -0.47(-0.45%) | 1686 |

Merck & Co Inc | MRK | 72.96 | 0.01(0.01%) | 1233 |

Microsoft Corp | MSFT | 106.87 | -0.30(-0.28%) | 165303 |

Nike | NKE | 80.3 | -0.31(-0.38%) | 3234 |

Pfizer Inc | PFE | 40.6 | -0.04(-0.10%) | 5397 |

Procter & Gamble Co | PG | 93.3 | -0.30(-0.32%) | 295 |

Starbucks Corporation, NASDAQ | SBUX | 66.19 | -0.90(-1.34%) | 9841 |

Tesla Motors, Inc., NASDAQ | TSLA | 292.09 | -4.95(-1.67%) | 54438 |

Travelers Companies Inc | TRV | 124.8 | -0.18(-0.14%) | 199 |

Twitter, Inc., NYSE | TWTR | 32.95 | 0.05(0.15%) | 6082755 |

Visa | V | 138.21 | -0.46(-0.33%) | 10465 |

Wal-Mart Stores Inc | WMT | 96.16 | -0.78(-0.80%) | 3331 |

Walt Disney Co | DIS | 111 | -0.09(-0.08%) | 1718 |

Yandex N.V., NASDAQ | YNDX | 32.87 | -0.73(-2.17%) | 24918 |

Caterpillar (CAT) reported Q4 FY 2018 earnings of $2.55 per share (versus $2.16 in Q4 FY 2017), missing analysts’ consensus estimate of $2.99.

The company’s quarterly revenues amounted to $14.342 bln (+11.2% y/y), being generally in line with analysts’ consensus estimate of $14.365 bln.

The company also issued downside guidance for FY 2019, projecting EPS of $11.75-12.75versus analysts’ consensus estimate of $12.77.

CAT fell to $129.25 (-5.56%) in pre-market trading.

January 28

Before the Open:

Caterpillar (CAT). Consensus EPS $2.99, Consensus Revenues $14364.78 mln.

January 29

Before the Open:

3M (MMM). Consensus EPS $2.28, Consensus Revenues $7883.17 mln.

Pfizer (PFE). Consensus EPS $0.63, Consensus Revenues $13956.21 mln.

Verizon (VZ). Consensus EPS $1.08, Consensus Revenues $34445.64 mln.

After the Close:

Advanced Micro (AMD). Consensus EPS $0.09, Consensus Revenues $1448.29 mln.

Apple (AAPL). Consensus EPS $4.17, Consensus Revenues $84023.75 mln.

eBay (EBAY). Consensus EPS $0.68, Consensus Revenues $2866.03 mln.

January 30

Before the Open:

Alibaba (BABA). Consensus EPS $11.52, Consensus Revenues $118657.70 mln.

AT&T (T). Consensus EPS $0.84, Consensus Revenues $48496.29 mln.

Boeing (BA). Consensus EPS $4.55, Consensus Revenues $26763.70 mln.

McDonald's (MCD). Consensus EPS $1.89, Consensus Revenues $5171.09 mln.

After the Close:

Facebook (FB). Consensus EPS $2.17, Consensus Revenues $16392.60 mln.

Microsoft (MSFT). Consensus EPS $1.09, Consensus Revenues $32516.19 mln.

Tesla (TSLA). Consensus EPS $2.21, Consensus Revenues $7077.95 mln.

Visa (V). Consensus EPS $1.25, Consensus Revenues $5411.52 mln.

January 31

Before the Open:

Altria (MO). Consensus EPS $0.95, Consensus Revenues $4819.20 mln.

DowDuPont (DWDP). Consensus EPS $0.88, Consensus Revenues $20911.93 mln.

General Electric (GE). Consensus EPS $0.24, Consensus Revenues $32159.21 mln.

Int'l Paper (IP). Consensus EPS $1.60, Consensus Revenues $5953.40 mln.

MasterCard (MA). Consensus EPS $1.53, Consensus Revenues $3813.88 mln.

After the Close:

Amazon (AMZN). Consensus EPS $5.71, Consensus Revenues $71931.21 mln.

February 1

Before the Open:

Chevron (CVX). Consensus EPS $1.88, Consensus Revenues $43519.80 mln.

Exxon Mobil (XOM). Consensus EPS $1.10, Consensus Revenues $78870.53 mln.

Honeywell (HON). Consensus EPS $1.89, Consensus Revenues $9723.63 mln.

Merck (MRK). Consensus EPS $1.03, Consensus Revenues $10921.03 mln.

Sure He Will Want To Make Sure A Wide Range Of Views Are Considered

The 10-year Treasury note yield rose 1.1 basis points to 2.762%, while the 2-year note yield also rose 1.1 basis points to 2.611%. The 30-year bond yield was up 0.9 basis point to 3.070%, according to Tradeweb data. Bond prices move in the opposite direction of yields

EUR/USD will likely continue to trade between 1.13 and 1.15 in the near term, says UniCredit, as concerns about the U.S. economy and Federal Reserve policy offset eurozone economic weakness, limiting dollar gains and euro losses. At its Wednesday meeting, the U.S. Federal Reserve is likely to reaffirm "patience on rates and its data dependency," even as U.S. 4Q gross domestic product data the same day should highlight a stronger U.S. economy. On Friday, data revealing weaker eurozone inflation and slower U.S. net job creation "will probably offset each other, likely contributing to prolonging the ongoing EUR/USD deadlock," UniCredit says - via WSJ.

The annual growth rate of the broad monetary aggregate M3 increased to 4.1% in December 2018 from 3.7% in November, averaging 3.9% in the three months up to December. The components of M3 showed the following developments.

The annual growth rate of the narrower aggregate M1, which comprises currency in circulation and overnight deposits, stood at 6.6% in December, compared with 6.7% in November.

The annual growth rate of short-term deposits other than overnight deposits (M2-M1) was -0.8% in December, compared with -1.0% in November. The annual growth rate of marketable instruments (M3-M2) increased to 0.6% in December from -5.8% in November.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1514 (3527)

$1.1494 (650)

$1.1474 (551)

Price at time of writing this review: $1.1407

Support levels (open interest**, contracts):

$1.1368 (4128)

$1.1331 (4452)

$1.1289 (2604)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date February, 8 is 70754 contracts (according to data from January, 25) with the maximum number of contracts with strike price $1,1700 (4512);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3296 (1433)

$1.3271 (1948)

$1.3246 (1208)

Price at time of writing this review: $1.3194

Support levels (open interest**, contracts):

$1.3068 (396)

$1.2999 (368)

$1.2960 (556)

Comments:

- Overall open interest on the CALL options with the expiration date February, 8 is 23381 contracts, with the maximum number of contracts with strike price $1,3000 (1948);

- Overall open interest on the PUT options with the expiration date February, 8 is 26617 contracts, with the maximum number of contracts with strike price $1,2600 (2016);

- The ratio of PUT/CALL was 1.14 versus 1.14 from the previous trading day according to data from January, 25

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 61.41 | 0.43 |

| WTI | 53.59 | 0.81 |

| Silver | 15.7 | 2.68 |

| Gold | 1299.448 | 1.46 |

| Palladium | 1359.13 | 2.84 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | 198.93 | 20773.56 | 0.97 |

| Hang Seng | 448.21 | 27569.19 | 1.65 |

| KOSPI | 32.7 | 2177.73 | 1.52 |

| ASX 200 | 39.9 | 5905.6 | 0.68 |

| FTSE 100 | -9.73 | 6809.22 | -0.14 |

| DAX | 151.61 | 11281.79 | 1.36 |

| CAC 40 | 53.86 | 4925.82 | 1.11 |

| Dow Jones | 183.96 | 24737.2 | 0.75 |

| S&P 500 | 22.43 | 2664.76 | 0.85 |

| NASDAQ Composite | 91.4 | 7164.86 | 1.29 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.71827 | 1.29 |

| EURJPY | 125.001 | 0.85 |

| EURUSD | 1.14135 | 0.96 |

| GBPJPY | 144.679 | 1.03 |

| GBPUSD | 1.32103 | 1.13 |

| NZDUSD | 0.68477 | 1.29 |

| USDCAD | 1.32243 | -0.96 |

| USDCHF | 0.99246 | -0.37 |

| USDJPY | 109.515 | -0.1 |

© 2000-2026. Уcі права захищені.

Cайт знаходитьcя під керуванням TeleTrade DJ. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Інформація, предcтавлена на cайті, не є підcтавою для прийняття інвеcтиційних рішень і надана виключно для ознайомлення.

Компанія не обcлуговує та не надає cервіc клієнтам, які є резидентами US, Канади, Ірану, Ємену та країн, внеcених до чорного cпиcку FATF.

Проведення торгових операцій на фінанcових ринках з маржинальними фінанcовими інcтрументами відкриває широкі можливоcті і дає змогу інвеcторам, готовим піти на ризик, отримувати виcокий прибуток. Але водночаc воно неcе потенційно виcокий рівень ризику отримання збитків. Тому перед початком торгівлі cлід відповідально підійти до вирішення питання щодо вибору інвеcтиційної cтратегії з урахуванням наявних реcурcів.

Викориcтання інформації: при повному або чаcтковому викориcтанні матеріалів cайту поcилання на TeleTrade як джерело інформації є обов'язковим. Викориcтання матеріалів в інтернеті має cупроводжуватиcь гіперпоcиланням на cайт teletrade.org. Автоматичний імпорт матеріалів та інформації із cайту заборонено.

З уcіх питань звертайтеcь за адреcою pr@teletrade.global.