- Analytics

- News and Tools

- Market News

- Forex: Wednesday's review

Forex: Wednesday's review

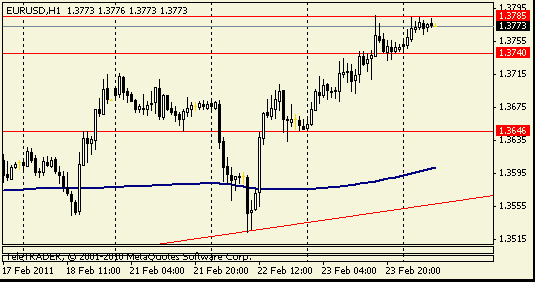

The dollar fell against most of its major counterparts on speculation central banks in Europe and the U.K. will seek to combat inflation from rising fuel costs by increasing interest rates before the Federal Reserve.

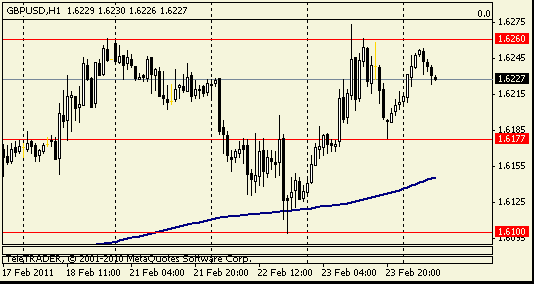

The pound gained versus the dollar as minutes of the Bank of England’s Feb. 10 meeting showed an additional policy maker backed an increase in rates.

European Central Bank policy makers will make the decisions necessary to maintain price stability, ECB President Jean-Claude Trichet told reporters today. The ECB will “inevitably” have to “rebalance our monetary policy stance,” with the 17-nation euro-area economy strengthening and inflation in breach of the central bank’s 2% limit, council member Yves Mersch said yesterday, without giving a time frame.

Governments rushed to evacuate thousands of expatriates from Libya as army units defected and a former aide to the leader Muammar Qaddafi warned that the spreading revolt may topple the regime within days. The nation holds Africa’s largest crude reserves.

Crude for April delivery rose as much as 6.8% to $99.94 a barrel in New York, the highest level since October 2008. In London, it gained as much as 5.7% to $111.85, the highest since September 2008.

Sterling gained after minutes of the Bank of England’s Feb. 10 rate decision showed Spencer Dale joined Andrew Sentance and Martin Weale in voting for higher rates as an increasing number of officials said the case for tightening policy had “grown in strength.” The central bank has held the rate at 0.5% since March 2009.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.